Here is the question

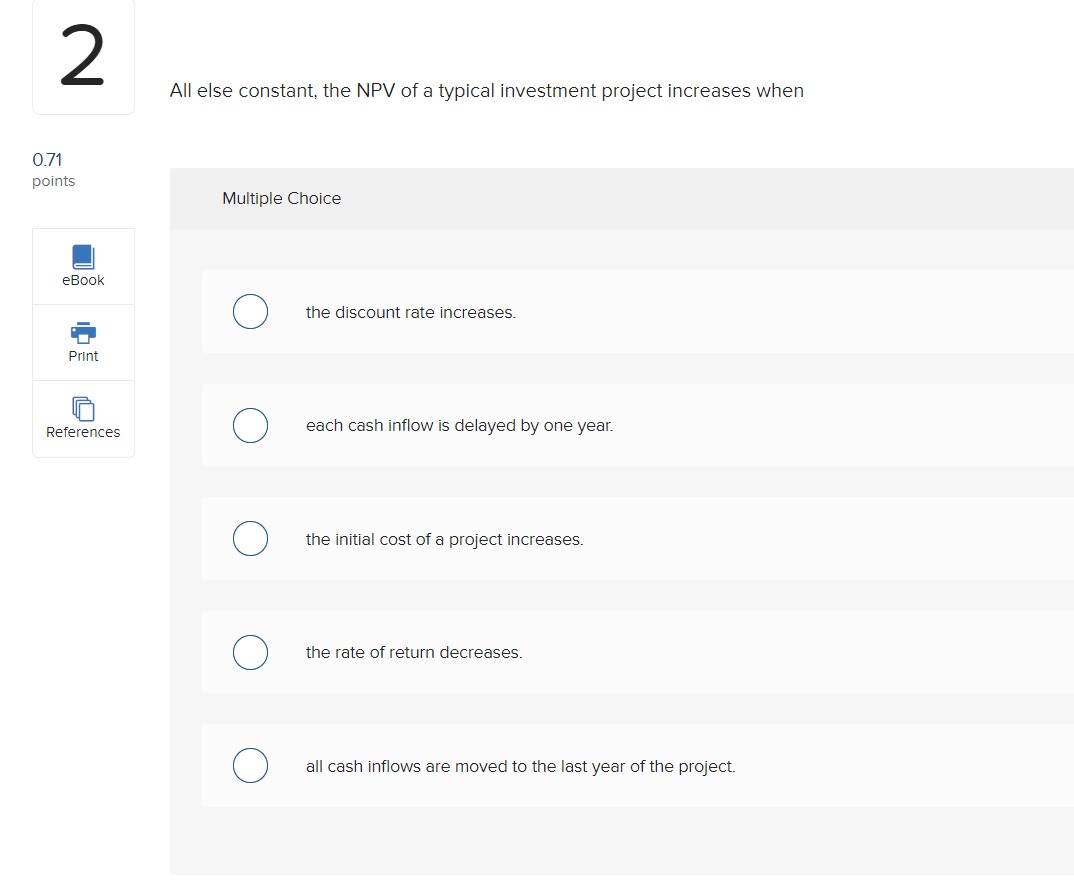

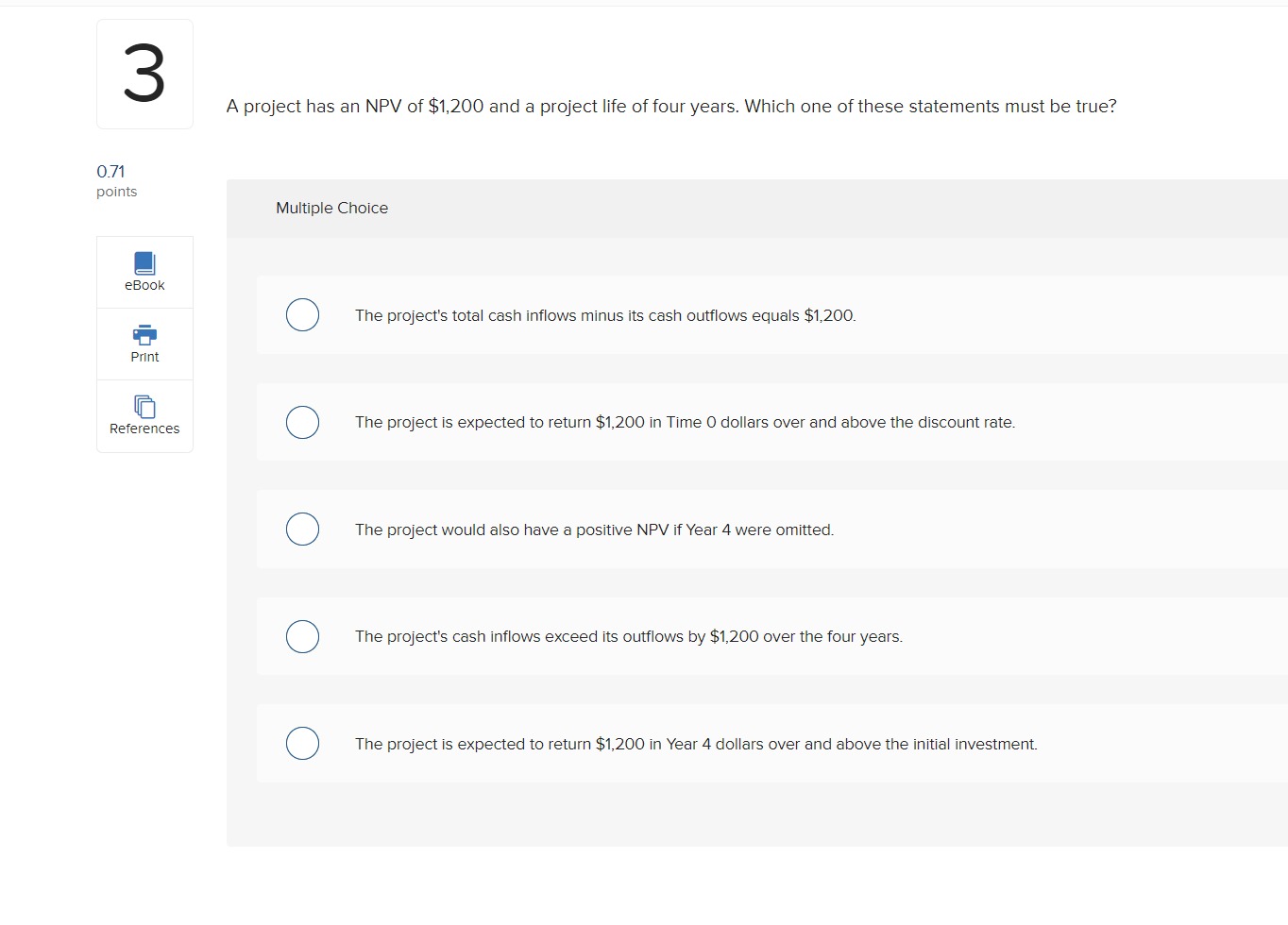

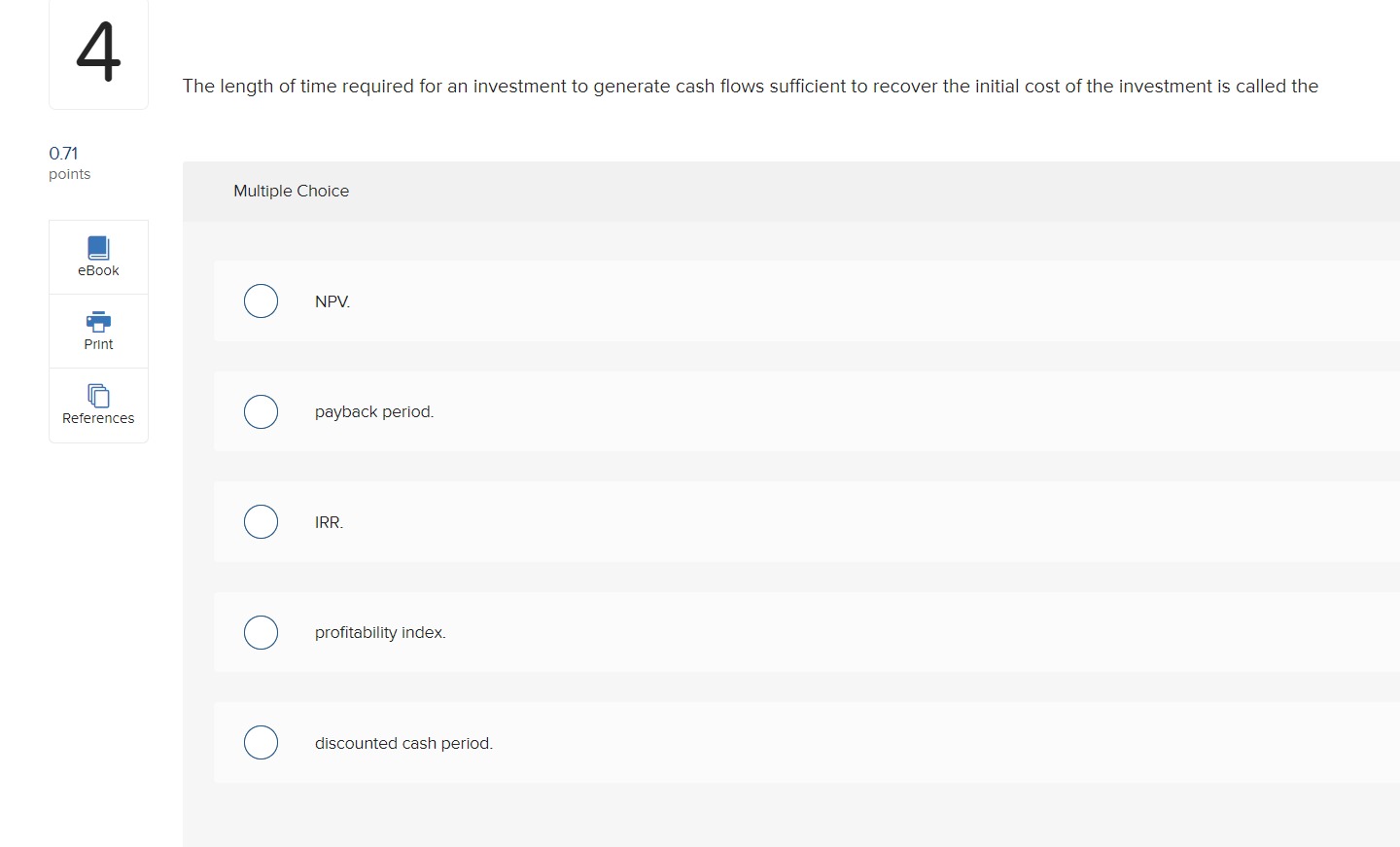

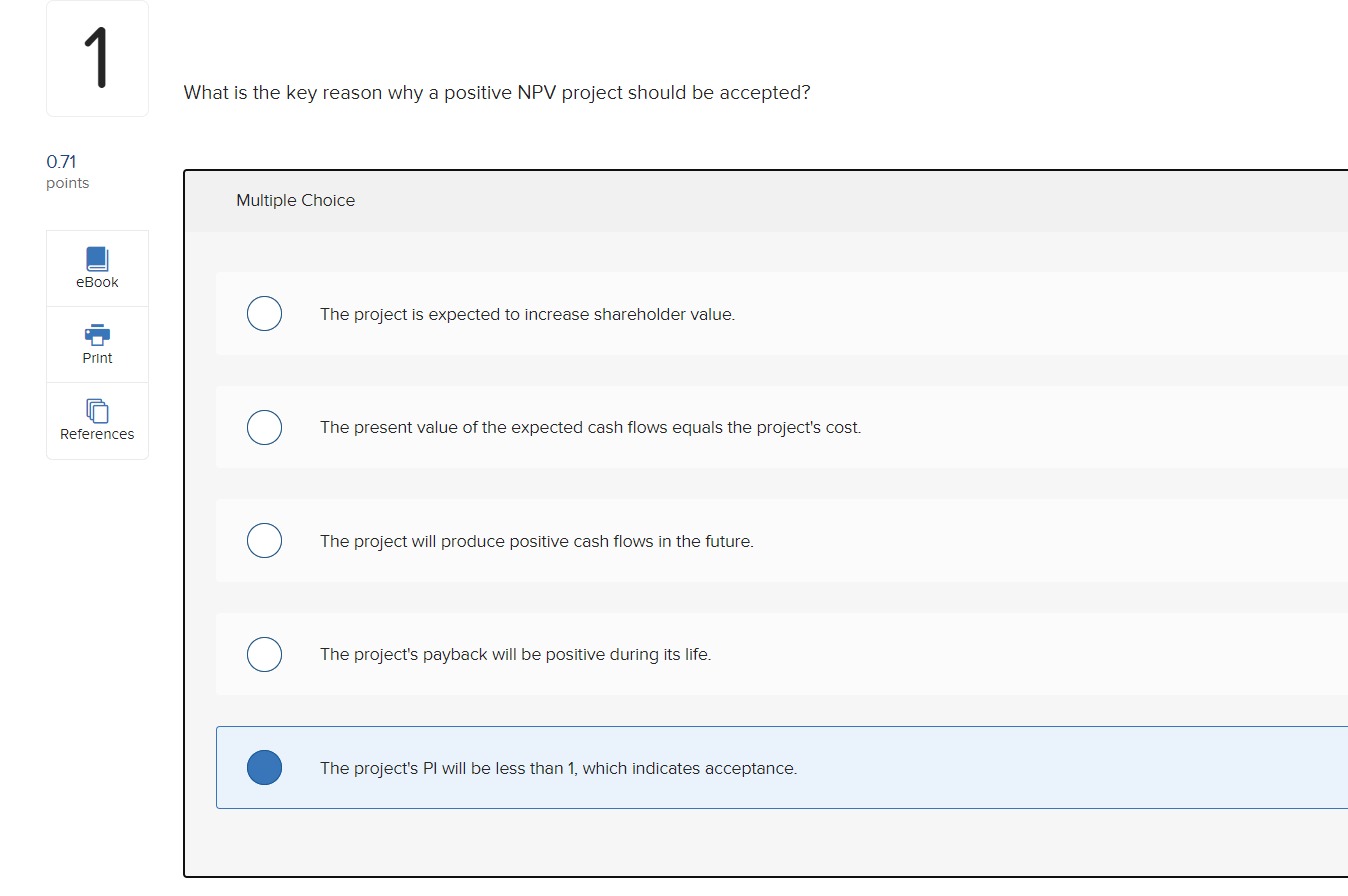

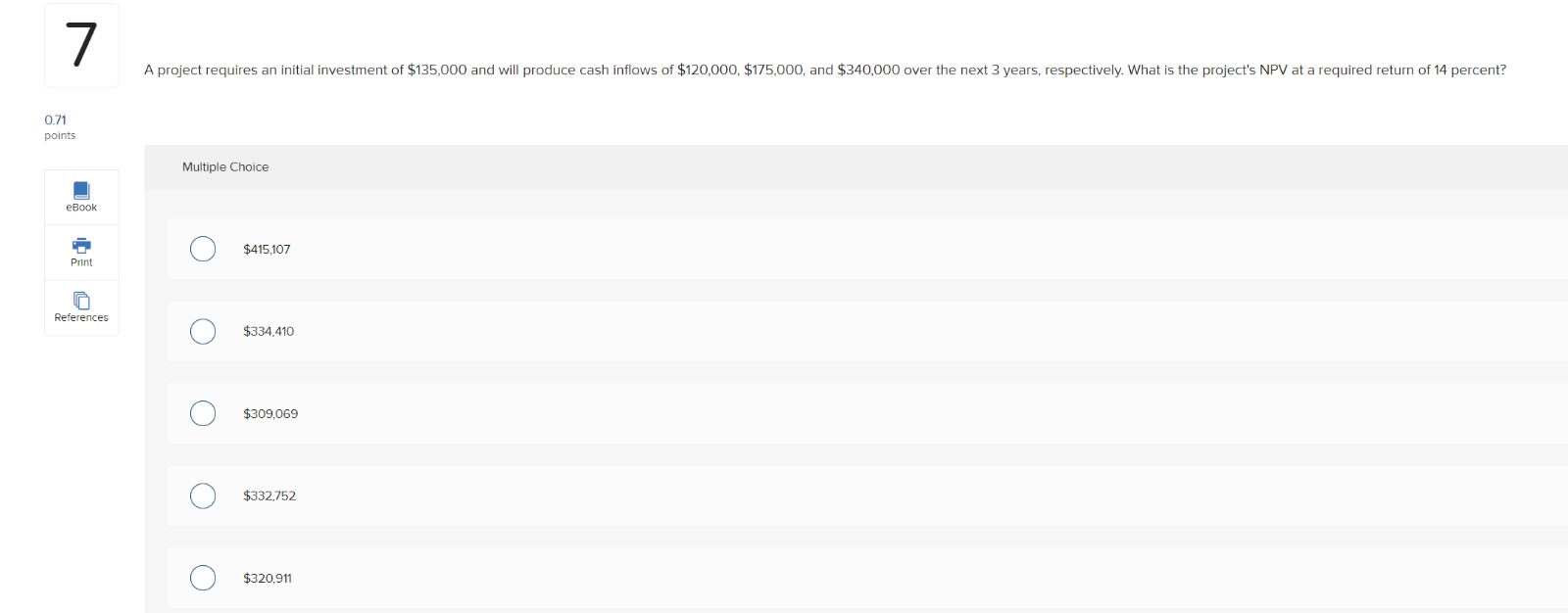

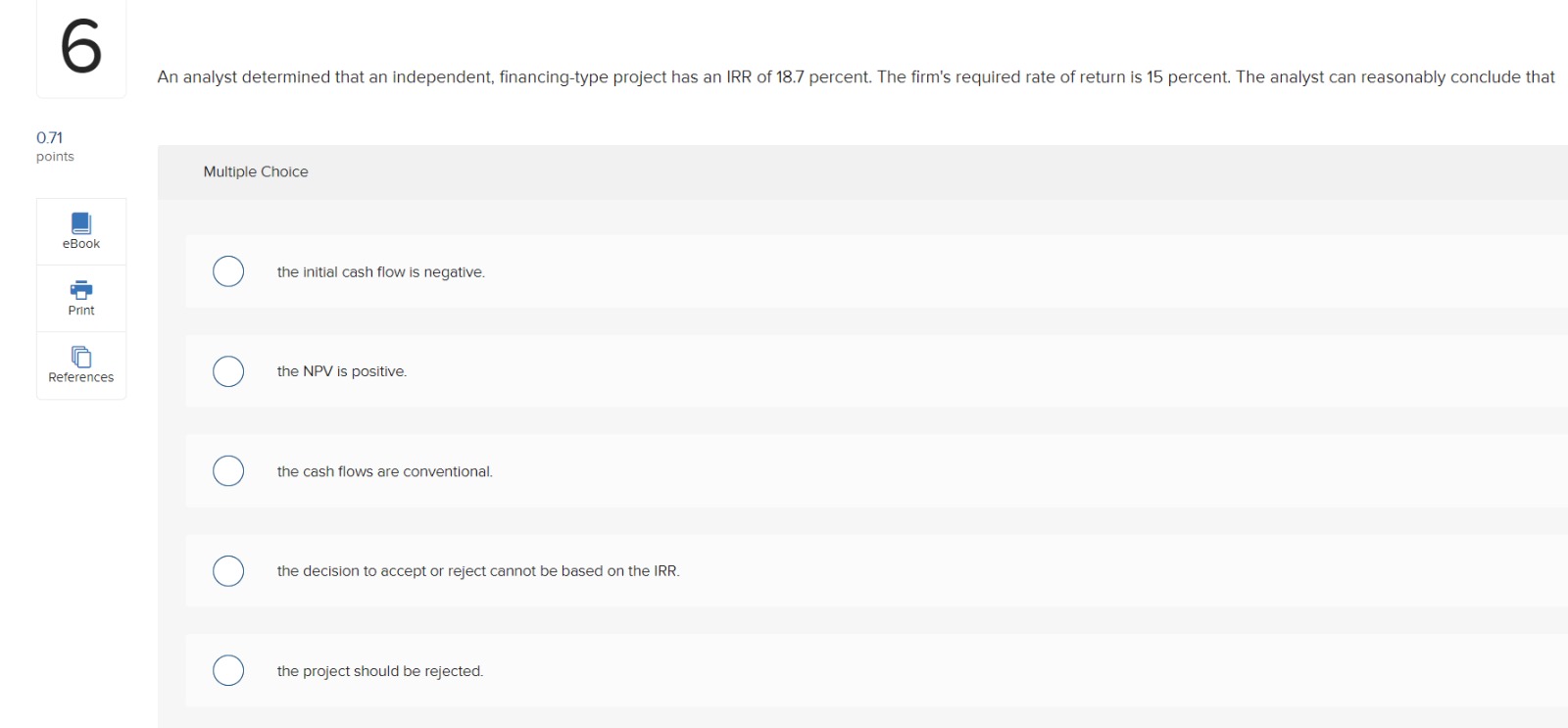

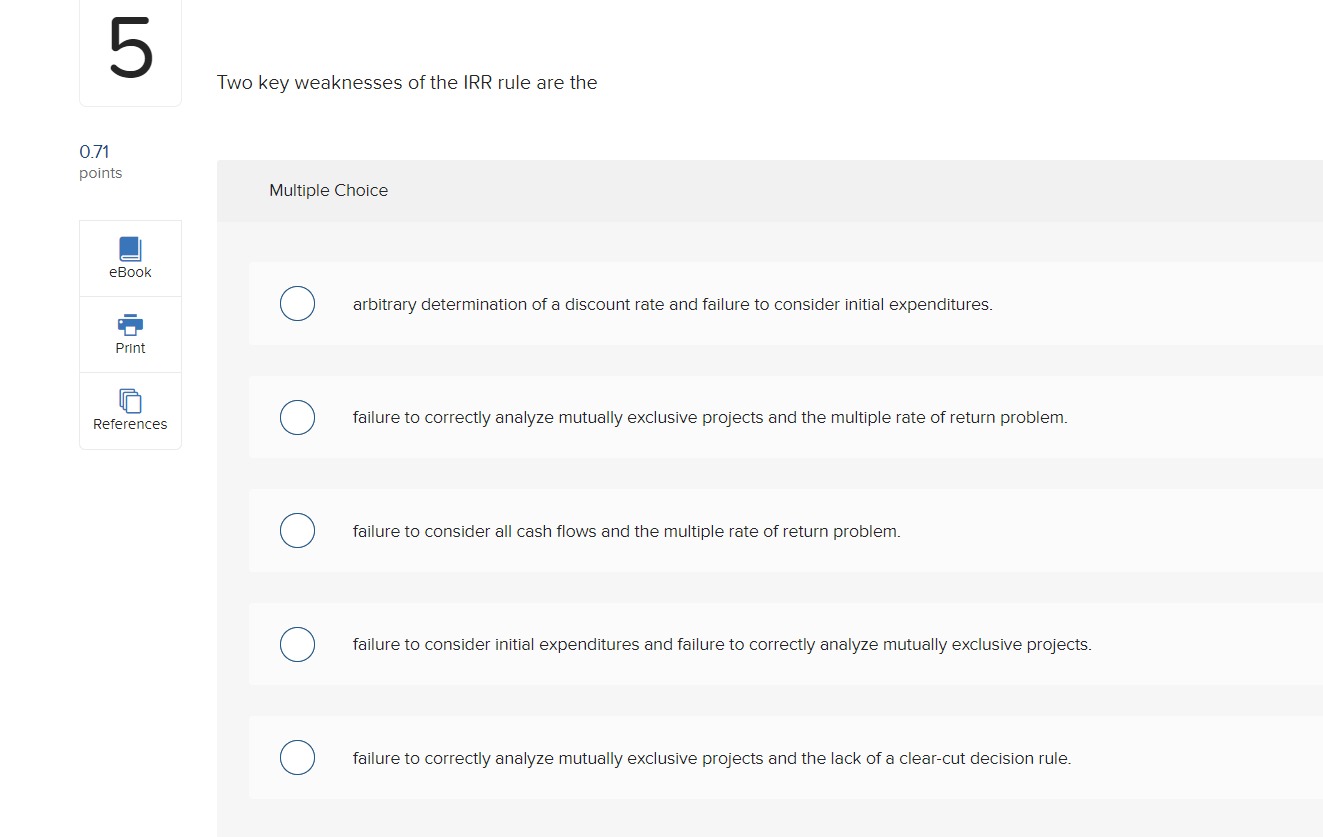

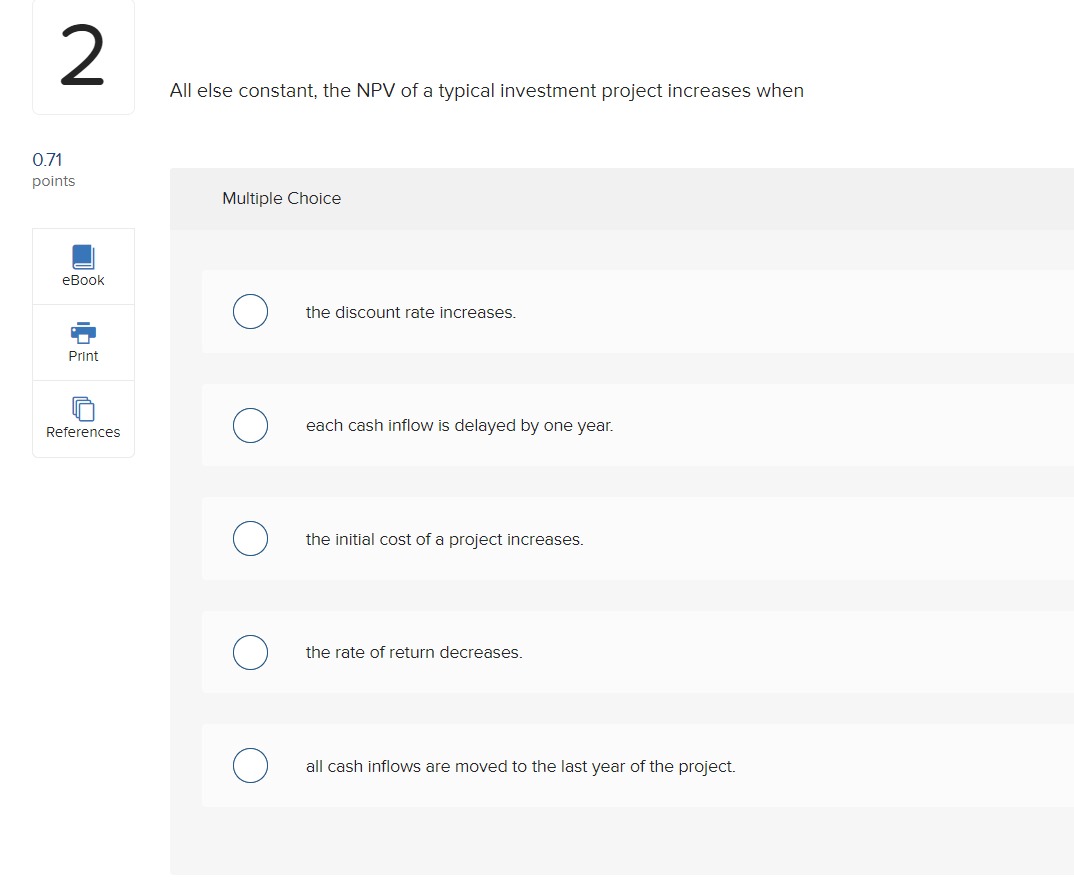

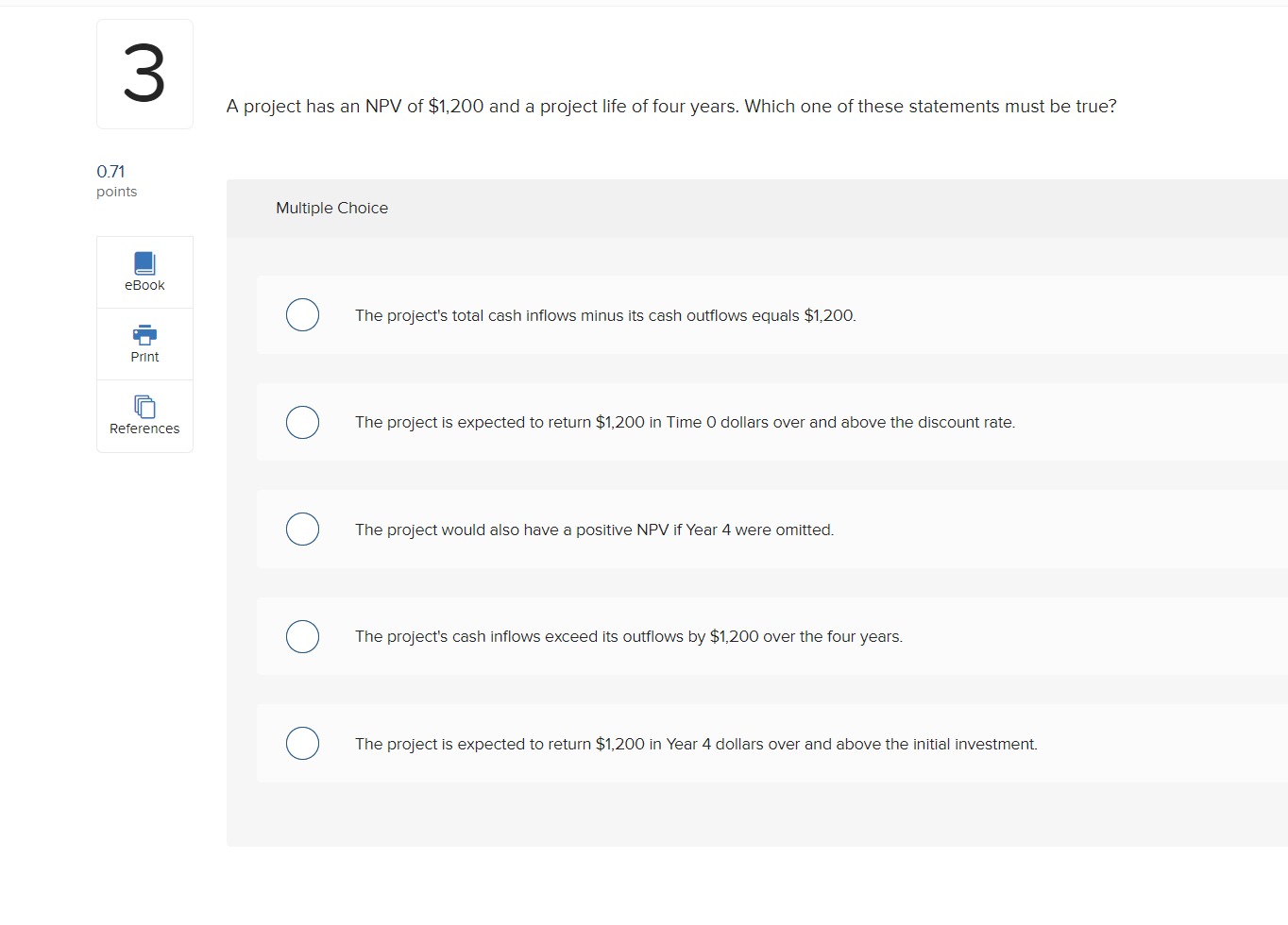

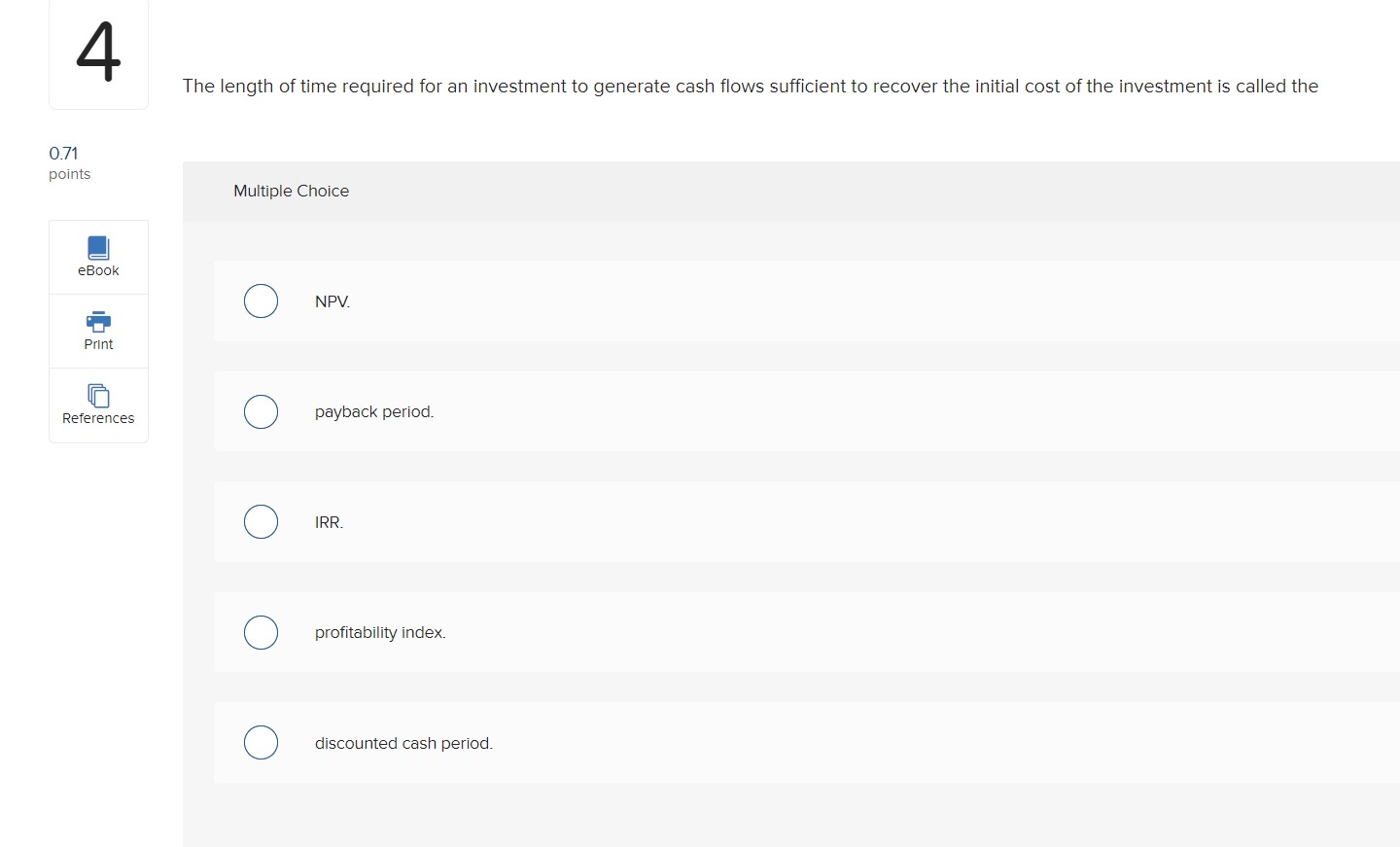

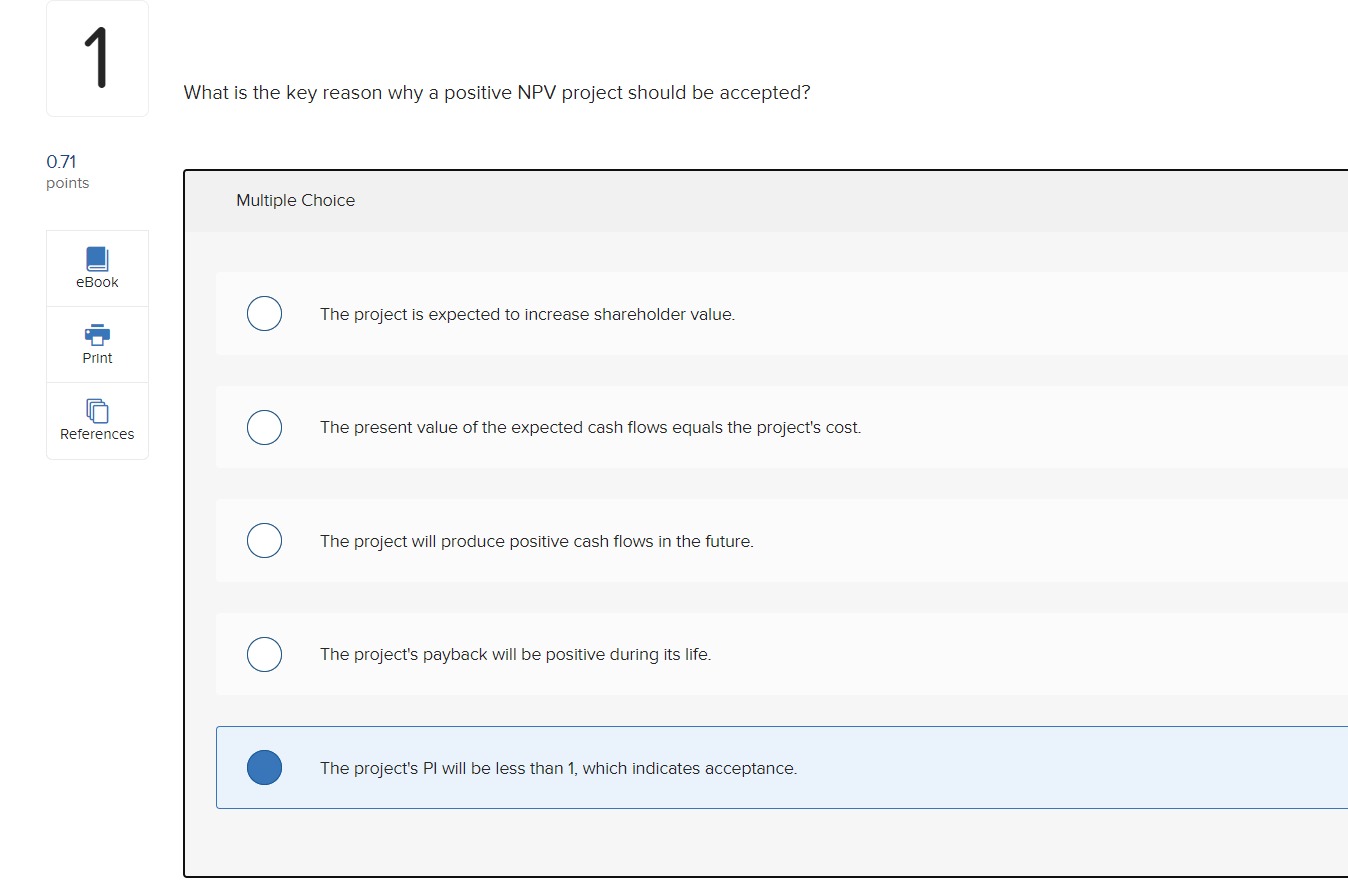

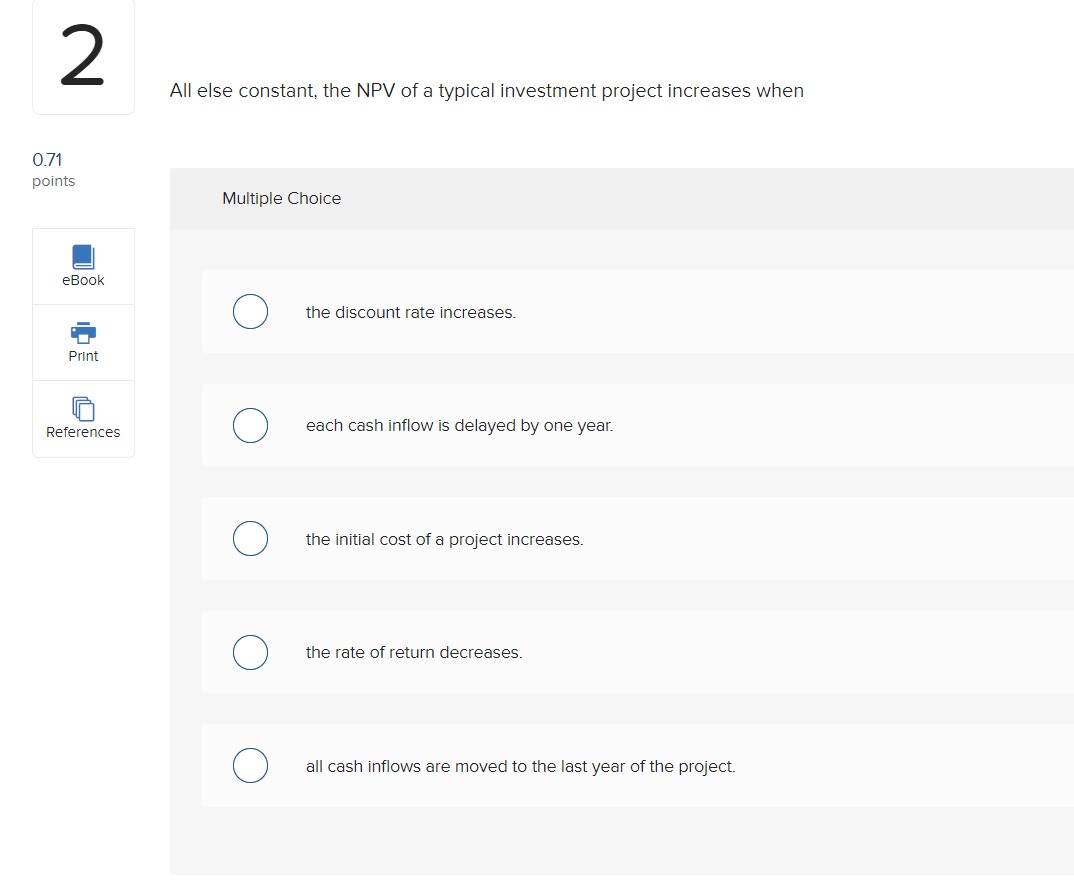

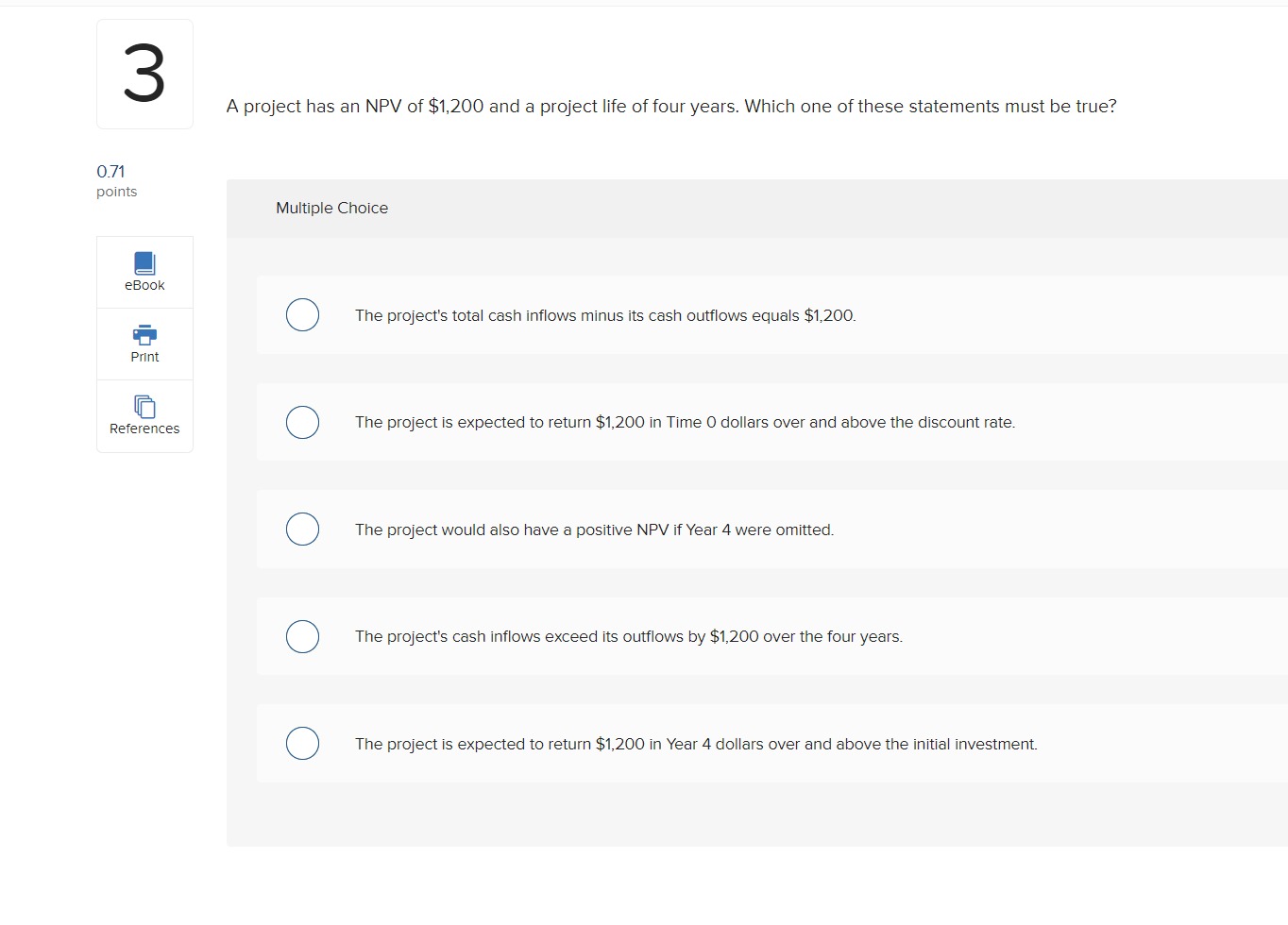

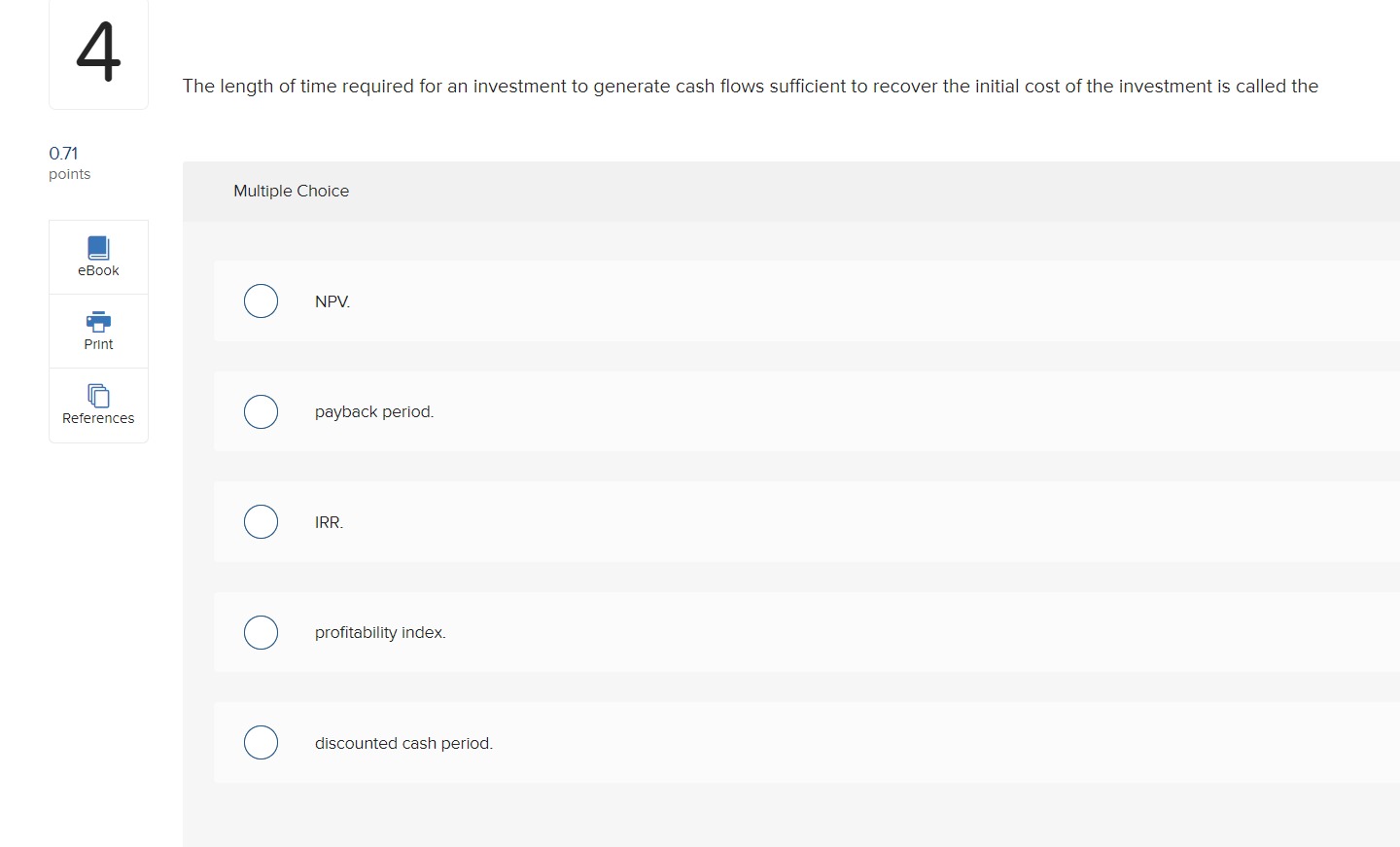

7 A project requires an initial investment of $135,000 and will produce cash inflows of $120,000, $175,000, and $340,000 over the next 3 years, respectively. What is the project's NPV at a required return of 14 percent? 0.71 points Multiple Choice eBook $415,107 Print O n References O $334.410 O $309,069 O $332.752 O $320,9116 An analyst determined that an independent, financing-type project has an IRR of 18.7 percent. The firm's required rate of return is 15 percent. The analyst can reasonably conclude that 0.71 points Multiple Choice eBook O the initial cash flow is negative. Print References O the NPV is positive. O the cash flows are conventional. O the decision to accept or reject cannot be based on the IRR. O the project should be rejected.0.71 points Refe rences Two key weaknesses ofthe IRR rule are the Multiple Choice @0000 arbitrary determination of a discount rate and failure to consider initial expenditures. failure to correctly analyze mutually exclusive projects and the multiple rate of return problem, failure to consider all cash flows and the multiple rate of return problem. failure to consider initial expenditures and failure to correctly analyze mutually exclusive projects, failure to correctly analyze mutually exclusive projects and the lack of a clear-cut decision rule. 2 All else constant, the NPV of a typical investment project increases when 0.71 points Multiple Choice eBook O the discount rate increases. Print References O each cash inflow is delayed by one year. O the initial cost of a project increases. O the rate of return decreases. O all cash inflows are moved to the last year of the project.A project has an NPV of $1,200 and a project life of four years. Which one of these statements must be true? 0.71 points Multiple Choice The project's total cash inflows minus its cash outflows equals $1,200. The project is expected to return $1,200 in Time 0 dollars over and above the discount rate. Rate rences The project would also have a positive NPV if Year 4 were omitted, The project's. cash inflows exceed its outows by $1200 over the four years, 00000 The project is expected to return $1,200 in Year 4 dollars over and above the initial investment. 4 The length of time required for an investment to generate cash flows sufficient to recover the initial cost of the investment is called the 0.71 points Multiple Choice eBook O NPV. Print References O payback period. O IRR. O profitability index. O discounted cash period.Refe I'EFICES What is the key reason why a positive NPV project should be accepted? Multiple Choice The project is expected to increase shareholder value, The present value of the expected cash flows equals the project's cost The project will produce positive cash flows in the future The project's payback will be positive during its life, .0000 The project's Pl will be less than 1, which indicates acceptance