Answered step by step

Verified Expert Solution

Question

1 Approved Answer

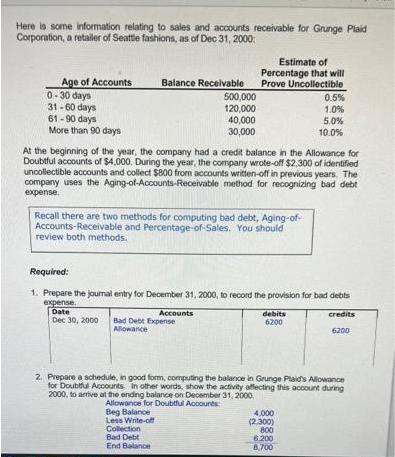

Here is some information relating to sales and accounts receivable for Grunge Plaid Corporation, a retailer of Seattle fashions, as of Dec 31, 2000:

Here is some information relating to sales and accounts receivable for Grunge Plaid Corporation, a retailer of Seattle fashions, as of Dec 31, 2000: Age of Accounts 0-30 days 31-60 days 61-90 days More than 90 days Estimate of Percentage that will Balance Receivable Prove Uncollectible At the beginning of the year, the company had a credit balance in the Allowance for Doubtful accounts of $4,000. During the year, the company wrote-off $2,300 of identified uncollectible accounts and collect $800 from accounts written-off in previous years. The company uses the Aging-of-Accounts-Receivable method for recognizing bad debt expense. Recall there are two methods for computing bad debt, Aging-of- Accounts-Receivable and Percentage-of-Sales. You should review both methods. 500,000 120,000 40,000 30,000 Beg Balance Less Write-off Required: 1. Prepare the journal entry for December 31, 2000, to record the provision for bad debts expense. Date Dec 30, 2000 Bad Debt Expense Allowance Collection Bad Debt End Balance Accounts 0.5% 1.0% 5.0% 10.0% debits 6200 2. Prepare a schedule, in good form, computing the balance in Grunge Plaid's Allowance for Doubtful Accounts. In other words, show the activity affecting this account during 2000, to arrive at the ending balance on December 31, 2000, Allowance for Doubtful Accounts 4,000 (2.300) 800 6.200 8,700 credits 6200

Step by Step Solution

★★★★★

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Here are the answers to your questions 1 Journal entry ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started