Hey everyone I am really stuck on this entire question and I was wondering if anyone could help

thank you so much

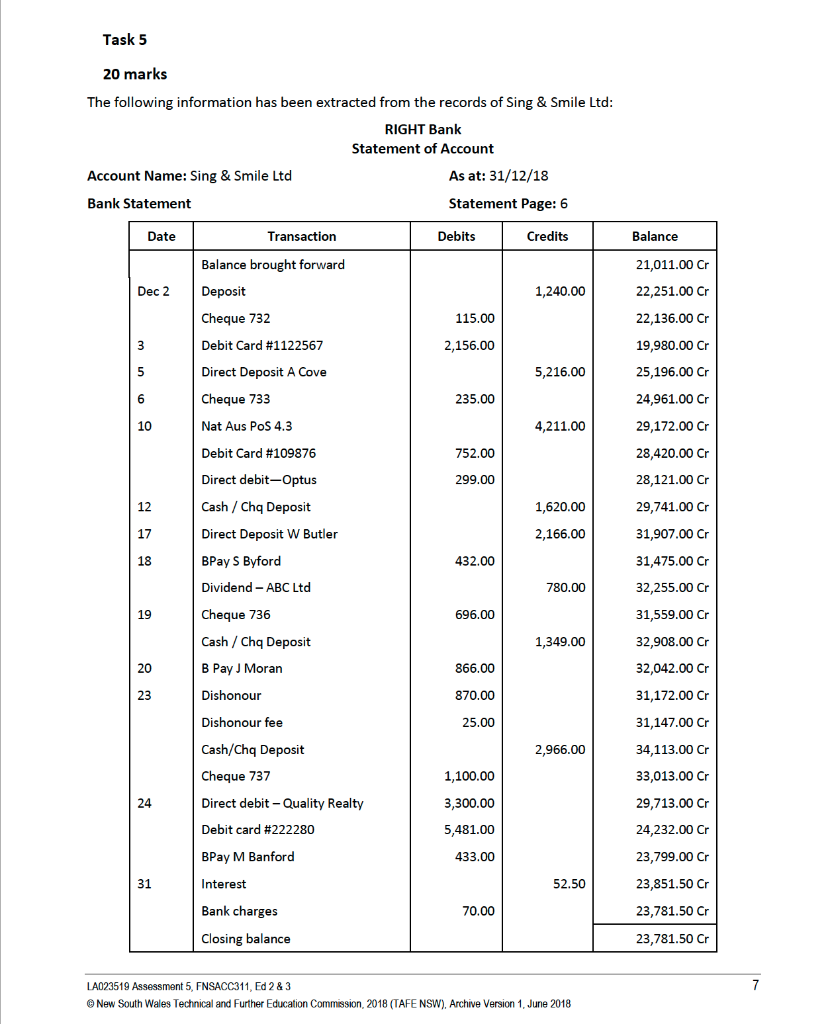

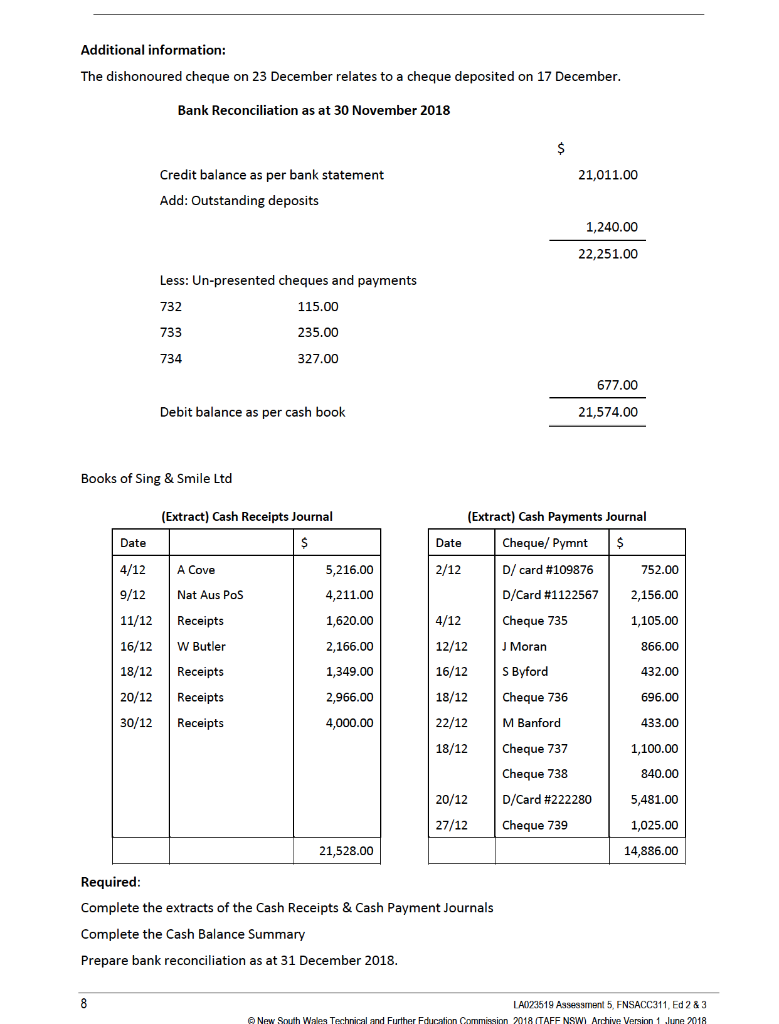

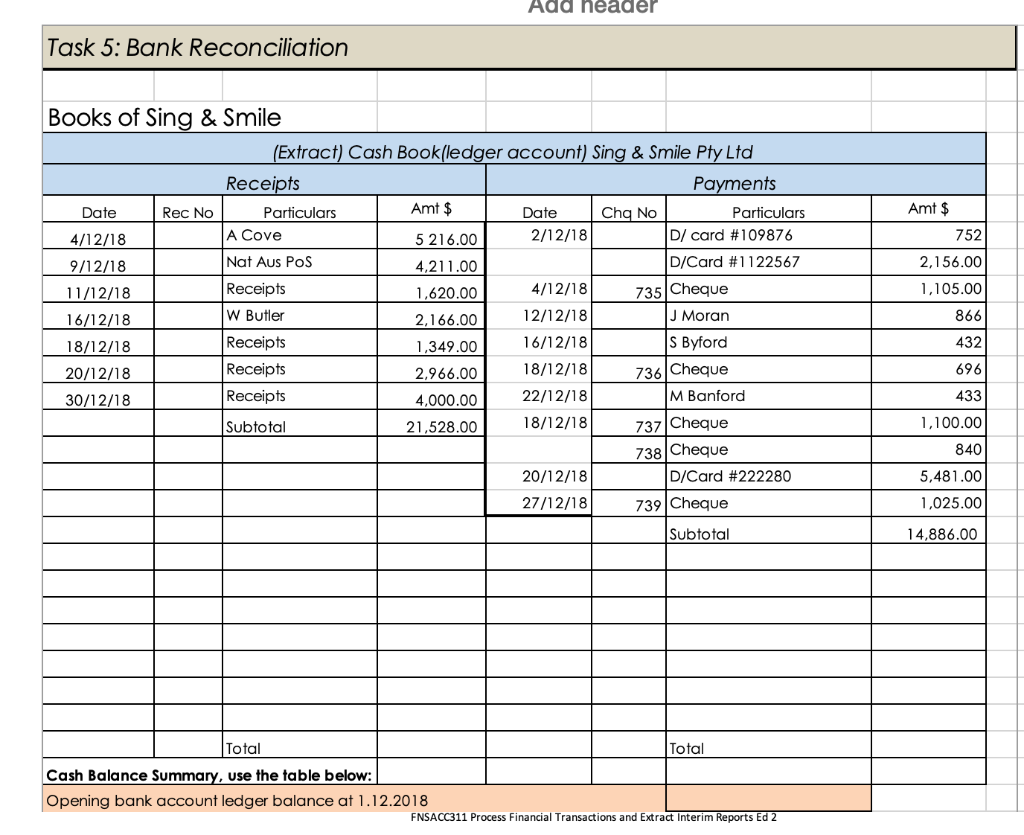

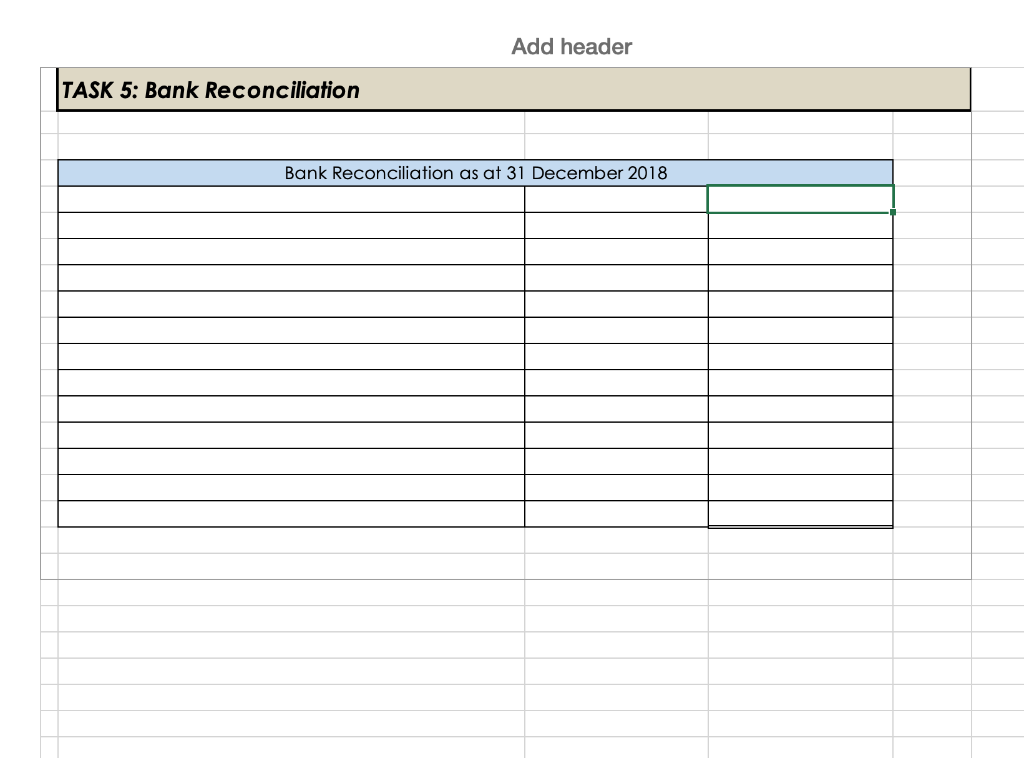

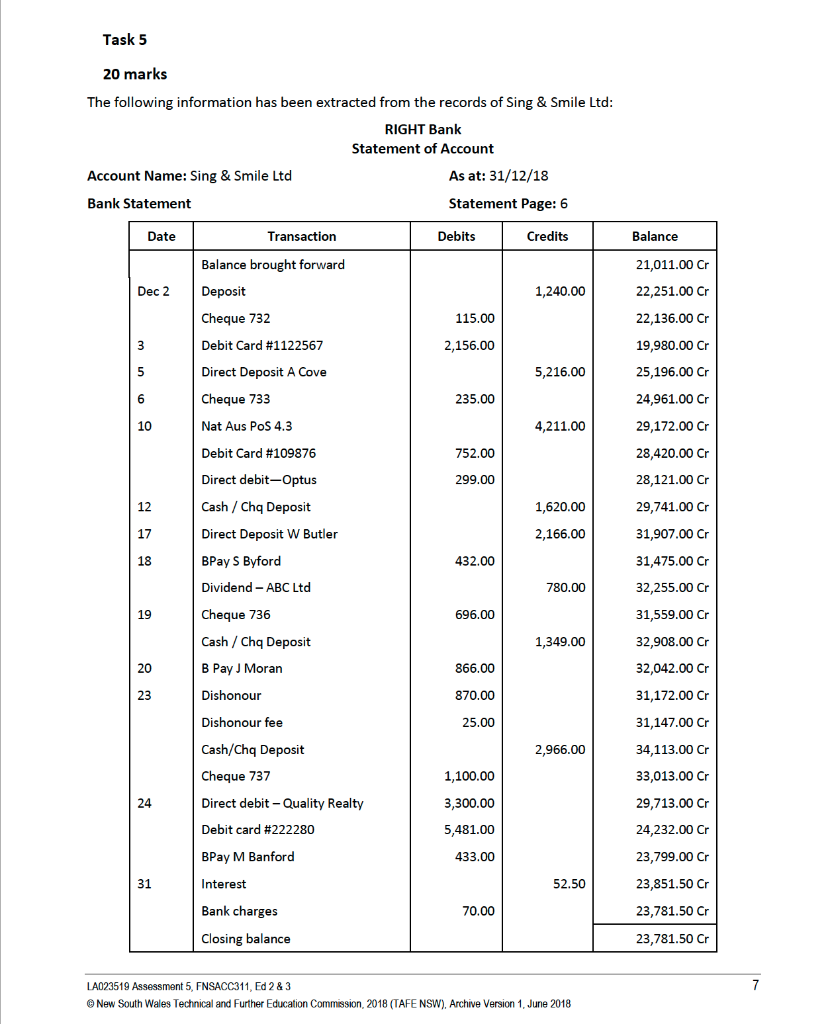

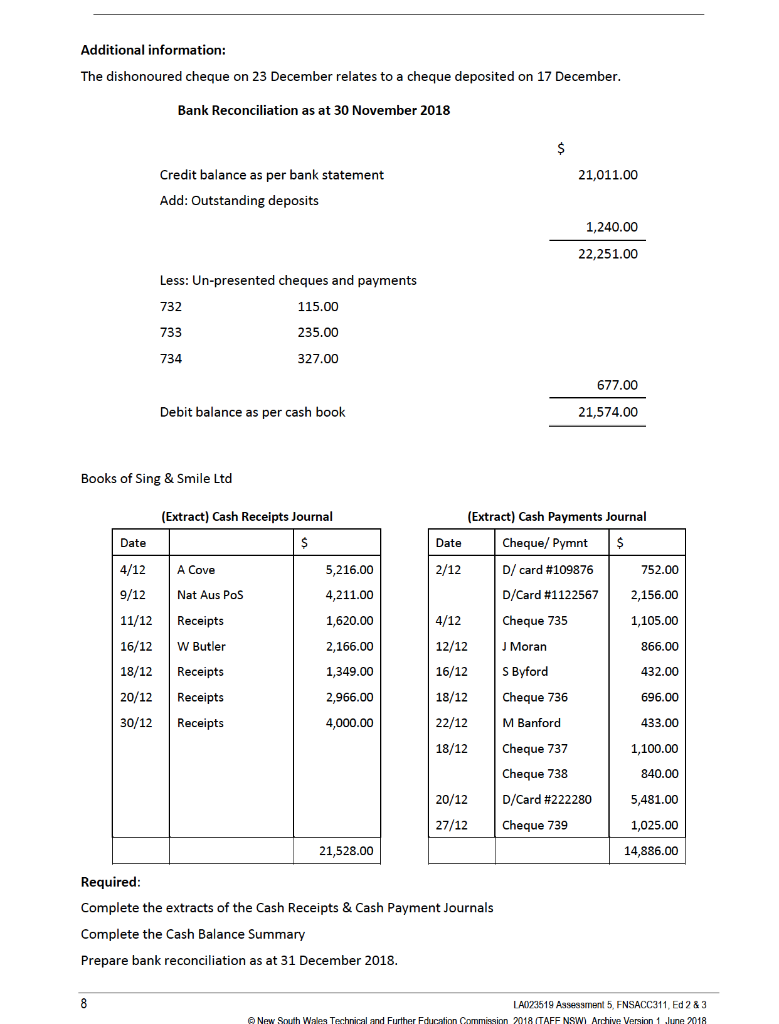

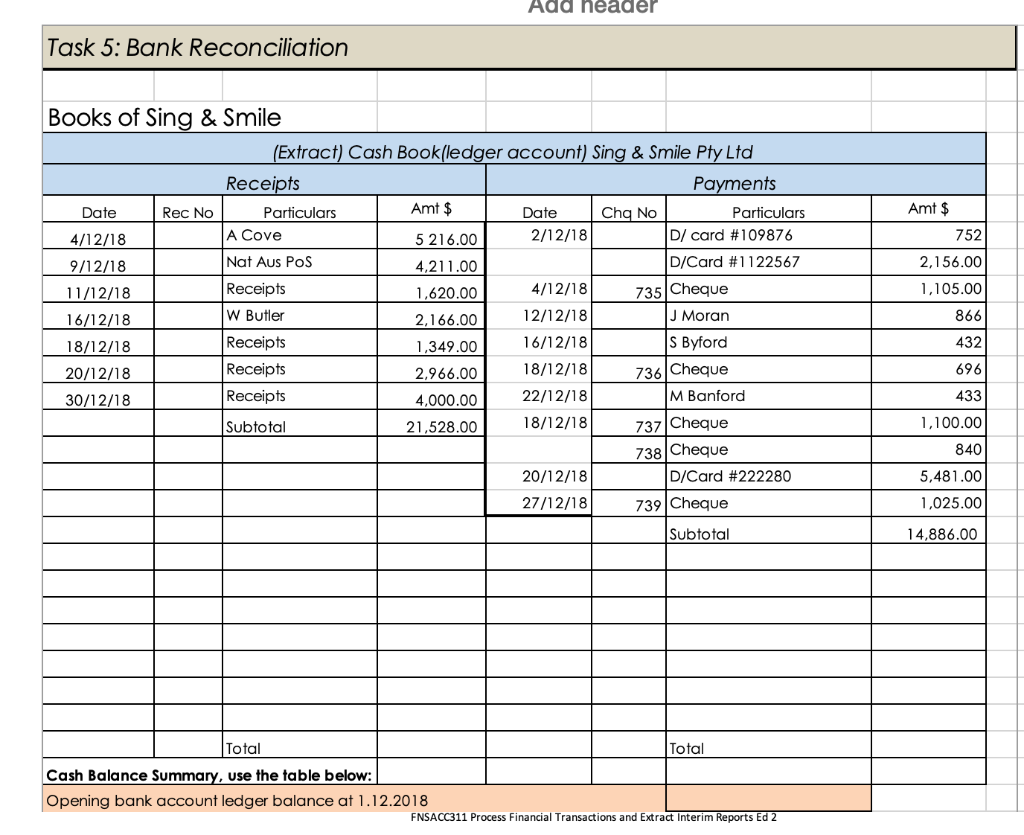

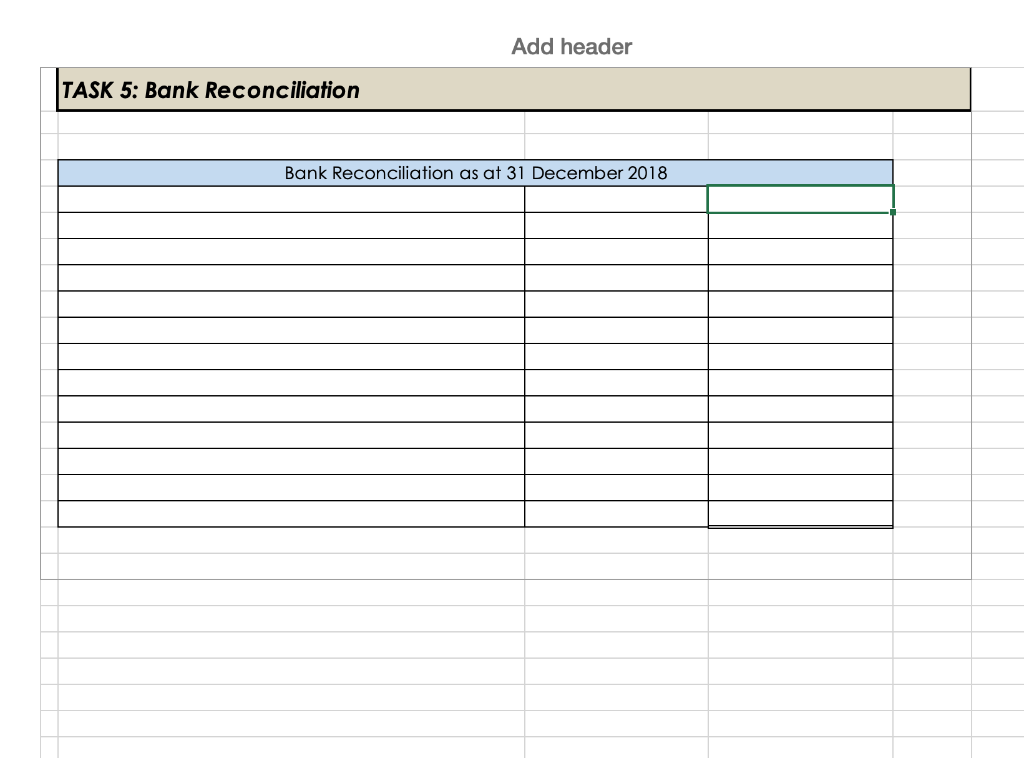

Task 5 20 marks The following information has been extracted from the records of Sing & Smile Ltd: RIGHT Bank Statement of Account As at: 31/12/18 Account Name: Sing & Smile Ltd Bank Statement Statement Page: 6 Date Transaction Debits Credits Balance Balance brought forward 21,011.00 Cr Dec 2 Deposit 1,240.00 22,251.00 Cr Cheque 732 115.00 22,136.00 Cr 3 2,156.00 19,980.00 Cr Debit Card #1122567 Direct Deposit A Cove 5 5,216.00 25,196.00 Cr 6 Cheque 733 235.00 24,961.00 Cr 10 LO Nat Aus POS 4.3 4,211.00 29,172.00 Cr Debit Card #109876 752.00 28,420.00 Cr 299.00 28,121.00 Cr 12 Direct debit-Optus Cash / Chq Deposit Direct Deposit W Butler 1,620.00 29,741.00 Cr 17 2,166.00 31,907.00 Cr 18 BPay S Byford 432.00 31,475.00 Cr Dividend - ABC Ltd 780.00 32,255.00 Cr 19 Cheque 736 696.00 31,559.00 Cr Cash / Chq Deposit 1,349.00 32,908.00 Cr 20 B Pay) Moran 866.00 32,042.00 Cr 23 Dishonour 870.00 31,172.00 Cr Dishonour fee 25.00 31,147.00 Cr Cash/Chq Deposit 2,966.00 34,113.00 Cr Cheque 737 1,100.00 33,013.00 Cr 24 3,300.00 29,713.00 Cr Direct debit - Quality Realty Debit card #222280 5,481.00 24,232.00 Cr BPay M Banford 433.00 23,799.00 Cr 31 Interest 52.50 23,851.50 Cr Bank charges 70.00 23,781.50 Cr Closing balance 23,781.50 Cr 7 LA023519 Assessment 5, FNSACC311, Ed 2 & 3 New South Wales Technical and further Education Commission 2018 (TAFE NSW), Archive Version 1. June 2018 Additional information: The dishonoured cheque on 23 December relates to a cheque deposited on 17 December. Bank Reconciliation as at 30 November 2018 $ 21,011.00 Credit balance as per bank statement Add: Outstanding deposits 1,240.00 22,251.00 Less: Un-presented cheques and payments 732 115.00 733 235.00 734 327.00 677.00 Debit balance as per cash book 21,574.00 Books of Sing & Smile Ltd (Extract) Cash Receipts Journal (Extract) Cash Payments Journal Date Cheque/ Pymnt $ Date $ 4/12 A Cove 5,216.00 2/12 D/ card #109876 752.00 9/12 Nat Aus Pos 4,211.00 D/Card #1122567 2,156.00 11/12 Receipts 1,620.00 4/12 Cheque 735 1,105.00 16/12 W Butler 2,166.00 12/12 J Moran 866.00 Receipts 1,349.00 16/12 S Byford 432.00 18/12 20/12 Receipts 2,966.00 18/12 Cheque 736 696.00 30/12 Receipts 4,000.00 22/12 M Banford 433.00 18/12 Cheque 737 1,100.00 Cheque 738 840.00 20/12 D/Card #222280 5,481.00 27/12 Cheque 739 1,025.00 21,528.00 14,886.00 Required: Complete the extracts of the Cash Receipts & Cash Payment Journals Complete the Cash Balance Summary Prepare bank reconciliation as at 31 December 2018. 8 LA023519 Assessment 5. FNSACC311. Ed 2 & 3 New South Wales Technical and Further Education Commission 2018 (TAFF NSW) Archive Version 1 June 2018 Add header Task 5: Bank Reconciliation Amt $ 752 2,156.00 1,105.00 Books of Sing & Smile (Extract) Cash Book(ledger account) Sing & Smile Pty Ltd Receipts Payments Date Rec No Particulars Amt $ Date Chq No Particulars 4/12/18 A Cove 5 216.00 2/12/18 D/ card #109876 9/12/18 Nat Aus POS 4,211.00 D/Card #1122567 11/12/18 Receipts 1,620.00 4/12/18 735 Cheque 16/12/18 W Butler 2,166.00 12/12/18 J Moran 18/12/18 Receipts 1,349.00 16/12/18 S Byford 20/12/18 Receipts 2,966.00 18/12/18 30/12/18 Receipts 4,000.00 22/12/18 M Banford Subtotal 21,528.00 18/12/18 737 Cheque 738 |Cheque 20/12/18 D/Card #222280 27/12/18 739 |Cheque 866 432 736 Cheque 696 433 1,100.00 840 5,481.00 1,025.00 Subtotal 14,886.00 Total Total Cash Balance Summary, use the table below: Opening bank account ledger balance at 1.12.2018 FNSACC311 Process Financial Transactions and Extract Interim Reports Ed 2 Add header TASK 5: Bank Reconciliation Bank Reconciliation as at 31 December 2018