Hi, can I please get help with these practice questions. For the calcualtion questions, can you please show the working out so I can understand. Thank you in advance

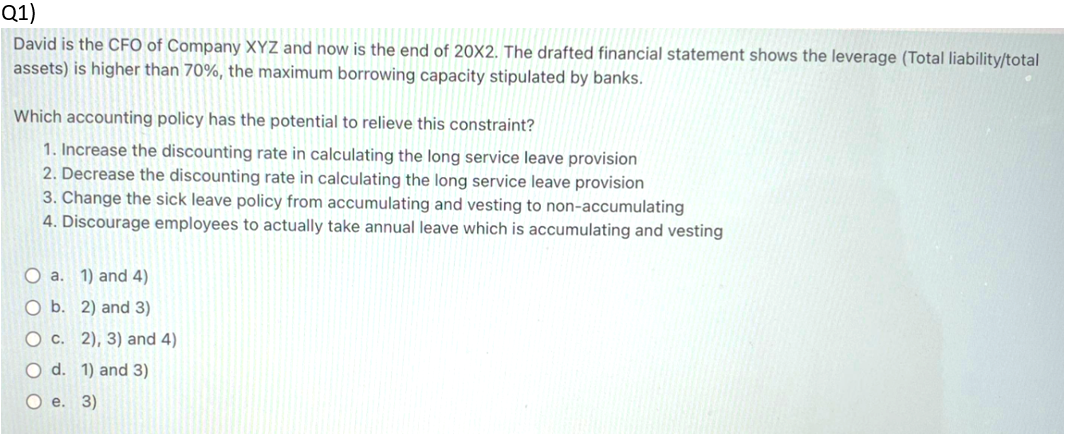

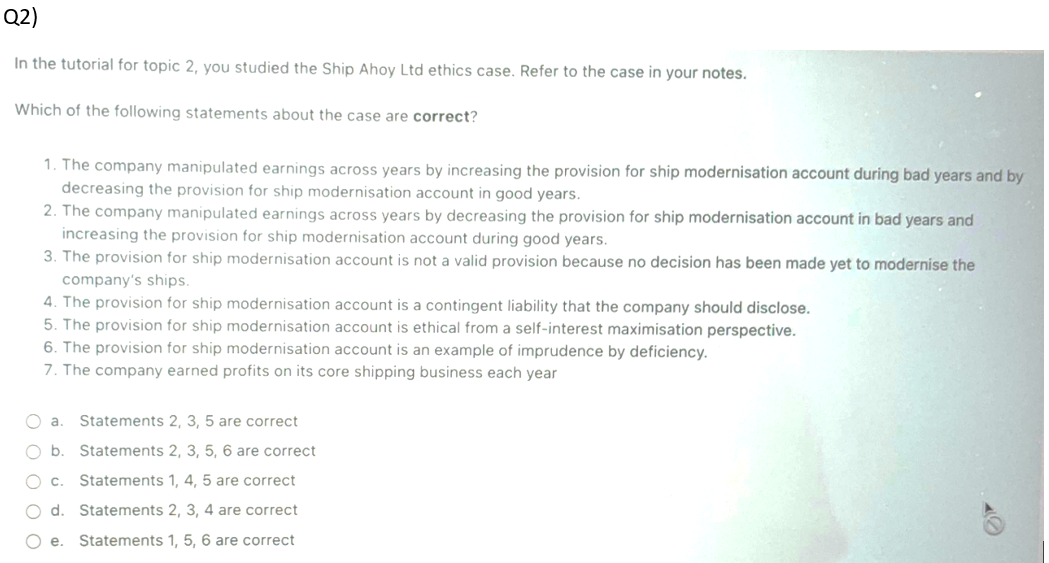

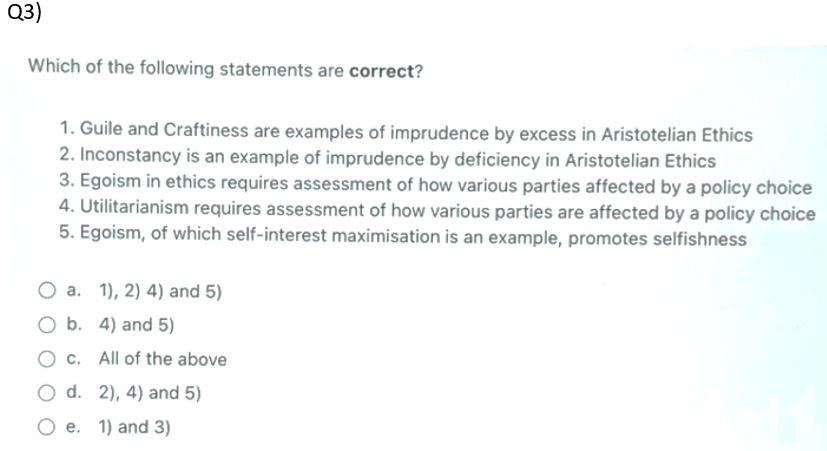

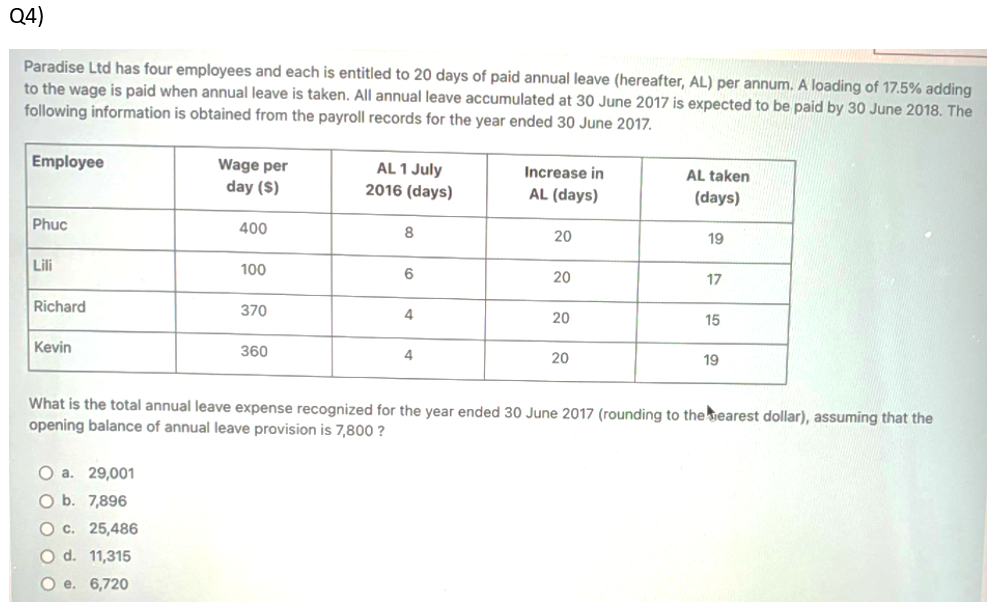

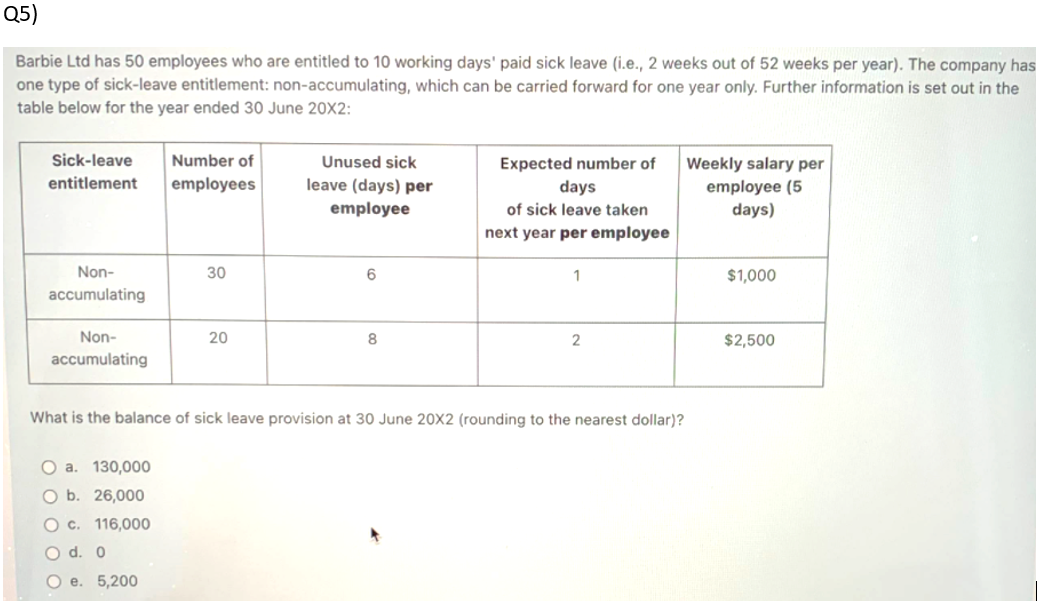

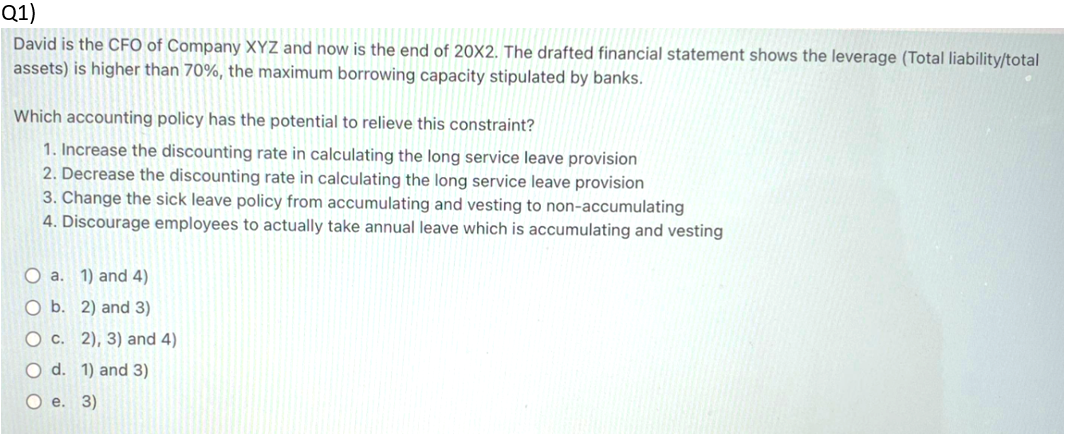

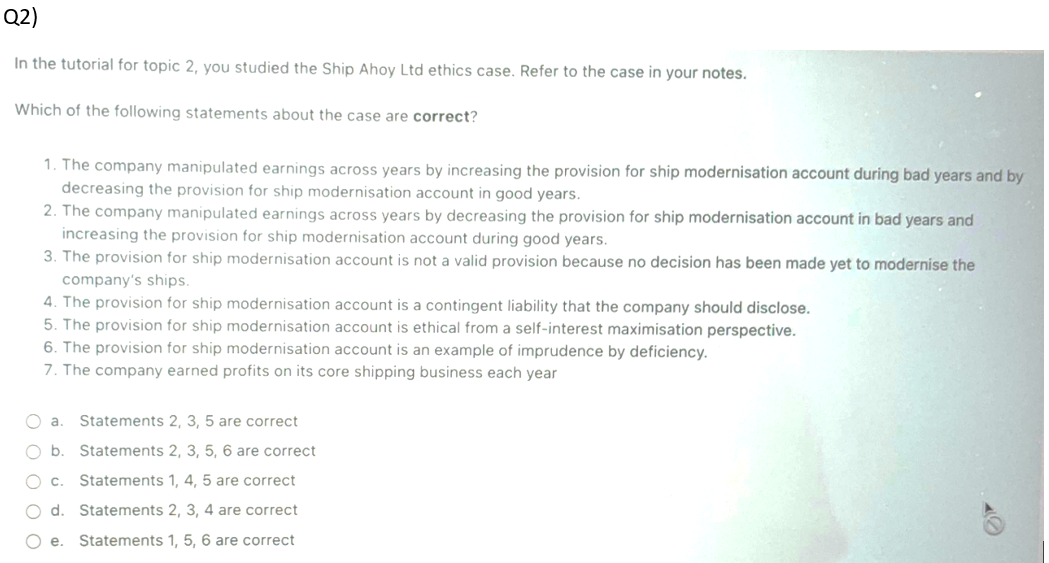

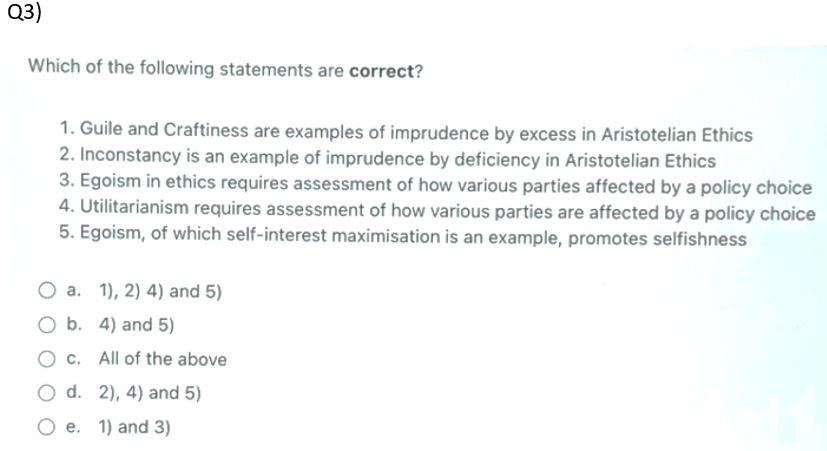

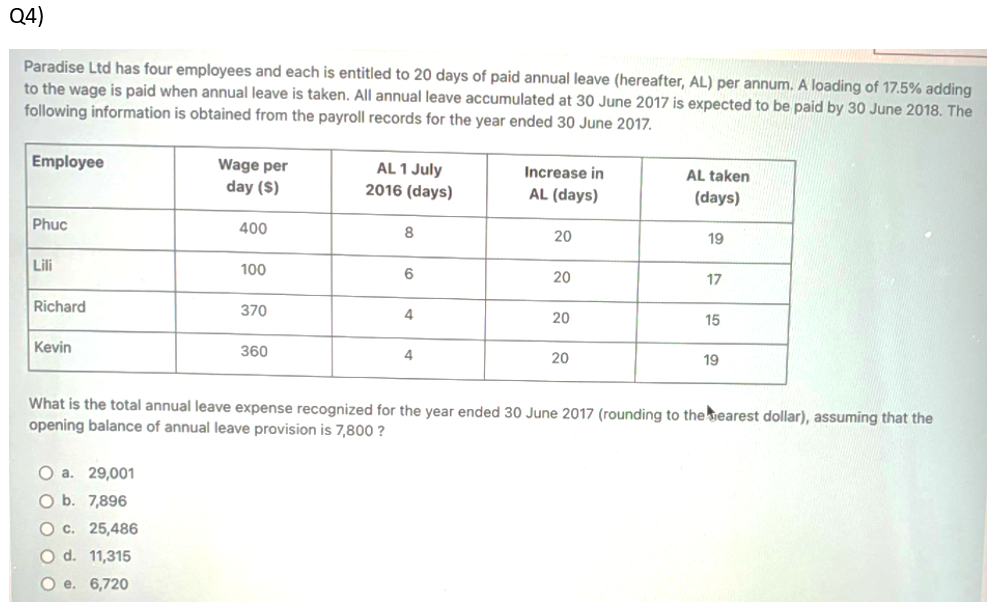

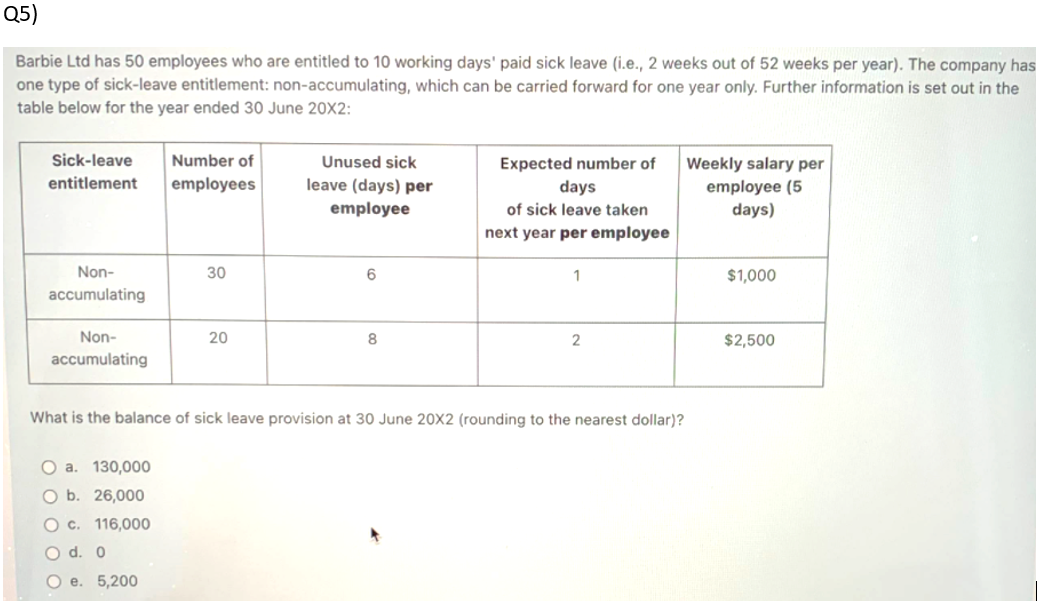

Q1) David is the CFO of Company XYZ and now is the end of 20X2. The drafted financial statement shows the leverage (Total liability/total assets) is higher than 70%, the maximum borrowing capacity stipulated by banks. Which accounting policy has the potential to relieve this constraint? 1. Increase the discounting rate in calculating the long service leave provision 2. Decrease the discounting rate in calculating the long service leave provision 3. Change the sick leave policy from accumulating and vesting to non-accumulating 4. Discourage employees to actually take annual leave which is accumulating and vesting O a. 1) and 4) O b. 2) and 3) O c. 2), 3) and 4) O d. 1) and 3) O e. 3) Q2) In the tutorial for topic 2, you studied the Ship Ahoy Ltd ethics case. Refer to the case in your notes. Which of the following statements about the case are correct? 1. The company manipulated earnings across years by increasing the provision for ship modernisation account during bad years and by decreasing the provision for ship modernisation account in good years. 2. The company manipulated earnings across years by decreasing the provision for ship modernisation account in bad years and increasing the provision for ship modernisation account during good years. 3. The provision for ship modernisation account is not a valid provision because no decision has been made yet to modernise the company's ships 4. The provision for ship modernisation account is a contingent liability that the company should disclose. 5. The provision for ship modernisation account is ethical from a self-interest maximisation perspective. 6. The provision for ship modernisation account is an example of imprudence by deficiency. 7. The company earned profits on its core shipping business each year O a Statements 2, 3, 5 are correct O b. Statements 2, 3, 5, 6 are correct C Statements 1, 4, 5 are correct O d. Statements 2, 3, 4 are correct e. Statements 1, 5, 6 are correct Q3) Which of the following statements are correct? 1. Guile and Craftiness are examples of imprudence by excess in Aristotelian Ethics 2. Inconstancy is an example of imprudence by deficiency in Aristotelian Ethics 3. Egoism in ethics requires assessment of how various parties affected by a policy choice 4. Utilitarianism requires assessment of how various parties are affected by a policy choice 5. Egoism, of which self-interest maximisation is an example, promotes selfishness O a. 1), 2) 4) and 5) O b. 4) and 5) O c. All of the above O d. 2), 4) and 5) O e. 1) and 3) Q4) Paradise Ltd has four employees and each is entitled to 20 days of paid annual leave (hereafter, AL) per annum. A loading of 17.5% adding to the wage is paid when annual leave is taken. All annual leave accumulated at 30 June 2017 is expected to be paid by 30 June 2018. The following information is obtained from the payroll records for the year ended 30 June 2017 Employee Wage per day ($) AL 1 July 2016 (days) Increase in AL (days) AL taken (days) Phuc 400 8 20 19 Lili 100 6 20 17 Richard 370 4 20 15 Kevin 360 4 20 19 What is the total annual leave expense recognized for the year ended 30 June 2017 (rounding to the searest dollar), assuming that the opening balance of annual leave provision is 7,800 ? O a. 29,001 O b. 7,896 O c. 25,486 O d. 11,315 O e. 6,720 Q5) Barbie Ltd has 50 employees who are entitled to 10 working days' paid sick leave (i.e., 2 weeks out of 52 weeks per year). The company has one type of sick-leave entitlement: non-accumulating, which can be carried forward for one year only. Further information is set out in the table below for the year ended 30 June 20x2: Sick-leave entitlement Number of employees Unused sick leave (days) per employee Expected number of days of sick leave taken next year per employee Weekly salary per employee (5 days) 30 6 1 Non- accumulating $1,000 20 8 2 $2,500 Non- accumulating What is the balance of sick leave provision at 30 June 20x2 (rounding to the nearest dollar)? O a. 130,000 O b. 26,000 O c. 116,000 O d. 0 O e. 5,200 Q1) David is the CFO of Company XYZ and now is the end of 20X2. The drafted financial statement shows the leverage (Total liability/total assets) is higher than 70%, the maximum borrowing capacity stipulated by banks. Which accounting policy has the potential to relieve this constraint? 1. Increase the discounting rate in calculating the long service leave provision 2. Decrease the discounting rate in calculating the long service leave provision 3. Change the sick leave policy from accumulating and vesting to non-accumulating 4. Discourage employees to actually take annual leave which is accumulating and vesting O a. 1) and 4) O b. 2) and 3) O c. 2), 3) and 4) O d. 1) and 3) O e. 3) Q2) In the tutorial for topic 2, you studied the Ship Ahoy Ltd ethics case. Refer to the case in your notes. Which of the following statements about the case are correct? 1. The company manipulated earnings across years by increasing the provision for ship modernisation account during bad years and by decreasing the provision for ship modernisation account in good years. 2. The company manipulated earnings across years by decreasing the provision for ship modernisation account in bad years and increasing the provision for ship modernisation account during good years. 3. The provision for ship modernisation account is not a valid provision because no decision has been made yet to modernise the company's ships 4. The provision for ship modernisation account is a contingent liability that the company should disclose. 5. The provision for ship modernisation account is ethical from a self-interest maximisation perspective. 6. The provision for ship modernisation account is an example of imprudence by deficiency. 7. The company earned profits on its core shipping business each year O a Statements 2, 3, 5 are correct O b. Statements 2, 3, 5, 6 are correct C Statements 1, 4, 5 are correct O d. Statements 2, 3, 4 are correct e. Statements 1, 5, 6 are correct Q3) Which of the following statements are correct? 1. Guile and Craftiness are examples of imprudence by excess in Aristotelian Ethics 2. Inconstancy is an example of imprudence by deficiency in Aristotelian Ethics 3. Egoism in ethics requires assessment of how various parties affected by a policy choice 4. Utilitarianism requires assessment of how various parties are affected by a policy choice 5. Egoism, of which self-interest maximisation is an example, promotes selfishness O a. 1), 2) 4) and 5) O b. 4) and 5) O c. All of the above O d. 2), 4) and 5) O e. 1) and 3) Q4) Paradise Ltd has four employees and each is entitled to 20 days of paid annual leave (hereafter, AL) per annum. A loading of 17.5% adding to the wage is paid when annual leave is taken. All annual leave accumulated at 30 June 2017 is expected to be paid by 30 June 2018. The following information is obtained from the payroll records for the year ended 30 June 2017 Employee Wage per day ($) AL 1 July 2016 (days) Increase in AL (days) AL taken (days) Phuc 400 8 20 19 Lili 100 6 20 17 Richard 370 4 20 15 Kevin 360 4 20 19 What is the total annual leave expense recognized for the year ended 30 June 2017 (rounding to the searest dollar), assuming that the opening balance of annual leave provision is 7,800 ? O a. 29,001 O b. 7,896 O c. 25,486 O d. 11,315 O e. 6,720 Q5) Barbie Ltd has 50 employees who are entitled to 10 working days' paid sick leave (i.e., 2 weeks out of 52 weeks per year). The company has one type of sick-leave entitlement: non-accumulating, which can be carried forward for one year only. Further information is set out in the table below for the year ended 30 June 20x2: Sick-leave entitlement Number of employees Unused sick leave (days) per employee Expected number of days of sick leave taken next year per employee Weekly salary per employee (5 days) 30 6 1 Non- accumulating $1,000 20 8 2 $2,500 Non- accumulating What is the balance of sick leave provision at 30 June 20x2 (rounding to the nearest dollar)? O a. 130,000 O b. 26,000 O c. 116,000 O d. 0 O e. 5,200