Answered step by step

Verified Expert Solution

Question

1 Approved Answer

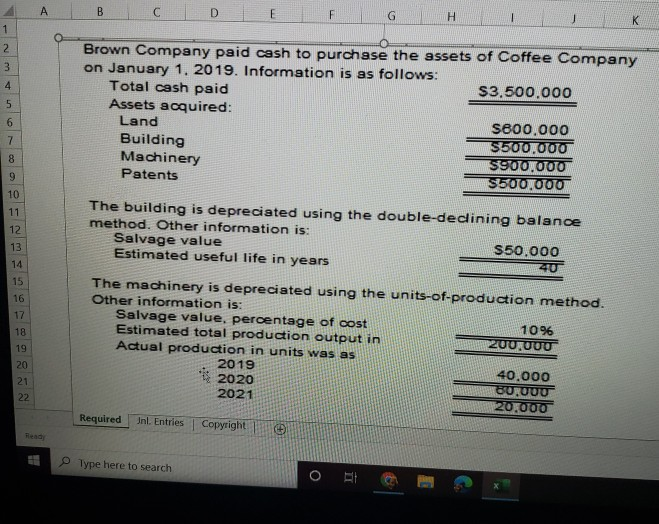

here is the part thats missing A B D E F G H 1 2 3 4 5 Brown Company paid cash to purchase the

here is the part thats missing

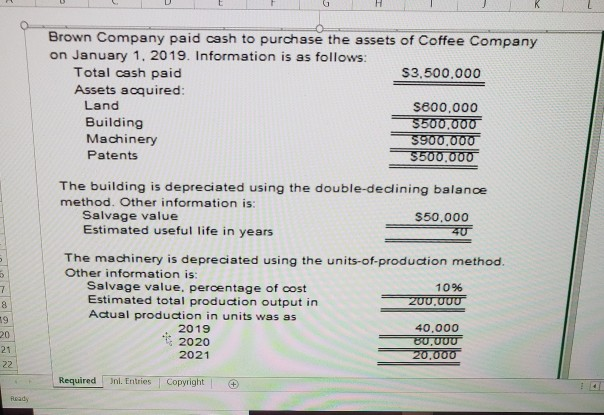

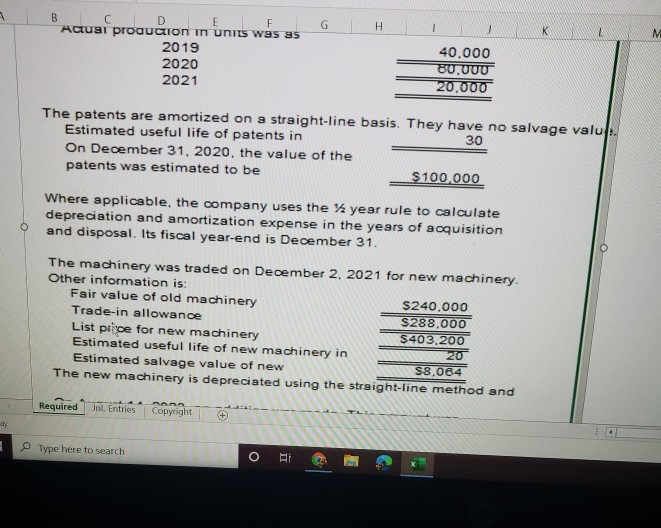

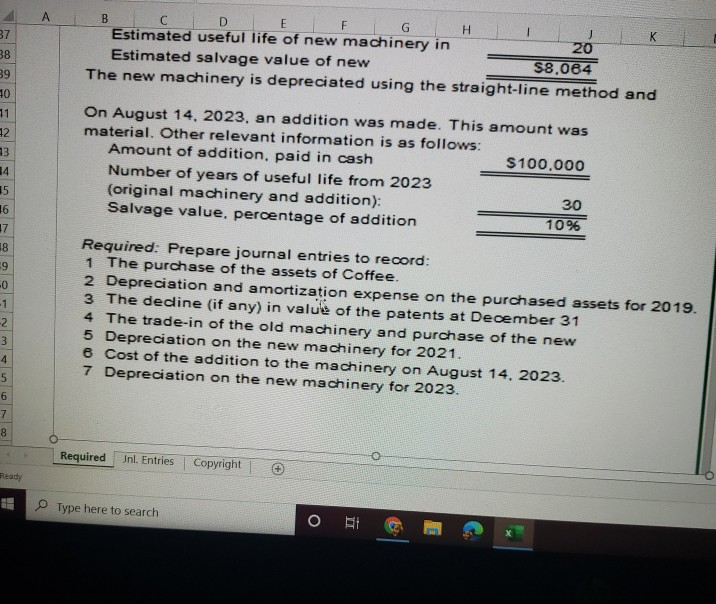

A B D E F G H 1 2 3 4 5 Brown Company paid cash to purchase the assets of Coffee Company on January 1. 2019. Information is as follows: Total cash paid $3.500.000 Assets acquired: Land S800.000 Building $500,000 Machinery 5900.000 Patents 5500.000 6 7 8 9 10 11 12 13 14 15 16 The building is depreciated using the double-declining balance method. Other information is: Salvage value 550.000 Estimated useful life in years 20 The machinery is depreciated using the units-of-production method. Other information is: Salvage value, percentage of cost 10% Estimated total production output in 200.000 Actual production in units was as 2019 40.000 30.000 2021 120.000 18 19 20 21 22 2020 Required Jnl Entries Copyright F Type here to search O hanya Brown Company paid cash to purchase the assets of Coffee Company on January 1, 2019. Information is as follows: Total cash paid $3.500.000 Assets acquired: Land $600,000 Building $500.000 Machinery $900.000 Patents 5500.000 5 7 8 59 20 21 22 The building is depreciated using the double-declining balance method. Other information is: Salvage value $50,000 Estimated useful life in years 40 The machinery is depreciated using the units-of-production method Other information is: Salvage value, percentage of cost 1096 Estimated total production output in 200.000 Actual production in units was as 2019 40.000 2020 80,000 2021 20.000 Required Inl. Entries Copyright + Ready G H 1 M B E F Acuar production in Units W95 ss 2019 2020 2021 40.000 80.000 20.000 The patents are amortized on a straight-line basis. They have no salvage valu. Estimated useful life of patents in 30 On December 31, 2020, the value of the patents was estimated to be $ 100 000 Where applicable, the company uses the year rule to calculate depreciation and amortization expense in the years of acquisition and disposal. Its fiscal year-end is December 31. The machinery was traded on December 2, 2021 for new machinery Other information is: Fair value of old machinery S240.000 Trade-in allowance $288.000 List price for new machinery S403.200 Estimated useful life of new machinery in 20 Estimated salvage value of new S8,064 The new machinery is depreciated using the straight-line method and Required Inl. Entries Copyright Type here to search o BE > A F 37 38 B D E H Estimated useful life of new machinery in 20 Estimated salvage value of new $8,084 The new machinery is depreciated using the straight-line method and 39 10 11 12 13 14 On August 14, 2023, an addition was made. This amount was material. Other relevant information is as follows: Amount of addition, paid in cash $100,000 Number of years of useful life from 2023 (original machinery and addition): 30 Salvage value, percentage of addition 10% 15 16 17 18 9 -0 - 1 Required: Prepare journal entries to record: 1 The purchase of the assets of Coffee. 2 Depreciation and amortization expense on the purchased assets for 2019. 3 The decline (if any) in value of the patents at December 31 4 The trade-in of the old machinery and purchase of the new 5 Depreciation on the new machinery for 2021. 6 Cost of the addition to the machinery on August 14, 2023. 7 Depreciation on the new machinery for 2023. 2 3 4 5 6 7 8 Required Jnl. Entries Copyright Ready Type here to search O BE

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started