Answered step by step

Verified Expert Solution

Question

1 Approved Answer

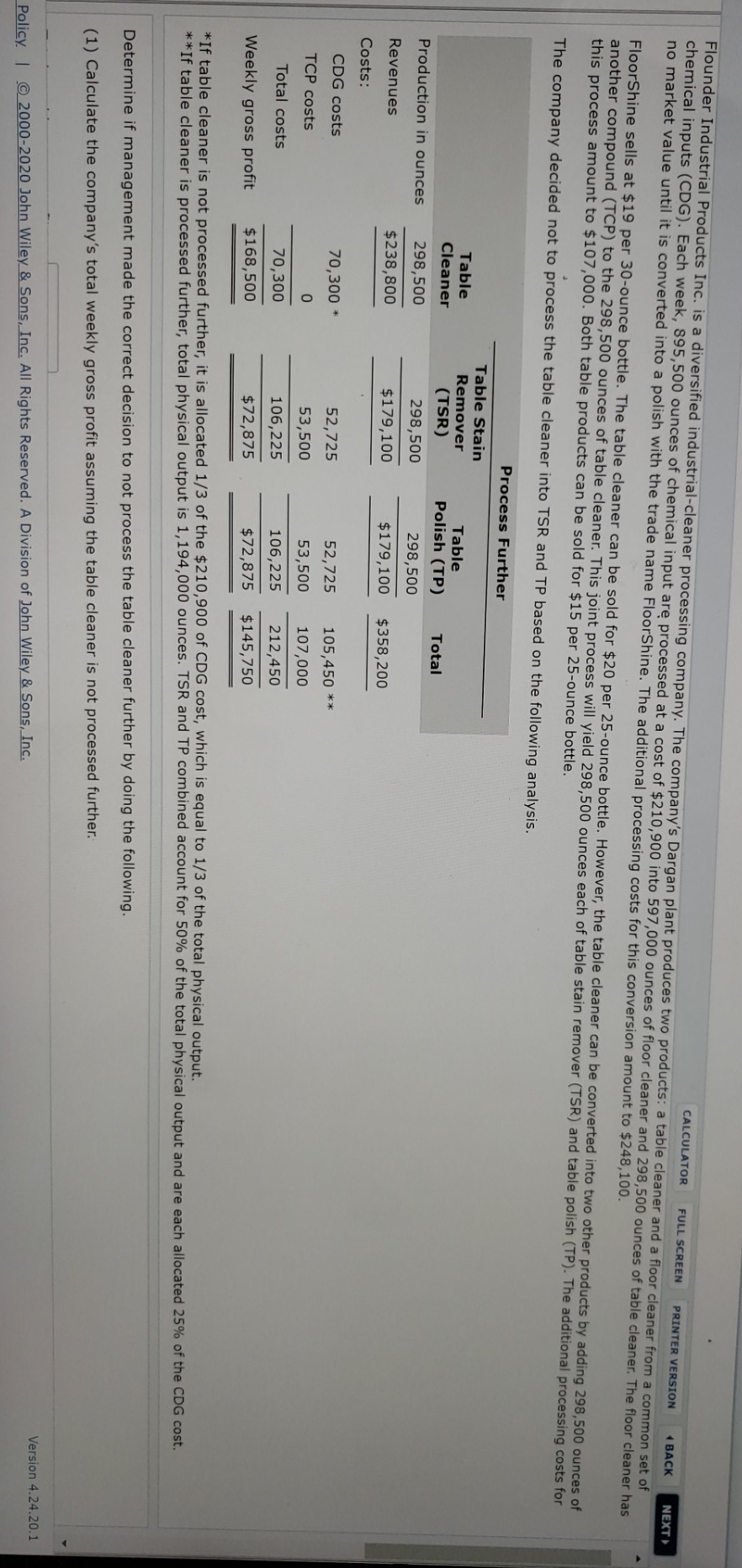

Here is the initial question to the question everyone is commenting on, in regards to needed data. The response is a 4 part response. (1)

Here is the initial question to the question everyone is commenting on, in regards to needed data. The response is a 4 part response. (1) Shown in picture. (2) Calculate the company's total weekly gross profit assuming the table cleaner is processed further. (3) Compare the resulting net incomes and comment on managements decision (right or wrong) decision by choosing to not process table cleaner further. (4) Using incremental analysis, determine if the table cleaner should be processed further.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started