Question

Here is some information about Company S's Dec. 31, Year 0 balance sheet: Total stockholders' equity: $2,400,000 Common Stock + APIC: $950,000

Here is some information about Company S's Dec. 31, Year 0 balance sheet:

• Total stockholders' equity: $2,400,000

• Common Stock + APIC: $950,000

• Retained Earnings: $1,450,000.

• Total accumulated depreciation (property plant and equipment): $410,000.

Company S continues to possess this PP&E throughout the duration of this problem.

• The book values of Company S's individual assets and liabilities all equaled their fair values.

On Jan. 1, Year 1, Company P acquired 70% of the outstanding shares of Company S for $1,680,000. Company P uses “fully-adjusted equity method” to account for its investment in Company S. During Year 1:

• On Jan. 1, Year 1, Company S issued $100,000 of 10-year, 10% bonds to Company X (an unrelated party).

• The bonds pay annual interest every December 31 until maturity.

• The bonds were priced to yield 9%, and thus the bonds were sold at $106,417.66.

• On Dec. 31, Year 1 (immediately after Company S made the first interest payment to Company X), Company P acquired the bonds from Company X for $94,462.95.

• Based on this purchase price, the implied yield to maturity on the bonds to Company P is 11%.

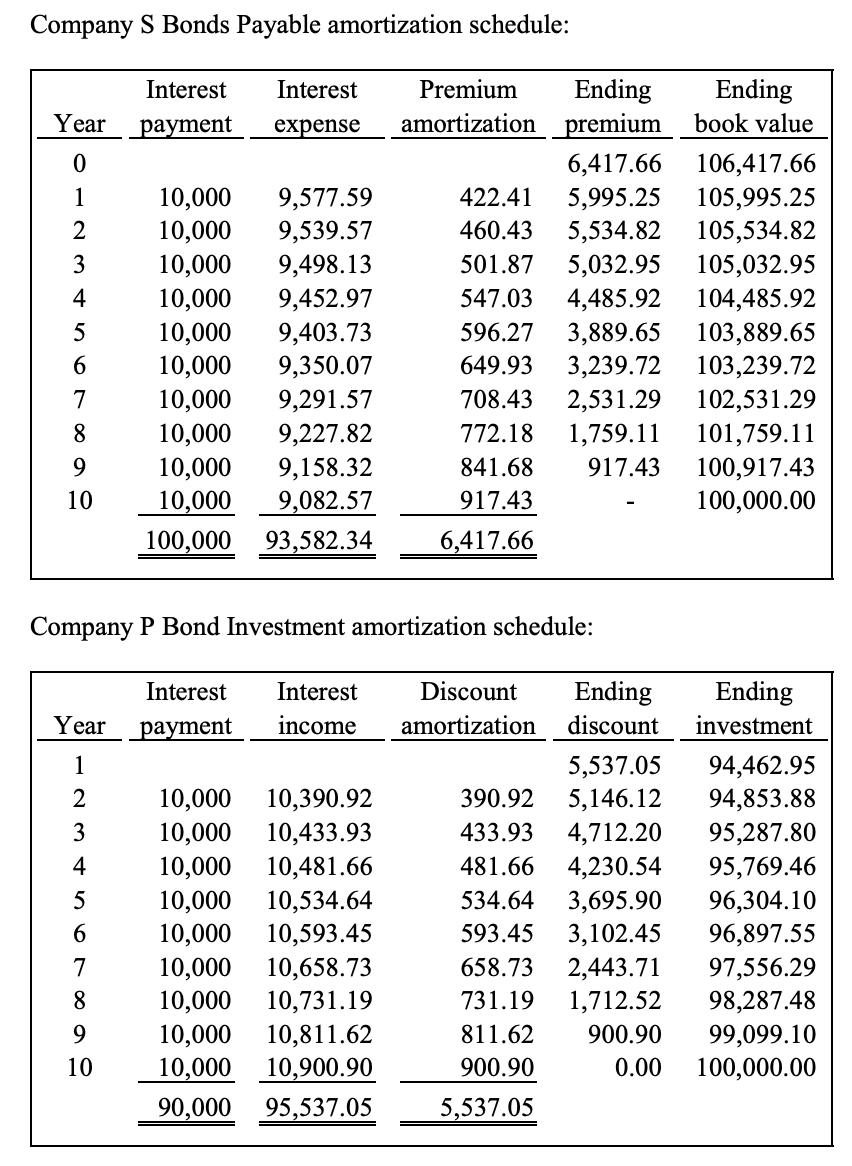

• Company S reports net income of $400,000 and declares/distributes cash dividends of $120,000. See next page for Company S Bonds Payable amortization schedule and Company P Bond Investment amortization schedule. During Year 2:

• No intercompany transactions between Company P and Company S. • Company P continues to hold the bonds that it purchased from Company X. • Company S reports net income of $420,000 and declares/distributes cash dividends of $130,000.

[3.1] Prepare Company P's Year 1 equity-method journal entries.

[3.2] Prepare all necessary consolidation entries needed for preparation of the Year 1 consolidated financial statements. [3.3] Prepare Company P's Year 2 equity method journal entries.

[3.4] Prepare all necessary consolidation entries needed for preparation of the Year 2 consolidated financial statements.

Company S Bonds Payable amortization schedule: Interest Interest expense Year payment 0 1 2 3 4 5 6 7690 8 10 Year 1 2 3 4 5 Company P Bond Investment amortization schedule: not a g 6 7 8 9 10,000 9,577.59 10,000 9,539.57 10,000 9,498.13 10,000 9,452.97 10,000 9,403.73 10,000 9,350.07 10,000 9,291.57 10,000 9,227.82 10,000 9,158.32 10,000 9,082.57 100,000 93,582.34 10 Interest Interest payment income Premium Ending Ending amortization premium book value 6,417.66 106,417.66 422.41 5,995.25 105,995.25 460.43 5,534.82 105,534.82 501.87 5,032.95 105,032.95 547.03 4,485.92 104,485.92 103,889.65 103,239.72 102,531.29 101,759.11 100,917.43 100,000.00 10,000 10,390.92 10,000 10,433.93 10,000 10,481.66 10,000 10,534.64 10,000 10,593.45 10,000 10,658.73 10,000 10,731.19 10,000 10,811.62 10,000 10,900.90 90,000 95,537.05 596.27 3,889.65 649.93 3,239.72 708.43 2,531.29 772.18 1,759.11 841.68 917.43 917.43 6,417.66 Discount Ending amortization discount 5,537.05 390.92 5,146.12 433.93 4,712.20 481.66 4,230.54 534.64 3,695.90 593.45 3,102.45 658.73 2,443.71 731.19 1,712.52 811.62 900.90 900.90 5,537.05 Ending investment 94,462.95 94,853.88 95,287.80 95,769.46 96,304.10 96,897.55 97,556.29 98,287.48 99,099.10 0.00 100,000.00

Step by Step Solution

3.49 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Here are the equitymethod journal entries for Company P in Year 1 Date Account Titles Debit Credit Jan 1 Year 1 Investment in Company S 1680000 Cash 1...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started