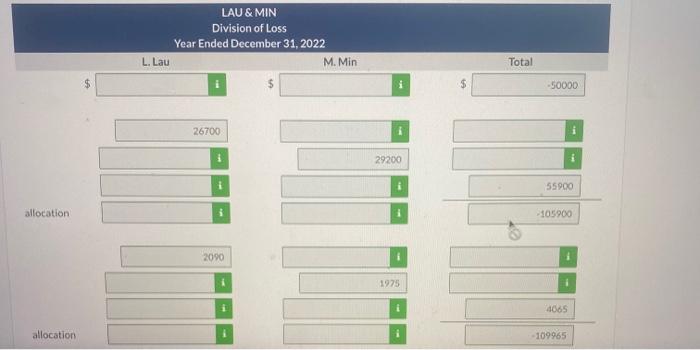

hey guys,

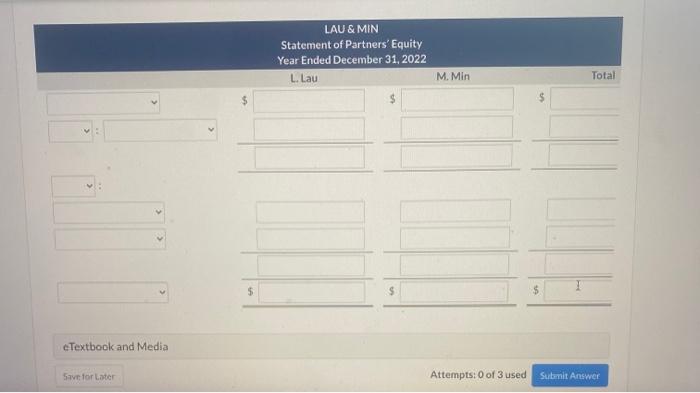

can anyone help me to fill only last photo about statement of partner equity @ year ended december 31,2022

those other photo is help only for more information.

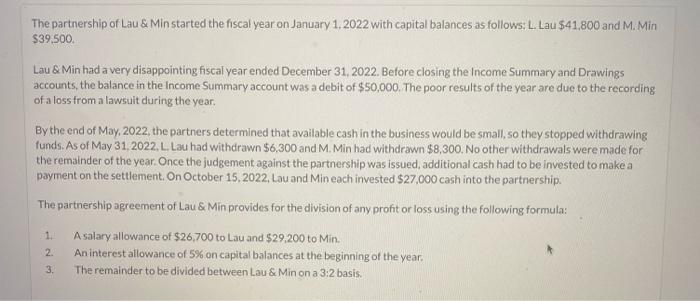

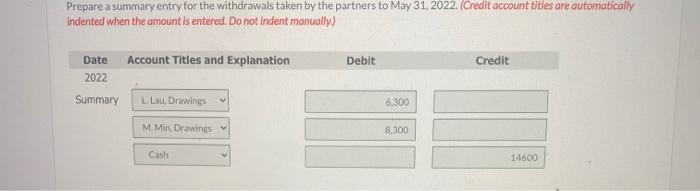

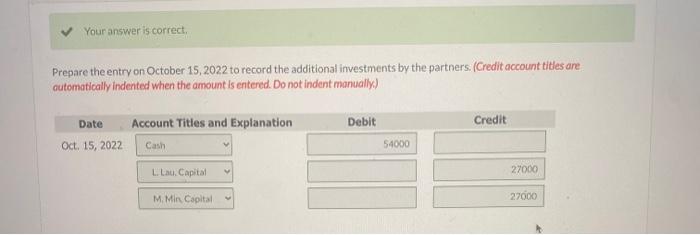

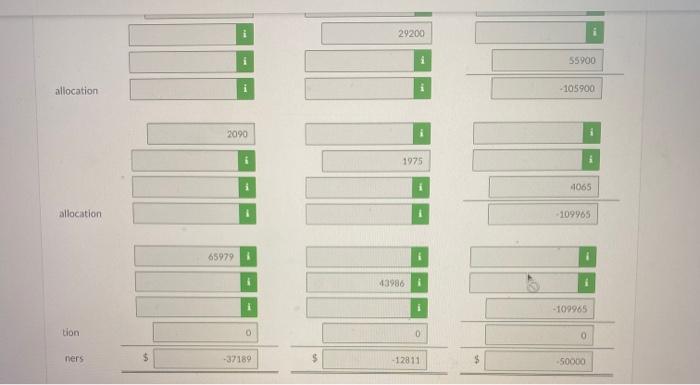

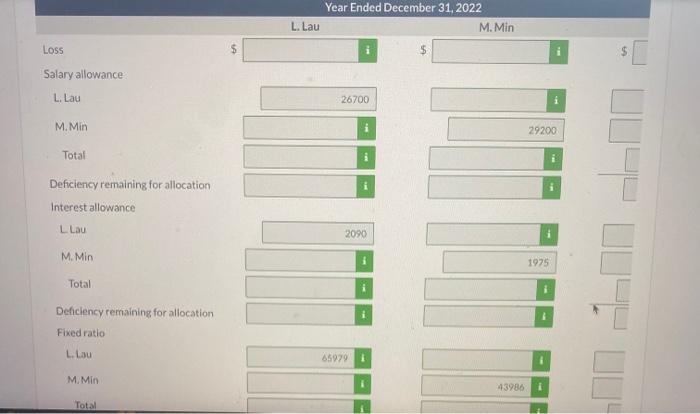

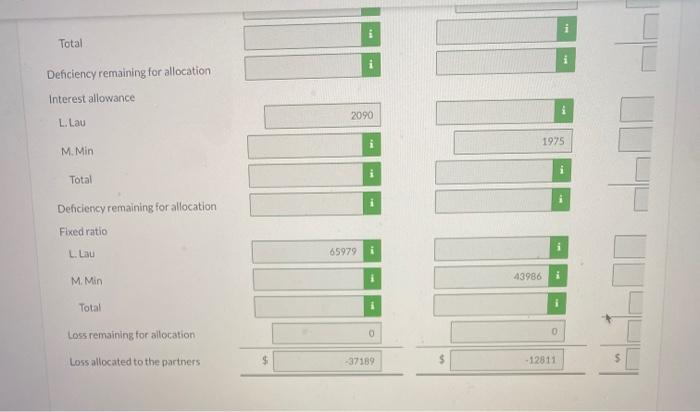

The partnership of Lau & Min started the fiscal year on January 1, 2022 with capital balances as follows: L. Lau $41,800 and M. Min $39.500. Lau & Min had a very disappointing fiscal year ended December 31, 2022. Before closing the Income Summary and Drawings accounts, the balance in the Income Summary account was a debit of $50,000. The poor results of the year are due to the recording of a loss from a lawsuit during the year. By the end of May, 2022, the partners determined that available cash in the business would be small, so they stopped withdrawing funds. As of May 31, 2022. L. Lau had withdrawn $6,300 and M Min had withdrawn $8,300. No other withdrawals were made for the remainder of the year. Once the judgement against the partnership was issued additional cash had to be invested to make a payment on the settlement on October 15, 2022, Lau and Min each invested $27.000 cash into the partnership The partnership agreement of Lau & Min provides for the division of any profit or loss using the following formula: 1 2. A salary allowance of $26,700 to Lau and $29,200 to Min. An interest allowance of 5% on capital balances at the beginning of the year. The remainder to be divided between Lau & Min on a 3:2 basis. 3. Prepare a summary entry for the withdrawals taken by the partners to May 31, 2022. (Credit account titles are automatically Indented when the amount is entered. Do not indent manually) Debit Credit Date Account Titles and Explanation 2022 Summary LLau, Drawings 6.300 M. Min, Drawings 8,300 14600 Your answer is correct, Prepare the entry on October 15, 2022 to record the additional investments by the partners. (Credit account titles are automatically indented when the amount is entered. Do not indent manually) Account Tities and Explanation Debit Credit Date Oct 15, 2022 Cash 54000 L. Lau. Capital 27000 M. Min Capital 27000 LAU & MIN Division of Loss Year Ended December 31, 2022 M. Min L. Lau Total -50000 26700 29200 1 55900 allocation 105900 2090 1975 1 4065 allocation -109965 i 29200 55900 allocation 4105900 2090 1975 4065 allocation 109965 65979 43986 1 i -109965 tion 0 0 ners $ -37189 - 12811 50000 Year Ended December 31, 2022 L. Lau M. Min LOSS $ $ Salary allowance L. Lau 26700 M. Min 29200 Total Deficiency remaining for allocation Interest allowance L Lau 2090 M. Min 1975 Total i Deficiency remaining for allocation Fixed ratio L.LU 65979 M. Min 43986 i Total Total Dehciency remaining for allocation Interest allowance 2090 L. Lau 1975 M. Min i Total Dehciency remaining for allocation Fixed ratio i L. Lau 65979 43986 M. Min Total 0 Loss remaining for allocation 0 Loss allocated to the partners $ -37189 -12811 LAU & MIN Statement of Partners' Equity Year Ended December 31, 2022 L. Lau M. Min Total eTextbook and Media save or later Attempts: 0 of 3 used Submit