Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Herschel Industries is evaluating whether to invest in solar panels to provide some of the electrical needs of its main office building in Atlanta, Georgia.

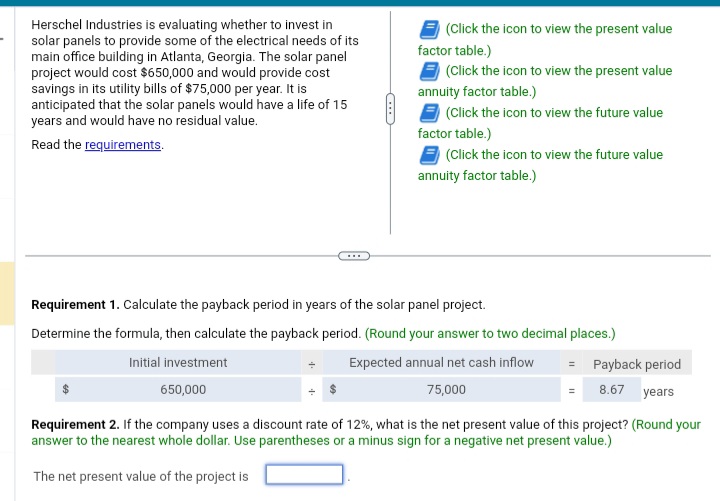

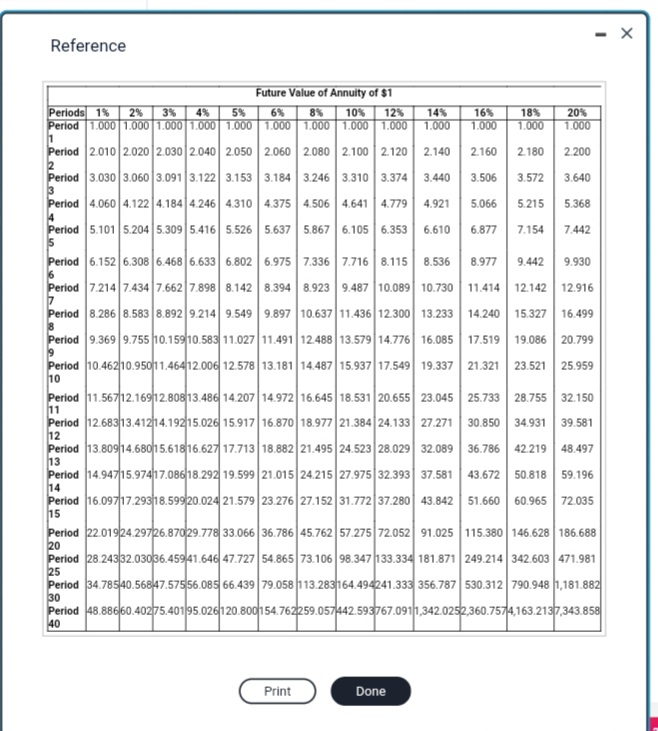

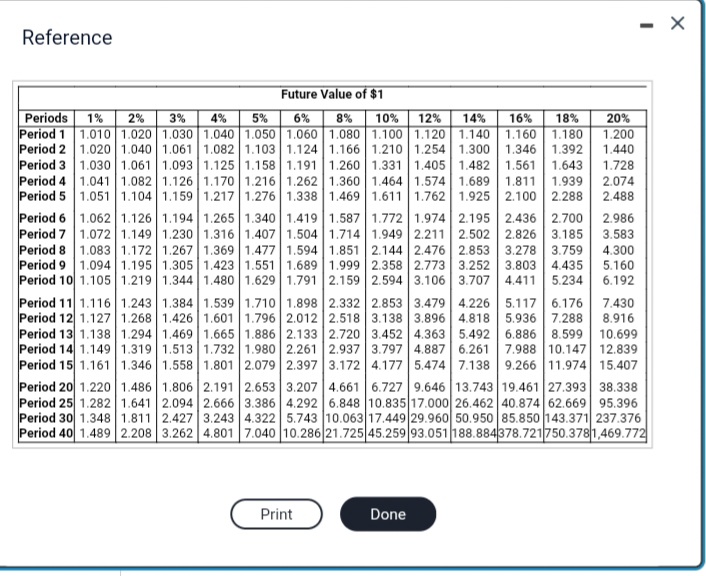

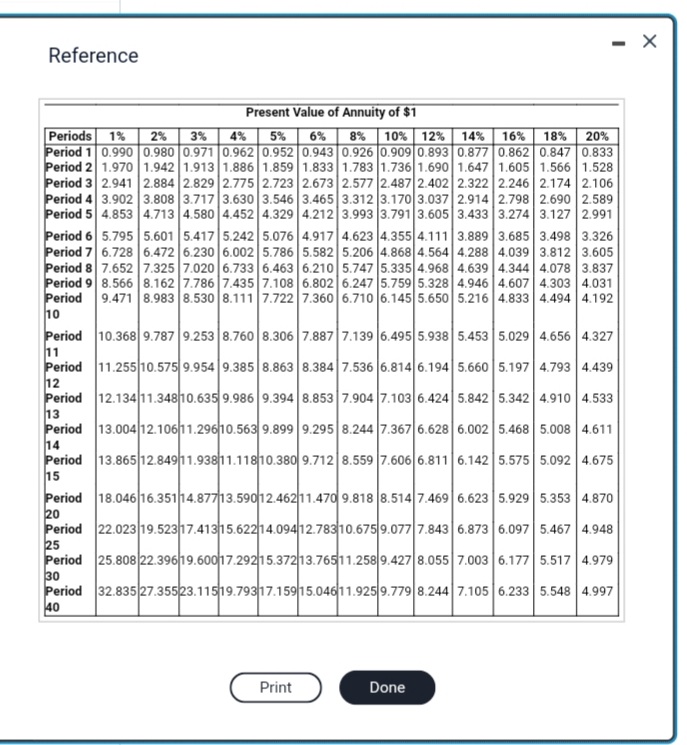

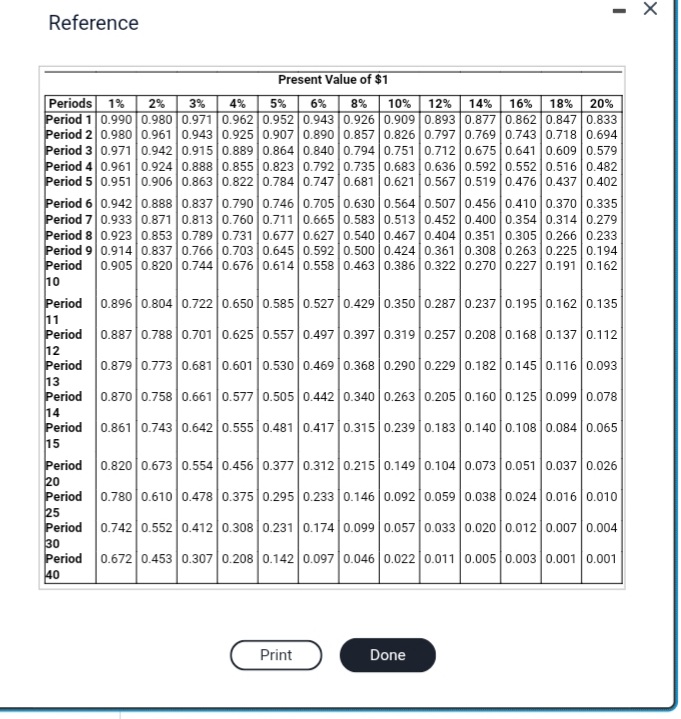

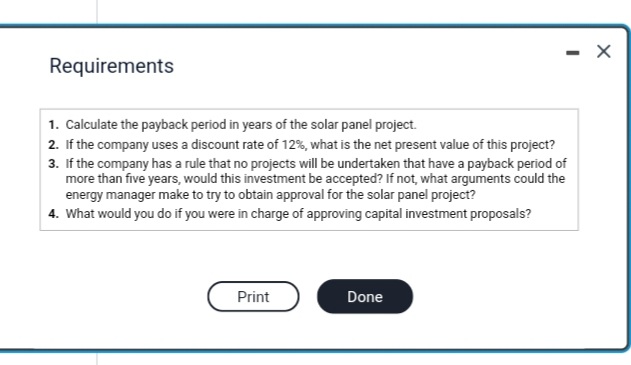

Herschel Industries is evaluating whether to invest in solar panels to provide some of the electrical needs of its main office building in Atlanta, Georgia. The solar panel project would cost $650,000 and would provide cost savings in its utility bills of $75,000 per year. It is anticipated that the solar panels would have a life of 15 years and would have no residual value. Read the requirements. (Click the icon to view the present value factor table.) (Click the icon to view the present value annuity factor table.) (Click the icon to view the future value factor table.) (Click the icon to view the future value annuity factor table.) Requirement 1. Calculate the payback period in years of the solar panel project. Determine the formula, then calculate the payback period. (Round your answer to two decimal places.) Requirement 2. If the company uses a discount rate of 12%, what is the net present value of this project? (Round your answer to the nearest whole dollar. Use parentheses or a minus sign for a negative net present value.) The net present value of the project is Reference Reference Reference Reference Requirements 1. Calculate the payback period in years of the solar panel project. 2. If the company uses a discount rate of 12%, what is the net present value of this project? 3. If the company has a rule that no projects will be undertaken that have a payback period of more than five years, would this investment be accepted? If not, what arguments could the energy manager make to try to obtain approval for the solar panel project? 4. What would you do if you were in charge of approving capital investment proposals

Herschel Industries is evaluating whether to invest in solar panels to provide some of the electrical needs of its main office building in Atlanta, Georgia. The solar panel project would cost $650,000 and would provide cost savings in its utility bills of $75,000 per year. It is anticipated that the solar panels would have a life of 15 years and would have no residual value. Read the requirements. (Click the icon to view the present value factor table.) (Click the icon to view the present value annuity factor table.) (Click the icon to view the future value factor table.) (Click the icon to view the future value annuity factor table.) Requirement 1. Calculate the payback period in years of the solar panel project. Determine the formula, then calculate the payback period. (Round your answer to two decimal places.) Requirement 2. If the company uses a discount rate of 12%, what is the net present value of this project? (Round your answer to the nearest whole dollar. Use parentheses or a minus sign for a negative net present value.) The net present value of the project is Reference Reference Reference Reference Requirements 1. Calculate the payback period in years of the solar panel project. 2. If the company uses a discount rate of 12%, what is the net present value of this project? 3. If the company has a rule that no projects will be undertaken that have a payback period of more than five years, would this investment be accepted? If not, what arguments could the energy manager make to try to obtain approval for the solar panel project? 4. What would you do if you were in charge of approving capital investment proposals Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started