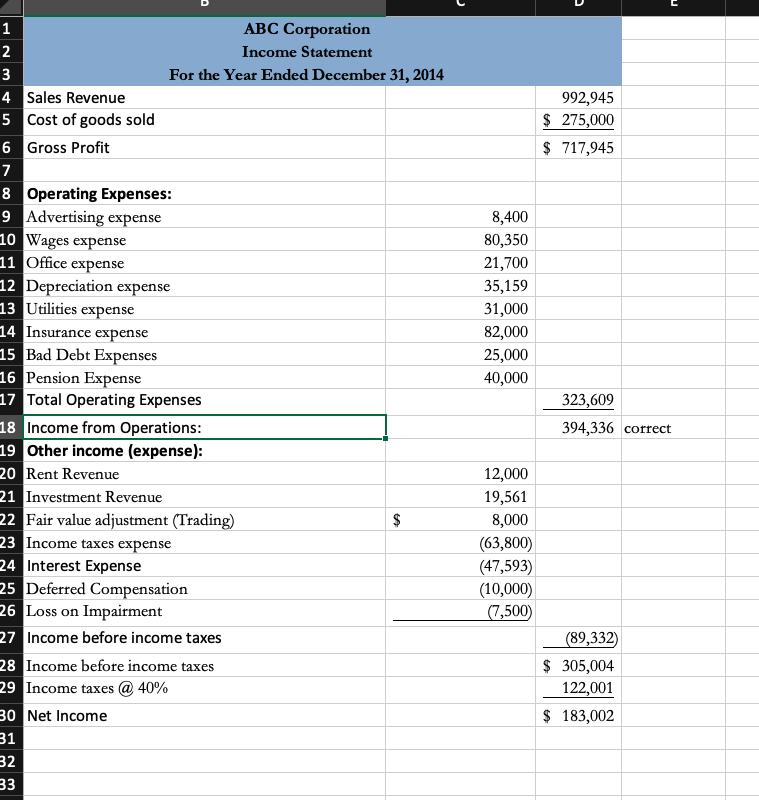

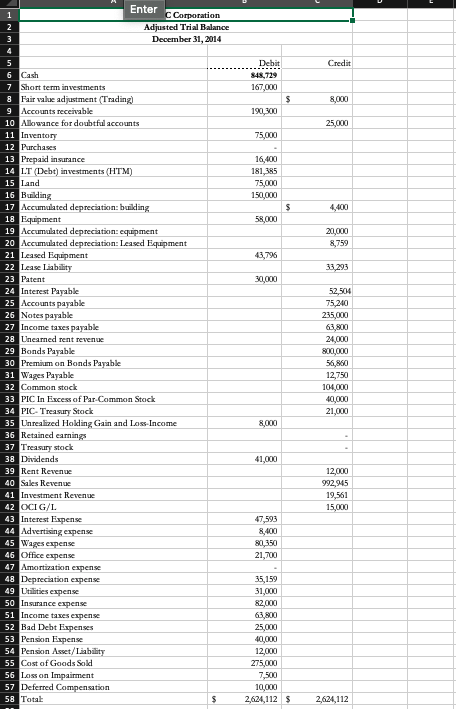

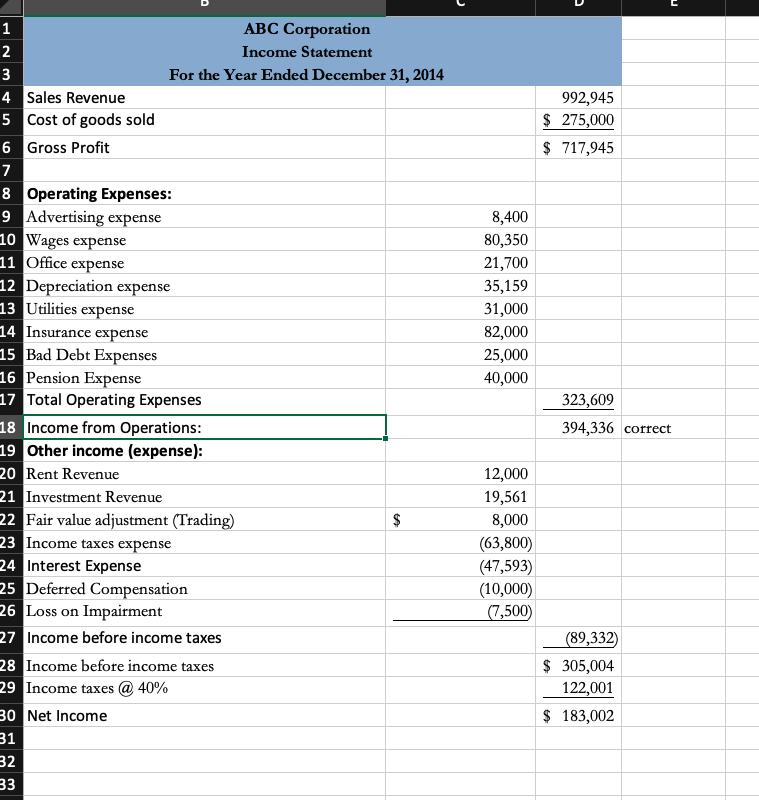

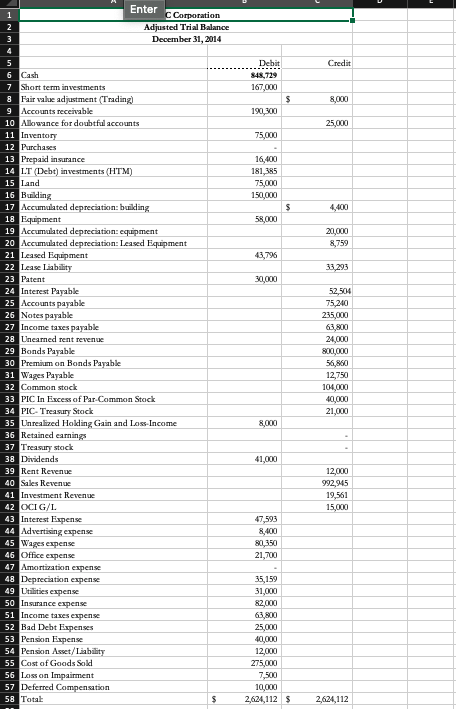

Here is my adjusted trial balance. Is my income statement correct? What is the correct net income?

w NP 992,945 $ 275,000 $ 717,945 8,400 80,350 21,700 35,159 31,000 82,000 25,000 40,000 1 ABC Corporation 2 Income Statement For the Year Ended December 31, 2014 4 Sales Revenue 5 Cost of goods sold 6 Gross Profit 7 8 Operating Expenses: 9 Advertising expense 10 Wages expense 11 Office expense 12 Depreciation expense 13 Utilities expense 14 Insurance expense 15 Bad Debt Expenses 16 Pension Expense 17 Total Operating Expenses 18 Income from Operations: 19 Other income (expense): 20 Rent Revenue 21 Investment Revenue 22 Fair value adjustment (Trading) $ 23 Income taxes expense 24 Interest Expense 25 Deferred Compensation 26 Loss on Impairment 27 Income before income taxes 28 Income before income taxes 29 Income taxes @ 40% 30 Net Income 31 32 33 323,609 394,336 correct 12,000 19,561 8,000 (63,800) (47,593) (10,000) (7,500 (89,332 $ 305,004 122,001 $ 183,002 1 2 3 Enter Corporation Adjusted Trial Balance December 31, 2014 4 5 Credit Debit 848,729 167,000 $ 8,000 190,00 25,000 75,000 16,400 181,385 75,000 150,000 $ 58,000 20,000 8,759 43,796 33,293 30,000 6 Cash 7 Short term investments Fair value adjustment Trading) 9 Accounts receivable 10 Allowance for doubtful accounts 11 Inventory 12 Purchases 13 Prepaid insurance 14 LT (Debt) investments (HTM) 15 Land 16 Building 17 Accumulated depreciation building 18 Equipment 19 mulated depreciation equipment 20 Accumulated depreciation: Leased Equipment 21 Leased Equipment 22 Lease Liability 23 Patent 24 Interest Payable 25 Accounts payable 26 Notes payable 27 Income taxes payable 28 Unearned rent revenue 29 Bonds Payable 30 Premium on Bonds Payable 31 Wages Payable 32 Common stock 33 PIC In Excess of Par-Common Stock 34 PIC-Treasury Stock 35 Unrealized Holding Gain and Loss-Income 36 Retained earnings 37 Treasury stack 38 Dividends 39 Rent Revenue 40 Sales Revenue 41 Investment Revenue 42 CXCIG/L 43 Interest Expense 44 Advertising expense 45 Wages expense 46 Office expense 47 Amortization expense 48 Depreciation expense 49 Utilities expense 50 Insurance expense 51 Income taxes expense 52 Bad Debt Expenses 53 Pension Expense 54 Pension Asset/Liability 55 Cast of Goods Sold 56 Loss on Impairment 57 Deferred Compensation 58 Total 52,504 75,240 235,000 63,800 24,000 800,000 56,860 12,750 104,000 40,000 21,000 8,000 41,000 12,000 992,945 19,561 15,000 47,593 8,400 80,350 21,700 35,159 31,000 82,000 63,800 25,000 40,000 12,000 275,000 7,500 10,000 2,624,112 5 $ 2,624,112