Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Here is the data. Be accurate Euro/Japanese Yen. A French firm is expecting to receive 10.4 million in 120 days as a result of an

Here is the data. Be accurate

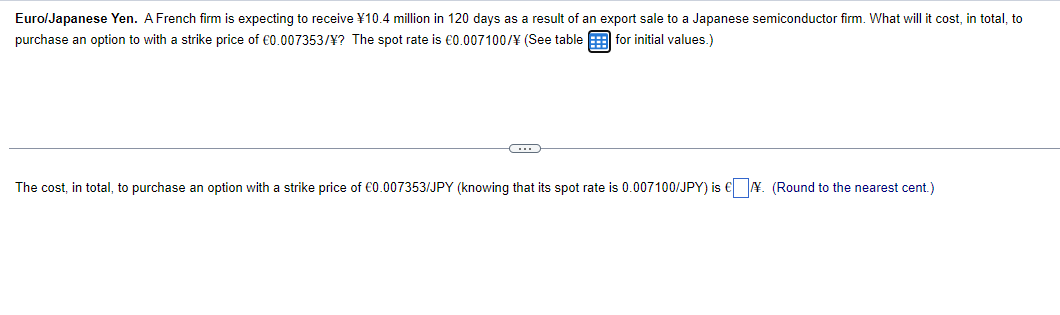

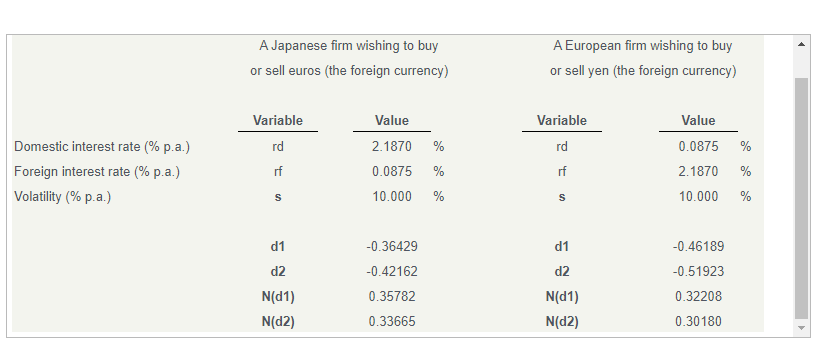

Euro/Japanese Yen. A French firm is expecting to receive 10.4 million in 120 days as a result of an export sale to a Japanese semiconductor firm. What will it cost, in total, to purchase an option to with a strike price of 0.007353/ ? The spot rate is 0.007100/ (See table for initial values.) The cost, in total, to purchase an option with a strike price of 0.007353/JPY (knowing that its spot rate is 0.007100/JPY ) is I. (Round to the nearest cent.) A European firm wishing to buy or sell yen (the foreign currency) Euro/Japanese Yen. A French firm is expecting to receive 10.4 million in 120 days as a result of an export sale to a Japanese semiconductor firm. What will it cost, in total, to purchase an option to with a strike price of 0.007353/ ? The spot rate is 0.007100/ (See table for initial values.) The cost, in total, to purchase an option with a strike price of 0.007353/JPY (knowing that its spot rate is 0.007100/JPY ) is I. (Round to the nearest cent.) A European firm wishing to buy or sell yen (the foreign currency)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started