Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hermes Helicopters is located in Athens, Georgia. The company has a complex capital structure with common stock, convertible bonds, preferred stock and some stock

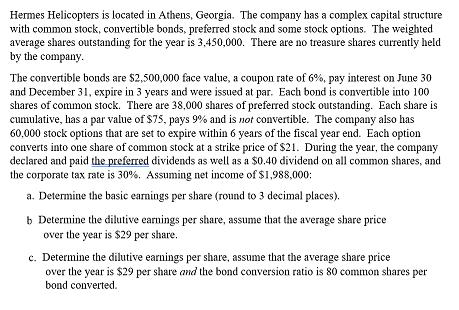

Hermes Helicopters is located in Athens, Georgia. The company has a complex capital structure with common stock, convertible bonds, preferred stock and some stock options. The weighted average shares outstanding for the year is 3,450,000. There are no treasure shares currently held by the company. The convertible bonds are $2,500,000 face value, a coupon rate of 6%, pay interest on June 30 and December 31, expire in 3 years and were issued at par. Each bond is convertible into 100 shares of common stock. There are 38,000 shares of preferred stock outstanding. Each share is cumulative, has a par value of $75, pays 9% and is not convertible. The company also has 60,000 stock options that are set to expire within 6 years of the fiscal year end. Each option converts into one share of common stock at a strike price of $21. During the year, the company declared and paid the preferred dividends as well as a $0.40 dividend on all common shares, and the corporate tax rate is 30%. Assuming net income of $1,988,000: a. Determine the basic earnings per share (round to 3 decimal places). b Determine the dilutive earnings per share, assume that the average share price over the year is $29 per share. c. Determine the dilutive earnings per share, assume that the average share price over the year is $29 per share and the bond conversion ratio is 80 common shares per bond converted.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To calculate the basic earnings per share EPS we need to divide the net income by the weighted average number of shares outstanding Given Net Income ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started