Answered step by step

Verified Expert Solution

Question

1 Approved Answer

hi, calculate all the net presesent values for all 3 projects, the discount factor is 4.25% i have included the discount rates below the tax

hi,

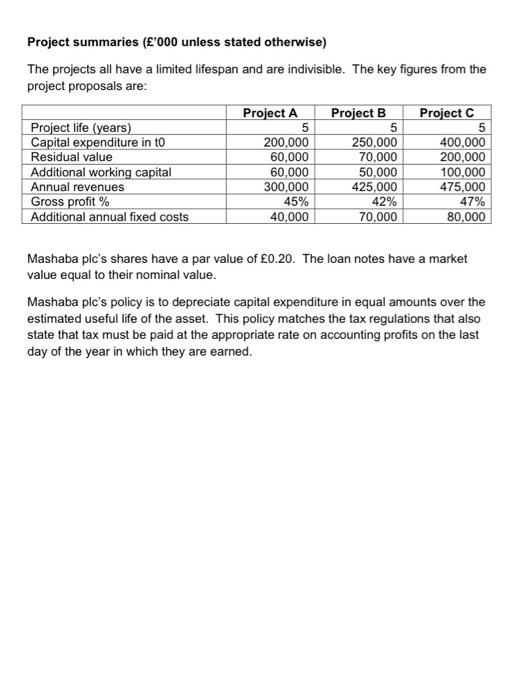

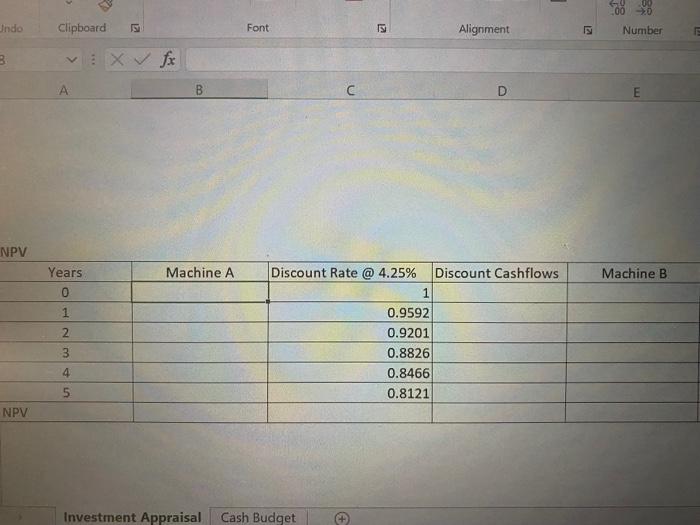

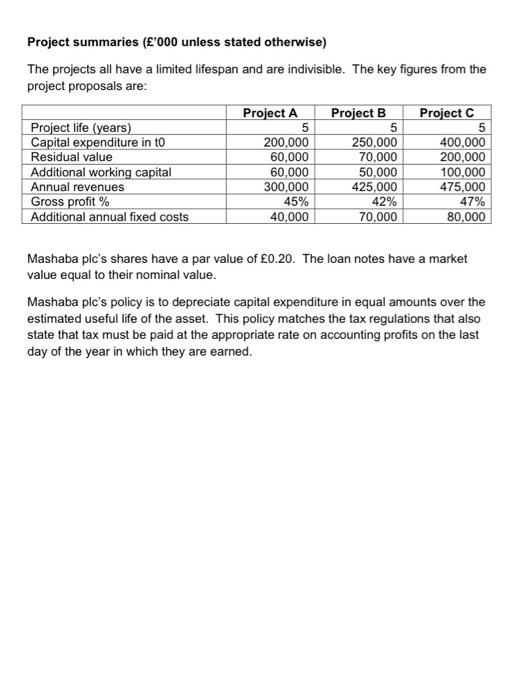

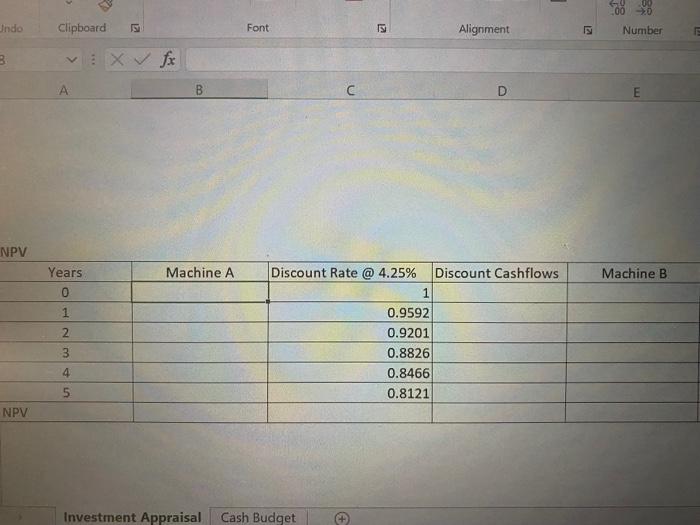

Project summaries ('000 unless stated otherwise) The projects all have a limited lifespan and are indivisible. The key figures from the project proposals are: Project A Project B Project C Project life (years) 5 5 5 Capital expenditure in to 200,000 250,000 400,000 Residual value 60,000 70,000 200,000 Additional working capital 60,000 50,000 100,000 Annual revenues 300,000 425,000 475,000 Gross profit % 45% 42% 47% Additional annual fixed costs 40,000 70,000 80,000 Mashaba ple's shares have a par value of 0.20. The loan notes have a market value equal to their nominal value. Mashaba plc's policy is to depreciate capital expenditure in equal amounts over the estimated useful life of the asset. This policy matches the tax regulations that also state that tax must be paid at the appropriate rate on accounting profits on the last day of the year in which they are earned. 8 Number Undo Clipboard Font IS Alignment 2 3 Xfx A D E NPV Machine A Machine B Years 0 1 2 Discount Rate @ 4.25% Discount Cashflows 1 0.9592 0.9201 0.8826 0.8466 0.8121 3 4 5 NPV Investment Appraisal Cash Budget calculate all the net presesent values for all 3 projects, the discount factor is 4.25% i have included the discount rates below

the tax rate is 20.0%

pls show all workings out if possible :)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started