Answered step by step

Verified Expert Solution

Question

1 Approved Answer

hi can i get help please !! Cardinat Company is considering a five-year project that would require a $2,765,000 investment in equipment with a useful

hi can i get help please !!

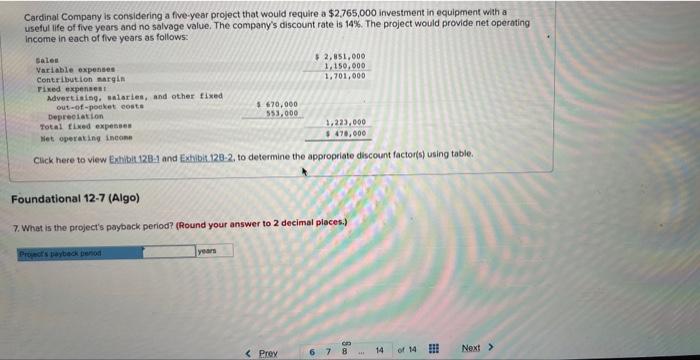

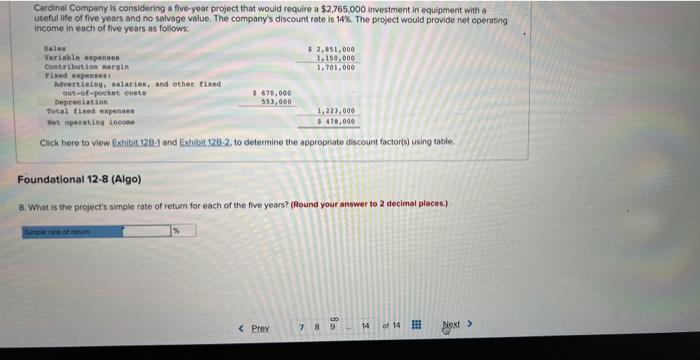

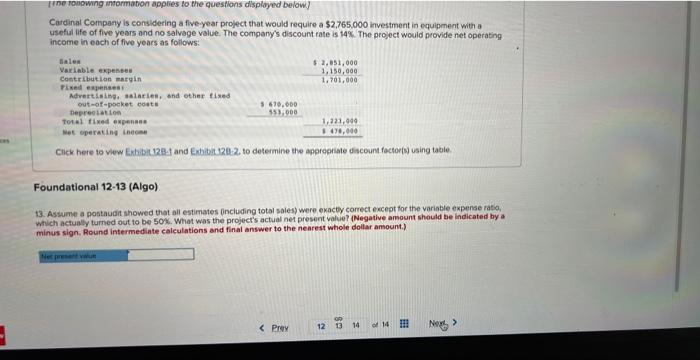

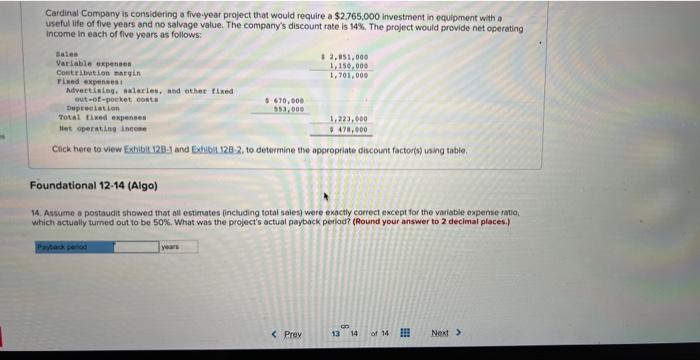

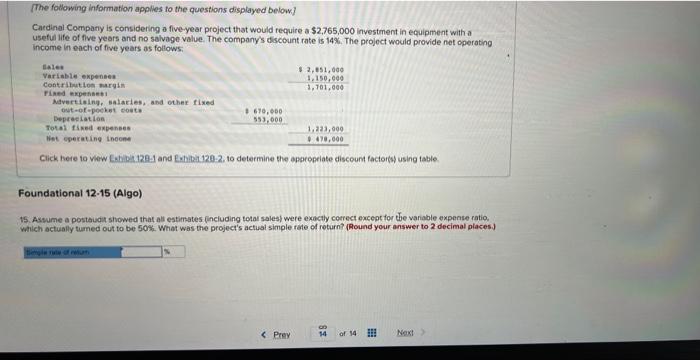

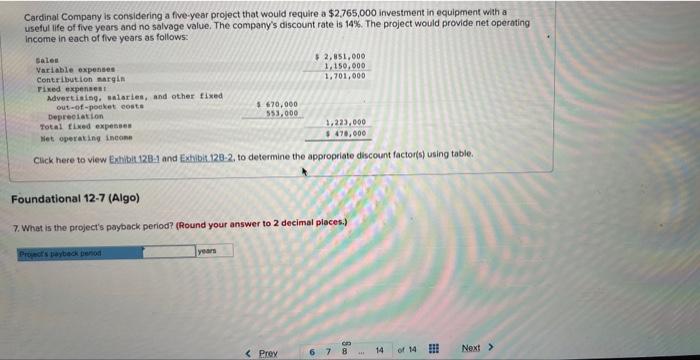

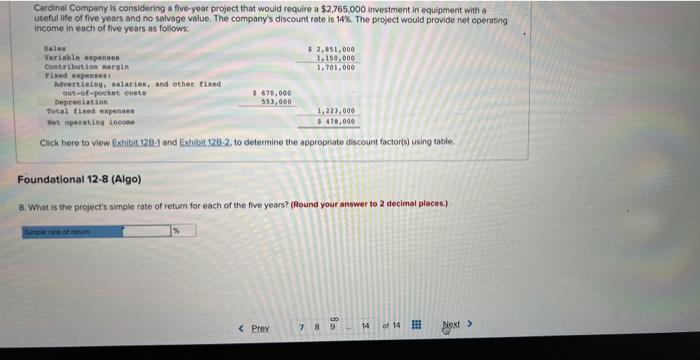

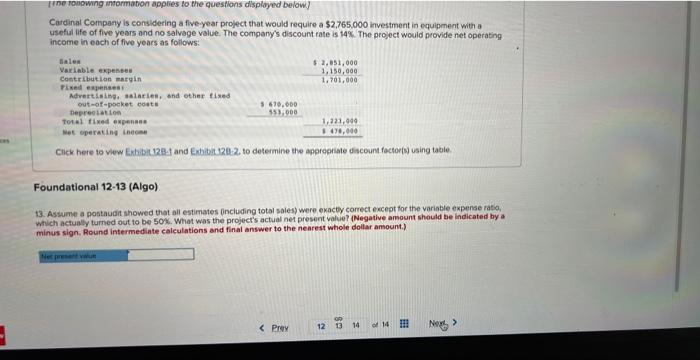

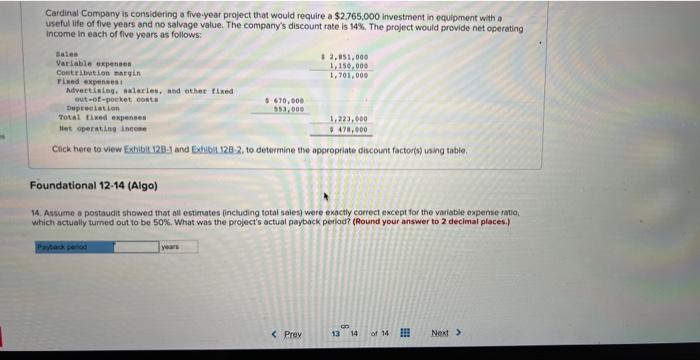

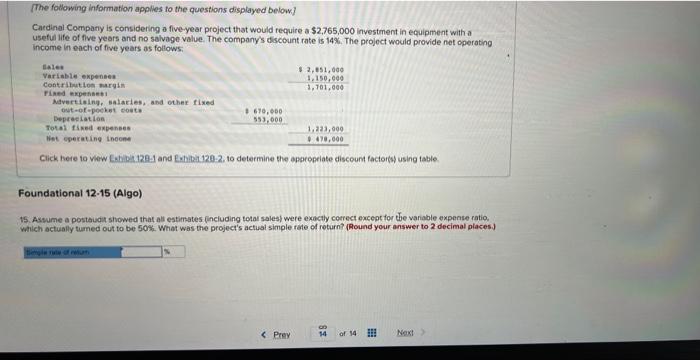

Cardinat Company is considering a five-year project that would require a $2,765,000 investment in equipment with a useful ife of five years and no salvage value. The company's discount rate is 14%. The project would provide net operating income in each of five years as follows: Cuck here to view Exhibit128-1 and Exhibit 128-2, to determine the appropriate discount factor(s) using table. Foundational 12-7 (Algo) 7. What is the project's paybock period? (Round your answer to 2 decimal places.) Cardinal Company is considering a five-year project that would requlre a $2,765,000 investment in equipment with a useful ilfe of five years and no salvage value. The company's discount rate is 14%. The project would provide net operating income in each of five years as follows: Cick here to view Exhibit 1281 and Exhibh 12:2, to determine the appropilate discount factor(s) using table. Foundational 128(Algo) 8. What is the project's simple rate of return for each of the five years? (Round your answer to 2 decimat places.) Cardinal Company is consudering a five-year project that would require a $2,765,000 investment in equipment with a useful iffe of flve years and no salvage value. The company's discount rate is 14%. The project would provide net operating income in each of five years as follows: Click here to view Ekhbic 128-1 and Exhiba 120.2, to determine the apprepriate discoun factor(s) using table. Foundational 12-13 (Algo) 13. Assume a postaudit showed that all estimates (including totol sales) were exacty correct except tor the variable expense rato, which actualy turned out to be 50\%. What was the project's actual ne1 present value? (Negative amount should be indicated by a minus sign. Round intermediate calculations and final answer to the nearest whole dollar amount.) Cardinal Company is considering a five-year project that would require a $2,765,000 investment in equipment with a useful ife of flve years and no salvage value. The company's discount rate is 14%. The project would provide net operating income in each of flve years as follows: Click here to view Exhibit 1281 and Exhibi 128-2, to determine the appropriate discount factor(s) ising table. Foundational 12-14 (Algo) 14. Assume a postaudit showed that all estimstes (including total sales) were exactly correct except for the variable expense ratio. Which actually turned out to be 50%. What was the project's actural payback perlod? (Round your answer to 2 decimal places.) The following information applles fo the questions displayed below? Cardinal Company is considering a five-year project that would require a $2,765,000 investment in equipment with a usetullife of flve years and no salvage value. The company's discount rate is 14%. The project would provide net operating income in each of five years as follows: Cick here to viw Lahb: 1281 and Evbibit 120-2, to determine the oppropeiate discoum factoris) using table. Foundational 12-15 (Algo) 15. Assume a postasait showed that all estimates (inciuding totar sales) were exinctly correct except for the vanable expente fatio. which actually tumed out to be 50%. What was the project's actual simple rate of return? (Round your answer to 2 decimal places

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started