heres the graph

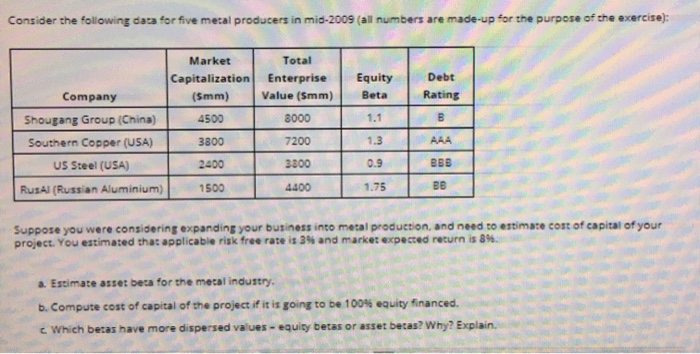

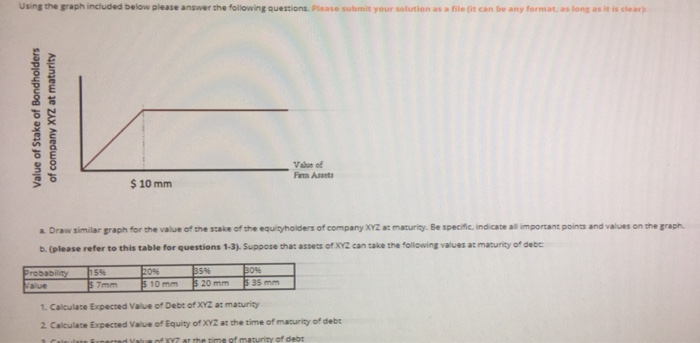

Consider the following data for five metal producers in mis-2009 (all numbers are made-up for the purpose of the exercise): Market Capitalization (5mm) Total Enterprise Value (5mm) Equity Beta Debt Rating 4500 8000 1.1 B Company Shougang Group (China) Southern Copper (USA) US Steel (USA) Rusal (Russian Aluminium) 3800 7200 1.3 2400 3800 0.9 BBB 1500 4400 1.75 BB Suppose you were considering expanding your business into metal production and need to estimate cost of capital of your project. You estimated that applicable risk free rate is 3% and market expected return is 8%. a. Estimate asset beta for the metal industry, b. Compute cost of capital of the project if it is going to be 100% equity financed. c Which beras have more dispersed values - equity betas or asset becas? Why? Explain. Using the graph included below please answer the following questions. Please submit your solution as a file it can be any format as long as it is clear Value of Stake of Bondholders of company XYZ at maturity Van of Firm Anitta $ 10 mm a Draw similar graph for the value of the state of the equityholders of company XYZ : maturity. Be specific indicate al important points and values on the graph b. (please refer to this table for questions 1-3). Suppose that assets of XYZ can take the following values at maturity of debe Probability 154 mm 205 $ 10 mm 15 520 mm 50% $ 35 mm 1. Calculate Expected Value of Debt of XYZ at maturity 2. Calculate Expected Value of Equity of XYZ at the time of maturity of debt u need any at the time of maturity of debt Consider the following data for five metal producers in mis-2009 (all numbers are made-up for the purpose of the exercise): Market Capitalization (5mm) Total Enterprise Value (5mm) Equity Beta Debt Rating 4500 8000 1.1 B Company Shougang Group (China) Southern Copper (USA) US Steel (USA) Rusal (Russian Aluminium) 3800 7200 1.3 2400 3800 0.9 BBB 1500 4400 1.75 BB Suppose you were considering expanding your business into metal production and need to estimate cost of capital of your project. You estimated that applicable risk free rate is 3% and market expected return is 8%. a. Estimate asset beta for the metal industry, b. Compute cost of capital of the project if it is going to be 100% equity financed. c Which beras have more dispersed values - equity betas or asset becas? Why? Explain. Using the graph included below please answer the following questions. Please submit your solution as a file it can be any format as long as it is clear Value of Stake of Bondholders of company XYZ at maturity Van of Firm Anitta $ 10 mm a Draw similar graph for the value of the state of the equityholders of company XYZ : maturity. Be specific indicate al important points and values on the graph b. (please refer to this table for questions 1-3). Suppose that assets of XYZ can take the following values at maturity of debe Probability 154 mm 205 $ 10 mm 15 520 mm 50% $ 35 mm 1. Calculate Expected Value of Debt of XYZ at maturity 2. Calculate Expected Value of Equity of XYZ at the time of maturity of debt u need any at the time of maturity of debt