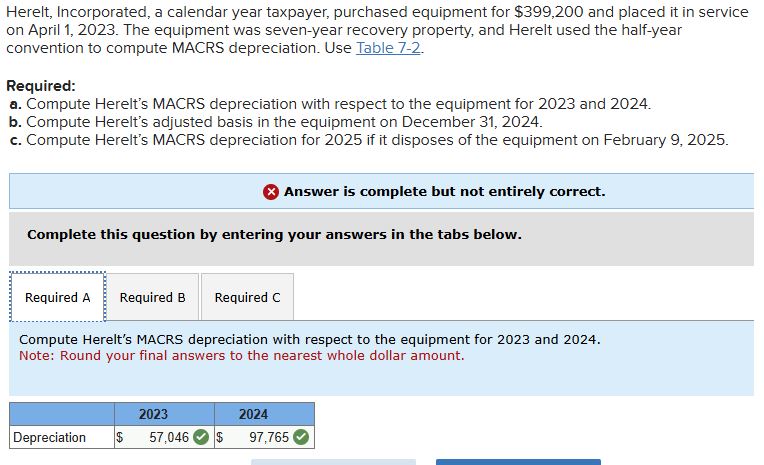

Question: Herelt, Incorporated, a calendar year taxpayer, purchased equipment for $ 3 9 9 , 2 0 0 and placed it in service on April 1

Herelt, Incorporated, a calendar year taxpayer, purchased equipment for $ and placed it in service on April The equipment was sevenyear recovery property, and Herelt used the halfyear convention to compute MACRS depreciation. Refer to MACRS for Business Personalty HalfYear Convention

Required:

A: Compute Herelts MACRS depreciation with respect to the equipment for and

B: Compute Herelts adjusted basis in the equipment on December

C: Compute Herelts MACRS depreciation for if it disposes of the equipment on February

See images for all details.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock