Answered step by step

Verified Expert Solution

Question

1 Approved Answer

hey i need help with this question, if you can provide how you get the answer please share need help understanding. pretty sure the answers

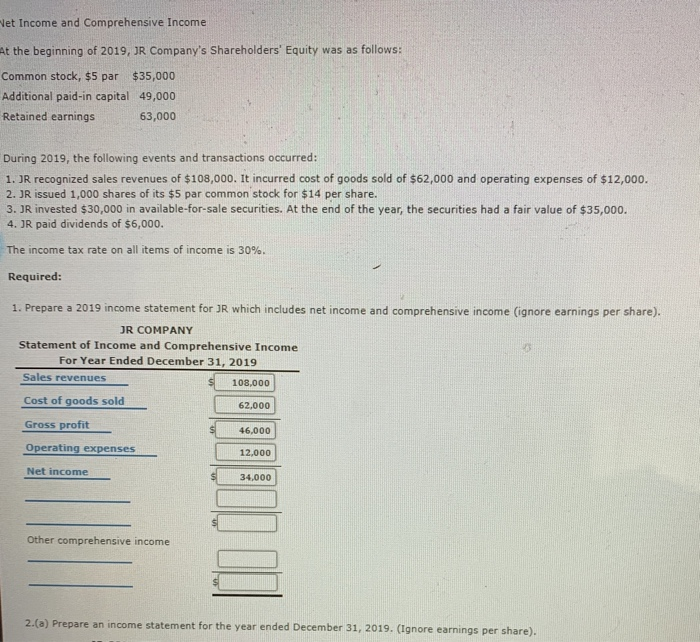

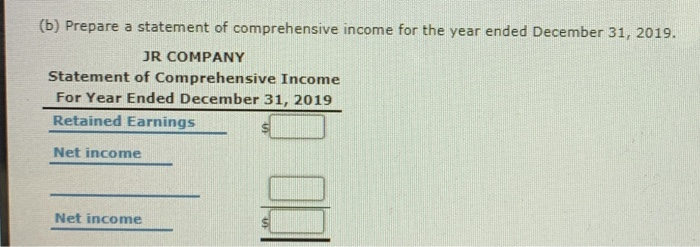

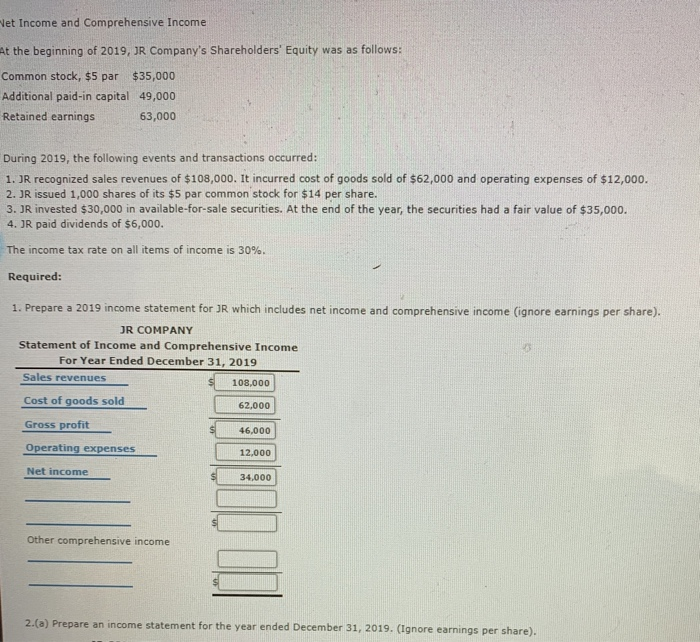

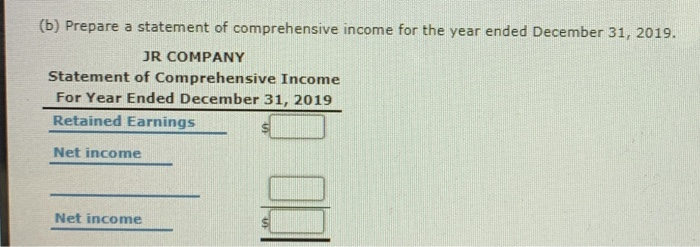

hey i need help with this question, if you can provide how you get the answer please share need help understanding. pretty sure the answers i have now are wrong Net Income and Comprehensive Income At the beginning of 2019, JR Company's Shareholders' Equity was as follows: Common stock, $5 par $35,000 Additional paid-in capital 49,000 Retained earnings 63,000 During 2019, the following events and transactions occurred: 1. JR recognized sales revenues of $108,000. It incurred cost of goods sold of $62,000 and operating expenses of $12,000. 2. JR issued 1,000 shares of its $5 par common stock for $14 per share. 3. JR invested $30,000 in available-for-sale securities. At the end of the year, the securities had a fair value of $35,000. 4. JR paid dividends of $6,000. The income tax rate on all items of income is 30%. Required: 1. Prepare a 2019 income statement for JR which includes net income and comprehensive income (ignore earnings per share), JR COMPANY Statement of Income and Comprehensive Income For Year Ended December 31, 2019 Sales revenues 108,000 Cost of goods sold 62.000 Gross profit 46.000 Operating expenses 12,000 Net income 34,000 Other comprehensive income 2.(a) Prepare an income statement for the year ended December 31, 2019. (Ignore earnings per share). (b) Prepare a statement of comprehensive income for the year ended December 31, 2019. JR COMPANY Statement of Comprehensive Income For Year Ended December 31, 2019 Retained Earnings Net income Net income

hey i need help with this question, if you can provide how you get the answer please share need help understanding. pretty sure the answers i have now are wrong Net Income and Comprehensive Income At the beginning of 2019, JR Company's Shareholders' Equity was as follows: Common stock, $5 par $35,000 Additional paid-in capital 49,000 Retained earnings 63,000 During 2019, the following events and transactions occurred: 1. JR recognized sales revenues of $108,000. It incurred cost of goods sold of $62,000 and operating expenses of $12,000. 2. JR issued 1,000 shares of its $5 par common stock for $14 per share. 3. JR invested $30,000 in available-for-sale securities. At the end of the year, the securities had a fair value of $35,000. 4. JR paid dividends of $6,000. The income tax rate on all items of income is 30%. Required: 1. Prepare a 2019 income statement for JR which includes net income and comprehensive income (ignore earnings per share), JR COMPANY Statement of Income and Comprehensive Income For Year Ended December 31, 2019 Sales revenues 108,000 Cost of goods sold 62.000 Gross profit 46.000 Operating expenses 12,000 Net income 34,000 Other comprehensive income 2.(a) Prepare an income statement for the year ended December 31, 2019. (Ignore earnings per share). (b) Prepare a statement of comprehensive income for the year ended December 31, 2019. JR COMPANY Statement of Comprehensive Income For Year Ended December 31, 2019 Retained Earnings Net income Net income

hey i need help with this question, if you can provide how you get the answer please share need help understanding. pretty sure the answers i have now are wrong

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started