here is the General Ledger, please help

solve income statement and impact on income

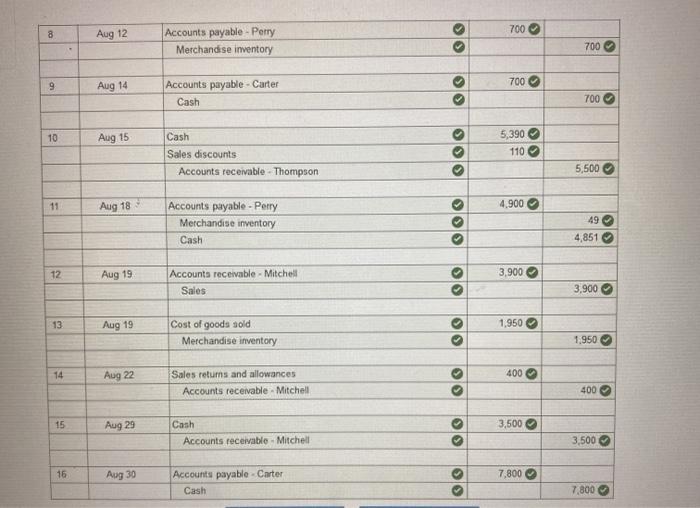

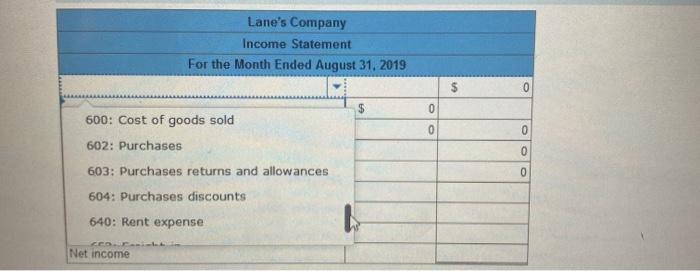

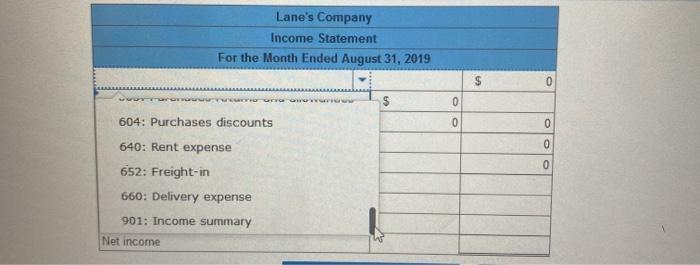

income statement

options for income statement

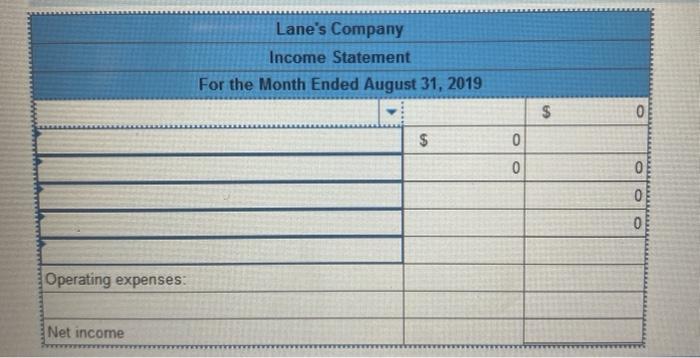

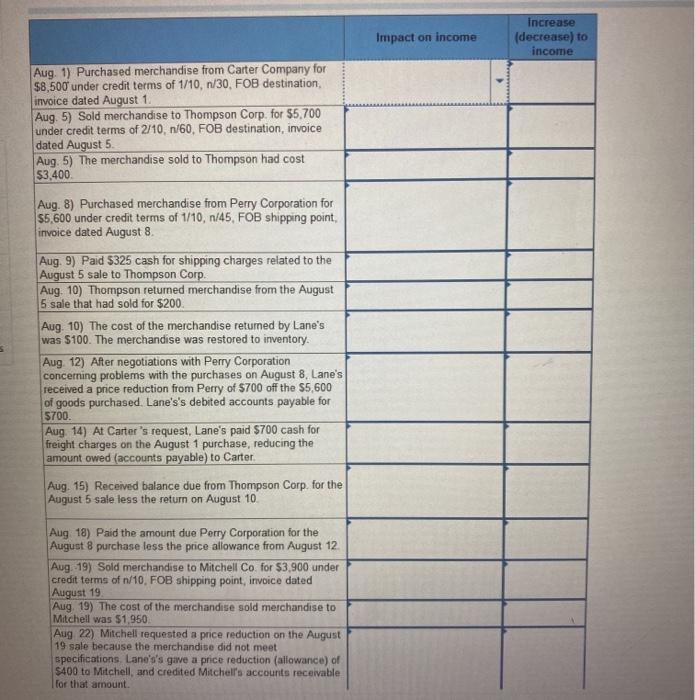

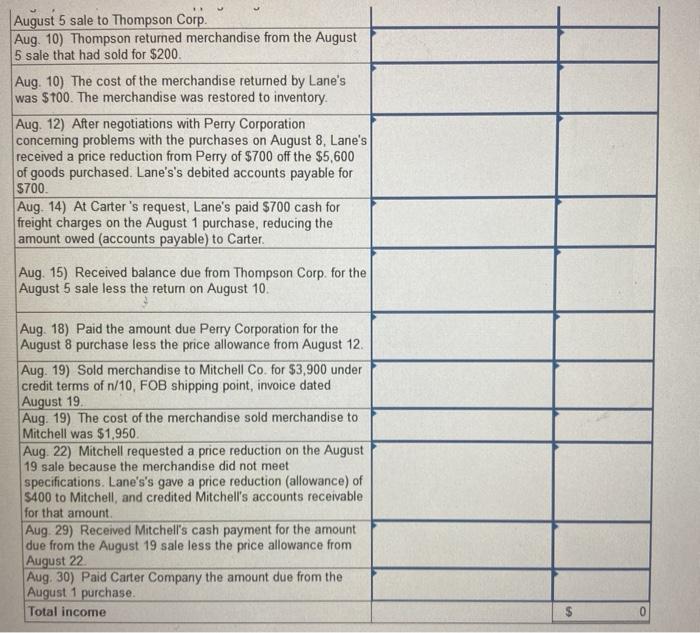

Impact on income

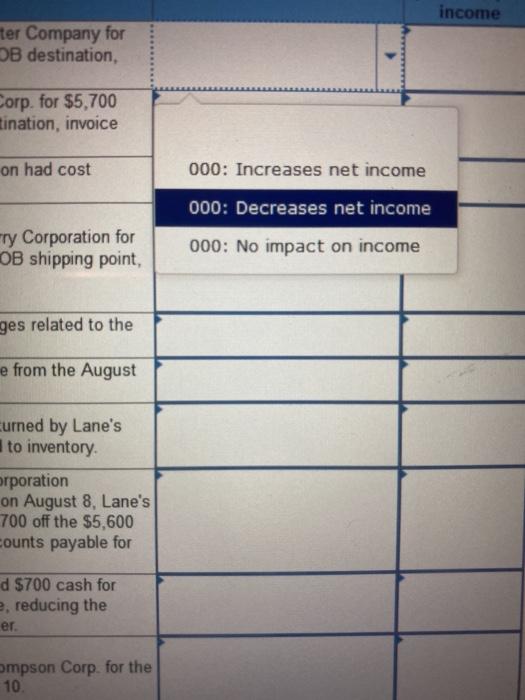

options for impact on income

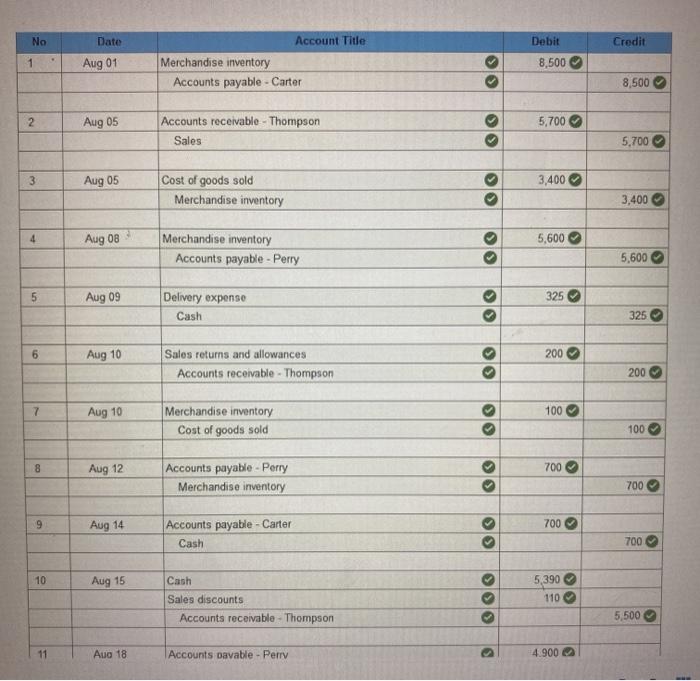

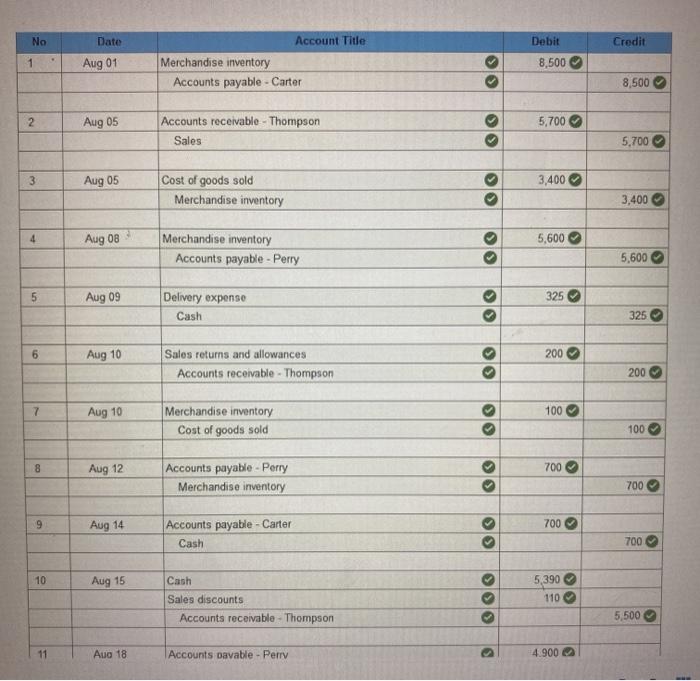

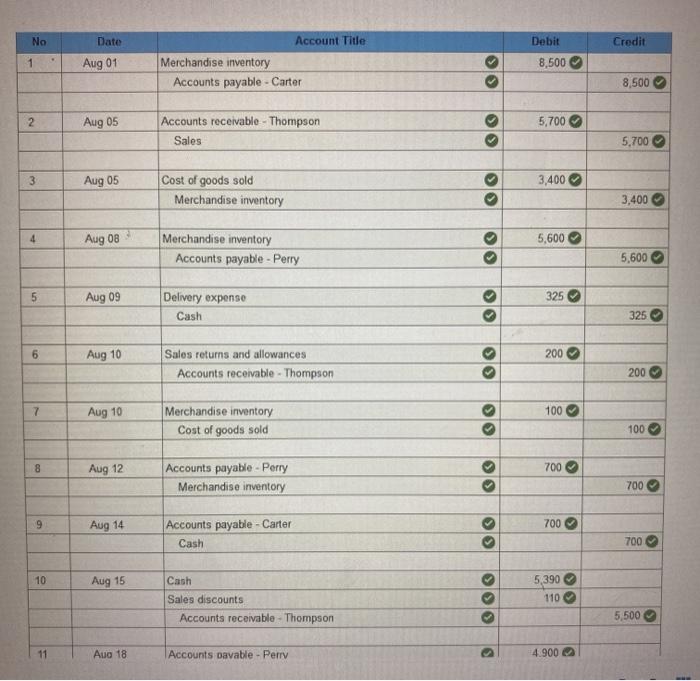

No Date Debit Credit 1 Aug 01 Account Title Merchandise inventory Accounts payable - Carter 8,500 8,500 2 Aug 05 5,700 Accounts receivable - Thompson Sales 5,700 Aug 05 3,400 Cost of goods sold Merchandise inventory ol 3,400 4 Aug 08 5,600 Merchandise inventory Accounts payable - Perry >> 5,600 5 Aug 09 325 Delivery expense Cash 9 325 6 Aug 10 200 Sales returns and allowances Accounts receivable - Thompson 200 7 Aug 10 100 Merchandise inventory Cost of goods sold Ol 100 > 8 Aug 12 700 Accounts payable - Perry Merchandise inventory >> 700 9 Aug 14 700 Accounts payable - Carter Cash 700 10 Aug 15 Cash Sales discounts Accounts receivable - Thompson 5,390 110 5,500 Aug 18 Accounts pavable - Perry 4.900 700 8 Aug 12 Accounts payable - Perry Merchandise inventory 700 9 Aug 14 700 Accounts payable - Carter Cash 700 10 Aug 15 5,390 110 Cash Sales discounts Accounts receivable Thompson >> DO 5,500 11 Aug 18 4.900 Accounts payable - Perry Merchandise inventory Cash O 49 4,851 SIS 12 Aug 19 3,900 Accounts receivable - Mitchell Sales 3,900 13 Aug 19 1,950 > Cost of goods sold Merchandise inventory 1.950 14 Aug 22 400 Sales returns and allowances Accounts receivable - Mitchell > 400 15 Aug 29 3,500 Cash Accounts receivable Mitchell 3,500 15 Aug 30 7,800 S Accounts payable - Carter Cash 7,800 Lane's Company Income Statement For the Month Ended August 31, 2019 $ $ 0 $ 0 0 0 0 0 Operating expenses: Net income Lane's Company Income Statement For the Month Ended August 31, 2019 $ 0 $ 0 0 0 0 0 000: No journal entry required 101: Cash 106: Accounts receivable - Carter 107: Accounts receivable - Thompson Net income Lane's Company Income Statement For the Month Ended August 31, 2019 $ 0 $ 0 108: Accounts receivable - Mitchell 0 0 0 0 109: Accounts receivable - Perry 120: Merchandise inventory 201: Accounts payable - Carter 202: Accounts payable - Thompson Net income Lane's Company Income Statement For the Month Ended August 31, 2019 S 0 $ 0 0 0 203: Accounts payable - Mitchell 204: Accounts payable - Perry 209: Salaries payable 0 0 226: Unearned fees 301: Lane, Capital Net income Lane's Company Income Statement For the Month Ended August 31, 2019 $ 0 $ 302: Lane, Withdrawals OO 0 403: Sales 0 404: Sales returns and allowances 0 405: Sales discounts 600: Cost of goods sold Net income Lane's Company Income Statement For the Month Ended August 31, 2019 $ 0 0 0 0 0 0 600: Cost of goods sold 602: Purchases 603: Purchases returns and allowances 604: Purchases discounts 640: Rent expense CO Net income Lane's Company Income Statement For the Month Ended August 31, 2019 $ 0 $ 0 604: Purchases discounts 0 0 640: Rent expense 0 0 652: Freight-in 660: Delivery expense 901: Income summary Net income Impact on income Increase (decrease) to income Aug. 1) Purchased merchandise from Carter Company for $8,500 under credit terms of 1/10, n/30, FOB destination, invoice dated August 1 Aug. 5) Sold merchandise to Thompson Corp. for $5.700 under Credit terms of 2/10,n/60. FOB destination, invoice dated August 5. Aug. 5) The merchandise sold to Thompson had cost $3,400 Aug. 8) Purchased merchandise from Perry Corporation for 55,600 under credit terms of 1/10, n/45. FOB shipping point, invoice dated August 8 Aug. 9) Paid $325 cash for shipping charges related to the August 5 sale to Thompson Corp. Aug. 10) Thompson returned merchandise from the August 5 sale that had sold for $200 Aug. 10) The cost of the merchandise returned by Lane's was $100. The merchandise was restored to inventory. Aug 12) After negotiations with Perry Corporation concerning problems with the purchases on August 8, Lane's received a price reduction from Perry of $700 off the $5,600 of goods purchased. Lane's's debited accounts payable for $700. Aug 14) At Carter's request, Lane's paid $700 cash for freight charges on the August 1 purchase, reducing the amount owed (accounts payable) to Carter Aug. 15) Received balance due from Thompson Corp. for the August 5 sale less the return on August 10 Aug 18) Paid the amount due Perry Corporation for the August 8 purchase less the price allowance from August 12 Aug 19) Sold merchandise to Mitchell Co for $3,900 under credit terms of n/10, FOB shipping point, invoice dated August 19 Aug 19) The cost of the merchandise sold merchandise to Mitchell was $1,950 Aug 22) Mitchell requested a price reduction on the August 19 sale because the merchandise did not meet specifications Lane's's gave a price reduction (allowance) of $400 to Mitchell, and credited Mitchell's accounts receivable for that amount August 5 sale to Thompson Corp. Aug. 10) Thompson returned merchandise from the August 5 sale that had sold for $200. Aug. 10) The cost of the merchandise returned by Lane's was $100. The merchandise was restored to inventory Aug. 12) After negotiations with Perry Corporation concerning problems with the purchases on August 8, Lane's received a price reduction from Perry of $700 off the $5,600 of goods purchased. Lane's's debited accounts payable for $700 Aug. 14) At Carter's request, Lane's paid $700 cash for freight charges on the August 1 purchase, reducing the amount owed (accounts payable) to Carter Aug. 15) Received balance due from Thompson Corp. for the August 5 sale less the return on August 10. Aug. 18) Paid the amount due Perry Corporation for the August 8 purchase less the price allowance from August 12. Aug. 19) Sold merchandise to Mitchell Co. for $3,900 under credit terms of n/10, FOB shipping point, invoice dated August 19 Aug. 19) The cost of the merchandise sold merchandise to Mitchell was $1,950 Aug. 22) Mitchell requested a price reduction on the August 19 sale because the merchandise did not meet specifications. Lane's's gave a price reduction (allowance) of $400 to Mitchell, and credited Mitchell's accounts receivable for that amount Aug 29) Received Mitchell's cash payment for the amount due from the August 19 sale less the price allowance from August 22 Aug. 30) Paid Carter Company the amount due from the August 1 purchase. Total income 0 income ter Company for B destination, Corp. for $5,700 tination, invoice on had cost 000: Increases net income ry Corporation for OB shipping point, 000: Decreases net income 000: No impact on income ages related to the e from the August Curned by Lane's to inventory orporation on August 8, Lane's 700 off the $5,600 counts payable for d $700 cash for e, reducing the er. mpson Corp. for the 10