Answered step by step

Verified Expert Solution

Question

1 Approved Answer

here. the app spoils the quality. please do any oke you can see. i need it urgently please, thanks. The cycle turrant Payment methods from

here.

the app spoils the quality. please do any oke you can see. i need it urgently please, thanks.

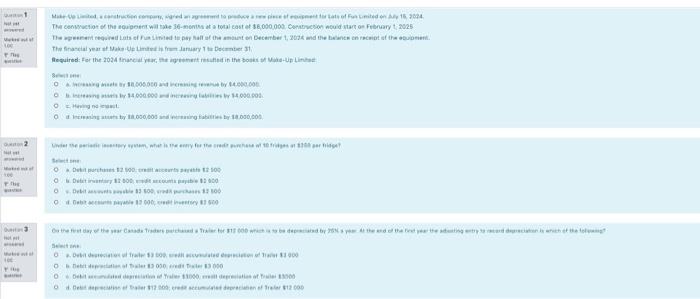

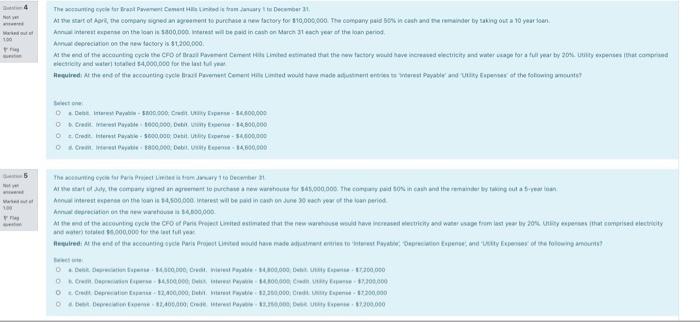

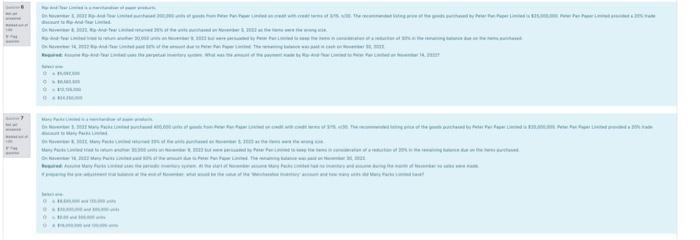

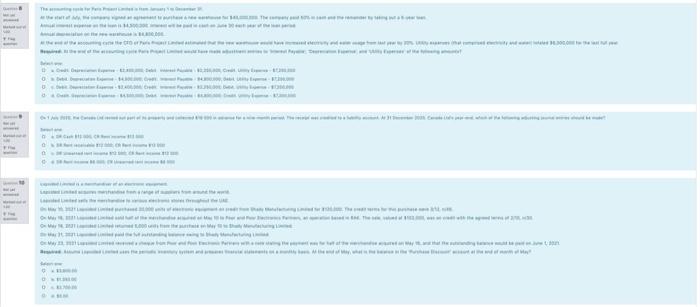

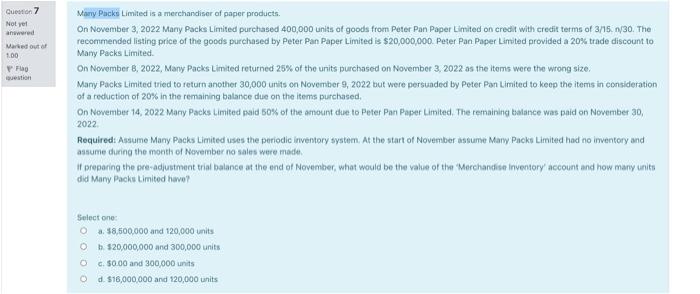

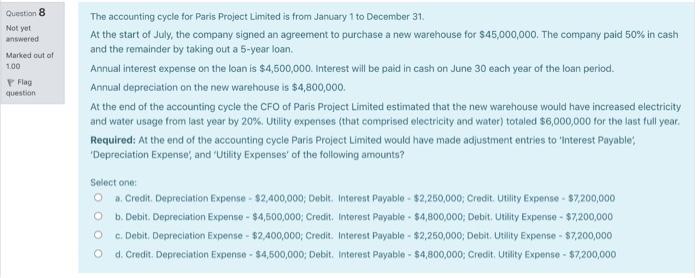

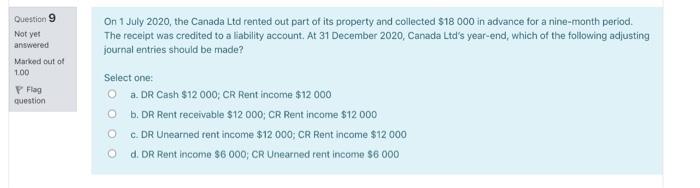

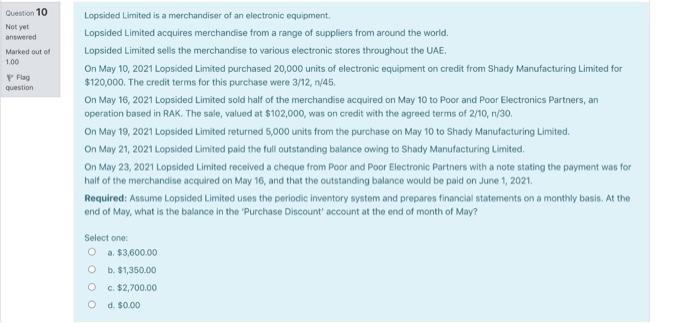

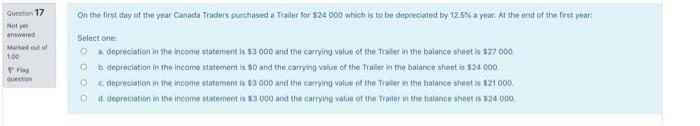

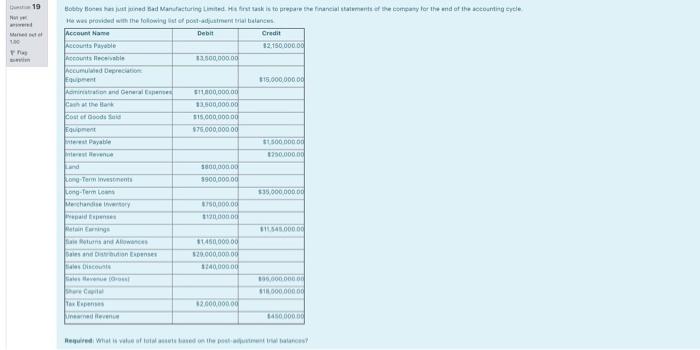

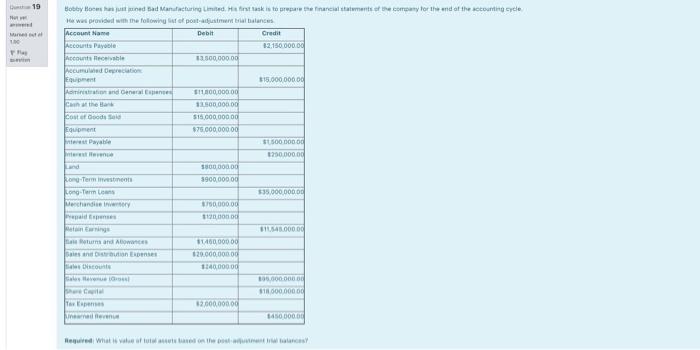

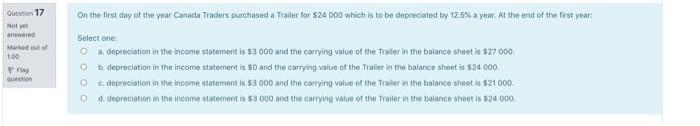

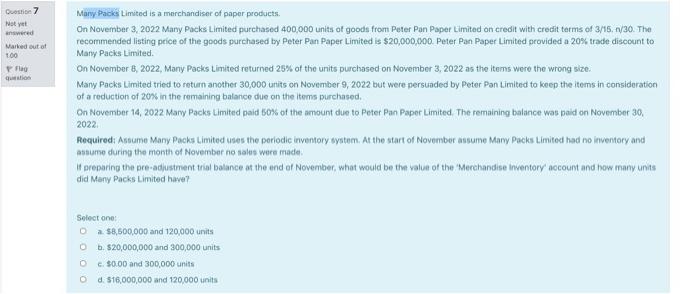

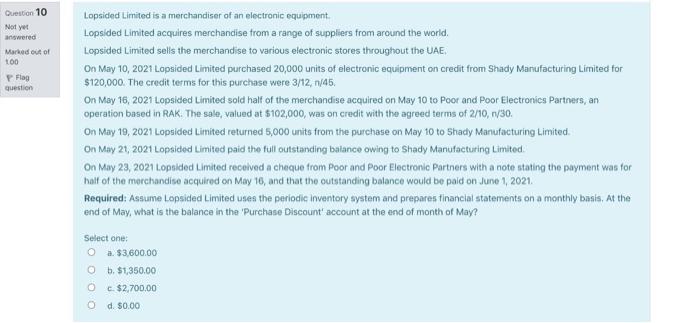

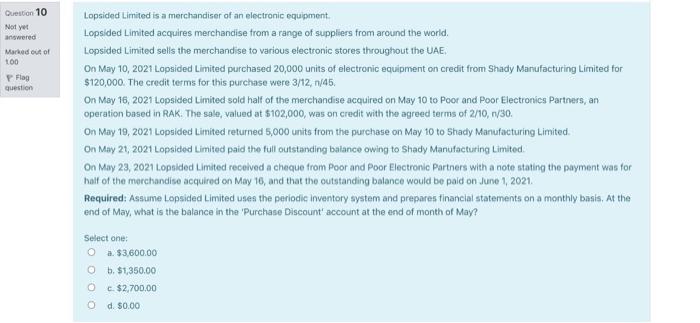

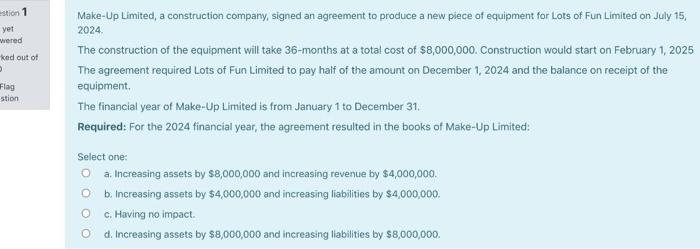

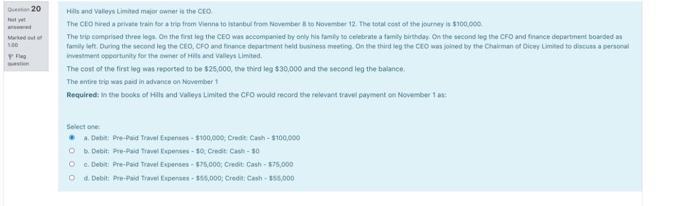

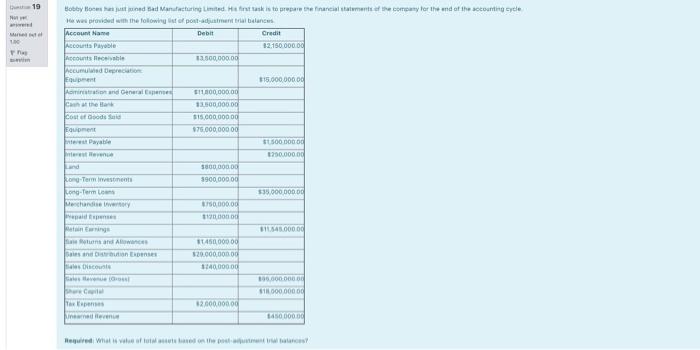

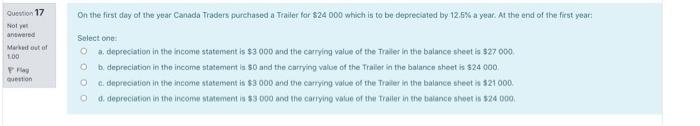

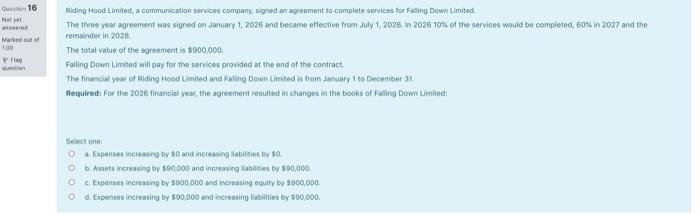

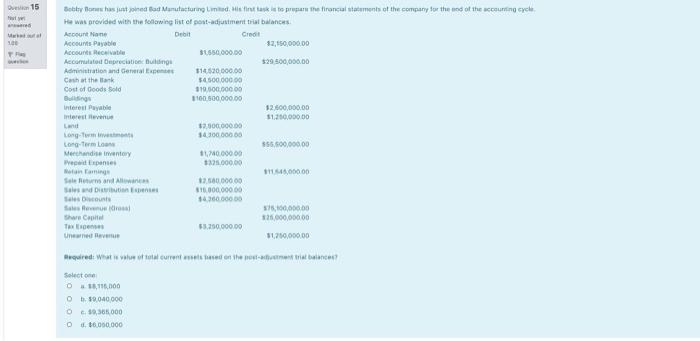

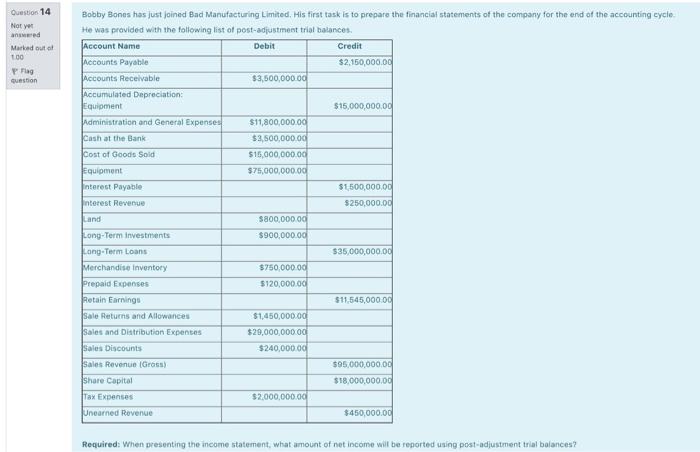

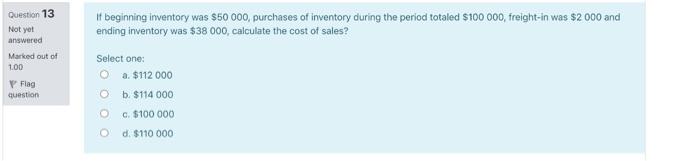

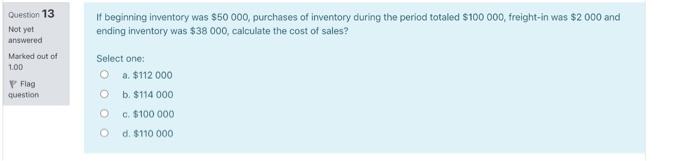

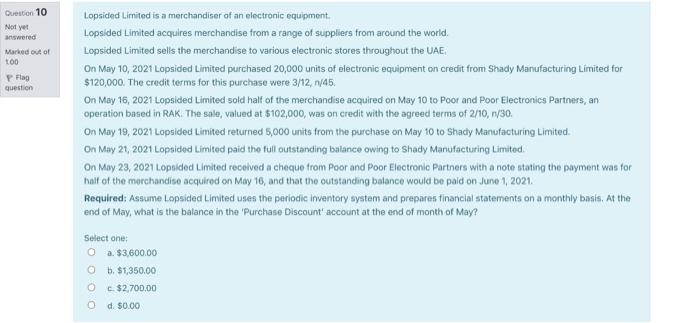

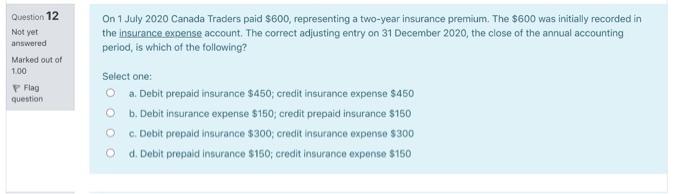

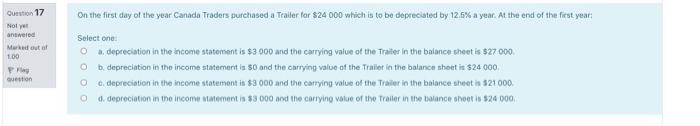

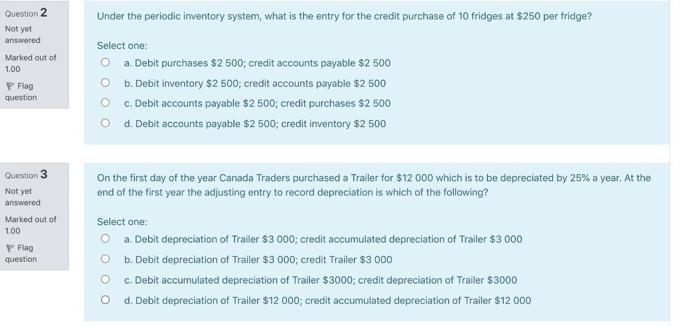

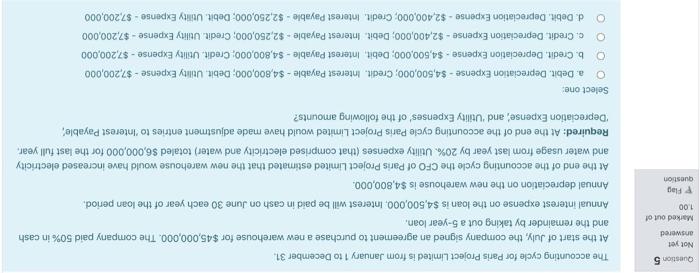

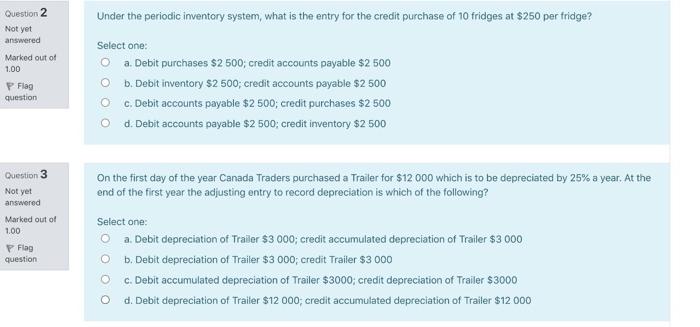

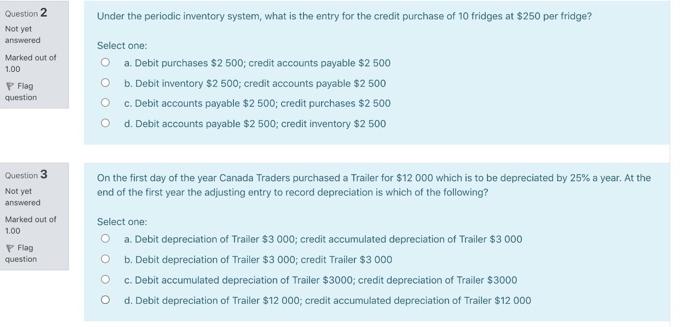

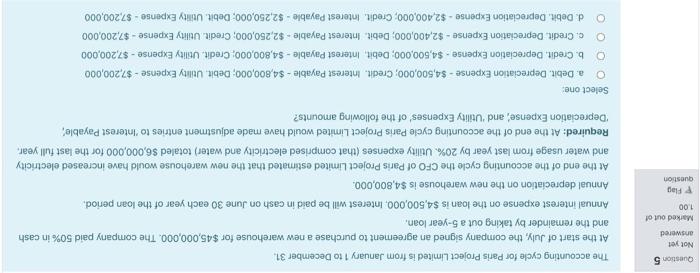

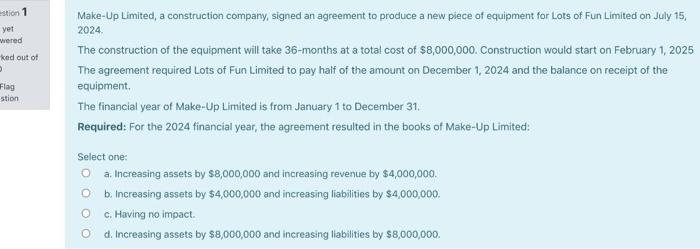

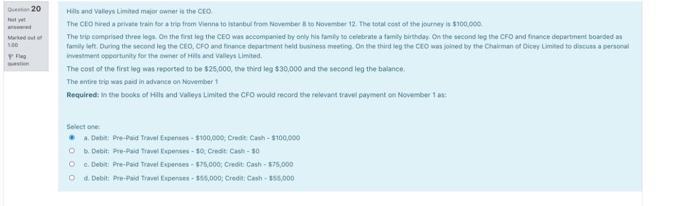

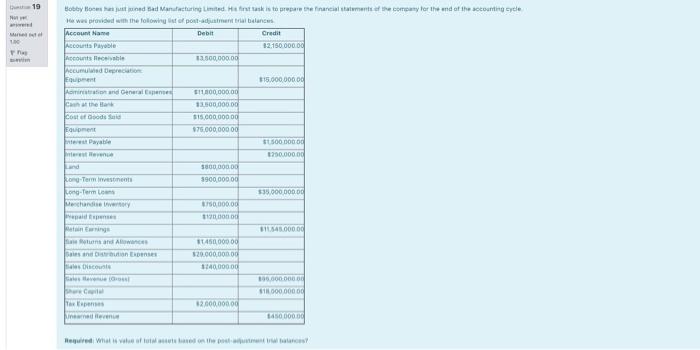

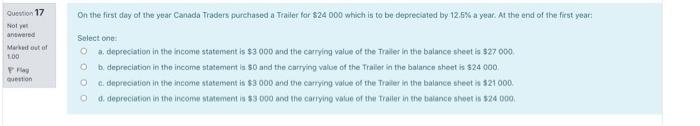

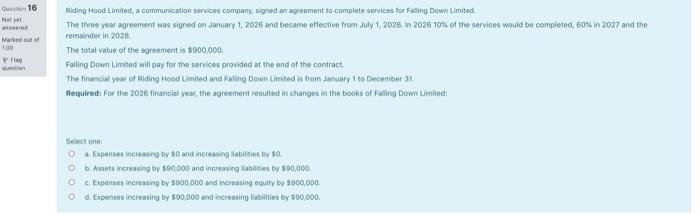

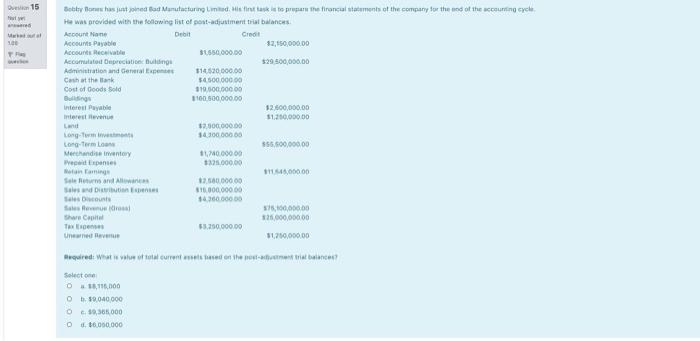

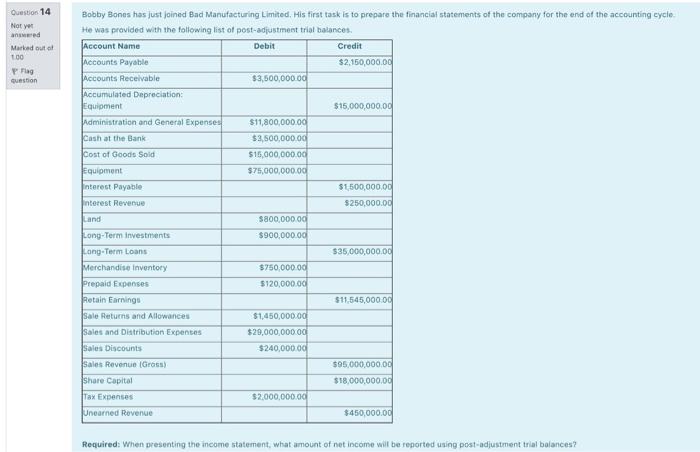

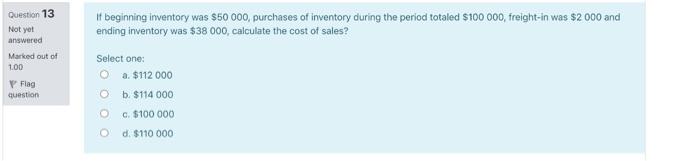

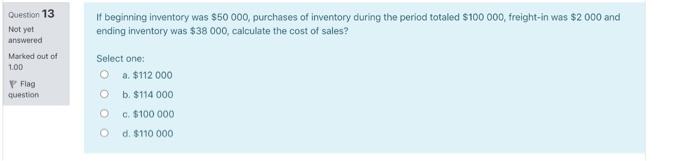

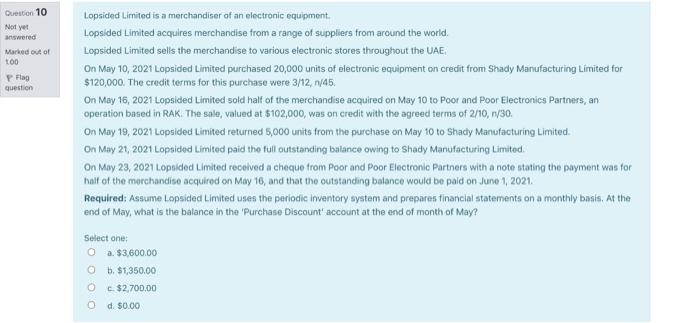

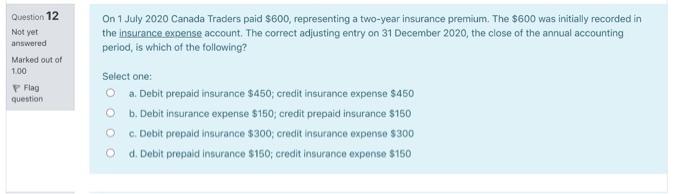

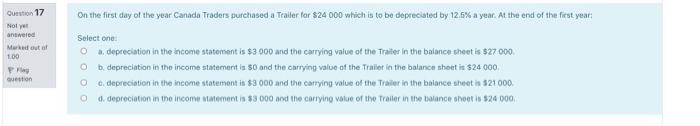

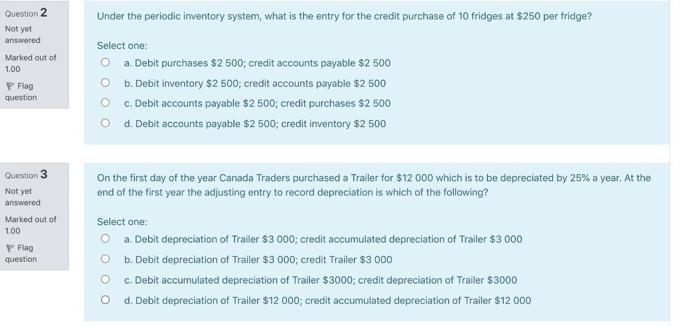

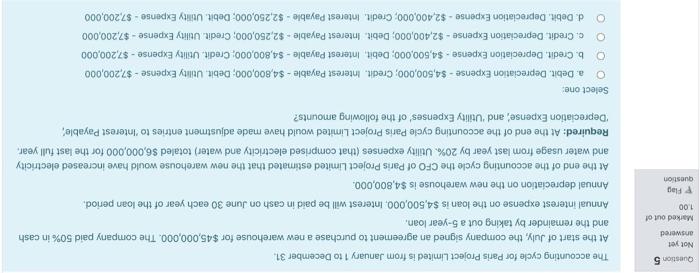

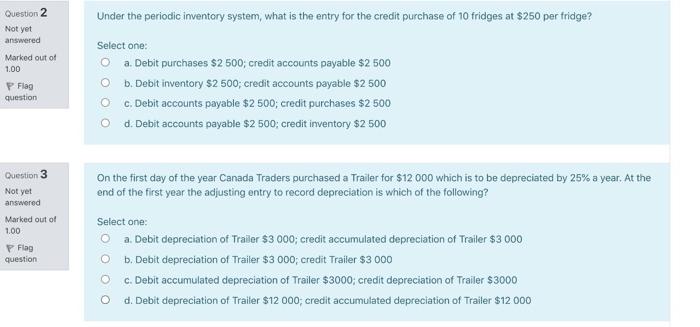

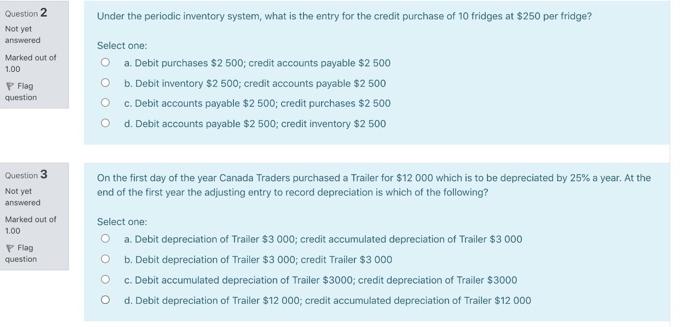

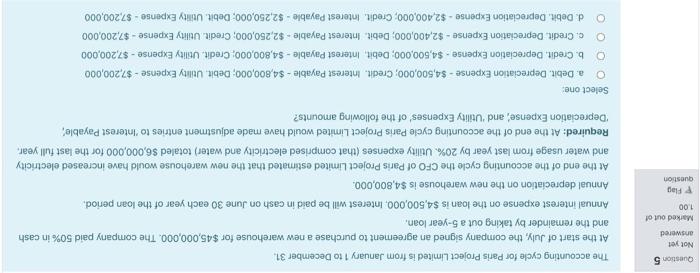

The cycle turrant Payment methods from a Decor A start of the company wgned an went te portate a new factory for $10,000,000. The company pod och ander by taking out a 10 year son An interest expert on the loan $800,000. art will be paid in canh on Khurch teach year of the loan period Apreciation on the factory is $1.200,000 A e end of the accounting Cycle the Crow Beant Current Limited me that the new actory would have decidere for a full year by 20 types that can etty and started 54,000.00 for the last #ruired At the end of the counting cycle Part Content with made in West Payable and Resot the fins Deti - 0.000 yrs $100.000 0000000014800,000 Credenteret Payne 5000.00 Datet Utry pre 54800.000 0.800.000 Debit. -14600.000 5 They come are cartell de contagiad an agreement le premie wartoute tour 48,000,000. The company and in can the water og eng dul a porta An interest on the loans14,500.00 Interest wil bed in June achar of the caneris reciation on the C600.000 und at the countoure e CroPro tinted activated that we would be verrann fericity and water sape from last year 2014 nyepes that evented electroly and ww.00.000 for the files gured the end of the coming ovde wis Promotinted wadhain made tant en tot Deathwinanonly Experte folown amount OD DDD de 100.000 1.200.000 OROD 4.500 4.000 Cd 17200.000 O E Dip 12.400.000,00 000 17200.000 Den 1,400 Crore, 1.200.000 . . Weet ...the ww b. ... Down Question 7 Not yet anwered Marted out of 1.00 Many Packs Limited is a merchandiser of paper products. On November 3, 2022 Many Packs Limited purchased 400,000 units of goods from Peter Pan Paper Limited on credit with credit terms of 3/16, 1/30. The recommended listing price of the goods purchased by Peter Pan Paper Limited is $20,000,000. Peter Pan Paper Limited provided a 20% trade discount to Many Packs Limited on November 8, 2022, Many Packs Limited returned 25% of the units purchased on November 3, 2022 as the items were the wrong size. Many Packs Limited tried to return another 30,000 units on November 9, 2022 but were persuaded by Peter Pan Limited to keep the items in consideration of a reduction of 20% in the remaining balance due on the items purchased, On November 14, 2022 Manny Packs Limited wald 60% of the amount due to Peter Pan Paper Limited. The remaining balance was paid on November 30, 2022 Required: Assume Many Packs Limited uses the periodic Inventory system. At the start of November assume Mary Packs Limited had no inventory and assume during the month of November no sales were made it preparing the pre-adjustment trial balance at the end of November, what would be the value of the Merchandise Inventory account and how many units did Many Pack Limited huvo Select one: O $8,500,000 and 120,000 units O h $20,000,000 and 300,000 units c. $0.00 and 300,000 units d. 516,000,000 and 120,000 units Question 8 Not yet answered Marked out of 1.00 P Flag question The accounting cycle for Paris Project Limited is from January 1 to December 31. At the start of July, the company signed an agreement to purchase a new warehouse for $45,000,000. The company paid 50% in cash and the remainder by taking out a 5-year loan. Annual interest expense on the loan is $4,500,000. Interest will be paid in cash on June 30 each year of the loan period. Annual depreciation on the new warehouse is $4,800,000. At the end of the accounting cycle the CFO of Paris Project Limited estimated that the new warehouse would have increased electricity and water usage from last year by 20% Utility expenses (that comprised electricity and water) totaled $6,000,000 for the last full year. Required: At the end of the accounting cycle Paris Project Limited would have made adjustment entries to 'interest Payable Depreciation Expense), and "Utility Expenses of the following amounts? Select one: O a. Credit Depreciation Expense - $2,400,000,Debit. Interest Payable - $2,250,000; Credit. Utility Expense - $7,200,000 b. Debit. Depreciation Expense - $4,500,000; Credit. Interest Payable - $4,800,000; Debit, Utility Expense - $7.200,000 c. Debit. Depreciation Expense - $2 400,000; Credit. Interest Payable - $2,250,000; Debit. Utility Expense - $7,200,000 O d. Credit. Depreciation Expense - $4,500,000; Debit. Interest Payable - $4,800,000; Credit Utility Expense - $7,200,000 O On 1 July 2020, the Canada Ltd rented out part of its property and collected $18 000 in advance for a nine-month period. The receipt was credited to a liability account. At 31 December 2020, Canada Ltd's year-end, which of the following adjusting journal entries should be made? Question 9 Not yet answered Marked out of 1.00 P Flag question Select one: a. DR Cash $12 000, CR Rent income $12 000 b. DR Rent receivable $12000; CR Rent income $12 000 C. DR Unearned rent income $12 000; CR Rent income $12 000 O d.DR Rent income $6000; CR Unearned rent income $6000 a Question 10 Not yet answered Marked out of 1.00 Flag question Lopsided Limited is a merchandiser of an electronic equipment. Lopsided Limited acquires merchandise from a range of suppliers from around the world. Lopsided Limited sells the merchandise to various electronic stores throughout the UAE On May 10, 2021 Lopsided Limited purchased 20,000 units of electronic equipment on credit from Shady Manufacturing Limited for $120,000. The credit terms for this purchase were 3/12, n/45 On May 16, 2021 Lopsided Limited sold half of the merchandise acquired on May 10 to Poor and Poor Electronics Partners, an operation based in RAK. The sale, valued at $102,000, was on credit with the agreed terms of 2/10, 1/30. On May 19, 2021 Lopsided Limited returned 5,000 units from the purchase on May 10 to Shady Manufacturing Limited. On May 21, 2021 Lopsided Limited paid the full outstanding balance owing to Shady Manufacturing Limited. On May 23, 2021 Lopaded Limited received a cheque from Poor and Poor Electronic Partners with a note stating the payment was for half of the merchandise acquired on May 16, and that the outstanding balance would be paid on June 1, 2021 Required: Assume Lopsided Limited uses the periodic Inventory system and prepares financial statements on a monthly basis. At the end of May, what is the balance in the "Purchase Discounts account at the end of month of May? Select one: a. $3,600.00 b. $1,350.00 c. $2,700.00 O d. $0.00 Our 17 Nolyet anowered Mad out of On the first day of the year Canada Traders purchased a Trailer for S24 000 which is to be depreciated by 12.6% a year. At the end of the first year: Select one: O a depreciation in the income statement is $3 000 and the carrying value of the Trailer in the balance sheet is 527 000 b. depreciation in the income statement is 50 and the carrying value of the Trailer in the balance sheet is $24 000 O C.depreciation in the income statement is $3000 and the carrying value of the Trailer in the balance sheet is 521000 d. depreciation in the income mentis 53 000 and the carrying value of the Trailer in the balance sheet is 524 000 PF Question Question 1 Not yet answered Marked out of 1,00 P Flag question Make-Up Limited, a construction company, signed an agreement to produce a new piece of equipment for Lots of Fun Limited on July 15, 2024 The construction of the equipment will take 36-months at a total cost of $8,000,000. Construction would start on February 1, 2025 The agreement required Lots of Fun Limited to pay half of the amount on December 1, 2024 and the balance on receipt of the equipment The financial year of Make-Up Limited is from January 1 to December 31 Required: For the 2024 financial year, the agreement resulted in the books of Make-Up Limited Select one Increasing assets by $8,000,000 and increasing revenue by $4,000,000, b. Increasing assets by 54,000,000 and increasing liabilities by $4,000,000 OC. Having no impact Od. Increasing assets by $8,000,000 and increasing liabilities by $8,000,000 19 N Hobby Boss Bad Manufacturing LimitedHe first task is to prepare the financial statement of the company for the end of the counting yde we provided with the following of post-adjustment blancas Account Name Debit Credit Accounts Payable 12.150 000.00 Account Reche 13.500,000.00 Pumuwd Equipment 315.000.000.00 Pin and Generales 51.800.000.00 Cathe 13.500.000.00 Cost od Sari 115.000.00000 Equipment 175.000,00000 S SOO DODO 1290,000.00 SBOBO kong-Terms 3900,000.00 Long-Term $35.000.000.00 Merchandise ESO. 000.00 1190.000 3154800000 and A 11450,000.00 Sales RSS $20.000.000 1140,000.00 195.000000 81100000000 Tape 12.000.000.00 new 150 DOOD 19 an Bobby Bosh just ned ad Manufacturing Limited. Haftakisto prepare incaltamente company for the end of the accounting cycle was provided with the following of potables Account Name Debit Credit Accounts Payable 12.150 000.00 Account Reche 13.500,000.00 | HELTH Oraoreet Equipment 315.000.000.00 Pontinand Generales 51.800.000.00 CINE 12.500.000,00 Cost of Goods $15.000.00000 Equipment $75.000.000.00 SUSOO DODO 1290,000.00 und THU HO || Rong-Termine 3900,000 0 Long Terms $35.000.000.00 Merchandise 3750,000.00 Pad 120.000 BUS4100000 usando 11,400,000.00 Bassin ERASER 120.000.000.00 114000000 85.000000 100000000 12.000.000.00 was even 1450000.00 a Question 1 Not yet answered Marked out of 100 P Flag question Make-Up Limited, a construction company, signed an agreement to produce a new piece of equipment for Lots of Fun Limited on July 15, 2024 The construction of the equipment will take 36-months at a total cost of $8,000,000. Construction would start on February 1, 2025 The agreement required Lots of Fun Limited to pay half of the amount on December 1, 2024 and the balance on receipt of the equipment The financial year of Make-Up Limited is from January 1 to December 31 Required: For the 2024 financial year, the agreement resulted in the books of Make-Up Limited Select one a Increasing assets by $8,000,000 and increasing revenue by $4,000,000 O b. Increasing assets by $4,000,000 and increasing liabilities by $4,000,000 OC. Having no impact Od. Increasing assets by $8,000,000 and increasing Ilabilities by $8,000,000 Out 17 Nole answered Marato 100 On the first day of the year Canada Traders purchased a Trailer for $24 000 which is to be depreciated by 12.6% a year. At the end of the first year: Select one: O depreciation in the income statement is $3000 and the carrying value of the Traiter in the balance sheet is $27.000 b depreciation in the income statement is $0 and the carrying value of the Trailer in the balance sheet is $24 000 e depreciation in the income statement is $3000 and the carrying value of the Trailer in the balance sheet is 521000 I. depreciation in the income statement is $3000 and the carrying voice of the Trailer in the balance shoot in 524 000 F Question Queste 7 Not yet answered Marked out of 100 Pro Mary Packs Limited is a merchandiser of paper products, On November 3, 2022 Mary Packs Limited purchased 400,000 units of goods from Peter Pan Paper Limited on credit with credit terms of 3/16, n/30. The recommended listing price of the goods purchased by Peter Pan Paper Limited is $20,000,000. Peter Pan Paper Limited provided a 20% trade discount to Many Packs Limited. On November 8, 2022, Many Packs Limited returned 25% of the units purchased on November 3, 2022 as the items were the wrong size Many Packs Limited tried to return another 30,000 units on November 9, 2022 but were persuaded by Peter Pan Limited to keep the items in consideration of a reduction of 20% in the remaining balance due on the items purchased On November 14, 2022 Many Packs Limited paid 50% of the amount due to Peter Pan Paper Limited. The remaining balance was paid on November 30, 2022 Required: Anume Many Packs Limited uses the periodic inventory system. At the start of November anume Marvy Packs Limited had no inventory and astume during the month of November no sales were made preparing the pre-alustment trial balance at the end of November, what would be the value of the Merchandise Inventory account and how many units did Mary Packs Limited have? Select one: a $8,500,000 and 120,000 units O b. $20,000,000 and 300,000 units c. $0.00 and 300,000 units d 516,000,000 and 120,000 units Question 10 Not yet answered Marked out of 100 P Flag question Lopsided Limited is a merchandiser of an electronic equipment Lopsided Limited acquires merchandise from a range of suppliers from around the world, Lopsided Limited sells the merchandise to various electronic stores throughout the UAE. On May 10, 2021 Lapsided Limited purchased 20,000 units of electronic equipment on credit from Shady Manufacturing Limited for $120,000. The credit terms for this purchase were 3/12, 6/45 On May 16, 2021 Lopsided Limited sold half of the merchandise acquired on May 10 to poor and Poor Electronics Partners, an operation based in RAK. The sale, valued at $102,000, was on credit with the agreed terms of 2/10, 1/30. On May 19, 2021 Lopsided Limited returned 5,000 units from the purchase on May 10 to Shady Manufacturing Limited On May 21, 2021 Lopsided Limited paid the full outstanding balance owing to Shady Manufacturing Limited On May 23, 2021 Lopsided Limited received a cheque from Poor and Poor Electronic Partners with a note stating the payment was for half of the merchandise acquired on May 16, and that the outstanding balance would be paid on June 1, 2021 Required: Assume Lopsided Limited uses the periodic Inventory system and prepares tinancial statements on a monthly basis, At the end of May, what is the balance in the Purchase Discount account at the end of month of May? Select one: a. $3,600.00 @ b. $1,350.00 c. $2,700,00 d. $0.00 Question 10 Not yet answered Marked out of 100 P Flag question Lopsided Limited is a merchandiser of an electronic equipment Lopsided Limited acquires merchandise from a range of suppliers from around the world, Lopsided Limited sells the merchandise to various electronic stores throughout the UAE. On May 10, 2021 Lapsided Limited purchased 20,000 units of electronic equipment on credit from Shady Manufacturing Limited for $120,000. The credit terms for this purchase were 3/12, 6/45 On May 16, 2021 Lopsided Limited sold half of the merchandise acquired on May 10 to poor and Poor Electronics Partners, an operation based in RAK. The sale, valued at $102,000, was on credit with the agreed terms of 2/10, 1/30. On May 19, 2021 Lopsided Limited returned 5,000 units from the purchase on May 10 to Shady Manufacturing Limited On May 21, 2021 Lopsided Limited paid the full outstanding balance owing to Shady Manufacturing Limited On May 23, 2021 Lopsided Limited received a cheque from Poor and Poor Electronic Partners with a note stating the payment was for half of the merchandise acquired on May 16, and that the outstanding balance would be paid on June 1, 2021 Required: Assume Lopsided Limited uses the periodic Inventory system and prepares tinancial statements on a monthly basis, At the end of May, what is the balance in the Purchase Discount account at the end of month of May? Select one: a. $3,600.00 @ b. $1,350.00 c. $2,700,00 d. $0.00 Make-Up Limited, a construction company, signed an agreement to produce a new piece of equipment for Lots of Fun Limited on July 15, 2024 estion 1 yet wered ked out of Flag stion The construction of the equipment will take 36-months at a total cost of $8,000,000. Construction would start on February 1, 2025 The agreement required Lots of Fun Limited to pay half of the amount on December 1, 2024 and the balance on receipt of the equipment The financial year of Make-Up Limited is from January 1 to December 31. Required: For the 2024 financial year, the agreement resulted in the books of Make-Up Limited: Select one: O a. Increasing assets by $8,000,000 and increasing revenue by $4,000,000. b. Increasing assets by $4,000,000 and increasing liabilities by $4,000,000. c. Having no impact d. Increasing assets by $8,000,000 and increasing liabilities by $8,000,000 20 Flag Hills and Valley Limhed meer wet is the CEO The red vetrain for trip from Visto istanbul from November 10 November 12. The total cost of the journey is $100.000 The trip comprised three loge. On the first the CEO was accompanied by ly his family to celebrate my birthday on the second to the CFO and France department boarded fame During the second leg the CEO, CFO and France department et ses meting on the thing the CEO was joined by the Chairman of Disay Cited to discuss a personal sant portunity for the one of its and valleys Limited The cost of the first leg was reported to be $25,000, the third leg $30,000 and the second leg the balance The entire traspard in advance on November Required in the books of Hith and Valley Limited the CFO would record the relevant travel payment on November Selector Detit Pre-Paid Travel - $100,000 Credit Cash - $100,000 O Debit Pre-Paid Tapes - 50 Crest Cash - 50 O Debit Pre-Par Express 528,000 Credit Cash - $75,000 O Debit Pravel Expert 4.000; Credit Cash-155,000 19 N Hobby Boss Bad Manufacturing LimitedHe first task is to prepare the financial statement of the company for the end of the counting yde we provided with the following of post-adjustment blancas Account Name Debit Credit Accounts Payable 12.150 000.00 Account Reche 13.500,000.00 Pumuwd Equipment 315.000.000.00 Pin and Generales 51.800.000.00 Cathe 13.500.000.00 Cost od Sari 115.000.00000 Equipment 175.000,00000 S SOO DODO 1290,000.00 SBOBO kong-Terms 3900,000.00 Long-Term $35.000.000.00 Merchandise ESO. 000.00 1190.000 3154800000 and A 11450,000.00 Sales RSS $20.000.000 1140,000.00 195.000000 81100000000 Tape 12.000.000.00 new 150 DOOD Our 17 Nolyet anowered Mad out of On the first day of the year Canada Traders purchased a Trailer for S24 000 which is to be depreciated by 12.6% a year. At the end of the first year: Select one: O a depreciation in the income statement is $3 000 and the carrying value of the Trailer in the balance sheet is 527 000 b. depreciation in the income statement is 50 and the carrying value of the Trailer in the balance sheet is $24 000 O C.depreciation in the income statement is $3000 and the carrying value of the Trailer in the balance sheet is 521000 d. depreciation in the income mentis 53 000 and the carrying value of the Trailer in the balance sheet is 524 000 PF Question O 16 Natt Marted out 1.00 Riding Hood Limited, a communication services company, igned an agreement to complete services for Falling Down Limited The three year agreement was signed on January 1, 2026 and became effective from July 1, 2026. in 2026 10% of the services would be completed, 60% in 2017 and the remainder in 2028 The total value of the agreement is $900,000 Falling Down Limited will pay for the services provided at the end of the contract The financial year of Riding Hood Limited and Falling Down Limited is from January 1 to December 31 Required for the 2020 financial year, the agreement resulted in changes in the books of Fating down Limited Select one: O Expenses increasing by 10 and increasing abilities by 10 Ob Assets increasing by $90,000 and increasing abilities by $90,000 O c.Expenses increasing by $500,000 and increasing equity by 9900,000 O d. Expenses increasing by $90,000 and increasing liabilities by 800,000. Du 15 100 Bobby Bows has justomed Bad Manufacturing Limited lintasie to prepare the francaments at the company for the and of the accounting cycle He wat provided with the following list of post-adjustment at balances Account Name Debit Creo Account Payable 32,150,000.00 Account Receive 31550,000.00 Accumulated Depreciation Building $29500,000.00 Administration and Generales 514.500.000,00 Cathat the lank 54500.000,00 Cost of Goods Sold 319.000.000.00 1100.500,000.00 Interest Payable 32,600,000.00 Interest even Land $2.500.000,00 Long- 54.100.000.00 Long-Term Loan $56.500,000.00 Merchandiserwenty 11.10.000.00 penie 125.000.00 1,000.00 Selemand Allow $2.500.000.00 Sedan $16.000.000,00 esco 14.36000000 Sena 375,100,000.00 Share 1,000,000.00 TE 53.250.000,00 Unane 11,200,000.00 Required: What we of total currence on the trainer Select 15,116,000 O. 59.040.000 c. 39,365.000 0 t. 6.000.000 Question 14 Not yol and Marked out of 100 Pring question Bobby Bones has just joined Bad Manufacturing Limited. His first task is to prepare the financial statements of the company for the end of the accounting cycle He was provided with the following list of post-adjustment trial balances. Account Name Debit Credit Accounts Payable $2,150,000.00 Accounts Receivable $3,500,000.00 Accumulated Depreciation: Equipment $15,000,000.00 Administration and General Expenses $11,800,000.00 Cash at the Bank $2,500,000.00 Cost of Goods Sold $15,000,000.00 Equipment $75,000,000.00 interest Payable interest Revenue $1.500,000.00 $250,000.00 Land $800,000.00 $900,000.00 Long-Term Investments Long Term Loans $35,000,000.00 Merchandise Inventory $750,000.00 $120,000.00 $11,545,000.00 Prepaid Expenses Retain Earnings Sale Returns and Allowances Sales and Distribution Expenses $1,450,000.00 $29,000,000.00 $240,000.00 Sales Discounts $95.000.000,00 $18,000,000.00 Sales Revenue (Gross) Share Capital Tax Expenses Unearned Revenue $2.000,000.00 $450,000.00 Required: When presenting the income statement, what amount of net income will be reported using post-adjustment trial balances? Question 13 Not yet answered Marked out of 100 it beginning inventory was $50 000, purchases of inventory during the period totaled $100 000, freight-in was $2 000 and ending inventory was $38 000, calculate the cost of sales? Select one: O a $112 000 b. $114 000 P Flag question O c. $100 000 d. $110 000 Question 13 Not yet answered Marked out of 100 it beginning inventory was $50 000, purchases of inventory during the period totaled $100 000, freight-in was $2 000 and ending inventory was $38 000, calculate the cost of sales? Select one: O a $112 000 b. $114 000 P Flag question O c. $100 000 d. $110 000 Question 10 Not yet answered Marked out of 100 P Flag question Lopsidad Limited is a merchandiser of an electronic equipment Lopsided Limited acquires merchandise from a range of suppliers from around the world, Lopsided Limited sells the merchandise to various electronic stores throughout the UAE On May 10, 2021 Lapsided Limited purchased 20,000 units of electronic equipment on credit from Shady Manufacturing Limited for $120,000. The credit terms for this purchase were 3/12, 1/45 On May 16, 2021 Lopsided Limited sold half of the merchandise acquired on May 10 to Poor and Poor Electronics Partners, an operation based in RAK. The sale, valued at $102,000, was on credit with the agreed terms of 2/10, 1/30 On May 19, 2021 Lopsided Limited returned 5,000 units from the purchase on May 10 to Shacy Manufacturing Limited On May 21, 2021 Lopsidad Limited paid the full outstanding balance owing to Shady Manufacturing Limited On May 23, 2021 Lopsided Limited received a cheque from Poor and Poor Electronic Partners with a note stating the payment was for half of the merchandise acquired on May 16, and that the outstanding balance would be paid on June 1, 2021. Required: Assume Lopsided Limited uses the periodic Inventory system and prepares tinancial statements on a monthly basis. At the end of May, what is the balance in the Purchase Discount account at the end of month of May? Select one: a. $3,600.00 b. $1,350.00 c. $2,700.00 d. $0.00 Question 12 Not yet answered Marked out of 1.00 Flag question On 1 July 2020 Canada Traders paid $600, representing a two-year insurance premium. The $600 was initially recorded in the insurance expense account. The correct adjusting entry on 31 December 2020, the close of the annual accounting period, is which of the following? Select one: a. Debit prepaid insurance $450, credit insurance expense $450 ob. Debit insurance expense $150 credit prepaid insurance $150 c. Debit prepold Insurance $300; credit Insurance expense $300 d. Debit prepaid insurance $150; credit insurance expense $150 Out 17 Nole answered Marato 100 On the first day of the year Canada Traders purchased a Trailer for $24 000 which is to be depreciated by 12.6% a year. At the end of the first year: Select one: O depreciation in the income statement is $3000 and the carrying value of the Traiter in the balance sheet is $27.000 b depreciation in the income statement is $0 and the carrying value of the Trailer in the balance sheet is $24 000 e depreciation in the income statement is $3000 and the carrying value of the Trailer in the balance sheet is 521000 I. depreciation in the income statement is $3000 and the carrying voice of the Trailer in the balance shoot in 524 000 F Question Under the periodic inventory system, what is the entry for the credit purchase of 10 fridges at $250 per fridge? Question 2 Not yet answered Marked out of 1.00 P Flag question Select one: a. Debit purchases $2 500; credit accounts payable $2 500 O b. Debit inventory $2 500; credit accounts payable $2 500 C. Debit accounts payable $2 500; credit purchases $2 500 d. Debit accounts payable $2 500; credit inventory $2 500 Question 3 Not yet answered Marked out of 1.00 On the first day of the year Canada Traders purchased a Trailer for $12 000 which is to be depreciated by 25% a year. At the end of the first year the adjusting entry to record depreciation is which of the following? Select one: a. Debit depreciation of Trailer $3 000; credit accumulated depreciation of Trailer $3 000 b. Debit depreciation of Trailer $3 000 credit Trailer $3 000 c. Debit accumulated depreciation of Trailer $3000; credit depreciation of Trailer $3000 d. Debit depreciation of Trailer $12 000; credit accumulated depreciation of Trailer $12000 O P Flag question Question 5 Not yet answered Marked out of 1.00 F Flag question The accounting cycle for Paris Project Limited is from January 1 to December 31. At the start of July, the company signed an agreement to purchase a new warehouse for $45,000,000. The company paid 50% in cash and the remainder by taking out a 5-year loan. Annual interest expense on the loan is $4,500,000, interest will be paid in cash on June 30 each year of the loan period. Annual depreciation on the new warehouse is $4,800,000 At the end of the accounting cycle the CFO of Paris Project Limited estimated that the new warehouse would have increased electricity and water usage from last year by 20%. Utility expenses (that comprised electricity and water) totaled $6,000,000 for the last full year. Required: At the end of the accounting cycle Paris Project Limited would have made adjustment entries to "Interest Payable Depreciation Expense and Utility Expenses of the following amounts? Select one: a. Debit. Depreciation Expense - $4,500,000; Credit. Interest Payable - $4,800,000; Debit. Utility Expense - $7,200,000 O b. Credit. Depreciation Expense - $4,500,000; Debit, Interest Payable - $4,800,000 Credit. Utility Expense - $7,200,000 OC.Credit. Depreciation Expense - $2,400,000; Debit. Interest Payable - $2,250,000; Credit Utility Expense - $7,200,000 Od Debit. Depreciation Expense - $2,400,000, Credit. Interest Payable - $2,250,000; Debit. Utility Expense - $7.200,000 Under the periodic inventory system, what is the entry for the credit purchase of 10 fridges at $250 per fridge? Question 2 Not yet answered Marked out of 1.00 P Flag question Select one: a. Debit purchases $2 500; credit accounts payable $2 500 O b. Debit inventory $2 500; credit accounts payable $2 500 C. Debit accounts payable $2 500; credit purchases $2 500 d. Debit accounts payable $2 500; credit inventory $2 500 Question 3 Not yet answered Marked out of 1.00 On the first day of the year Canada Traders purchased a Trailer for $12 000 which is to be depreciated by 25% a year. At the end of the first year the adjusting entry to record depreciation is which of the following? Select one: a. Debit depreciation of Trailer $3 000; credit accumulated depreciation of Trailer $3 000 b. Debit depreciation of Trailer $3 000 credit Trailer $3 000 c. Debit accumulated depreciation of Trailer $3000; credit depreciation of Trailer $3000 d. Debit depreciation of Trailer $12 000; credit accumulated depreciation of Trailer $12000 O P Flag question Under the periodic inventory system, what is the entry for the credit purchase of 10 fridges at $250 per fridge? Question 2 Not yet answered Marked out of 1.00 P Flag question Select one: a. Debit purchases $2 500; credit accounts payable $2 500 O b. Debit inventory $2 500; credit accounts payable $2 500 C. Debit accounts payable $2 500; credit purchases $2 500 d. Debit accounts payable $2 500; credit inventory $2 500 Question 3 Not yet answered Marked out of 1.00 On the first day of the year Canada Traders purchased a Trailer for $12 000 which is to be depreciated by 25% a year. At the end of the first year the adjusting entry to record depreciation is which of the following? Select one: a. Debit depreciation of Trailer $3 000; credit accumulated depreciation of Trailer $3 000 b. Debit depreciation of Trailer $3 000 credit Trailer $3 000 c. Debit accumulated depreciation of Trailer $3000; credit depreciation of Trailer $3000 d. Debit depreciation of Trailer $12 000; credit accumulated depreciation of Trailer $12000 O P Flag question Question 5 Not yet answered Marked out of 1.00 F Flag question The accounting cycle for Paris Project Limited is from January 1 to December 31. At the start of July, the company signed an agreement to purchase a new warehouse for $45,000,000. The company paid 50% in cash and the remainder by taking out a 5-year loan. Annual interest expense on the loan is $4,500,000, interest will be paid in cash on June 30 each year of the loan period. Annual depreciation on the new warehouse is $4,800,000 At the end of the accounting cycle the CFO of Paris Project Limited estimated that the new warehouse would have increased electricity and water usage from last year by 20%. Utility expenses (that comprised electricity and water) totaled $6,000,000 for the last full year. Required: At the end of the accounting cycle Paris Project Limited would have made adjustment entries to "Interest Payable Depreciation Expense and Utility Expenses of the following amounts? Select one: a. Debit. Depreciation Expense - $4,500,000; Credit. Interest Payable - $4,800,000; Debit. Utility Expense - $7,200,000 O b. Credit. Depreciation Expense - $4,500,000; Debit, Interest Payable - $4,800,000 Credit. Utility Expense - $7,200,000 OC.Credit. Depreciation Expense - $2,400,000; Debit. Interest Payable - $2,250,000; Credit Utility Expense - $7,200,000 Od Debit. Depreciation Expense - $2,400,000, Credit. Interest Payable - $2,250,000; Debit. Utility Expense - $7.200,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started