Question

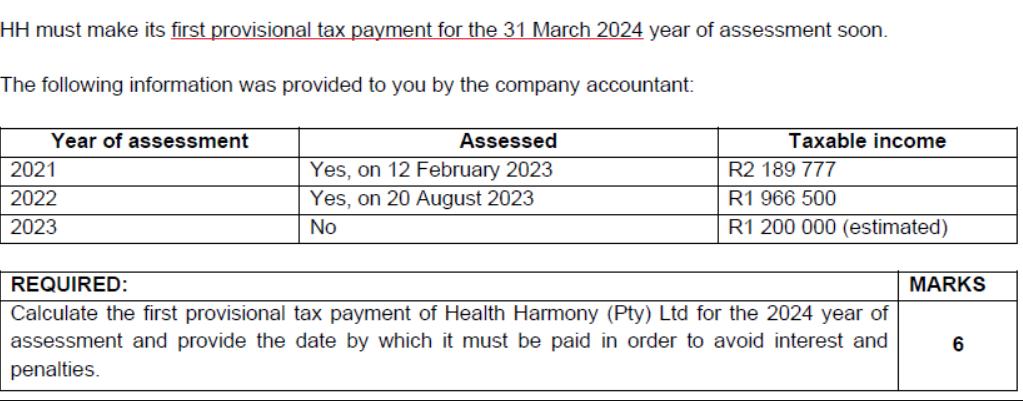

HH must make its first provisional tax payment for the 31 March 2024 year of assessment soon. The following information was provided to you

HH must make its first provisional tax payment for the 31 March 2024 year of assessment soon. The following information was provided to you by the company accountant: Year of assessment 2021 2022 2023 Assessed Yes, on 12 February 2023 Yes, on 20 August 2023 No Taxable income R2 189 777 R1 966 500 R1 200 000 (estimated) REQUIRED: Calculate the first provisional tax payment of Health Harmony (Pty) Ltd for the 2024 year of assessment and provide the date by which it must be paid in order to avoid interest and penalties. MARKS 6

Step by Step Solution

3.46 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the first provisional tax payment for Health Harmony Pty Ltd for the 2024 year of asses...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting and Reporting a Global Perspective

Authors: Michel Lebas, Herve Stolowy, Yuan Ding

4th edition

978-1408066621, 1408066629, 1408076861, 978-1408076866

Students also viewed these Corporate Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App