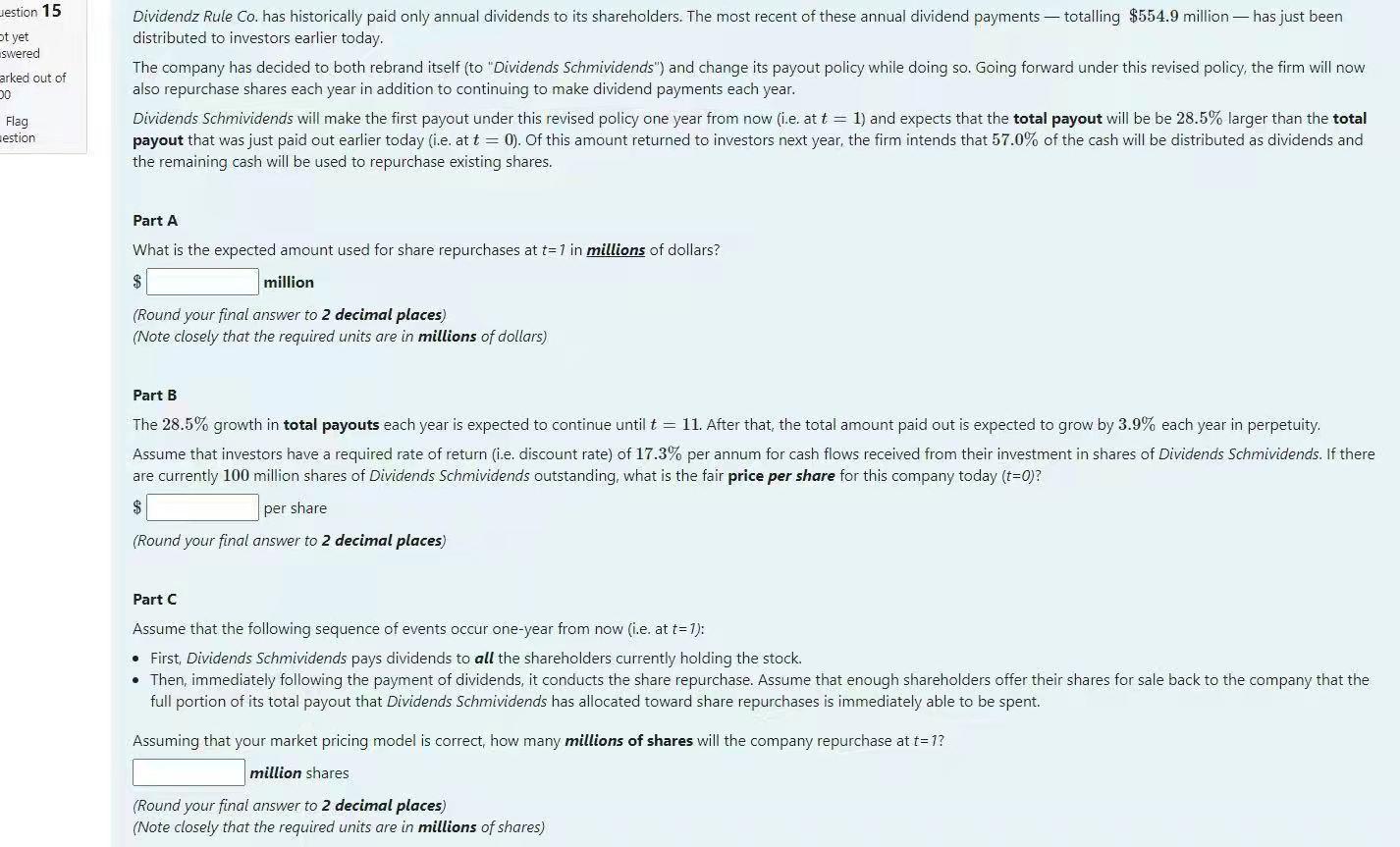

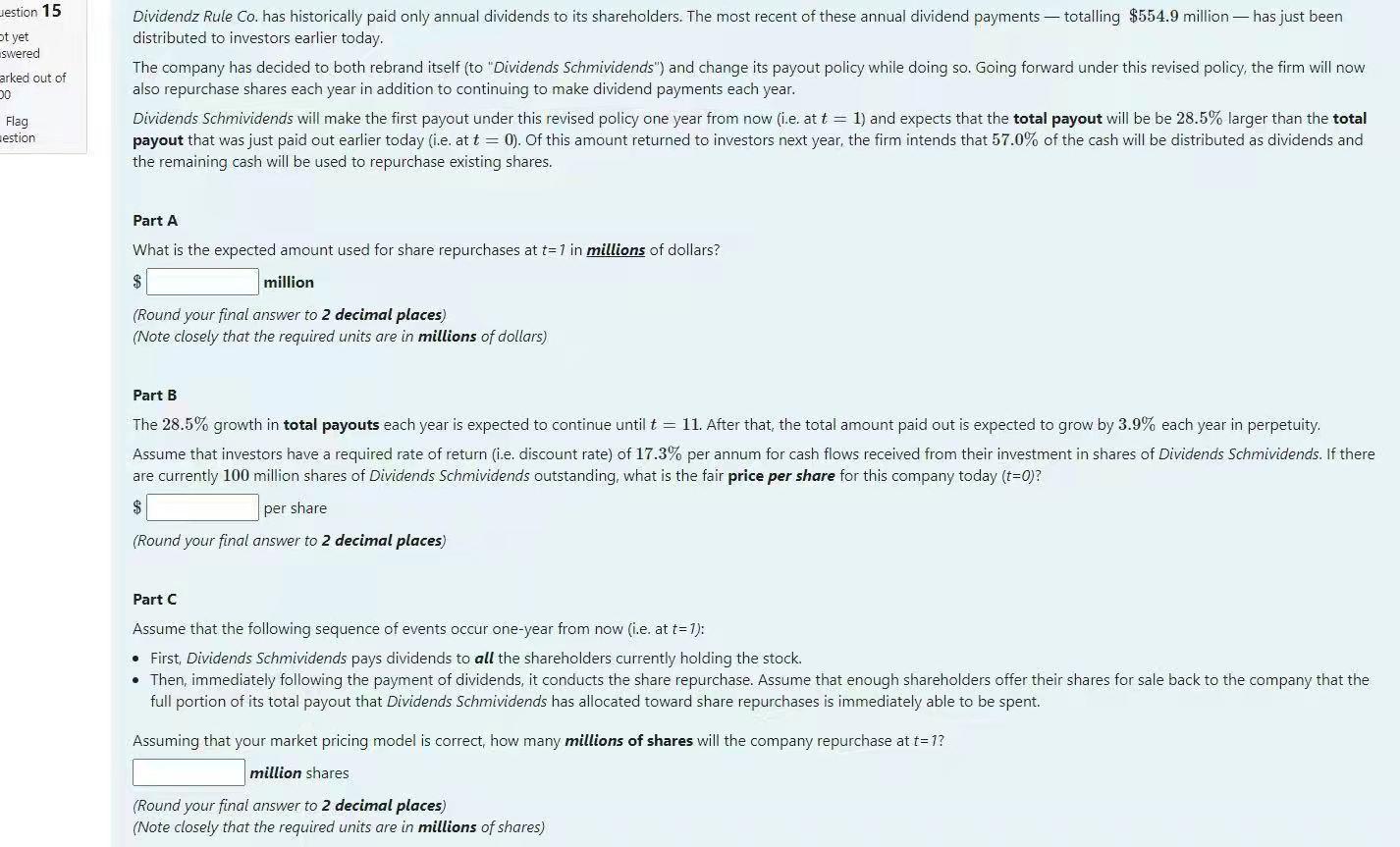

Hestion 15 ot yet swered arked out of DO Dividendz Rule Co. has historically paid only annual dividends to its shareholders. The most recent of these annual dividend payments totalling $554.9 million has just been distributed to investors earlier today. The company has decided to both rebrand itself (to "Dividends Schmividends") and change its payout policy while doing so. Going forward under this revised policy, the firm will now also repurchase shares each year in addition to continuing to make dividend payments each year. Dividends Schmividends will make the first payout under this revised policy one year from now (i.e. at t = 1) and expects that the total payout will be be 28.5% larger than the total payout that was just paid out earlier today (i.e. at t = 0). Of this amount returned to investors next year, the firm intends that 57.0% of the cash will be distributed as dividends and the remaining cash will be used to repurchase existing shares. Flag estion Part A What is the expected amount used for share repurchases at t= 1 in millions of dollars? $ million (Round your final answer to 2 decimal places) (Note closely that the required units are in millions of dollars) Part B The 28.5% growth in total payouts each year is expected to continue until t = 11. After that, the total amount paid out is expected to grow by 3.9% each year in perpetuity. Assume that inve have a required rate of return (i.e. discount rate) 17.3% per annum for cash flows received from investment shares of Dividends Schmividends. If there are currently 100 million shares of Dividends Schmividends outstanding, what is the fair price per share for this company today (t=0)? $ per share (Round your final answer to 2 decimal places) Part C Assume that the following sequence of events occur one-year from now (i.e. at t=1): First, Dividends Schmividends pays dividends to all the shareholders currently holding the stock. Then, immediately following the payment of dividends, it conducts the share repurchase. Assume that enough shareholders offer their shares for sale back to the company that the full portion of its total payout that Dividends Schmividends has allocated toward share repurchases is immediately able to be spent. Assuming that your market pricing model is correct, how many millions of shares will the company repurchase at t=1? million shares (Round your final answer to 2 decimal places) (Note closely that the required units are in millions of shares)