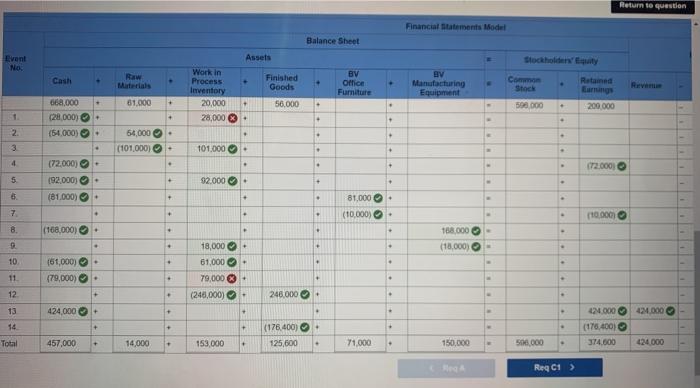

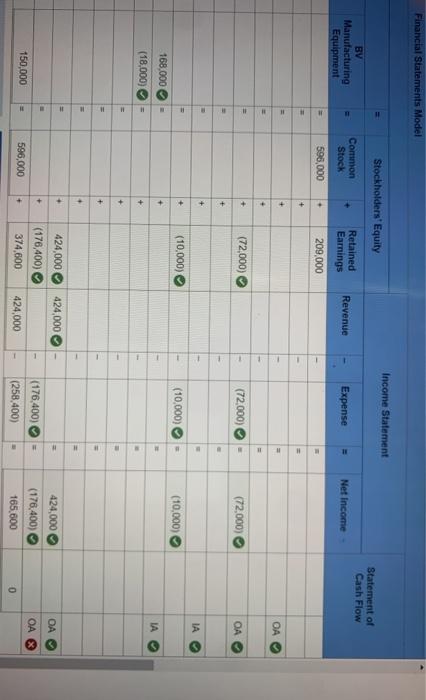

hi!! can someone please correct the wrong answers in red? and help me complete the statement of cash flows collumn on the financial statement.

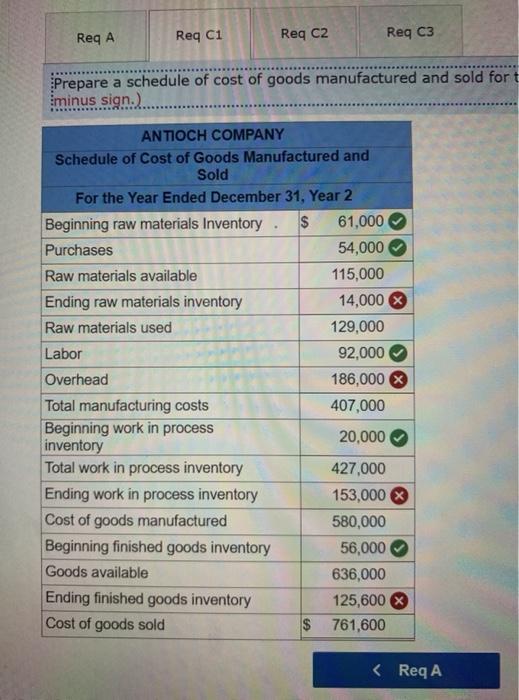

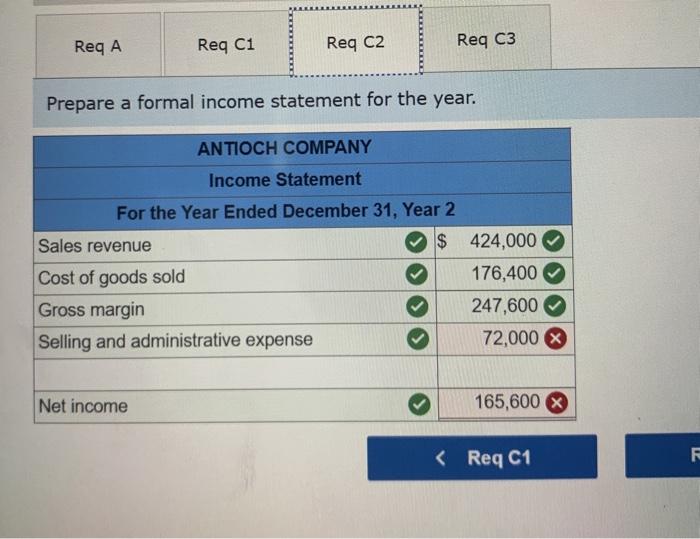

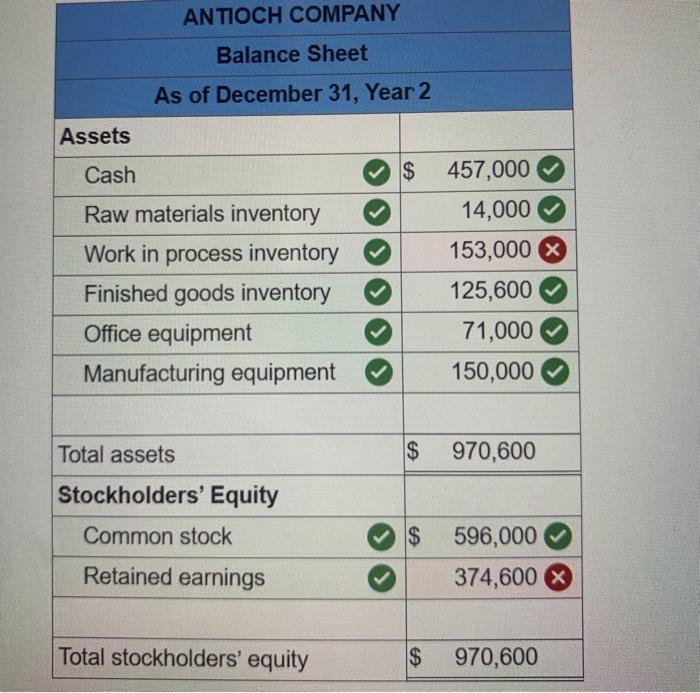

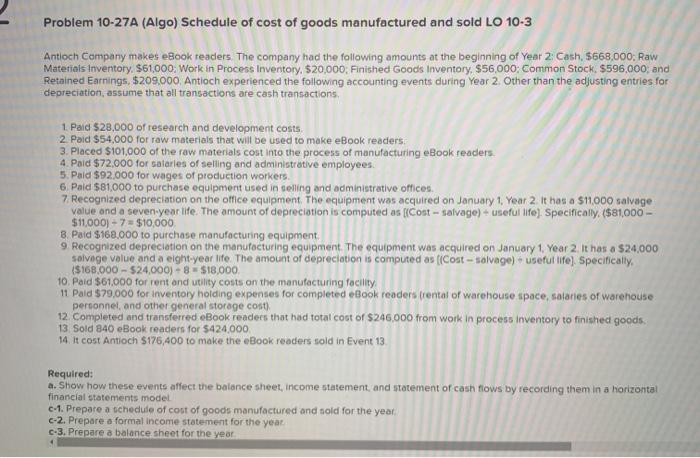

Problem 10-27A (Algo) Schedule of cost of goods manufactured and sold LO 10-3 Antioch Company makes eBook readers. The company had the following amounts at the beginning of Year 2: Cash $668,000: Raw Materials inventory $61,000. Work in Process Inventory $20,000: Finished Goods Inventory $56,000: Common Stock. $596,000, and Retained Earnings. $209.000. Antioch experienced the following accounting events during Year 2. Other than the adjusting entries for depreciation, assume that all transactions are cash transactions, 1. Paid $28,000 of research and development costs. 2. Paid S54,000 for raw materials that will be used to make eBook readers 3. Placed $101,000 of the raw materials cost into the process of manufacturing eBook readers 4. Pald $72,000 for salaries of selling and administrative employees 5. Pald $92,000 for wages of production workers 6. Paid $81,000 to purchase equipment used in selling and administrative offices. 7 Recognized depreciation on the office equipment . The equipment was acquired on January 1, Year 2. It has a $11.000 salvage value and a seven-year life. The amount of depreciation is computed as [(Cost - salvage) + useful life). Specifically (581,000 - $11,000) - 7 $10,000 8. Paid $168,000 to purchase manufacturing equipment 9. Recognized depreciation on the manufacturing equipment. The equipment was acquired on January 1, Year 2. It has a $24,000 salvage value and a eight year life. The amount of depreciation is computed as (Cost-salvage) - useful life). Specifically ($168.000 - $24,000) - 8 $18,000 10. Paid $61.000 for rent and utility costs on the manufacturing facility 11 Pald 579,000 for inventory holding expenses for completed eBook readers trental of warehouse space, salaries of warehouse personnel, and other general storage cost) 12. Completed and transferred eBook readers that had total cost of $246.000 from work in process inventory to finished goods 13 Sold 840 eBook readers for 5424,000 14. It cost Antioch $176,400 to make the eBook readers sold in Event 13 Required: a. Show how these events affect the balance sheet, income statement, and statement of cash flows by recording them in a horizontal financial statements model 0-1. Prepare a schedule of cost of goods manufactured and sold for the year c-2. Prepare a formal income statement for the year C-3. Prepare a balance sheet for the year Return to question Financial statement Model Balance Sheet Assets Stockholders No Cash Finished Goods BV Office Furniture Work in Process Inventory 20,000 28,000 $ BV Manufacturing Equipment Com Stock Ratamed 81.000 + 56.000 598 000 200.000 668.000 (28,000) (54.000) 64,000 (101.000) . 101.000 . + 3 4 - 72.000 5 (72,000) (92.000) (81.000) + 92.000 - - . 81,000+ 7 + . (10.000) 110.000 B. (108,000) - 188.000 (18,000) . 10 . - (61,000) (79,000) 18,000 61,000+ 79,000 3 (248,000) 11 . 12 + S 246.000 + . 13 . 424,000 + 1.000 14 (176.400) 24.000 (178,400) 374.000 Total 457.000 14,000 153,000 - 125,600 . - 71.000 150,000 500.000 424.000 ReqC1 > Financial Statements Model Income Statement = Stockholders' Equity Statement of Cash Flow BV Manufacturing Equipment - Common Stock Retained Earnings Revenue Expense Net Income 595,000 . 209,000 + + (72,000) (72.000) (72,000) OA # + + IA + (10,000) (10,000) (10,000) 168,000 + IA (18,000) + + + = + . 424,000 424,000 + (176,400) 424,000 (176,400) 165 600 OA 150.000 596.000 (176,400) (258.400) 374,600 424,000 0 Req A Req C1 Reg C2 Req C3 Prepare a schedule of cost of goods manufactured and sold fort minus sign.) ANTIOCH COMPANY Schedule of Cost of Goods Manufactured and Sold For the Year Ended December 31, Year 2 Beginning raw materials Inventory. $ 61,000 Purchases 54,000 Raw materials available 115,000 Ending raw materials inventory 14,000 X Raw materials used 129,000 Labor 92,000 Overhead 186,000 X Total manufacturing costs 407,000 Beginning work in process 20,000 inventory Total work in process inventory 427,000 Ending work in process inventory 153,000 $ Cost of goods manufactured 580,000 Beginning finished goods inventory 56,000 Goods available 636,000 Ending finished goods inventory 125,600 X Cost of goods sold $ 761,600