HHelp me with Clear answers

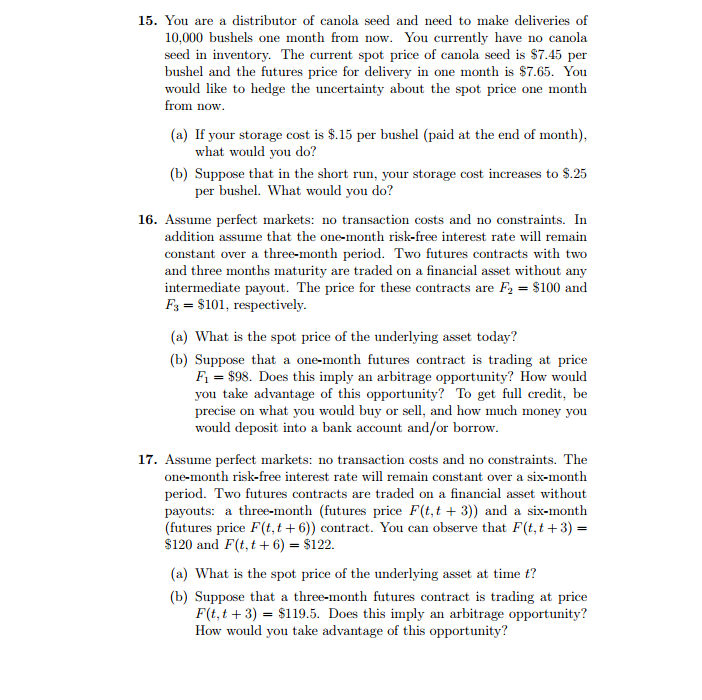

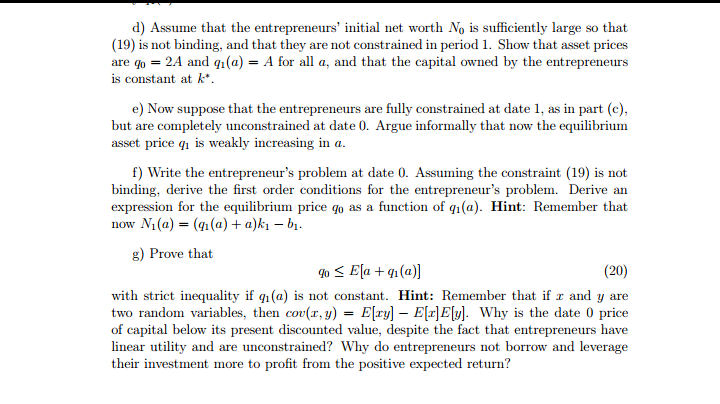

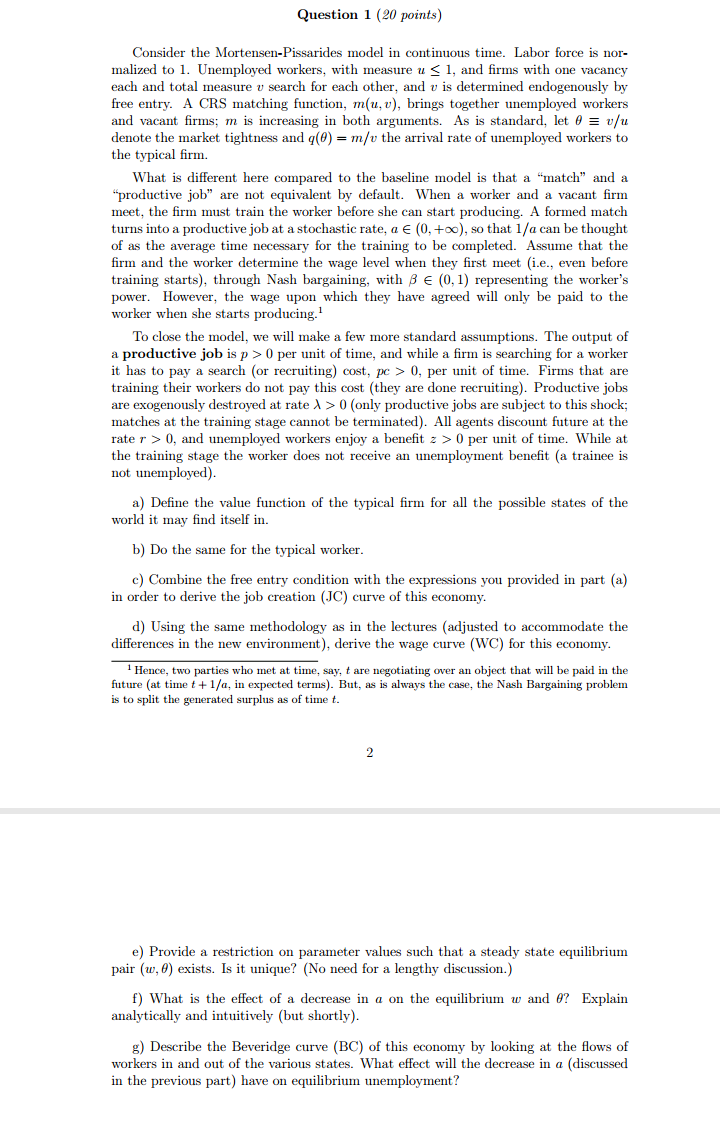

15. You are a distributor of canola seed and need to make deliveries of 10,000 bushels one month from now. You currently have no canola seed in inventory. The current spot price of canola seed is $7.45 per bushel and the futures price for delivery in one month is $7.65. You would like to hedge the uncertainty about the spot price one month from now. (a) If your storage cost is $.15 per bushel (paid at the end of month), what would you do? (b) Suppose that in the short run, your storage cost increases to $.25 per bushel. What would you do? 16. Assume perfect markets: no transaction costs and no constraints. In addition assume that the one-month risk-free interest rate will remain constant over a three-month period. Two futures contracts with two and three months maturity are traded on a financial asset without any intermediate payout. The price for these contracts are F2 = $100 and F3 = $101, respectively. (a) What is the spot price of the underlying asset today? (b) Suppose that a one-month futures contract is trading at price F1 = $98. Does this imply an arbitrage opportunity? How would you take advantage of this opportunity? To get full credit, be precise on what you would buy or sell, and how much money you would deposit into a bank account and/or borrow. 17. Assume perfect markets: no transaction costs and no constraints. The one-month risk-free interest rate will remain constant over a six-month period. Two futures contracts are traded on a financial asset without payouts: a three-month (futures price F(t, t + 3)) and a six-month futures price F(t,t + 6)) contract. You can observe that F(t, t + 3) = $120 and F(t, t + 6) = $122. (a) What is the spot price of the underlying asset at time t? (b) Suppose that a three-month futures contract is trading at price F(t, t+3) = $119.5. Does this imply an arbitrage opportunity? How would you take advantage of this opportunity?Question 5 (20 points) This problem analyzes the effect of future financial constraints on current invest- ment decisions. Consider an economy with two dates, denoted by t = 1, 2. There are two goods: consumption and capital. There is a continuum of entrepreneurs and a continuum of consumers. All individuals have linear utility and consume only in period 2, so U = E[c2]. There is a fixed supply of capital k, initially owned by the consumers. Consumers are endowed with a large amount of consumption good in each period and they can store this good between dates, such that if they store one unit of the consumption good in t = 1 they get one unit of the good in t = 2. The entrepreneurs have access to a linear technology that produces A units of consumption good in period 2 per unit of capital they own. The consumers have access to a concave technology G(k), where k denotes the capital owned by consumers in period 2. Assume limx-G'(k) = co and G'(k) = 0. The entrepreneurs enter period I with a given net worth M in terms of consumption goods. Assume agents can trade a risk-free bond by that pays an interest rate r. a) Argue that the gross rate of return on the risk-free bond is equal to 1 (i.e., the net return, r, is zero). b) Suppose that entrepreneurs face no borrowing constraints. State the optimiza tion problems of an entrepreneur and a consumer. Show that the equilibrium capital price is q1 = A and the entrepreneurs buy k*, where G'(k - k*) = A. c) Suppose that the entrepreneurs cannot borrow at all, so q1ke 0. For simplicity, we assume that consumption of farmers can be negative, that is c E R. Moreover, farmers can save (or borrow if negative) in a non-state contingent and non-defaultable asset a, which has a rate of return r. Farmers face the following "No-Ponzi" condition on assets lim 1-+o (1 + r)t 20. (22) Moreover, farmers can produce and hold capital, k, which is rented to the representative firm in competitive markets (1 unit of final consumption good produces 1 unit of capital). Let r* be the rental rate of capital and o the depreciation rate. Unlike farmers, workers don't own land, and they use their available time to work in the representative firm. Assume each worker is endowed with one unit of time. They cannot trade the asset a, but they can produce and hold capital, k (with the same technology as farmers). Their per-period utility is given by u(c), with u'(c) > 0, u"(c) 0 per unit of time, and while a firm is searching for a worker it has to pay a search (or recruiting) cost, pe > 0, per unit of time. Firms that are training their workers do not pay this cost (they are done recruiting). Productive jobs are exogenously destroyed at rate > > 0 (only productive jobs are subject to this shock; matches at the training stage cannot be terminated). All agents discount future at the rate r > 0, and unemployed workers enjoy a benefit z > 0 per unit of time. While at the training stage the worker does not receive an unemployment benefit (a trainee is not unemployed). a) Define the value function of the typical firm for all the possible states of the world it may find itself in. b) Do the same for the typical worker. c) Combine the free entry condition with the expressions you provided in part (a) in order to derive the job creation (JC) curve of this economy. d) Using the same methodology as in the lectures (adjusted to accommodate the differences in the new environment), derive the wage curve (WC) for this economy. 1 Hence, two parties who met at time, say, t are negotiating over an object that will be paid in the future (at time { + 1/a, in expected terms). But, as is always the case, the Nash Bargaining problem is to split the generated surplus as of time t. 2 e) Provide a restriction on parameter values such that a steady state equilibrium pair (w, 0) exists. Is it unique? (No need for a lengthy discussion.) f) What is the effect of a decrease in a on the equilibrium w and 0? Explain analytically and intuitively (but shortly). g) Describe the Beveridge curve (BC) of this economy by looking at the flows of workers in and out of the various states. What effect will the decrease in a (discussed in the previous part) have on equilibrium unemployment