Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hey guys sorry for the long question. All of them are all highly dependent on the other for the next answer so I couldn't really

Hey guys sorry for the long question. All of them are all highly dependent on the other for the next answer so I couldn't really separate them. I wanna ruin this professor's life for being so bad but anyways I'd appreciate it if anyone could help me figure this out.

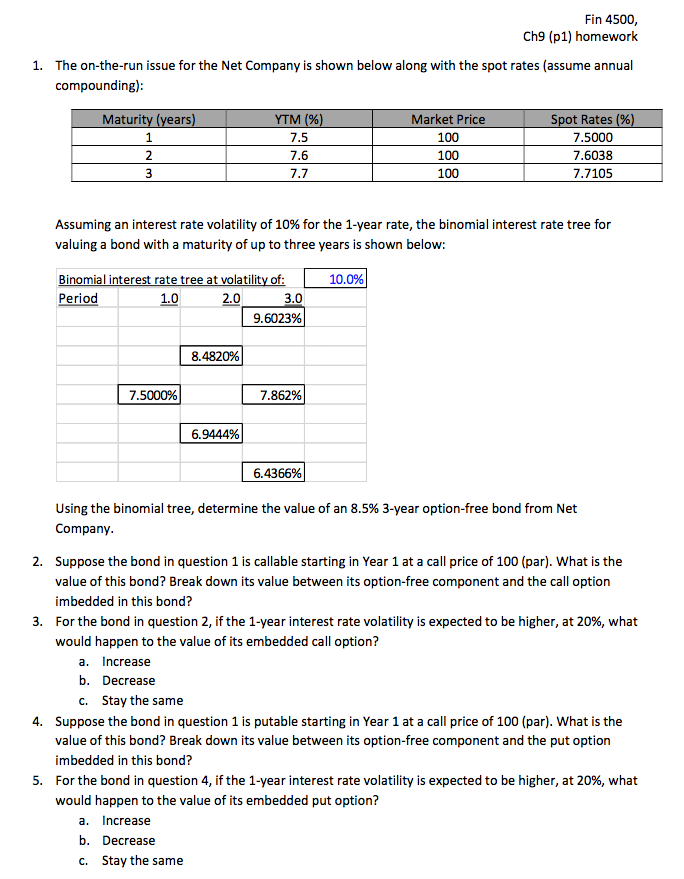

Fin 4500 Ch9 (p1) homework 1. The on-the-run issue for the Net Company is shown below along with the spot rates (assume annual compounding): Maturity (years) YTM (%) 7.5 27.6 3 7 7 . Market Price 100 100 100 Spot Rates (%) 7.5000 7.6038 7.7105 Assuming an interest rate volatility of 10% for the 1-year rate, the binomial interest rate tree for valuing a bond with a maturity of up to three years is shown below: 10.0% Binomial interest rate tree at volatility of: L Period 1.0 2.0 3.0 9.6023% 8.4820% 7.5000% 7.862% 6.9444% 6.4366% Using the binomial tree, determine the value of an 8.5% 3-year option-free bond from Net Company. 2. Suppose the bond in question 1 is callable starting in Year 1 at a call price of 100 (par). What is the value of this bond? Break down its value between its option-free component and the call option imbedded in this bond? 3. For the bond in question 2, if the 1-year interest rate volatility is expected to be higher, at 20%, what would happen to the value of its embedded call option? a. Increase b. Decrease C. Stay the same 4. Suppose the bond in question 1 is putable starting in Year 1 at a call price of 100 (par). What is the value of this bond? Break down its value between its option-free component and the put option imbedded in this bond? 5. For the bond in question 4, if the 1-year interest rate volatility is expected to be higher, at 20%, what would happen to the value of its embedded put option? a. Increase b. Decrease C. Stay the same Fin 4500 Ch9 (p1) homework 1. The on-the-run issue for the Net Company is shown below along with the spot rates (assume annual compounding): Maturity (years) YTM (%) 7.5 27.6 3 7 7 . Market Price 100 100 100 Spot Rates (%) 7.5000 7.6038 7.7105 Assuming an interest rate volatility of 10% for the 1-year rate, the binomial interest rate tree for valuing a bond with a maturity of up to three years is shown below: 10.0% Binomial interest rate tree at volatility of: L Period 1.0 2.0 3.0 9.6023% 8.4820% 7.5000% 7.862% 6.9444% 6.4366% Using the binomial tree, determine the value of an 8.5% 3-year option-free bond from Net Company. 2. Suppose the bond in question 1 is callable starting in Year 1 at a call price of 100 (par). What is the value of this bond? Break down its value between its option-free component and the call option imbedded in this bond? 3. For the bond in question 2, if the 1-year interest rate volatility is expected to be higher, at 20%, what would happen to the value of its embedded call option? a. Increase b. Decrease C. Stay the same 4. Suppose the bond in question 1 is putable starting in Year 1 at a call price of 100 (par). What is the value of this bond? Break down its value between its option-free component and the put option imbedded in this bond? 5. For the bond in question 4, if the 1-year interest rate volatility is expected to be higher, at 20%, what would happen to the value of its embedded put option? a. Increase b. Decrease C. Stay the sameStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started