Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Here is the questions with the formula you need to use Please answer with clear steps And comment about it QUESTION 1 [60] Dome Limited

Here is the questions with the formula you need to use Please answer with clear steps And comment about it

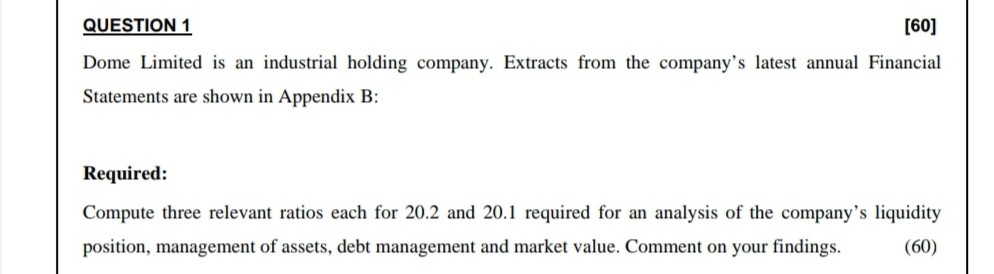

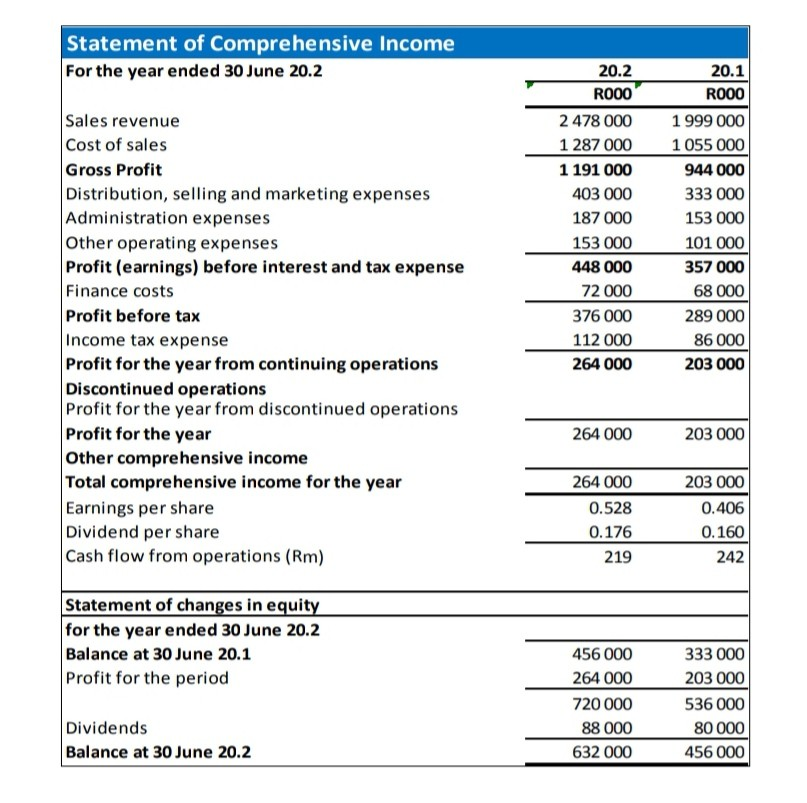

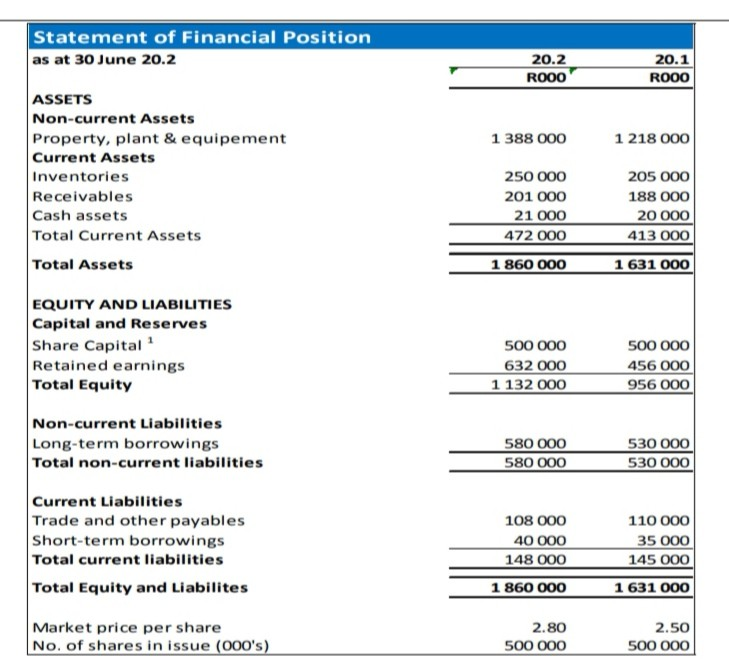

QUESTION 1 [60] Dome Limited is an industrial holding company. Extracts from the company's latest annual Financial Statements are shown in Appendix B: Required: Compute three relevant ratios each for 20.2 and 20.1 required for an analysis of the company's liquidity position, management of assets, debt management and market value. Comment on your findings. (60) PVA-PNT FVA - PNT 7.4+1-4 Resume vested Capital invested Capital Assetto (1 + r) + - ' operating FVA - PMTX NPV- for RR PVA-PNT X -{"kup, for equity nepati profitar la ROCE net operating sets ROA ERIT NOPAT EP, X (R-Ry NPAT S-VC DOL- S-V-7 ERIT DFL Cul flow to real daw from operation total del EBVT Net aperating profit margin Net profit margine prode sales DTL DOL XDFL CPU total contribution totale FC Mer income to ofit from continuar rake CPU Bodyluddividend per price per share Larga perere Current ratio current sets current in Quick ratio current assets inventory current liabilities entory turnover cost of sales intory intory price per share Price-camigratie carnings per share Delto per controlable EVA - NOPAT-(WACC Invesad Capital) sales/365 Creditor period trade and other payables cost of sales/365 Totalt hver males operating dele Debrate total debit Dette equity Raw material entory days (Raw material inwentary Purchases) * 365 days Work in progress inventory days (WIP inventory/Cost of Sales 365 days Finished poods inventory days (Finished goods inventory/Cost of sales) * 365 days Debters days (Debtors/Sales) 365 days Creditors days -- (Creditors/Purchases) * 365 days Times interested interest EDIT EBITDA coverage EBIT + depreciation artisation Interest sales Fixed asset Statement of Comprehensive Income For the year ended 30 June 20.2 Sales revenue Cost of sales Gross Profit Distribution, selling and marketing expenses Administration expenses Other operating expenses Profit (earnings) before interest and tax expense Finance costs Profit before tax Income tax expense Profit for the year from continuing operations Discontinued operations Profit for the year from discontinued operations Profit for the year Other comprehensive income Total comprehensive income for the year Earnings per share Dividend per share Cash flow from operations (Rm) 20.2 ROOO 2478 000 1 287 000 1 191 000 403 000 187 000 153 000 448 000 72 000 376 000 112 000 264 000 20.1 ROOO 1 999 000 1 055 000 944 000 333 000 153 000 101 000 357 000 68 000 289 000 86 000 203 000 264 000 203 000 264 000 0.528 0.176 219 203 000 0.406 0.160 242 Statement of changes in equity for the year ended 30 June 20.2 Balance at 30 June 20.1 Profit for the period 456 000 264 000 720 000 88 000 632 000 333 000 203 000 536 000 80 000 456 000 Dividends Balance at 30 June 20.2 Statement of Financial Position as at 30 June 20.2 20.2 ROOO 20.1 ROOO 1 388 000 1 218 000 ASSETS Non-current Assets Property, plant & equipement Current Assets Inventories Receivables Cash assets Total Current Assets Total Assets 250 000 201 000 21 000 472 000 205 000 188 000 20 000 413 000 1 860 000 1 631 000 EQUITY AND LIABILITIES Capital and Reserves Share Capital Retained earnings Total Equity 500 000 632 000 1 132 000 500 000 456 000 956 000 580 000 580 000 530 000 530 000 Non-current Liabilities Long-term borrowings Total non-current liabilities Current Liabilities Trade and other payables Short-term borrowings Total current liabilities Total Equity and Liabilites 108 000 40 000 148 000 1 860 000 110 000 35 000 145 000 1631 000 Market price per share No. of shares in issue (000's) 2.80 500 000 2.50 500 000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started