Answered step by step

Verified Expert Solution

Question

1 Approved Answer

hi can i get help from this please? Property, plant, and equipment are conventionally presented on the balance sheet at a Replacement cost less accumulated

hi can i get help from this please?

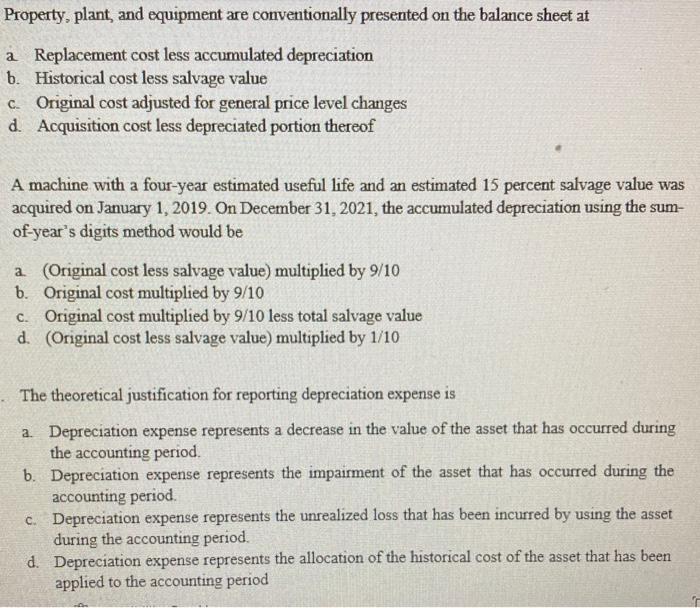

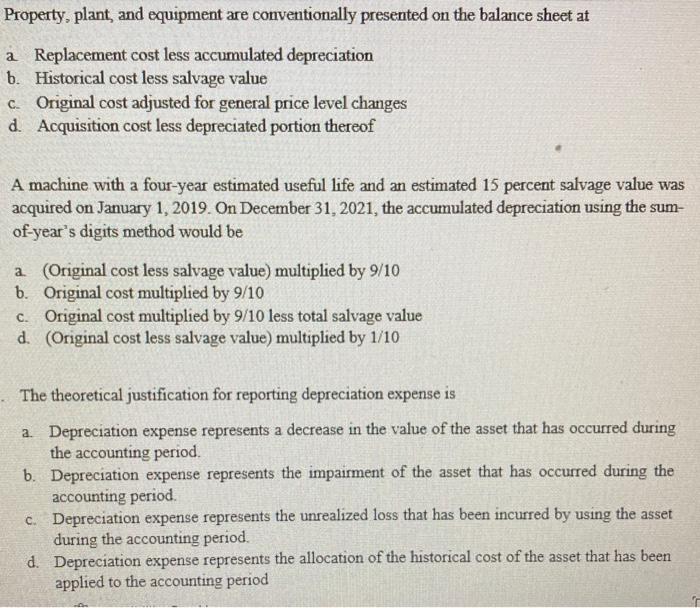

Property, plant, and equipment are conventionally presented on the balance sheet at a Replacement cost less accumulated depreciation b. Historical cost less salvage value c. Original cost adjusted for general price level changes d. Acquisition cost less depreciated portion thereof A machine with a four-year estimated useful life and an estimated 15 percent salvage value was acquired on January 1, 2019. On December 31,2021 , the accumulated depreciation using the sumof-year's digits method would be a. (Original cost less salvage value) multiplied by 9/10 b. Original cost multiplied by 9/10 c. Original cost multiplied by 9/10 less total salvage value d. (Original cost less salvage value) multiplied by 1/10 The theoretical justification for reporting depreciation expense is a. Depreciation expense represents a decrease in the value of the asset that has occurred during the accounting period. b. Depreciation expense represents the impairment of the asset that has occurred during the accounting period. c. Depreciation expense represents the unrealized loss that has been incurred by using the asset during the accounting period. d. Depreciation expense represents the allocation of the historical cost of the asset that has been applied to the accounting period

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started