Answered step by step

Verified Expert Solution

Question

1 Approved Answer

hi can i get the anwsers and explainations for this please l. the last word missing from the wording is 'year'. its suppose to be

hi can i get the anwsers and explainations for this please l. the last word missing from the wording is 'year'. its suppose to be at the end of the year.

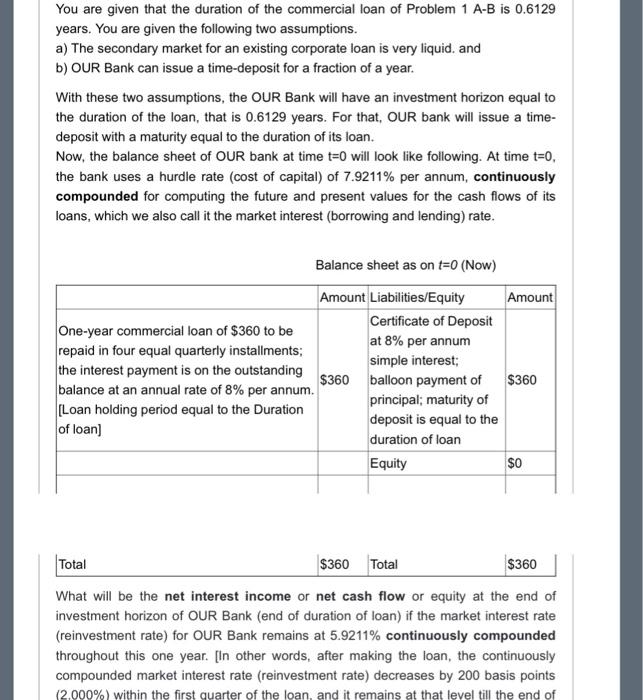

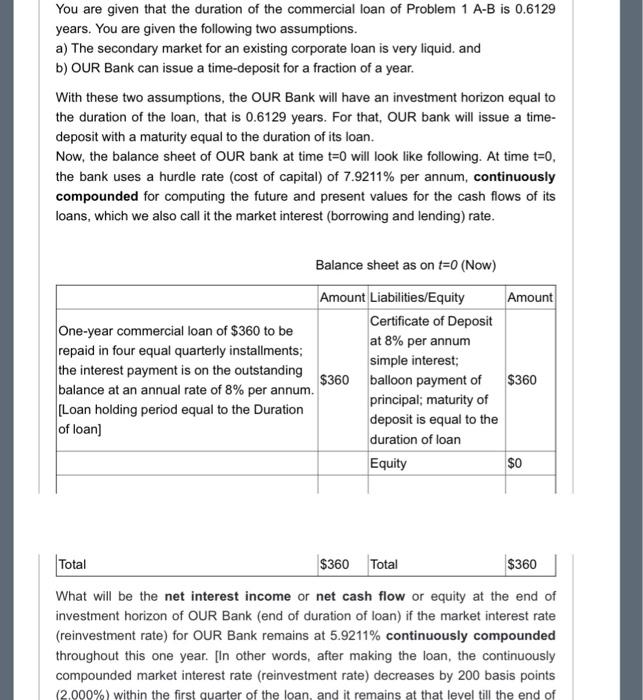

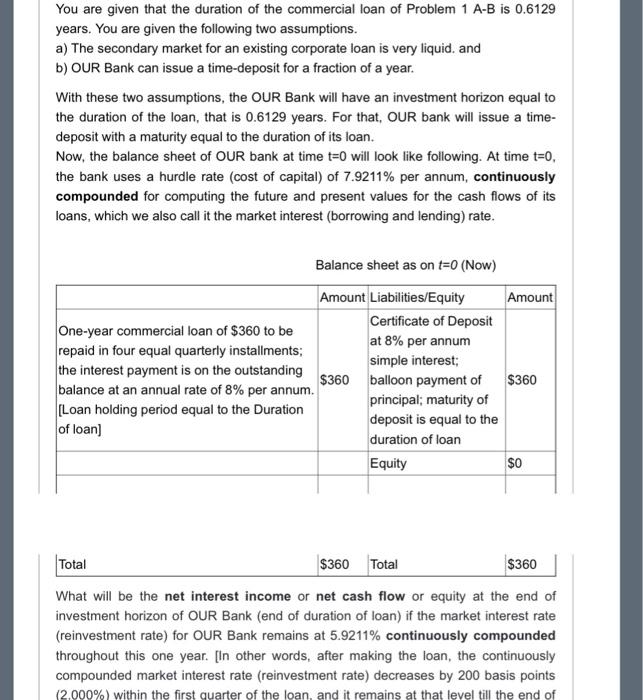

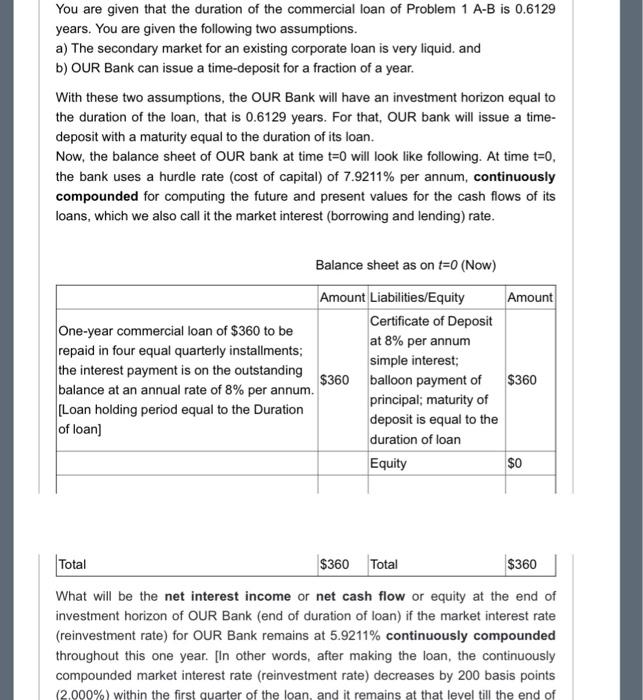

You are given that the duration of the commercial loan of Problem 1AB is 0.6129 years. You are given the following two assumptions. a) The secondary market for an existing corporate loan is very liquid. and b) OUR Bank can issue a time-deposit for a fraction of a year. With these two assumptions, the OUR Bank will have an investment horizon equal to the duration of the loan, that is 0.6129 years. For that, OUR bank will issue a timedeposit with a maturity equal to the duration of its loan. Now, the balance sheet of OUR bank at time t=0 will look like following. At time t=0, the bank uses a hurdle rate (cost of capital) of 7.9211% per annum, continuously compounded for computing the future and present values for the cash flows of its loans, which we also call it the market interest (borrowing and lending) rate. Balance sheet as on t=0 (Now) Total $360 Total $360 What will be the net interest income or net cash flow or equity at the end of investment horizon of OUR Bank (end of duration of loan) if the market interest rate (reinvestment rate) for OUR Bank remains at 5.9211% continuously compounded throughout this one year. [In other words, after making the loan, the continuously compounded market interest rate (reinvestment rate) decreases by 200 basis points (2.000%) within the first quarter of the loan, and it remains at that level till the end of You are given that the duration of the commercial loan of Problem 1AB is 0.6129 years. You are given the following two assumptions. a) The secondary market for an existing corporate loan is very liquid. and b) OUR Bank can issue a time-deposit for a fraction of a year. With these two assumptions, the OUR Bank will have an investment horizon equal to the duration of the loan, that is 0.6129 years. For that, OUR bank will issue a timedeposit with a maturity equal to the duration of its loan. Now, the balance sheet of OUR bank at time t=0 will look like following. At time t=0, the bank uses a hurdle rate (cost of capital) of 7.9211% per annum, continuously compounded for computing the future and present values for the cash flows of its loans, which we also call it the market interest (borrowing and lending) rate. Balance sheet as on t=0 (Now) Total $360 Total $360 What will be the net interest income or net cash flow or equity at the end of investment horizon of OUR Bank (end of duration of loan) if the market interest rate (reinvestment rate) for OUR Bank remains at 5.9211% continuously compounded throughout this one year. [In other words, after making the loan, the continuously compounded market interest rate (reinvestment rate) decreases by 200 basis points (2.000%) within the first quarter of the loan, and it remains at that level till the end of You are given that the duration of the commercial loan of Problem 1AB is 0.6129 years. You are given the following two assumptions. a) The secondary market for an existing corporate loan is very liquid. and b) OUR Bank can issue a time-deposit for a fraction of a year. With these two assumptions, the OUR Bank will have an investment horizon equal to the duration of the loan, that is 0.6129 years. For that, OUR bank will issue a timedeposit with a maturity equal to the duration of its loan. Now, the balance sheet of OUR bank at time t=0 will look like following. At time t=0, the bank uses a hurdle rate (cost of capital) of 7.9211% per annum, continuously compounded for computing the future and present values for the cash flows of its loans, which we also call it the market interest (borrowing and lending) rate. Balance sheet as on t=0 (Now) Total $360 Total $360 What will be the net interest income or net cash flow or equity at the end of investment horizon of OUR Bank (end of duration of loan) if the market interest rate (reinvestment rate) for OUR Bank remains at 5.9211% continuously compounded throughout this one year. [In other words, after making the loan, the continuously compounded market interest rate (reinvestment rate) decreases by 200 basis points (2.000%) within the first quarter of the loan, and it remains at that level till the end of You are given that the duration of the commercial loan of Problem 1AB is 0.6129 years. You are given the following two assumptions. a) The secondary market for an existing corporate loan is very liquid. and b) OUR Bank can issue a time-deposit for a fraction of a year. With these two assumptions, the OUR Bank will have an investment horizon equal to the duration of the loan, that is 0.6129 years. For that, OUR bank will issue a timedeposit with a maturity equal to the duration of its loan. Now, the balance sheet of OUR bank at time t=0 will look like following. At time t=0, the bank uses a hurdle rate (cost of capital) of 7.9211% per annum, continuously compounded for computing the future and present values for the cash flows of its loans, which we also call it the market interest (borrowing and lending) rate. Balance sheet as on t=0 (Now) Total $360 Total $360 What will be the net interest income or net cash flow or equity at the end of investment horizon of OUR Bank (end of duration of loan) if the market interest rate (reinvestment rate) for OUR Bank remains at 5.9211% continuously compounded throughout this one year. [In other words, after making the loan, the continuously compounded market interest rate (reinvestment rate) decreases by 200 basis points (2.000%) within the first quarter of the loan, and it remains at that level till the end of

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started