hey could I please have help with questions B, E F and I

Thankyou and I have attached all info and templates !

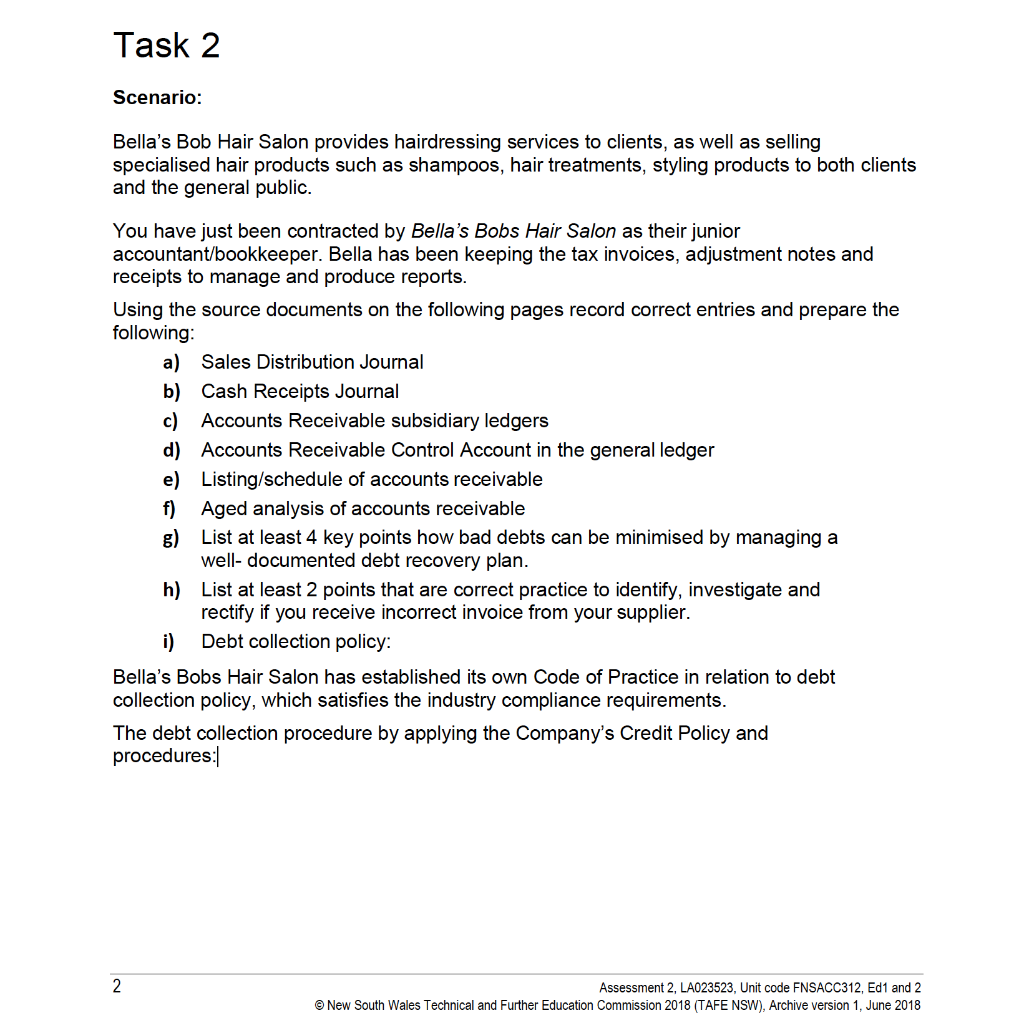

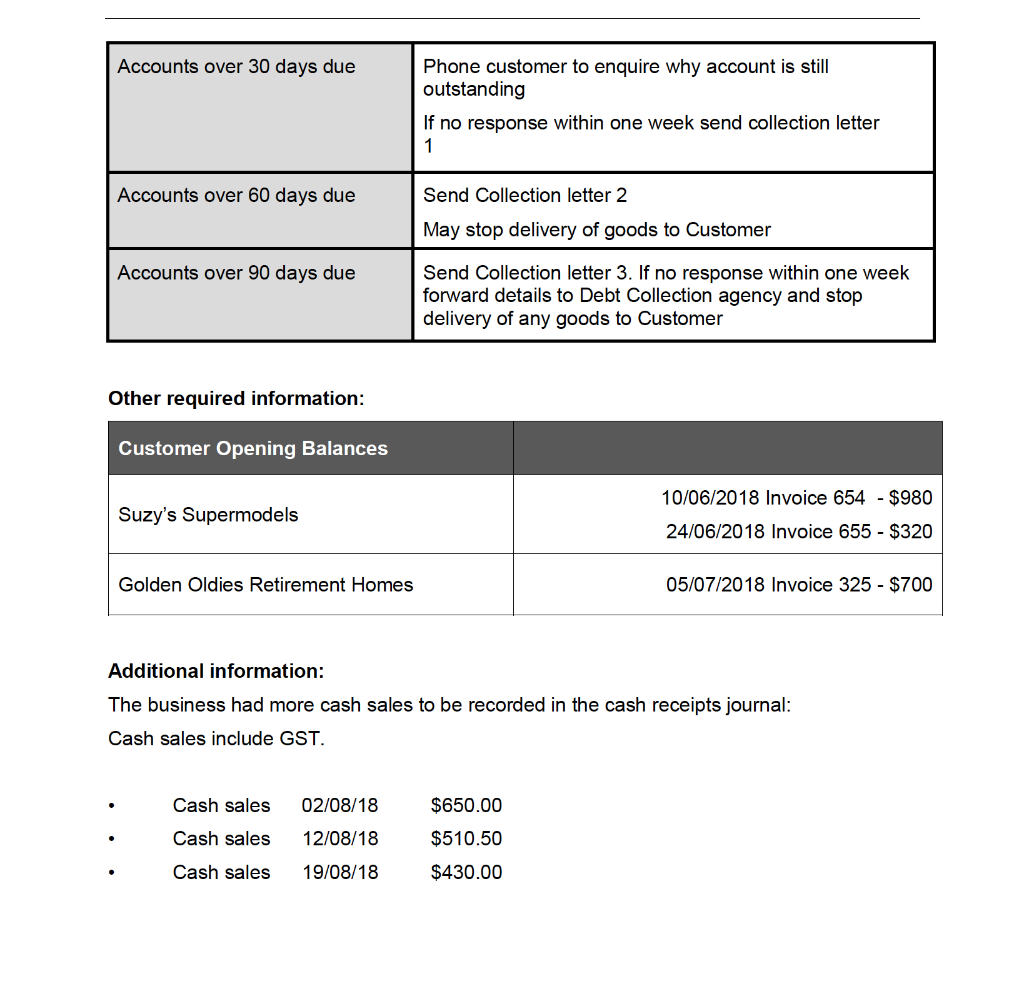

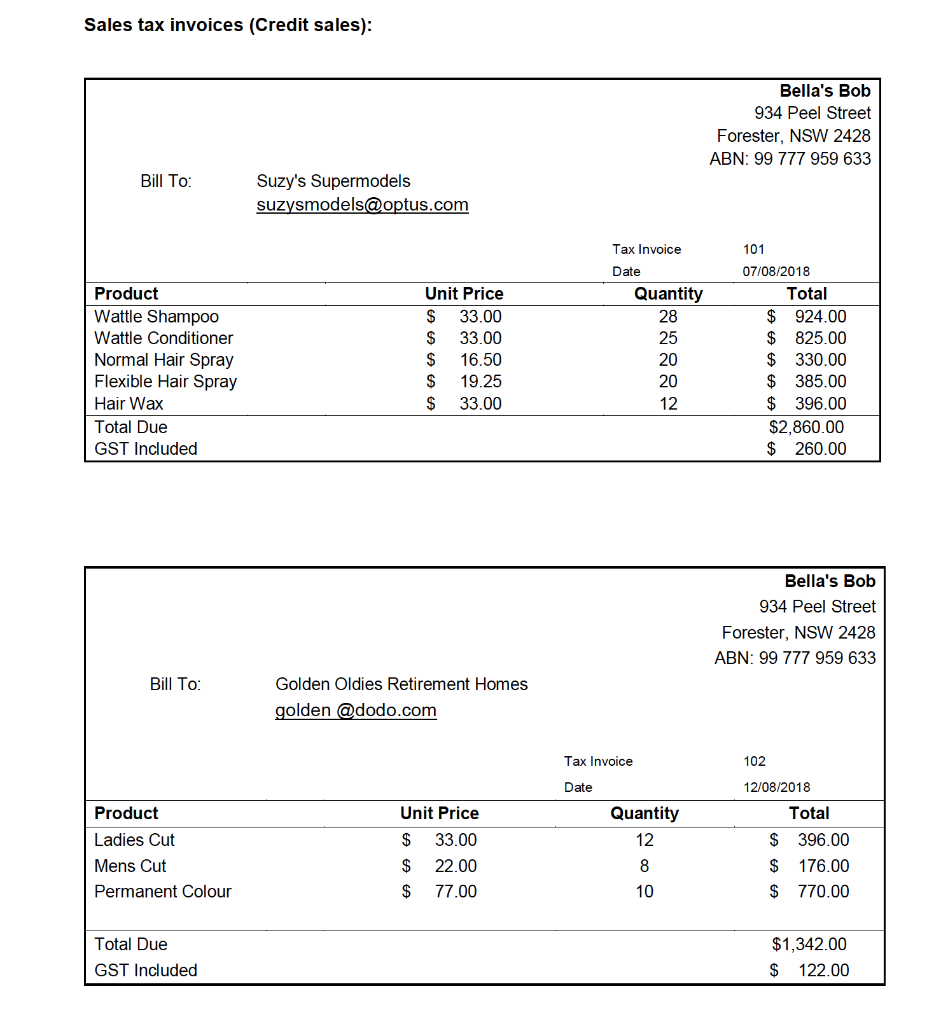

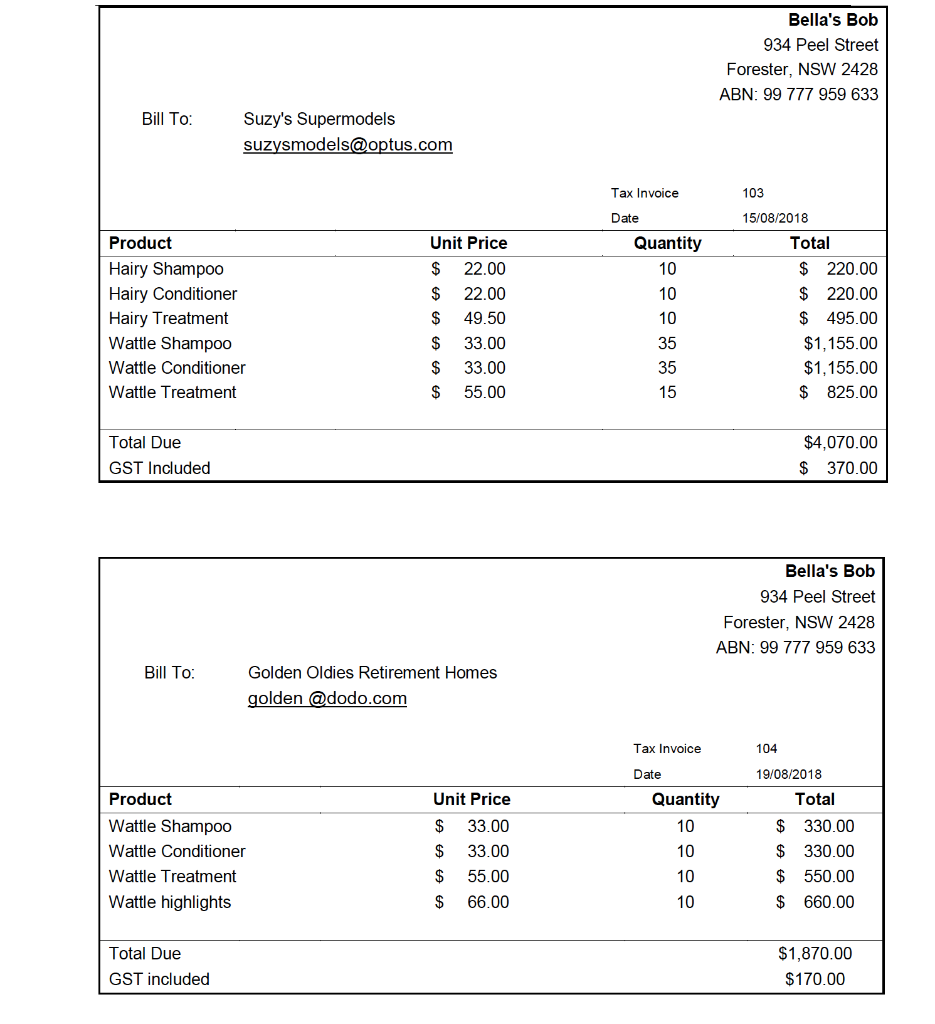

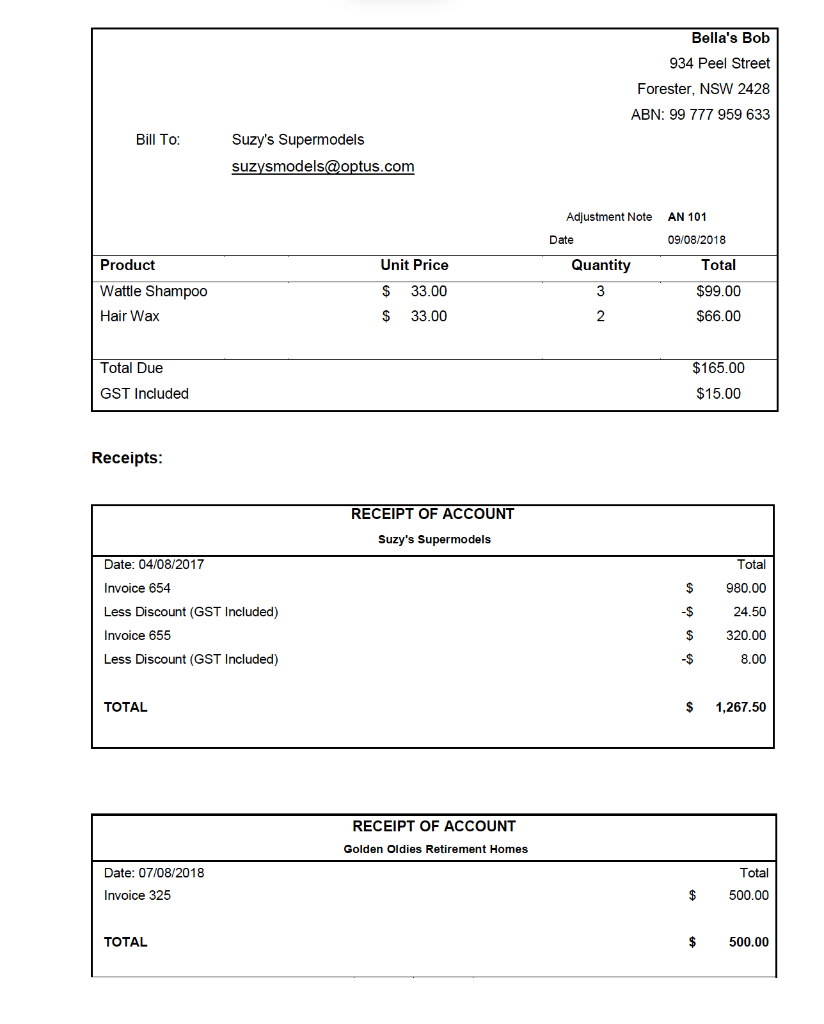

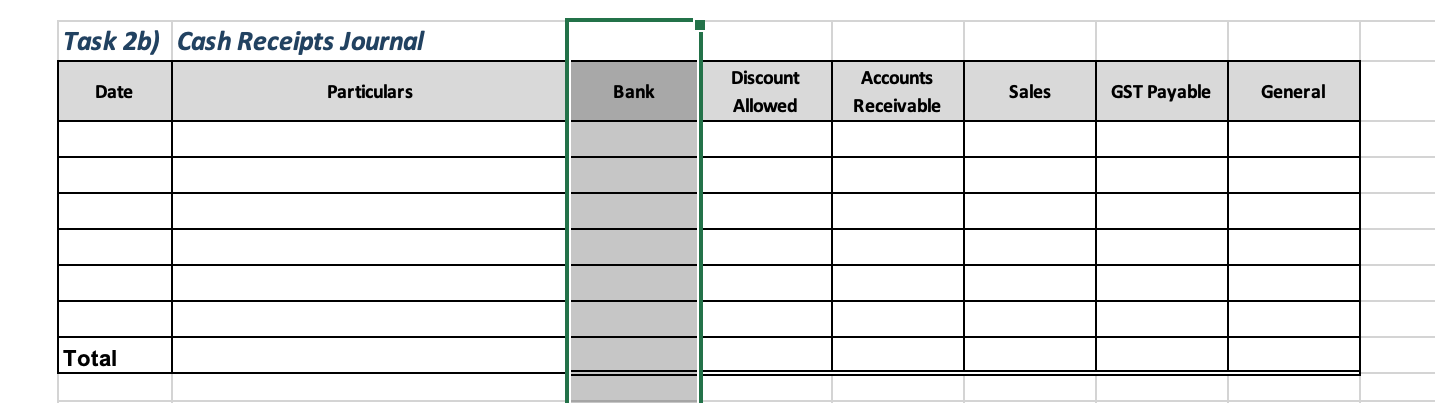

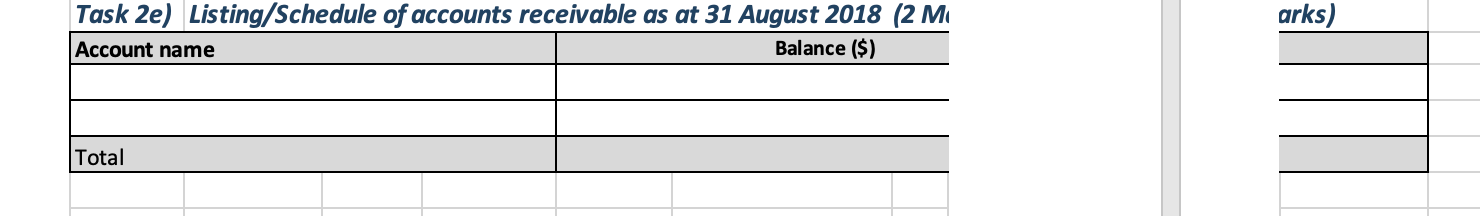

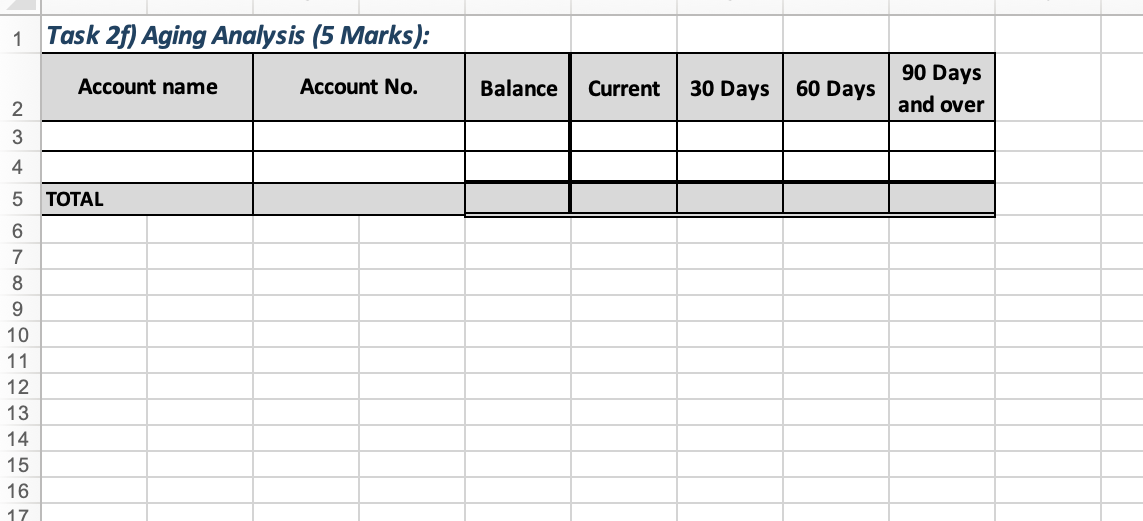

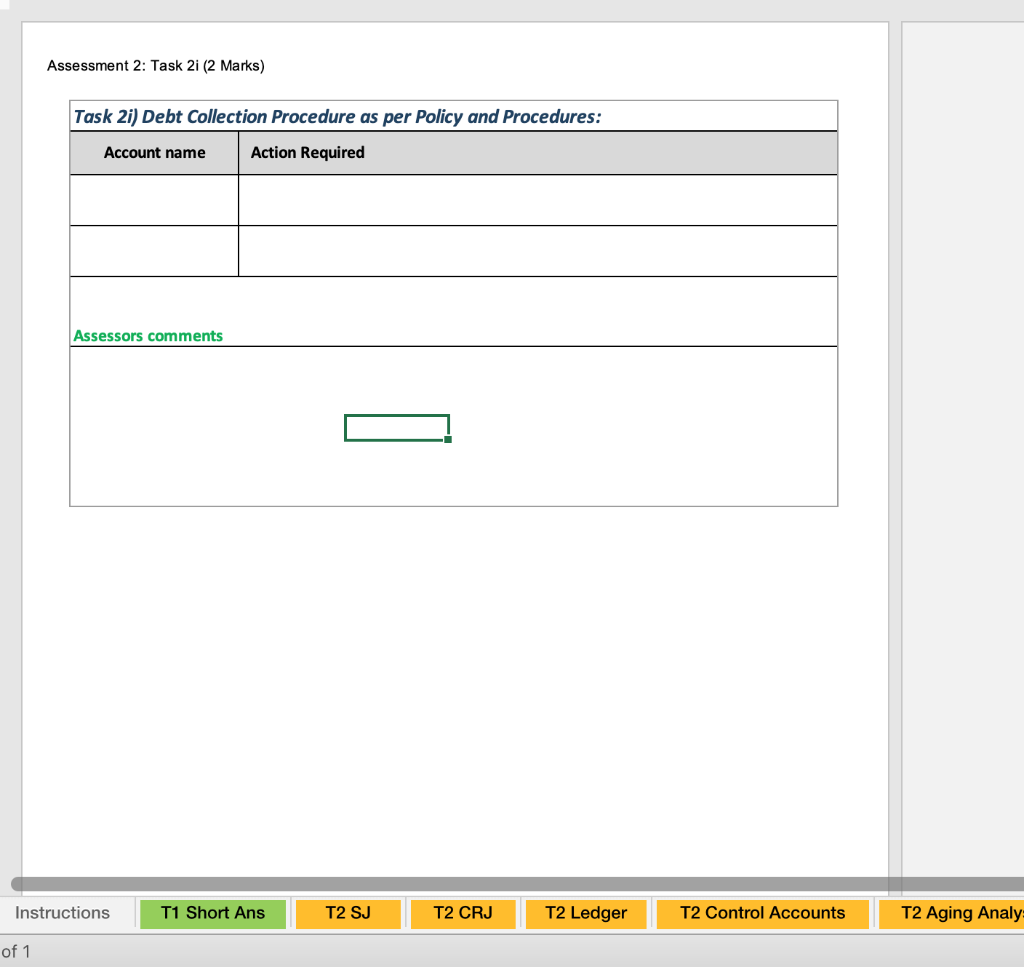

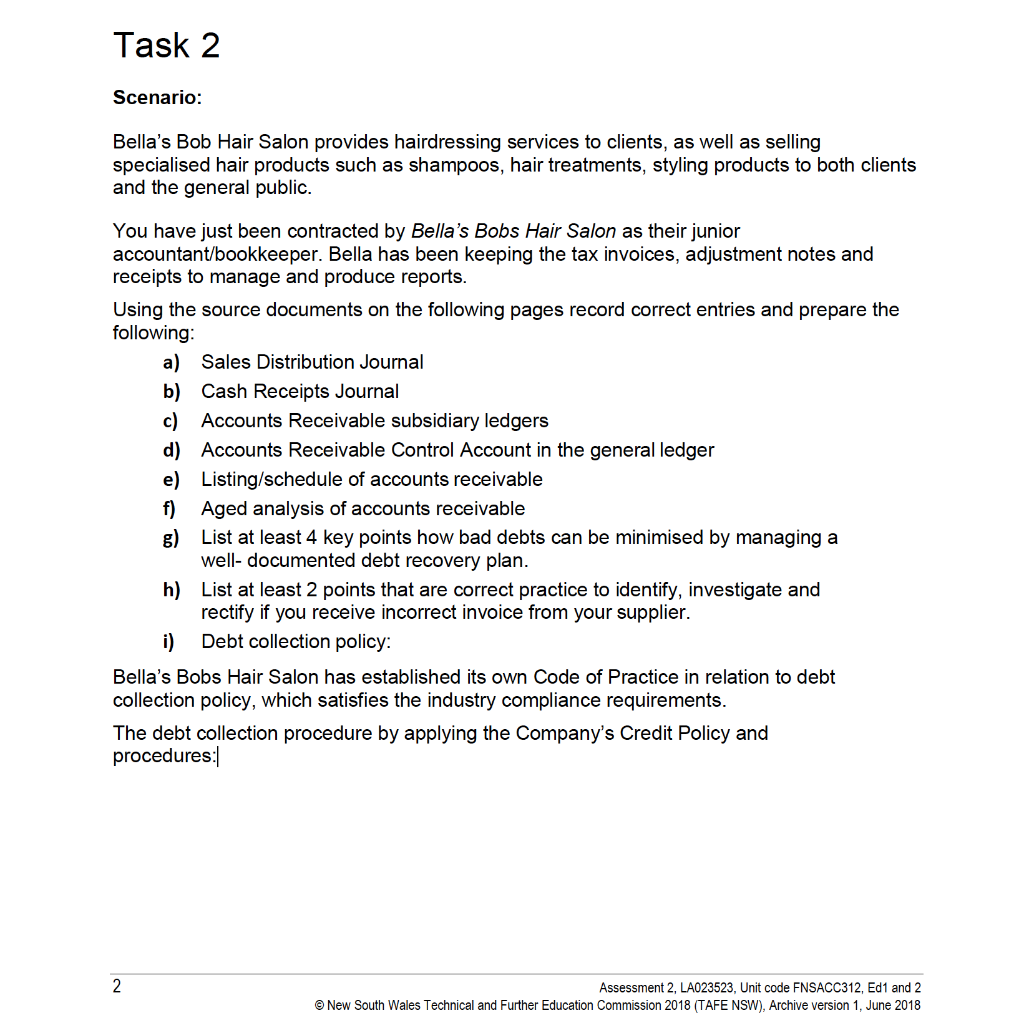

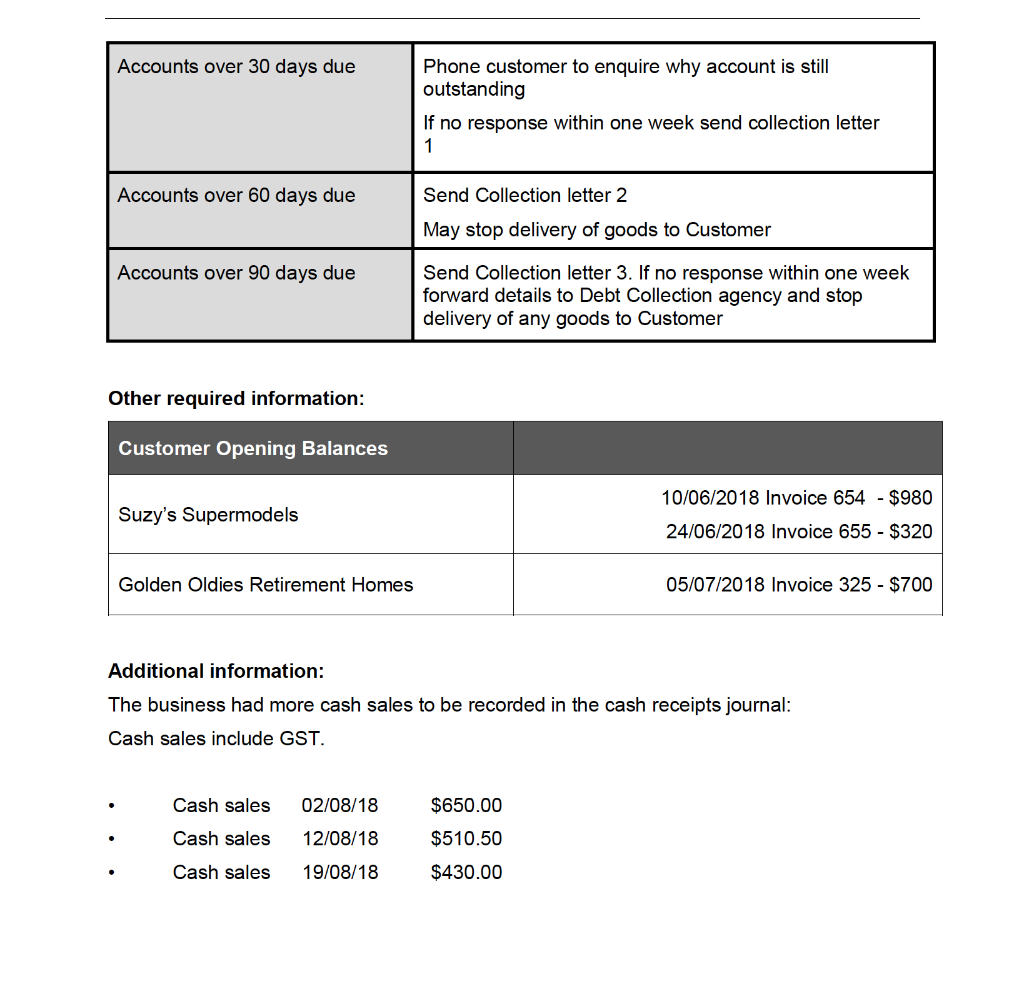

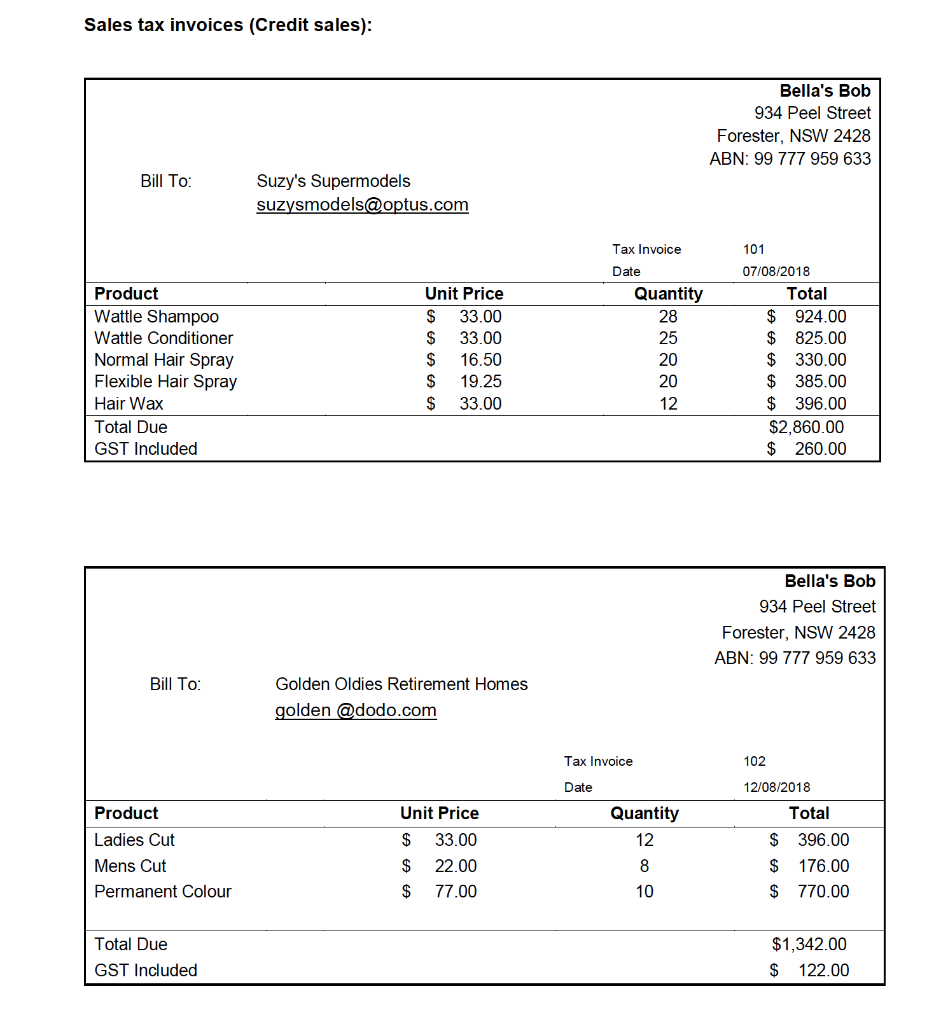

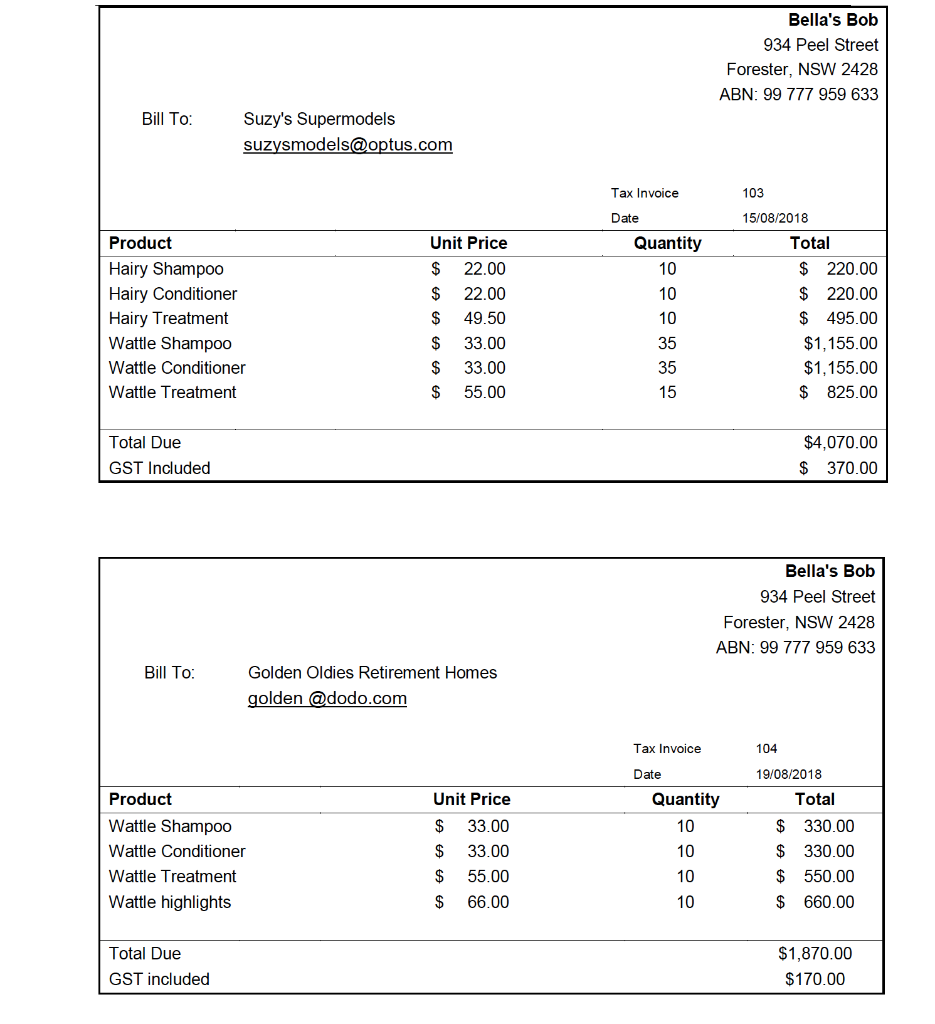

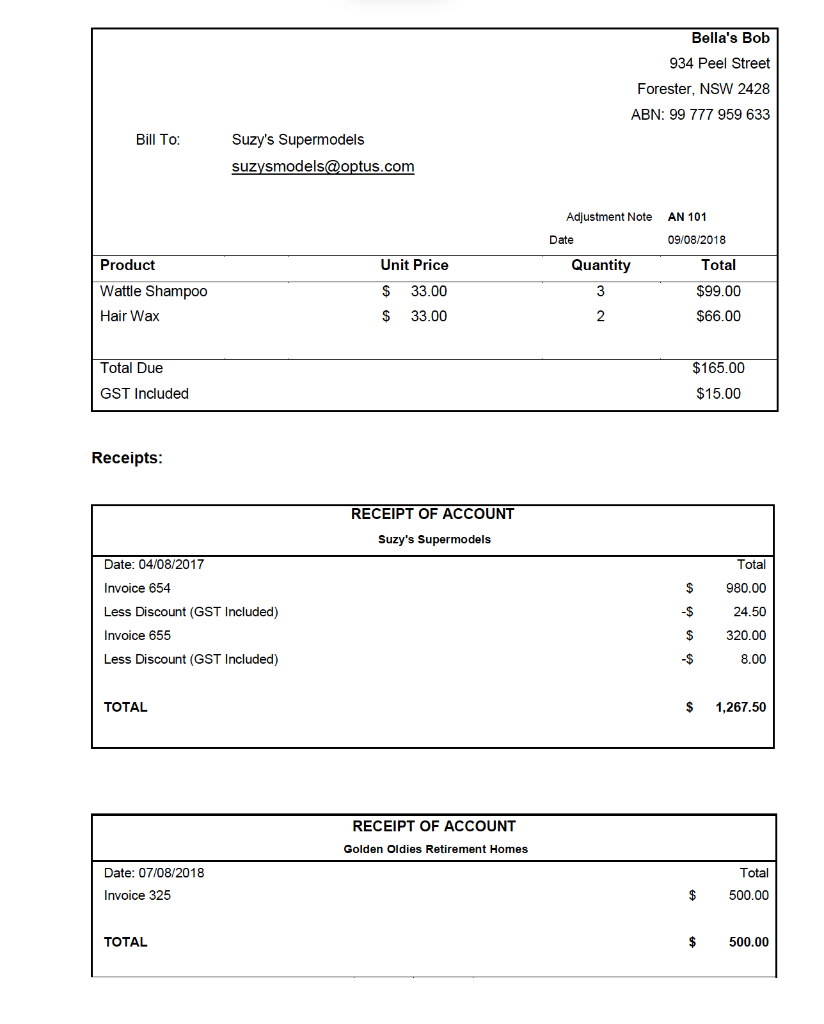

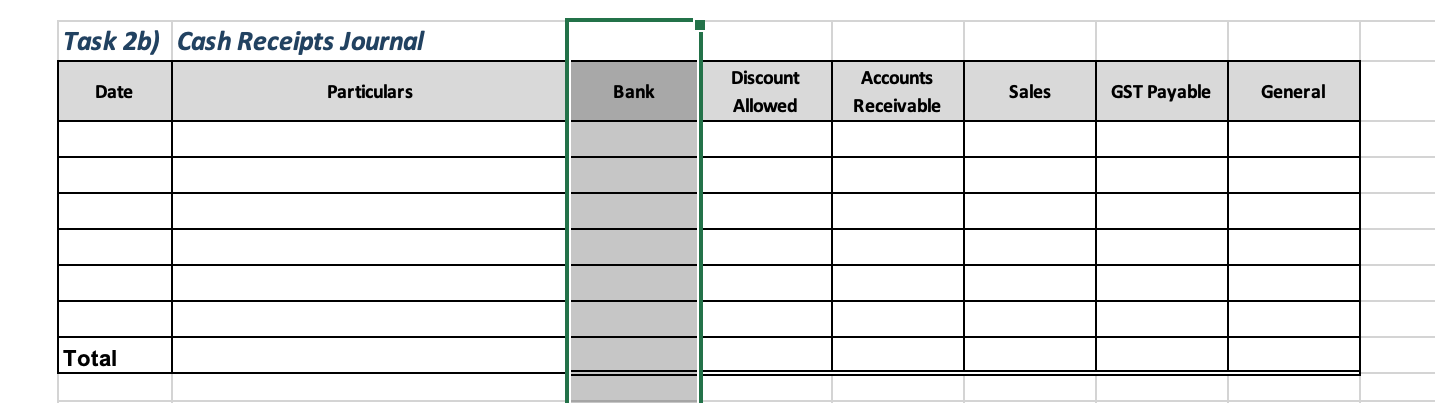

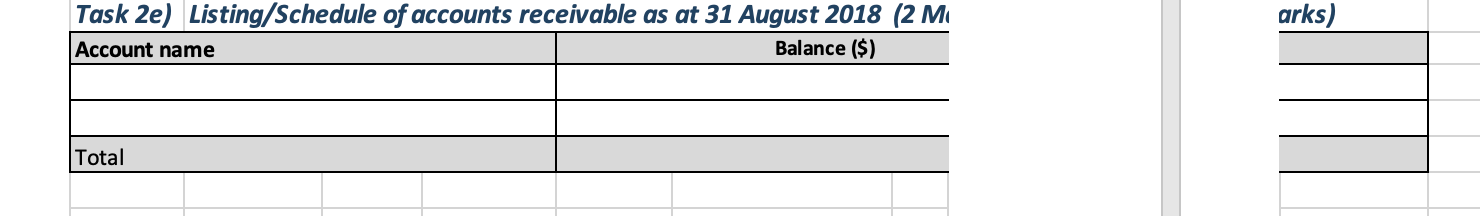

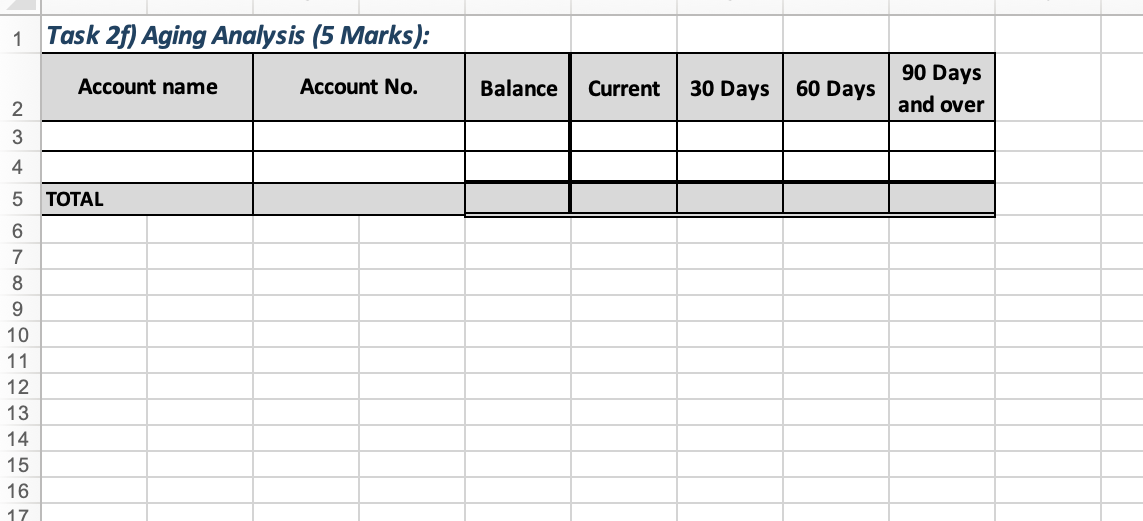

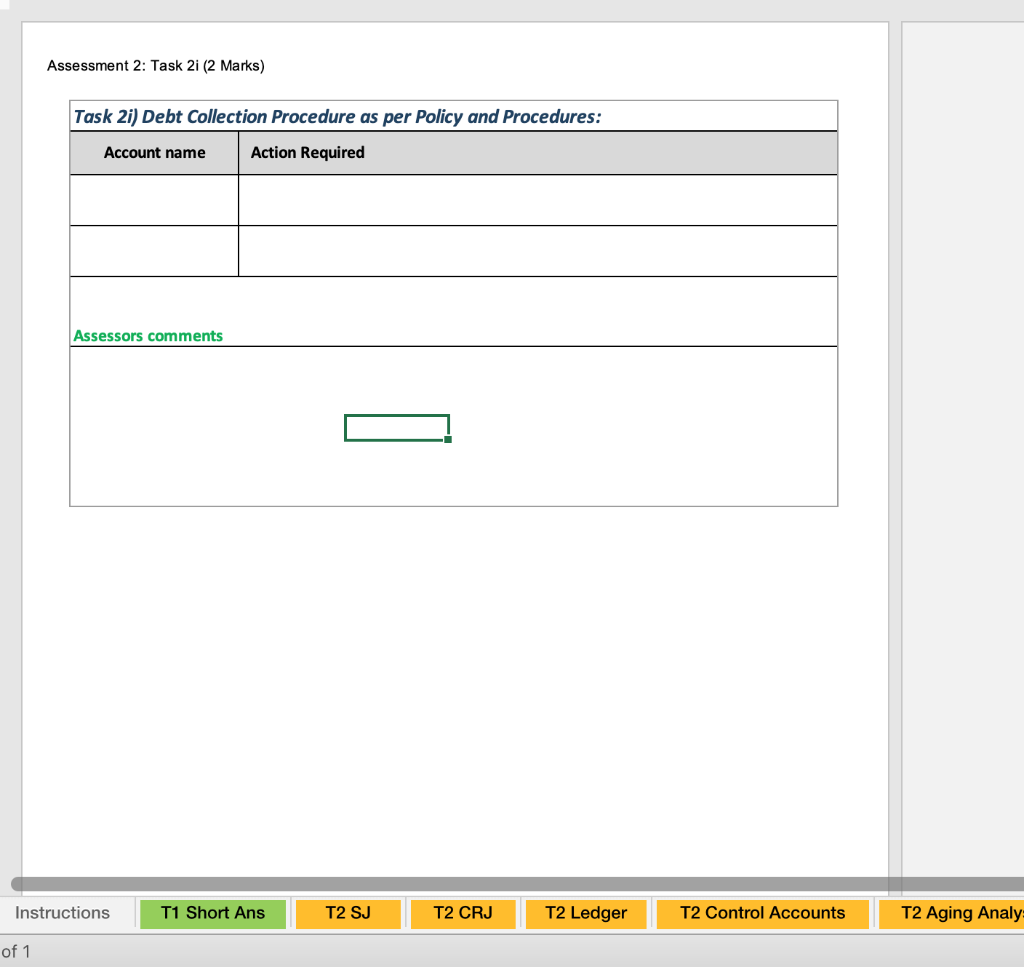

Task 2 Scenario: Bella's Bob Hair Salon provides hairdressing services to clients, as well as selling specialised hair products such as shampoos, hair treatments, styling products to both clients and the general public. You have just been contracted by Bella's Bobs Hair Salon as their junior accountant/bookkeeper. Bella has been keeping the tax invoices, adjustment notes and receipts to manage and produce reports. Using the source documents on the following pages record correct entries and prepare the following: a) Sales Distribution Journal b) Cash Receipts Journal c) Accounts Receivable subsidiary ledgers d) Accounts Receivable Control Account in the general ledger e) Listing/schedule of accounts receivable f) Aged analysis of accounts receivable g) List at least 4 key points how bad debts can be minimised by managing a well-documented debt recovery plan. h) List at least 2 points that are correct practice to identify, investigate and rectify if you receive incorrect invoice from your supplier. i) Debt collection policy: Bella's Bobs Hair Salon has established its own Code of Practice in relation to debt collection policy, which satisfies the industry compliance requirements. The debt collection procedure by applying the Company's Credit Policy and procedures: 2 Assessment 2, LA023523, Unit code FNSACC312, Ed1 and 2 New South Wales Technical and Further Education Commission 2018 (TAFE NSW), Archive version 1June 2018 Accounts over 30 days due Phone customer to enquire why account is still outstanding If no response within one week send collection letter 1 Accounts over 60 days due Send Collection letter 2 May stop delivery of goods to Customer Accounts over 90 days due Send Collection letter 3. If no response within one week forward details to Debt Collection agency and stop delivery of any goods to Customer Other required information: Customer Opening Balances 10/06/2018 Invoice 654 - $980 Suzy's Supermodels 24/06/2018 Invoice 655 - $320 Golden Oldies Retirement Homes 05/07/2018 Invoice 325 - $700 Additional information: The business had more cash sales to be recorded in the cash receipts journal: Cash sales include GST. Cash sales 02/08/18 $650.00 Cash sales 12/08/18 $510.50 Cash sales 19/08/18 $430.00 Sales tax invoices (Credit sales): Bella's Bob 934 Peel Street Forester, NSW 2428 ABN: 99 777 959 633 Bill To: Suzy's Supermodels suzysmodels@optus.com Product Wattle Shampoo Wattle Conditioner Normal Hair Spray Flexible Hair Spray Hair Wax Total Due GST Included Unit Price $ 33.00 $ 33.00 $ 16.50 $ 19.25 $ 33.00 Tax Invoice Date Quantity 28 25 20 20 12 101 07/08/2018 Total $ 924.00 $ 825.00 $ 330.00 $ 385.00 $ 396.00 $2,860.00 $ 260.00 Bella's Bob 934 Peel Street Forester, NSW 2428 ABN: 99 777 959 633 Bill To: Golden Oldies Retirement Homes golden @dodo.com Tax Invoice 102 Date Product Ladies Cut Mens Cut Permanent Colour Unit Price $ 33.00 22.00 $ 77.00 Quantity 12 8 10 12/08/2018 Total $ 396.00 $ 176.00 $ 770.00 $ Total Due GST Included $1,342.00 $ 122.00 Bella's Bob 934 Peel Street Forester, NSW 2428 ABN: 99 777 959 633 Bill To: Suzy's Supermodels suzysmodels@optus.com Tax Invoice 103 Date 15/08/2018 Product Hairy Shampoo Hairy Conditioner Hairy Treatment Wattle Shampoo Wattle Conditioner Wattle Treatment Unit Price $ 22.00 $ 22.00 $ 49.50 $ 33.00 $ 33.00 $ 55.00 Quantity 10 10 10 35 35 15 Total $ 220.00 $ 220.00 $ 495.00 $1,155.00 $1,155.00 $ 825.00 Total Due GST Included $4,070.00 $ 370.00 Bella's Bob 934 Peel Street Forester, NSW 2428 ABN: 99 777 959 633 Bill To: Golden Oldies Retirement Homes golden @dodo.com Tax Invoice 104 Date 19/08/2018 Quantity Total 10 Product Wattle Shampoo Wattle Conditioner Wattle Treatment Wattle highlights Unit Price $ 33.00 $ 33.00 $ 55.00 $ 66.00 10 $ 330.00 $ 330.00 $ 550.00 $ 660.00 10 10 Total Due GST included $1,870.00 $170.00 Bella's Bob 934 Peel Street Forester, NSW 2428 ABN: 99 777 959 633 Bill To: Suzy's Supermodels suzysmodels@optus.com Adjustment Note AN 101 Date 09/08/2018 Total Product Wattle Shampoo Hair Wax Unit Price $ 33.00 Quantity 3 $99.00 $ 33.00 2 $66.00 Total Due GST Included $165.00 $15.00 Receipts: RECEIPT OF ACCOUNT Suzy's Supermodels Date: 04/08/2017 Invoice 654 $ Total 980.00 24.50 Less Discount (GST Included) -$ Invoice 655 $ 320.00 8.00 Less Discount (GST Included) -$ TOTAL $ 1,267.50 RECEIPT OF ACCOUNT Golden Oldies Retirement Homes Date: 07/08/2018 Invoice 325 Total 500.00 TOTAL $ 500.00 Task 2b) Cash Receipts Journal Date Particulars Bank Discount Allowed Accounts Receivable Sales GST Payable General Total Task 2e) Listing/Schedule of accounts receivable as at 31 August 2018 (2 M Balance ($) Account name arks) Total 1 Task 2f) Aging Analysis (5 Marks): Account name Account No. Balance Current 30 Days 60 Days 90 Days and over 2 3 4 5 TOTAL 6 7 8 9 10 11 12 13 14 15 16 17 Assessment 2: Task 2i (2 Marks) Task 2i) Debt Collection Procedure as per Policy and Procedures: Account name Action Required Assessors comments Instructions T1 Short Ans T2 SJ T2 CRJ T2 Ledger T2 Control Accounts T2 Aging Analy of 1 Task 2 Scenario: Bella's Bob Hair Salon provides hairdressing services to clients, as well as selling specialised hair products such as shampoos, hair treatments, styling products to both clients and the general public. You have just been contracted by Bella's Bobs Hair Salon as their junior accountant/bookkeeper. Bella has been keeping the tax invoices, adjustment notes and receipts to manage and produce reports. Using the source documents on the following pages record correct entries and prepare the following: a) Sales Distribution Journal b) Cash Receipts Journal c) Accounts Receivable subsidiary ledgers d) Accounts Receivable Control Account in the general ledger e) Listing/schedule of accounts receivable f) Aged analysis of accounts receivable g) List at least 4 key points how bad debts can be minimised by managing a well-documented debt recovery plan. h) List at least 2 points that are correct practice to identify, investigate and rectify if you receive incorrect invoice from your supplier. i) Debt collection policy: Bella's Bobs Hair Salon has established its own Code of Practice in relation to debt collection policy, which satisfies the industry compliance requirements. The debt collection procedure by applying the Company's Credit Policy and procedures: 2 Assessment 2, LA023523, Unit code FNSACC312, Ed1 and 2 New South Wales Technical and Further Education Commission 2018 (TAFE NSW), Archive version 1June 2018 Accounts over 30 days due Phone customer to enquire why account is still outstanding If no response within one week send collection letter 1 Accounts over 60 days due Send Collection letter 2 May stop delivery of goods to Customer Accounts over 90 days due Send Collection letter 3. If no response within one week forward details to Debt Collection agency and stop delivery of any goods to Customer Other required information: Customer Opening Balances 10/06/2018 Invoice 654 - $980 Suzy's Supermodels 24/06/2018 Invoice 655 - $320 Golden Oldies Retirement Homes 05/07/2018 Invoice 325 - $700 Additional information: The business had more cash sales to be recorded in the cash receipts journal: Cash sales include GST. Cash sales 02/08/18 $650.00 Cash sales 12/08/18 $510.50 Cash sales 19/08/18 $430.00 Sales tax invoices (Credit sales): Bella's Bob 934 Peel Street Forester, NSW 2428 ABN: 99 777 959 633 Bill To: Suzy's Supermodels suzysmodels@optus.com Product Wattle Shampoo Wattle Conditioner Normal Hair Spray Flexible Hair Spray Hair Wax Total Due GST Included Unit Price $ 33.00 $ 33.00 $ 16.50 $ 19.25 $ 33.00 Tax Invoice Date Quantity 28 25 20 20 12 101 07/08/2018 Total $ 924.00 $ 825.00 $ 330.00 $ 385.00 $ 396.00 $2,860.00 $ 260.00 Bella's Bob 934 Peel Street Forester, NSW 2428 ABN: 99 777 959 633 Bill To: Golden Oldies Retirement Homes golden @dodo.com Tax Invoice 102 Date Product Ladies Cut Mens Cut Permanent Colour Unit Price $ 33.00 22.00 $ 77.00 Quantity 12 8 10 12/08/2018 Total $ 396.00 $ 176.00 $ 770.00 $ Total Due GST Included $1,342.00 $ 122.00 Bella's Bob 934 Peel Street Forester, NSW 2428 ABN: 99 777 959 633 Bill To: Suzy's Supermodels suzysmodels@optus.com Tax Invoice 103 Date 15/08/2018 Product Hairy Shampoo Hairy Conditioner Hairy Treatment Wattle Shampoo Wattle Conditioner Wattle Treatment Unit Price $ 22.00 $ 22.00 $ 49.50 $ 33.00 $ 33.00 $ 55.00 Quantity 10 10 10 35 35 15 Total $ 220.00 $ 220.00 $ 495.00 $1,155.00 $1,155.00 $ 825.00 Total Due GST Included $4,070.00 $ 370.00 Bella's Bob 934 Peel Street Forester, NSW 2428 ABN: 99 777 959 633 Bill To: Golden Oldies Retirement Homes golden @dodo.com Tax Invoice 104 Date 19/08/2018 Quantity Total 10 Product Wattle Shampoo Wattle Conditioner Wattle Treatment Wattle highlights Unit Price $ 33.00 $ 33.00 $ 55.00 $ 66.00 10 $ 330.00 $ 330.00 $ 550.00 $ 660.00 10 10 Total Due GST included $1,870.00 $170.00 Bella's Bob 934 Peel Street Forester, NSW 2428 ABN: 99 777 959 633 Bill To: Suzy's Supermodels suzysmodels@optus.com Adjustment Note AN 101 Date 09/08/2018 Total Product Wattle Shampoo Hair Wax Unit Price $ 33.00 Quantity 3 $99.00 $ 33.00 2 $66.00 Total Due GST Included $165.00 $15.00 Receipts: RECEIPT OF ACCOUNT Suzy's Supermodels Date: 04/08/2017 Invoice 654 $ Total 980.00 24.50 Less Discount (GST Included) -$ Invoice 655 $ 320.00 8.00 Less Discount (GST Included) -$ TOTAL $ 1,267.50 RECEIPT OF ACCOUNT Golden Oldies Retirement Homes Date: 07/08/2018 Invoice 325 Total 500.00 TOTAL $ 500.00 Task 2b) Cash Receipts Journal Date Particulars Bank Discount Allowed Accounts Receivable Sales GST Payable General Total Task 2e) Listing/Schedule of accounts receivable as at 31 August 2018 (2 M Balance ($) Account name arks) Total 1 Task 2f) Aging Analysis (5 Marks): Account name Account No. Balance Current 30 Days 60 Days 90 Days and over 2 3 4 5 TOTAL 6 7 8 9 10 11 12 13 14 15 16 17 Assessment 2: Task 2i (2 Marks) Task 2i) Debt Collection Procedure as per Policy and Procedures: Account name Action Required Assessors comments Instructions T1 Short Ans T2 SJ T2 CRJ T2 Ledger T2 Control Accounts T2 Aging Analy of 1