Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Here's how to calculate his monthly payment on a 1 5 - year ( 1 8 0 months ) 2 . 5 % interest rate

Here's how to calculate his monthly payment on a year months interest rate $ balance mortgage $ is acceptable in the answer due to rounding:

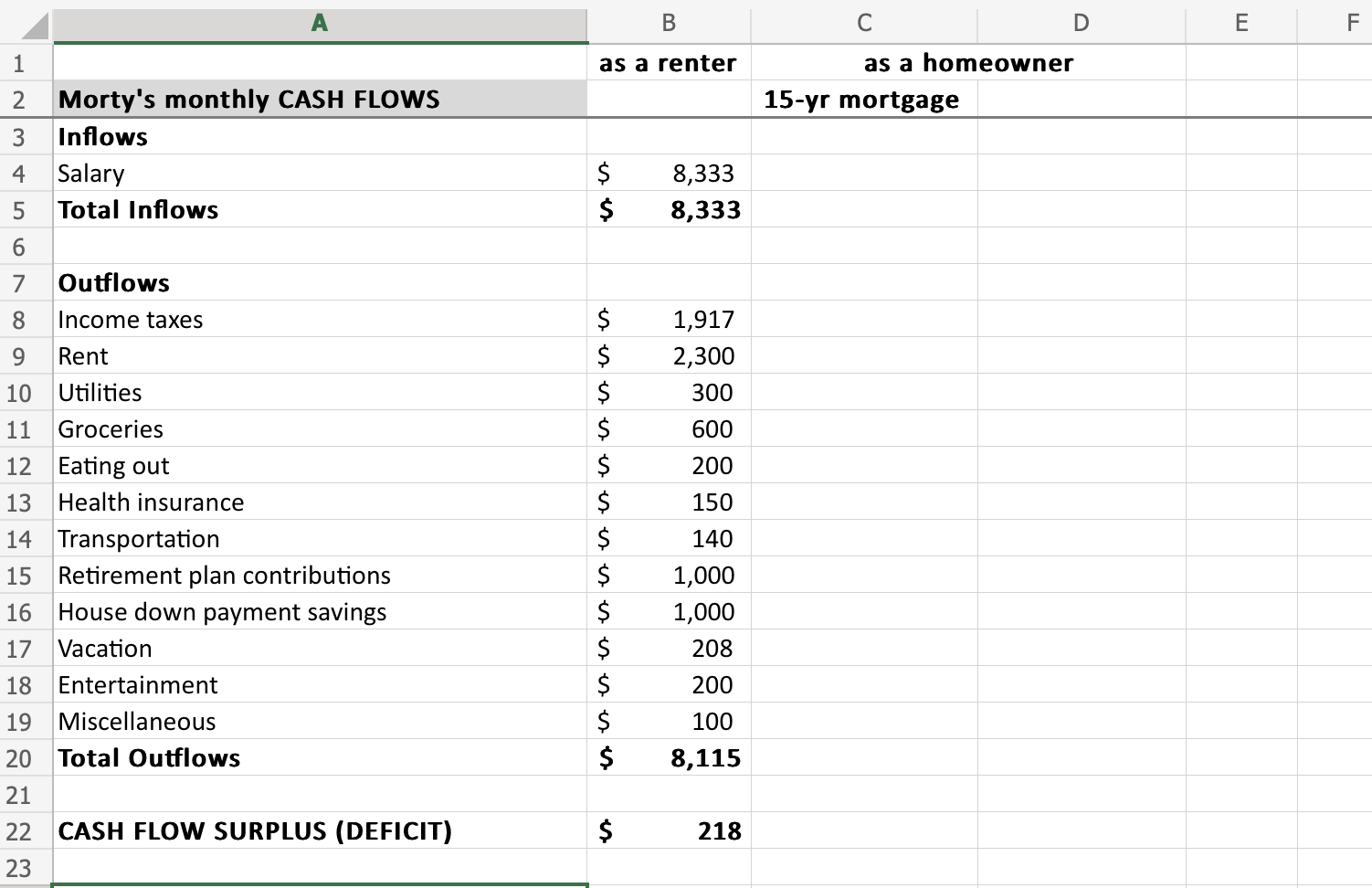

Here is Morty's cash flow statement as a renter. As you can see from this file, Morty has been saving a good chunk of his income every month, and still has a modest cash flow surplus of $ monthly on average, while renting. Help him understand what his cash flow is going to look like with a year mortgage in other words, fill out column C in the linked file. Morty wants you to make the following assumptions:

His income taxes will go down by $ a year, due to the mortgage interest deduction.

His real estate taxes and homeowner's insurance combined will be $ a month.

Morty will eliminate any cash outflows he had while preparing to buy an apartment, that he will not need to have once he actually buys it and moves.

If after making the changes above, there is a cash flow deficit, in other words, if it's necessary to cut some more expenses in order to possibly afford the mortgage payments Morty is willing to cut eating out, retirement plan contributions and his entertainment spending entirely. He's unable unwilling to cut any other expenses.

After you fill out column fully accounting for all four points above, answer the question: What will Morty's cash flow surplus be as a homeowner with a year mortgage? If you get a deficit meaning his expenses will be higher than his income then enter the negative amount. As always in these numerical questions, do not enter the dollar sign, for the answer to be autograded correctly.

Morty's monthly CASH FLOWS Income taxes UtilitiesInflows GroceriesSalary Eating outTotal Inflows Health insuranceOutflowsRent House down payment savingsTransportationRetirement plan contributionsVacationEntertainment Total OutflowsMiscellaneous CASH FLOW SURPLUS DEFICITas a renter$$$as a homeowneryr mortgage Morty's monthly CASH FLOWS Income taxes UtilitiesInflows GroceriesSalary Eating outTotal Inflows Health insuranceOutflowsRent House down payment savingsTransportationRetirement plan contributionsVacationEntertainment Total OutflowsMiscellaneous CASH FLOW SURPLUS DEFICITas a renter$$$as a homeowneryr mortgage

Here's how to calculate his monthly payment on a year months interest rate $ balance mortgage $ is acceptable in the answer due to rounding:

Here is Morty's cash flow statement as a renter. As you can see from this file, Morty has been saving a good chunk of his income every month, and still has a modest cash flow surplus of $ monthly on average, while renting. Help him understand what his cash flow is going to look like with a year mortgage in other words, fill out column C in the linked file. Morty wants you to make the following assumptions:

His income taxes will go down by $ a year, due to the mortgage interest deduction.

His real estate taxes and homeowner's insurance combined will be $ a month.

Morty will eliminate any cash outflows he had while preparing to buy an apartment, that he will not need to have once he actually buys it and moves.

If after making the changes above, there is a cash flow deficit, in other words, if it's necessary to cut some more expenses in order to possibly afford the mortgage payments Morty is willing to cut eating out, retirement plan contributions and his entertainment spending entirely. He's unable unwilling to cut any other expenses.

After you fill out column fully accounting for all four points above, answer the question: What will Morty's cash flow surplus be as a homeowner with a year mortgage? If you get a deficit meaning his expenses will be higher than his income then enter the negative amount. As always in these numerical questions, do not enter the dollar sign, for the answer to be autograded correctly.

Pro tip: This question requires attention to detail. Read carefully, do not rush, and check your work before submitting your answer.

Morty's monthly CASH FLOWS Income taxes UtilitiesInflows GroceriesSalary Eating outTotal Inflows Health insuranceOutflowsRent House down payment savingsTransportationRetirement plan contributionsVacationEntertainment Total OutflowsMiscellaneous CASH FLOW SURPLUS DEFICIT WHAT WILL BE MORTY CASH FLOW SURPLUS BE AS A HOMEOWNER WITH YEAR MORTGAGE PLS LIST DOWN STEPS

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started