Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hey, I would like to see whether my solution is correct. Thanks Several months ago, Buddy Inc. issued a unique fixed income security. As of

Hey, I would like to see whether my solution is correct.

Thanks

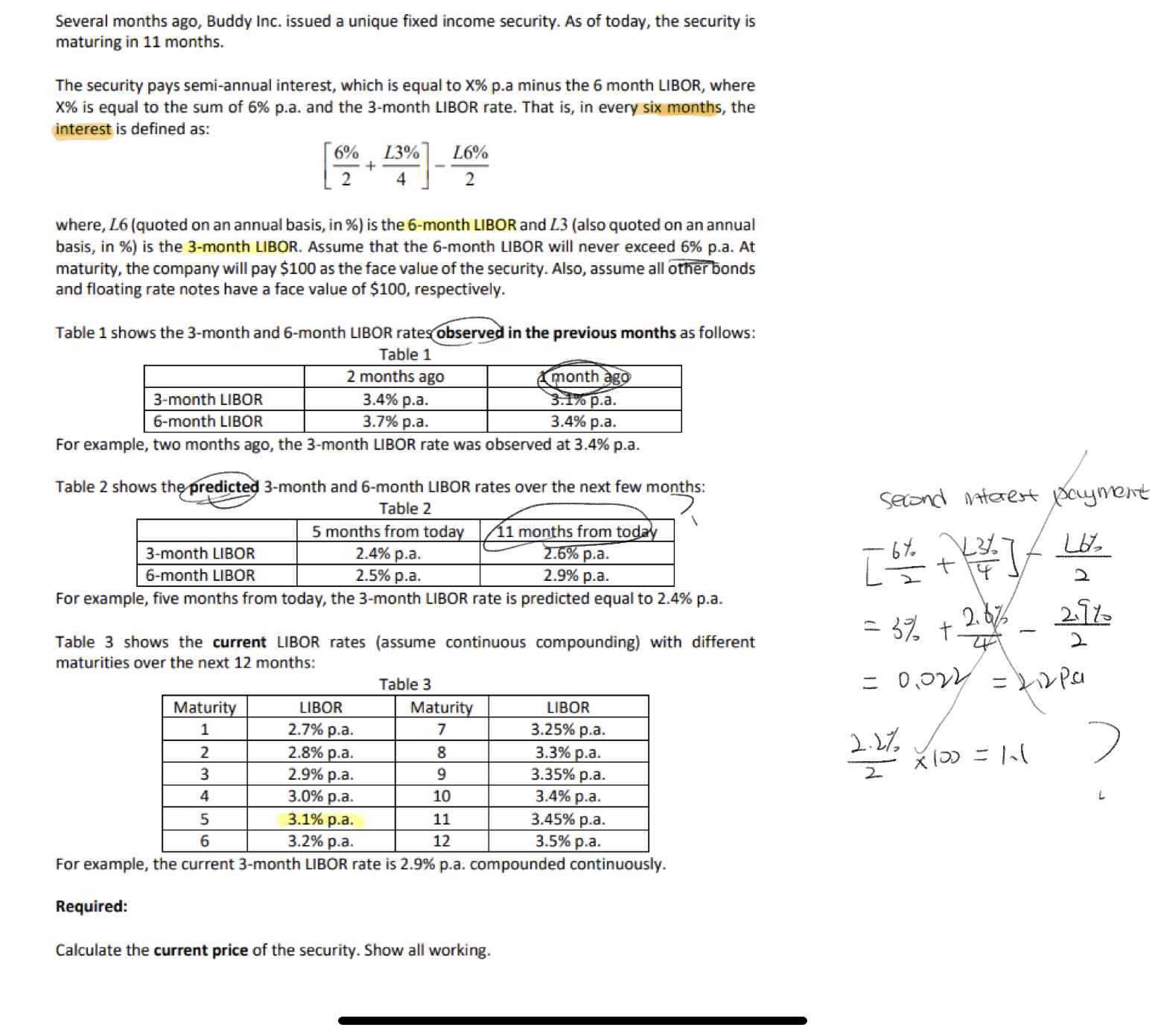

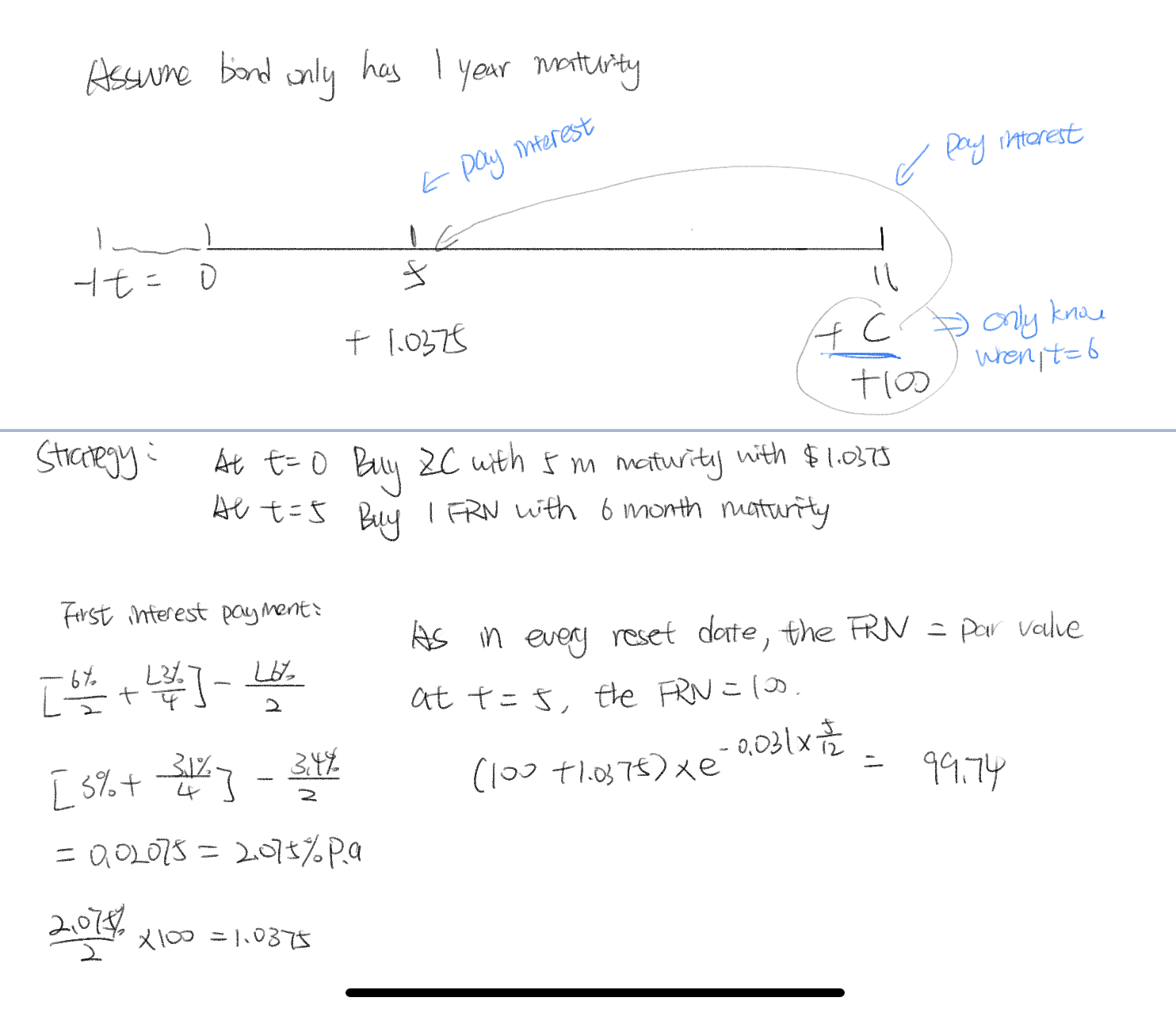

Several months ago, Buddy Inc. issued a unique fixed income security. As of today, the security is maturing in 11 months. The security pays semi-annual interest, which is equal to X\% p.a minus the 6 month LIBOR, where X% is equal to the sum of 6% p.a. and the 3-month LIBOR rate. That is, in every six months, the interest is defined as: [26%+4L3%]2L6% where, L6 (quoted on an annual basis, in \%) is the 6-month LIBOR and L3 (also quoted on an annual basis, in \%) is the 3-month LIBOR. Assume that the 6-month LIBOR will never exceed 6\% p.a. At maturity, the company will pay $100 as the face value of the security. Also, assume all other bonds and floating rate notes have a face value of $100, respectively. Table 1 shows the 3-month and 6-month LIBOR rates observed in the previous months as follows: Tahlo 1 For example, two months ago, the 3-month LIBOR rate was observed at 3.4% p.a. Table 2 shows the predicted 3-month and 6-month LIBOR rates over the next few months: For example, five months from today, the 3 -month LIBOR rate is predicted equal to 2.4% p.a. Table 3 shows the current LIBOR rates (assume continuous compounding) with different maturities over the next 12 months: For example, the current 3-month LIBOR rate is 2.9% p.a. compounded continuously. Required: Calculate the current price of the security. Show all working. Assume bond only has I year matturity Strategy: At t=0 Buy ZC with 5m maturity with $1.0375 At t=5 Buy I FRN with 6 month maturity First interest payment: Ferstinterestpayment:[26%+4L3%]2L6%[5%+43.1%]23.4%=0.02075=2.075%22.075%100=1.0375Asineveryresetdote,theFRV=paratt=5,theFRN=100.(100+1.0375)e0.031125=99.74P.9Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started