Answered step by step

Verified Expert Solution

Question

1 Approved Answer

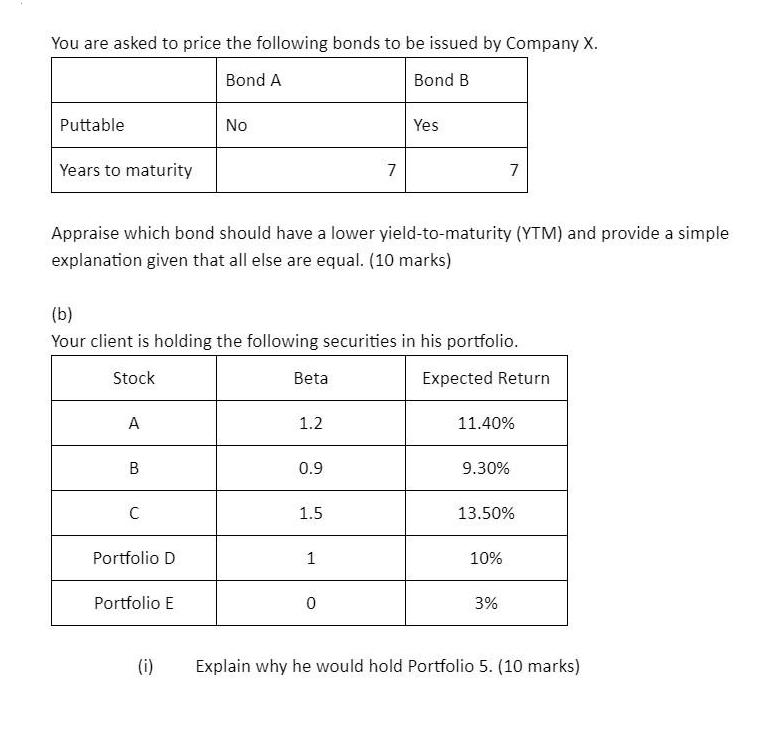

You are asked to price the following bonds to be issued by Company X. Bond A Bond B Puttable Years to maturity A B

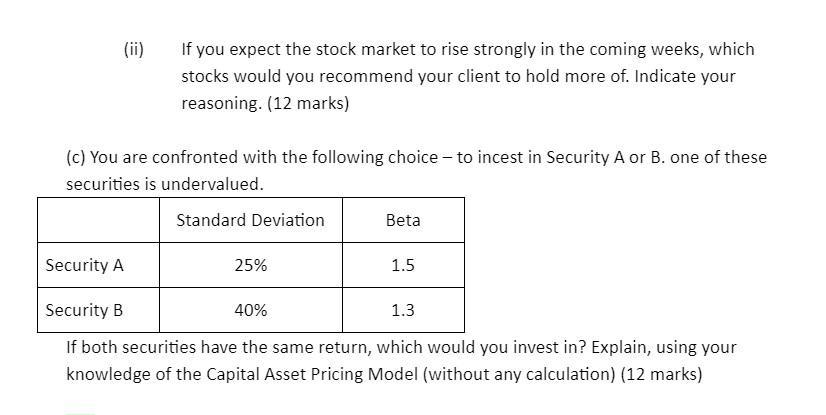

You are asked to price the following bonds to be issued by Company X. Bond A Bond B Puttable Years to maturity A B Appraise which bond should have a lower yield-to-maturity (YTM) and provide a simple explanation given that all else are equal. (10 marks) C (b) Your client is holding the following securities in his portfolio. Stock Expected Return Portfolio D No Portfolio E (i) Beta 1.2 0.9 1.5 7 1 Yes 0 7 11.40% 9.30% 13.50% 10% 3% Explain why he would hold Portfolio 5. (10 marks) (ii) If you expect the stock market to rise strongly in the coming weeks, which stocks would you recommend your client to hold more of. Indicate your reasoning. (12 marks) (c) You are confronted with the following choice - to incest in Security A or B. one of these securities is undervalued. Standard Deviation Beta 25% Security A Security B 40% 1.3 If both securities have the same return, which would you invest in? Explain, using your knowledge of the Capital Asset Pricing Model (without any calculation) (12 marks) 1.5

Step by Step Solution

★★★★★

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Answer a Bond A should have a lower yieldtomaturity YTM A puttabl...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started