Hi can i get help with this please?

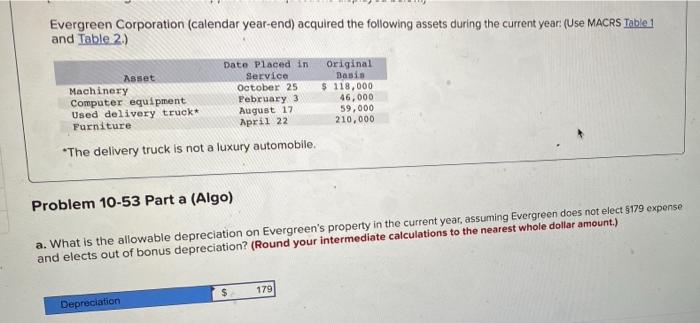

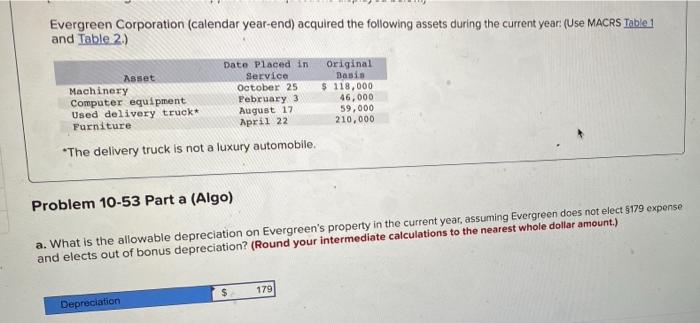

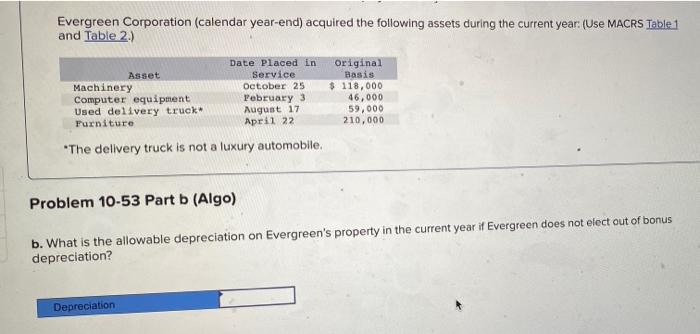

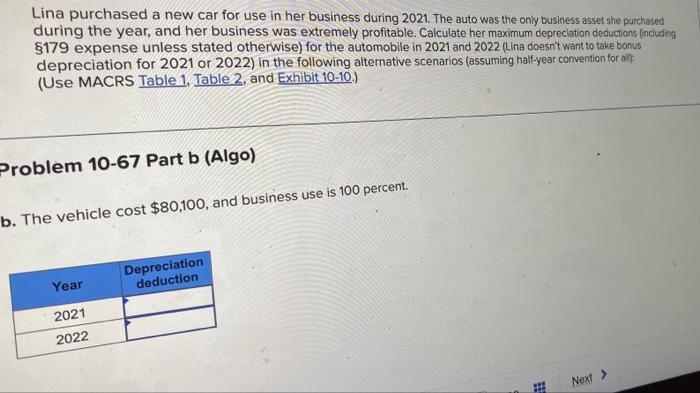

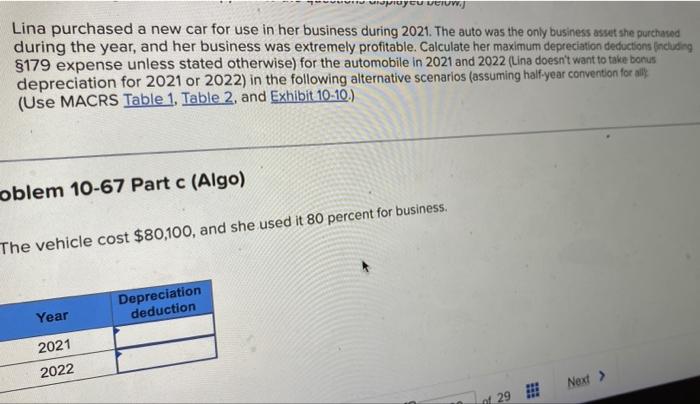

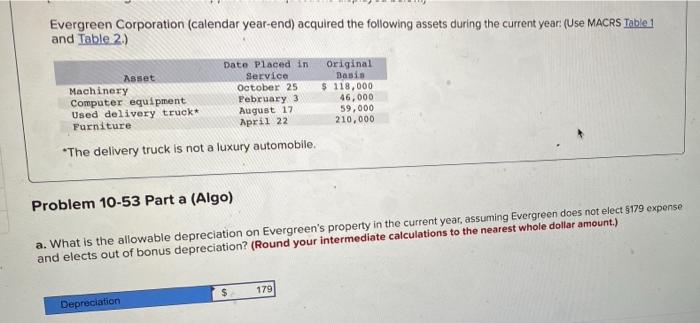

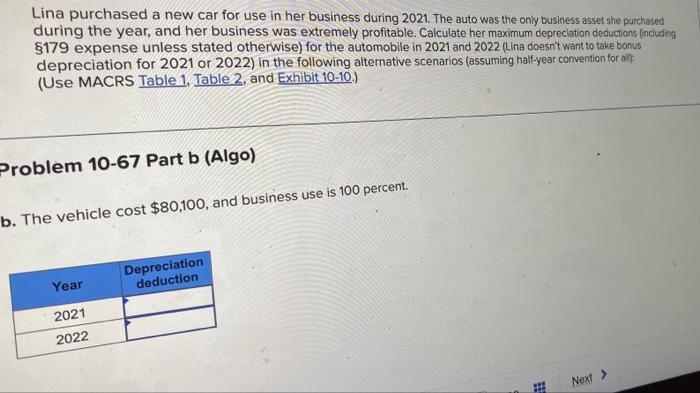

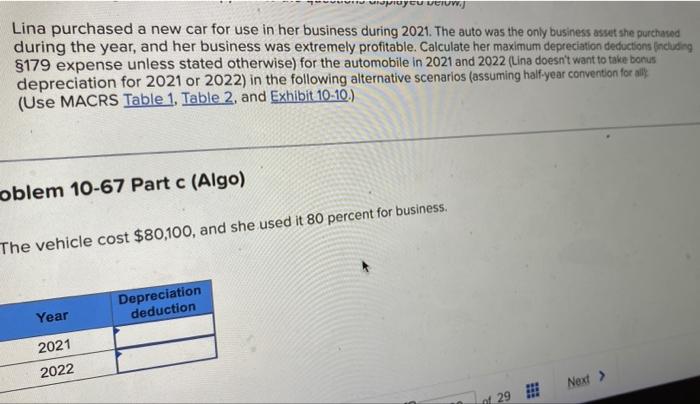

Evergreen Corporation (calendar year-end) acquired the following assets during the current year: (Use MACRS Table 1 and Table 2.) Asset Date Placed in Service October 25 February 3. Original Basis Machinery Computer equipment $ 118,000. 46,000 Used delivery truck* Furniture. August 17. 59,000 210,000 April 22 *The delivery truck is not a luxury automobile. Problem 10-53 Part a (Algo) a. What is the allowable depreciation on Evergreen's property in the current year, assuming Evergreen does not elect 179 expense and elects out of bonus depreciation? (Round your intermediate calculations to the nearest whole dollar amount.) $ 179 Depreciation Evergreen Corporation (calendar year-end) acquired the following assets during the current year: (Use MACRS Table 1 and Table 2.) Asset Date Placed in Service October 25 February 3 Original Basis Machinery $ 118,000 Computer equipment 46,000 Used delivery truck* August 17. 59,000 210,000 Furniture April 22 *The delivery truck is not a luxury automobile. Problem 10-53 Part b (Algo) b. What is the allowable depreciation on Evergreen's property in the current year if Evergreen does not elect out of bonus depreciation? Depreciation Lina purchased a new car for use in her business during 2021. The auto was the only business asset she purchased during the year, and her business was extremely profitable. Calculate her maximum depreciation deductions (including 179 expense unless stated otherwise) for the automobile in 2021 and 2022 (Lina doesn't want to take bonus depreciation for 2021 or 2022) in the following alternative scenarios (assuming half-year convention for all (Use MACRS Table 1, Table 2, and Exhibit 10-10.) Problem 10-67 Part b (Algo) b. The vehicle cost $80,100, and business use is 100 percent. Year Depreciation deduction 2021 2022 Next > www the unsplay cu below. Lina purchased a new car for use in her business during 2021. The auto was the only business asset she purchased during the year, and her business was extremely profitable. Calculate her maximum depreciation deductions (including 179 expense unless stated otherwise) for the automobile in 2021 and 2022 (Lina doesn't want to take bonus depreciation for 2021 or 2022) in the following alternative scenarios (assuming half-year convention for all (Use MACRS Table 1. Table 2, and Exhibit 10-10.) oblem 10-67 Part c (Algo) The vehicle cost $80,100, and she used it 80 percent for business. Year Depreciation deduction 2021 2022 Next > of 29