Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Here is some price information on Fincorp stock. Suppose that Fincorp trades in a dealer market. Bid Ask 36.33 36.68 Required: a. Suppose you

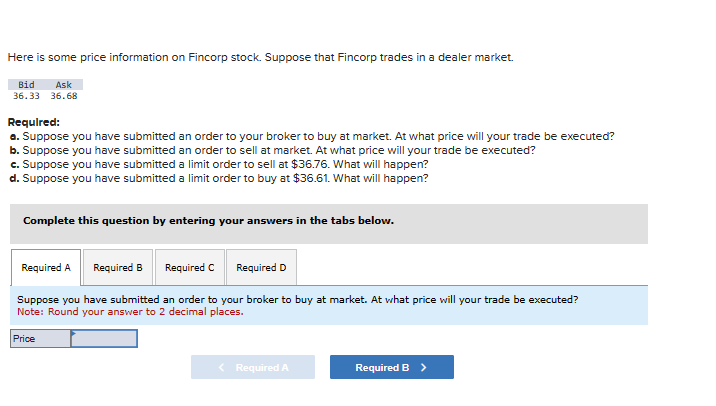

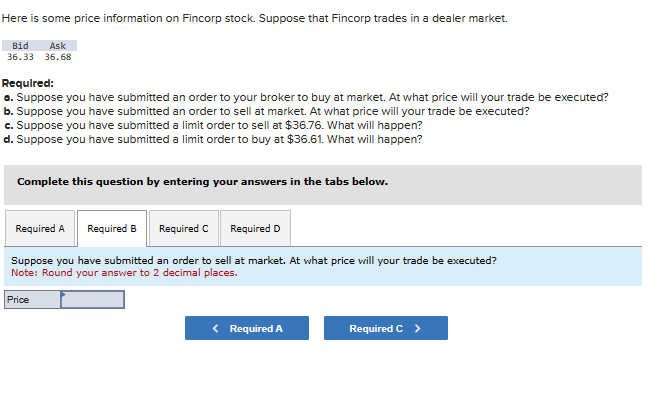

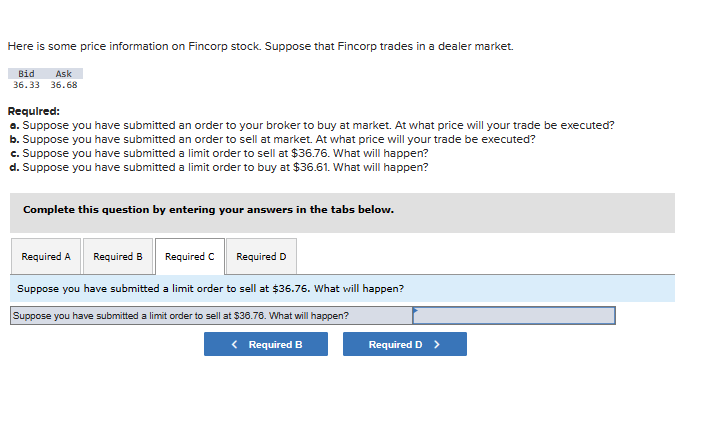

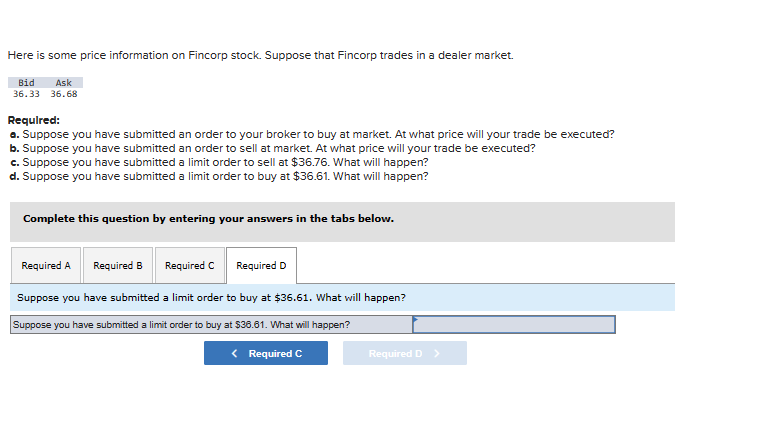

Here is some price information on Fincorp stock. Suppose that Fincorp trades in a dealer market. Bid Ask 36.33 36.68 Required: a. Suppose you have submitted an order to your broker to buy at market. At what price will your trade be executed? b. Suppose you have submitted an order to sell at market. At what price will your trade be executed? c. Suppose you have submitted a limit order to sell at $36.76. What will happen? d. Suppose you have submitted a limit order to buy at $36.61. What will happen? Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D Suppose you have submitted an order to your broker to buy at market. At what price will your trade be executed? Note: Round your answer to 2 decimal places. Price < Required A Required B > Here is some price information on Fincorp stock. Suppose that Fincorp trades in a dealer market. Bid Ask 36.33 36.68 Required: a. Suppose you have submitted an order to your broker to buy at market. At what price will your trade be executed? b. Suppose you have submitted an order to sell at market. At what price will your trade be executed? c. Suppose you have submitted a limit order to sell at $36.76. What will happen? d. Suppose you have submitted a limit order to buy at $36.61. What will happen? Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D Suppose you have submitted an order to sell at market. At what price will your trade be executed? Note: Round your answer to 2 decimal places. Price < Required A Required C > Here is some price information on Fincorp stock. Suppose that Fincorp trades in a dealer market. Bid Ask 36.33 36.68 Required: a. Suppose you have submitted an order to your broker to buy at market. At what price will your trade be executed? b. Suppose you have submitted an order sell at market. At what price will your trade be executed? c. Suppose you have submitted a limit order to sell at $36.76. What will happen? d. Suppose you have submitted a limit order to buy at $36.61. What will happen? Complete this question by entering your answers in the tabs below. Required B Required C Required D Suppose you have submitted a limit order to sell at $36.76. What will happen? Suppose you have submitted a limit order to sell at $36.76. What will happen? Required A < Required B Required D > Here is some price information on Fincorp stock. Suppose that Fincorp trades in a dealer market. Bid Ask 36.33 36.68 Required: a. Suppose you have submitted an order to your broker to buy at market. At what price will your trade be executed? b. Suppose you have submitted an order to sell at market. At what price will your trade be executed? c. Suppose you have submitted a limit order to sell at $36.76. What will happen? d. Suppose you have submitted a limit order to buy at $36.61. What will happen? Complete this question by entering your answers in the tabs below. Required A Required C Required D Suppose you have submitted a limit order to buy at $36.61. What will happen? Suppose you have submitted a limit order to buy at $36.61. What will happen? < Required C Required B Required D >

Step by Step Solution

★★★★★

3.47 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

a Buy at Market Order When I place an order to buy at market I am indicating that I am willing to pu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started