Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Herman and Sons' Law Offices opened on January 1, 2022. Herman's adjusted trial balance at December 31, 2022 is as follows: (Click the icon

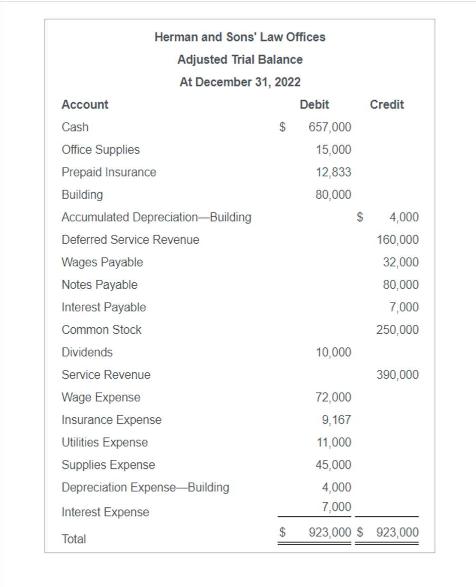

Herman and Sons' Law Offices opened on January 1, 2022. Herman's adjusted trial balance at December 31, 2022 is as follows: (Click the icon to view the adjusted trial balance.) Requirements Perform the following steps for Herman: a. Journalize and post the necessary closing entries at year-end. Omit explanations. Prepare a post-closing trial balance as of December 31, 2022. b. Herman and Sons' Law Offices Adjusted Trial Balance At December 31, 2022 Account Cash Office Supplies Prepaid Insurance Building Accumulated Depreciation Building Deferred Service Revenue Wages Payable Notes Payable Interest Payable Common Stock Dividends Service Revenue Wage Expense Insurance Expense Utilities Expense Supplies Expense Depreciation Expense Building Interest Expense Total $ Debit 657,000 15,000 12,833 80,000 10,000 72,000 9,167 11,000 45,000 $ Credit 4,000 160,000 32,000 80,000 7,000 250,000 390,000 4,000 7,000 923,000 $923,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer Date Account Debited Debit Account Credited Credit Service Revenue 390000 Income Summary Inco...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started