Heyyyy I need responses for all of it especially the 1-37 journal entries. I will def like if done corrcetly thank youuuu

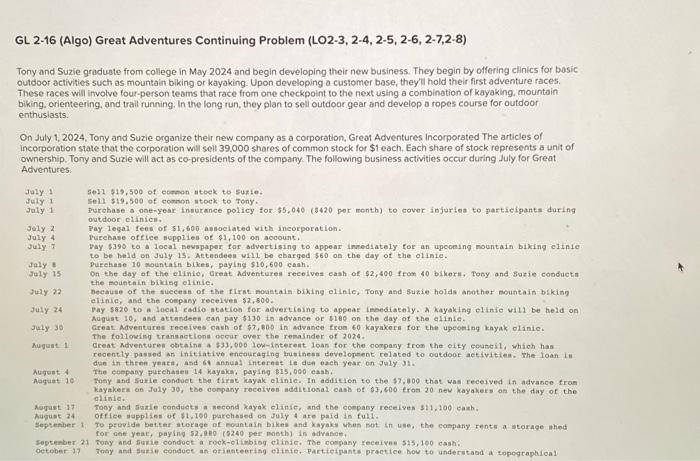

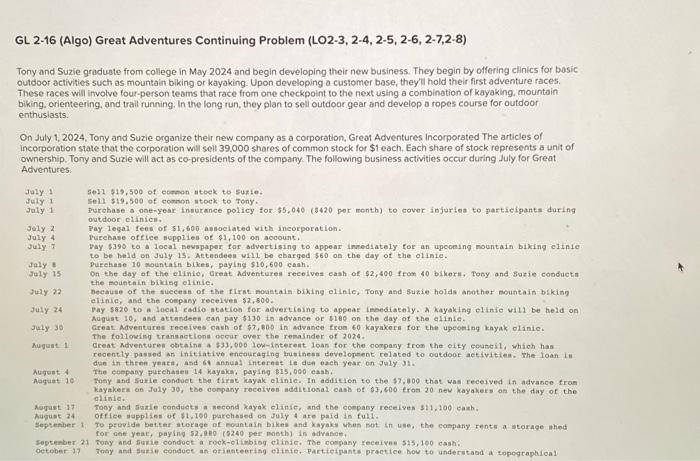

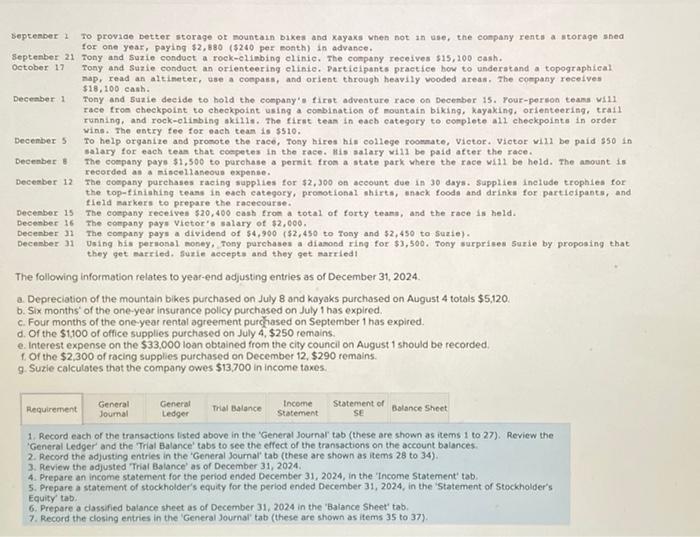

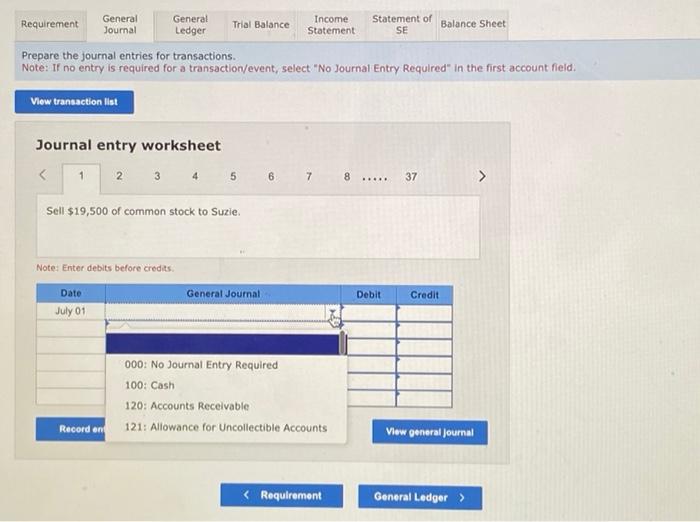

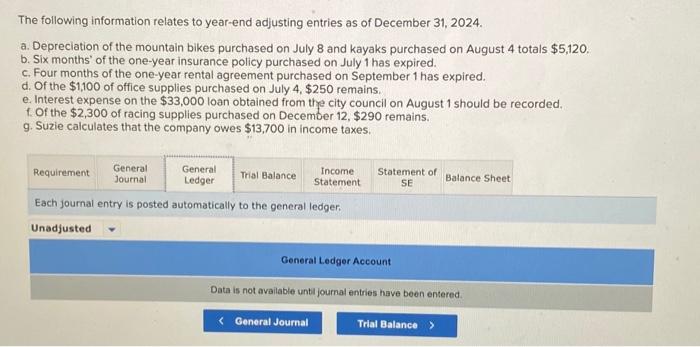

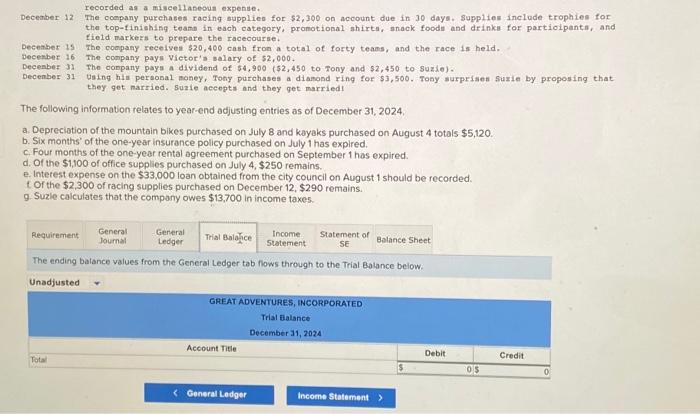

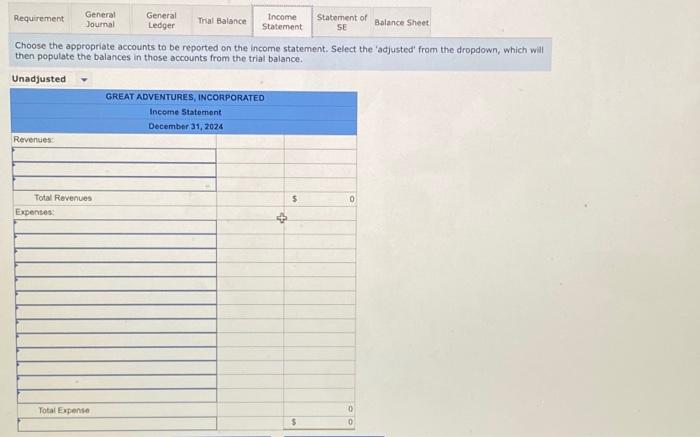

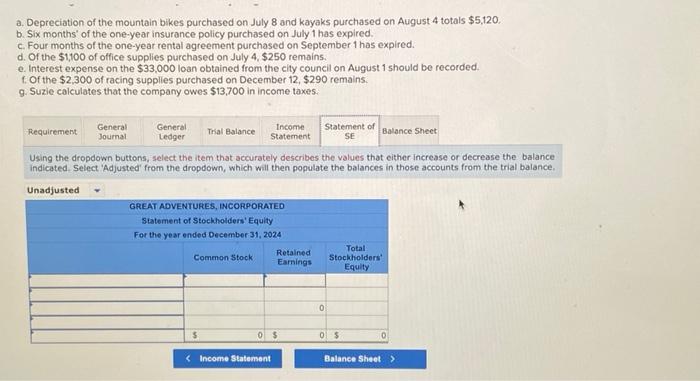

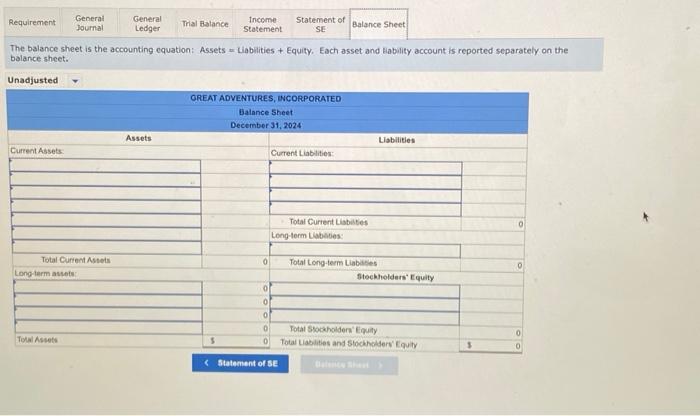

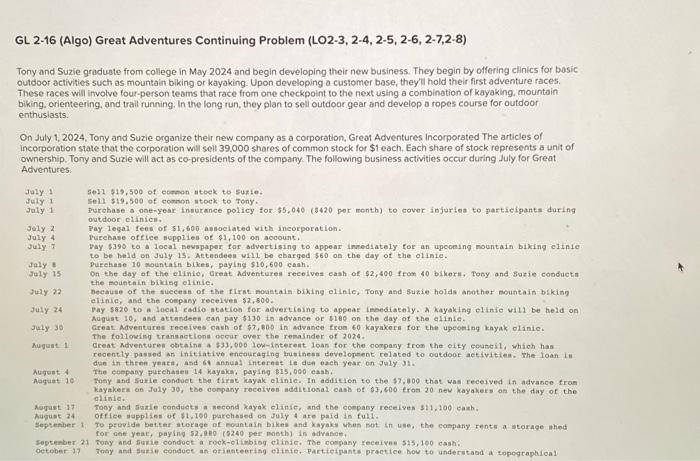

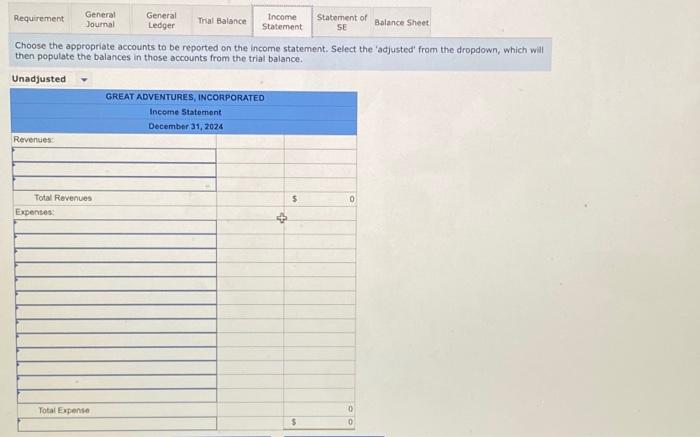

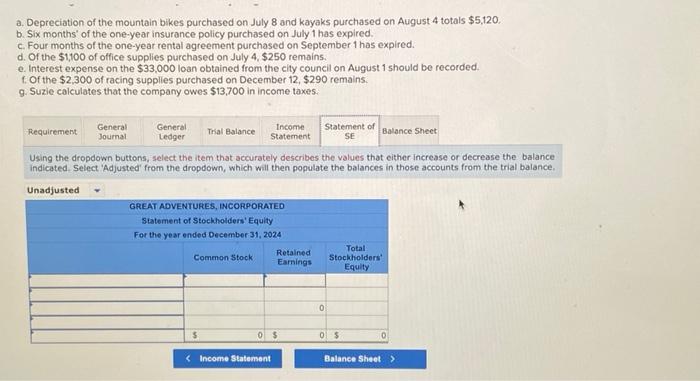

GL 2-16 (Algo) Great Adventures Continuing Problem (LO2-3, 2-4, 2-5, 2-6, 2-7,2-8) Tony and Suzie graduate from college in May 2024 and begin developing their new business. They begin by offering clinics for bosic outdoor activities such as mountain biking or kayaking. Upon developing a customer base, theyli hold their first adventure races. These races will involve fout-person teams that race from one checkpoint to the next using a combination of kayaking. mountain biking, orienteering, and trail running. In the long run, they plan to sell outdoor gear and develop a ropes course for outdoor enthusiasts. On July 1, 2024. Tony and Suzie organize their new company as a corporation, Great Adventures incorporated The articles of incorporation state that the corporation will sell 39,000 shares of common stock for $1 each. Each share of stock represents a unit of ownership. Tony and Suzle will act as co-presidents of the company. The following business activities occur during July for Great Adventures: beptender 1 To provade Detter storage or mountain buxea and xayaxs when not an ase, the conpany renta a storage shed for one year, paying $2,880 (\$240 per month) in advance. Septenber 21 Tony and Suzie conduct a roek-elinbing olinic. The company receives s15, 100 eash. october 17 Tony and sazie condoct an orlenteering elinio. Participants practice bow to underatand a topographical map, read an altineter, use a coepass, and orient through heavily vooded areas, the coepany receives 518,100 eash. Deceaber 1 Tony and 5uzie decide to bold the company's firat adventare race on Decenber 15 . rour-person teama Wil1 race froa checkpoint to ebeckpoint using a combination of mouatain biking, kayaking, orienteerisg. trail running, and rock-olimbing akilit. The first tean in eacb eategory to conplete al1 checkpoints in order vins. The eatry tee tor each tean is 5510 . December 5. To help organire and promote the race, tony hires hin college rookmate, Victor. victor will be paid s50 in Decenber 8 The company paya $1,500 to parehase a permit fron a state park where the race wild be held. The anount is Deceaber 12 recorded an a mincellaneovs expense. conany purehases racing supplies for $2,300 on account due in 30 days. Suppliea inelude trophies for the top-tinishing teans in each category, promotional shirts, insek fooda and drinki for partieipants, and tield markers to prepare the racecourse. Decesber is The coepany receives 520,400 cash from a total of forty teama, and the race is held. December 16 the company pays vietor's salary of 52,600 . Decenber 31 The company pays a dividend of 54,900($2,450 to 7ony and $2,450 to suzie }. Decenber 31 Using bis personsl noney, Tony purehasen a diasond ring for $3, 500 , Tony surprises 5 urie by proposing that they get barried. Suzie accepta and they get marriedi The following information relates to year-end adjusting entries as of December 31,2024. a. Depreciation of the mountain bikes purchased on July 8 and kayaks purchased on August 4 totals $5,120. b. Six months' of the one-year insurance policy purchased on July 1 has expired. c. Four months of the one-year rental agreement purchased on September 1 has expired. d. Of the $1,100 of office supplies purchased on July 4,$250 remains: e. Interest expense on the $33.000 loan obtained from the city council on August 1 should be recorded. f, Of the $2,300 of racing supplies purchased on December 12,$290 remains. 9. Suzle calculates that the company owes $13,700 in income taxes. 1. Record each of the transactions listed above in the 'General Journal tab (these are shown as items 1 to 27 ). Review the 'General Ledger' and the Trial Balance' tabs to see the effect of the transactions on the account balances. 2. Record the adjusting entries in the 'General Journal' tab (these are shown as items 28 to 34). 3. Review the adjusted 'Trial Balance' as of December 31, 2024. 4. Prepare an income statement for the period ended December 31, 2024, in the 'Income Statement' tab. 5. Prepare a statement of stockholder's equity for the period ended December 31, 2024, in the 'Statement of 5tockholder's Equity tab. 6. Prepare a ciassified balance sheet as of December 31, 2024 in the 'Balance Sheet' tab. 7. Record the closing entries in the 'General Journal' tab (these are shown as items 35 to 37). repare the journal entries for transactions. lote: If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field. Journal entry worksheet Notes Enter debits before credits. The following information relates to year-end adjusting entries as of December 31, 2024. a. Depreciation of the mountain bikes purchased on July 8 and kayaks purchased on August 4 totals $5,120. b. Six months' of the one-year insurance policy purchased on July 1 has expired. c. Four months of the one-year rental agreement purchased on September 1 has expired. d. Of the $1,100 of office supplies purchased on July 4,$250 remains. e. Interest expense on the $33,000 loan obtained from the city council on August 1 should be recorded. f. Of the $2,300 of racing supplies purchased on December 12,$290 remains. 9. Suzie calculates that the company owes $13,700 in income taxes. Each journal entry is posted automatically to the general ledger. General Ledger Account Data is not available until journal entrios have been entered recorded as a miscellabeoun expense. Deceaber 12 The company purchases raeing supplien for $2,300 on account due in 30 days. Suppliem include trophies for tha top-finiohing teams in each eategory, promotional shirta, snack foodi and drinke for partioipant,l, and field markers to prepare the racecourse. Decenber is the coopany recelvel 320,400 cash fron a total of forty teans, and the race is held. Decesber 16 . The conpany pays Vietor's salary of 52,000 . Decenber 31 The conpany pays a dividend of 54,900($2,450 to Tony and $2,450 to 50z10). Decenber 31 oing hil personal money. Tony purchases a diamond ring for $3,500. Foay aurprisen surie by proposing that they get narried. Suzie accepts and they get marriedl The following information relates to year-end adjusting entries as of December 31, 2024, a. Depreciation of the mountain bikes purchased on July 8 and kayaks purchased on August 4 totals $5,120. b. Six month's' of the one-year insurance policy purchascd on July 1 has expired. c. Four months of the one-year rental agreement purchased on September 1 has expired. d. Of the $1,100 of office supplies purchased on July 4,$250 remains. e. Interest expense on the $33,000 loan obtained from the city council on August 1 should be recorded. f. Of the $2,300 of racing supplies purchased on December 12,$290 remains. 9. Suzle calculates that the company owes $13,700 in income taxes. The ending balance values from the General Ledger tab fows through to the Trial Balance below: Choose the appropriate accounts to be reported on the income statement. Select the 'adjusted' from the dropdown, which will then populate the balances in those accounts from the trial balance. a. Depreciation of the mountain bikes purchased on July 8 and kayaks purchased on August 4 totals $5,120. b. Six months' of the one-year insurance policy purchased on July 1 has expired. c. Four months of the one-year rental agreement purchased on September 1 has expired. d. Of the $1,00 of office supplies purchased on July 4,$250 remains. e. Interest expense on the $33,000 loan obtained from the city council on August 1 should be recorded. f. Of the $2,300 of racing supplies purchased on December 12,$290 remains. 9. Suzie calculates that the company owes $13,700 in income taxes. Using the dropdown buttons, select the item that accurately describes the values that either increase or decrease the balance indicated. Select 'Adjusted' from the dropdown, which will then populate the balances in those accounts from the trial balance. The balance sheet is the accounting equation: Assets a Liabilities + Equity. Each asset and lability account is reported separately on the balance sheet. GL 2-16 (Algo) Great Adventures Continuing Problem (LO2-3, 2-4, 2-5, 2-6, 2-7,2-8) Tony and Suzie graduate from college in May 2024 and begin developing their new business. They begin by offering clinics for bosic outdoor activities such as mountain biking or kayaking. Upon developing a customer base, theyli hold their first adventure races. These races will involve fout-person teams that race from one checkpoint to the next using a combination of kayaking. mountain biking, orienteering, and trail running. In the long run, they plan to sell outdoor gear and develop a ropes course for outdoor enthusiasts. On July 1, 2024. Tony and Suzie organize their new company as a corporation, Great Adventures incorporated The articles of incorporation state that the corporation will sell 39,000 shares of common stock for $1 each. Each share of stock represents a unit of ownership. Tony and Suzle will act as co-presidents of the company. The following business activities occur during July for Great Adventures: beptender 1 To provade Detter storage or mountain buxea and xayaxs when not an ase, the conpany renta a storage shed for one year, paying $2,880 (\$240 per month) in advance. Septenber 21 Tony and Suzie conduct a roek-elinbing olinic. The company receives s15, 100 eash. october 17 Tony and sazie condoct an orlenteering elinio. Participants practice bow to underatand a topographical map, read an altineter, use a coepass, and orient through heavily vooded areas, the coepany receives 518,100 eash. Deceaber 1 Tony and 5uzie decide to bold the company's firat adventare race on Decenber 15 . rour-person teama Wil1 race froa checkpoint to ebeckpoint using a combination of mouatain biking, kayaking, orienteerisg. trail running, and rock-olimbing akilit. The first tean in eacb eategory to conplete al1 checkpoints in order vins. The eatry tee tor each tean is 5510 . December 5. To help organire and promote the race, tony hires hin college rookmate, Victor. victor will be paid s50 in Decenber 8 The company paya $1,500 to parehase a permit fron a state park where the race wild be held. The anount is Deceaber 12 recorded an a mincellaneovs expense. conany purehases racing supplies for $2,300 on account due in 30 days. Suppliea inelude trophies for the top-tinishing teans in each category, promotional shirts, insek fooda and drinki for partieipants, and tield markers to prepare the racecourse. Decesber is The coepany receives 520,400 cash from a total of forty teama, and the race is held. December 16 the company pays vietor's salary of 52,600 . Decenber 31 The company pays a dividend of 54,900($2,450 to 7ony and $2,450 to suzie }. Decenber 31 Using bis personsl noney, Tony purehasen a diasond ring for $3, 500 , Tony surprises 5 urie by proposing that they get barried. Suzie accepta and they get marriedi The following information relates to year-end adjusting entries as of December 31,2024. a. Depreciation of the mountain bikes purchased on July 8 and kayaks purchased on August 4 totals $5,120. b. Six months' of the one-year insurance policy purchased on July 1 has expired. c. Four months of the one-year rental agreement purchased on September 1 has expired. d. Of the $1,100 of office supplies purchased on July 4,$250 remains: e. Interest expense on the $33.000 loan obtained from the city council on August 1 should be recorded. f, Of the $2,300 of racing supplies purchased on December 12,$290 remains. 9. Suzle calculates that the company owes $13,700 in income taxes. 1. Record each of the transactions listed above in the 'General Journal tab (these are shown as items 1 to 27 ). Review the 'General Ledger' and the Trial Balance' tabs to see the effect of the transactions on the account balances. 2. Record the adjusting entries in the 'General Journal' tab (these are shown as items 28 to 34). 3. Review the adjusted 'Trial Balance' as of December 31, 2024. 4. Prepare an income statement for the period ended December 31, 2024, in the 'Income Statement' tab. 5. Prepare a statement of stockholder's equity for the period ended December 31, 2024, in the 'Statement of 5tockholder's Equity tab. 6. Prepare a ciassified balance sheet as of December 31, 2024 in the 'Balance Sheet' tab. 7. Record the closing entries in the 'General Journal' tab (these are shown as items 35 to 37). repare the journal entries for transactions. lote: If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field. Journal entry worksheet Notes Enter debits before credits. The following information relates to year-end adjusting entries as of December 31, 2024. a. Depreciation of the mountain bikes purchased on July 8 and kayaks purchased on August 4 totals $5,120. b. Six months' of the one-year insurance policy purchased on July 1 has expired. c. Four months of the one-year rental agreement purchased on September 1 has expired. d. Of the $1,100 of office supplies purchased on July 4,$250 remains. e. Interest expense on the $33,000 loan obtained from the city council on August 1 should be recorded. f. Of the $2,300 of racing supplies purchased on December 12,$290 remains. 9. Suzie calculates that the company owes $13,700 in income taxes. Each journal entry is posted automatically to the general ledger. General Ledger Account Data is not available until journal entrios have been entered recorded as a miscellabeoun expense. Deceaber 12 The company purchases raeing supplien for $2,300 on account due in 30 days. Suppliem include trophies for tha top-finiohing teams in each eategory, promotional shirta, snack foodi and drinke for partioipant,l, and field markers to prepare the racecourse. Decenber is the coopany recelvel 320,400 cash fron a total of forty teans, and the race is held. Decesber 16 . The conpany pays Vietor's salary of 52,000 . Decenber 31 The conpany pays a dividend of 54,900($2,450 to Tony and $2,450 to 50z10). Decenber 31 oing hil personal money. Tony purchases a diamond ring for $3,500. Foay aurprisen surie by proposing that they get narried. Suzie accepts and they get marriedl The following information relates to year-end adjusting entries as of December 31, 2024, a. Depreciation of the mountain bikes purchased on July 8 and kayaks purchased on August 4 totals $5,120. b. Six month's' of the one-year insurance policy purchascd on July 1 has expired. c. Four months of the one-year rental agreement purchased on September 1 has expired. d. Of the $1,100 of office supplies purchased on July 4,$250 remains. e. Interest expense on the $33,000 loan obtained from the city council on August 1 should be recorded. f. Of the $2,300 of racing supplies purchased on December 12,$290 remains. 9. Suzle calculates that the company owes $13,700 in income taxes. The ending balance values from the General Ledger tab fows through to the Trial Balance below: Choose the appropriate accounts to be reported on the income statement. Select the 'adjusted' from the dropdown, which will then populate the balances in those accounts from the trial balance. a. Depreciation of the mountain bikes purchased on July 8 and kayaks purchased on August 4 totals $5,120. b. Six months' of the one-year insurance policy purchased on July 1 has expired. c. Four months of the one-year rental agreement purchased on September 1 has expired. d. Of the $1,00 of office supplies purchased on July 4,$250 remains. e. Interest expense on the $33,000 loan obtained from the city council on August 1 should be recorded. f. Of the $2,300 of racing supplies purchased on December 12,$290 remains. 9. Suzie calculates that the company owes $13,700 in income taxes. Using the dropdown buttons, select the item that accurately describes the values that either increase or decrease the balance indicated. Select 'Adjusted' from the dropdown, which will then populate the balances in those accounts from the trial balance. The balance sheet is the accounting equation: Assets a Liabilities + Equity. Each asset and lability account is reported separately on the balance sheet