Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hi can someone please help me answer the questions (1 and 2) in the second picture. The information needed to answer the questions are provided

Hi can someone please help me answer the questions (1 and 2) in the second picture. The information needed to answer the questions are provided in picture 1 and 2. Thank you

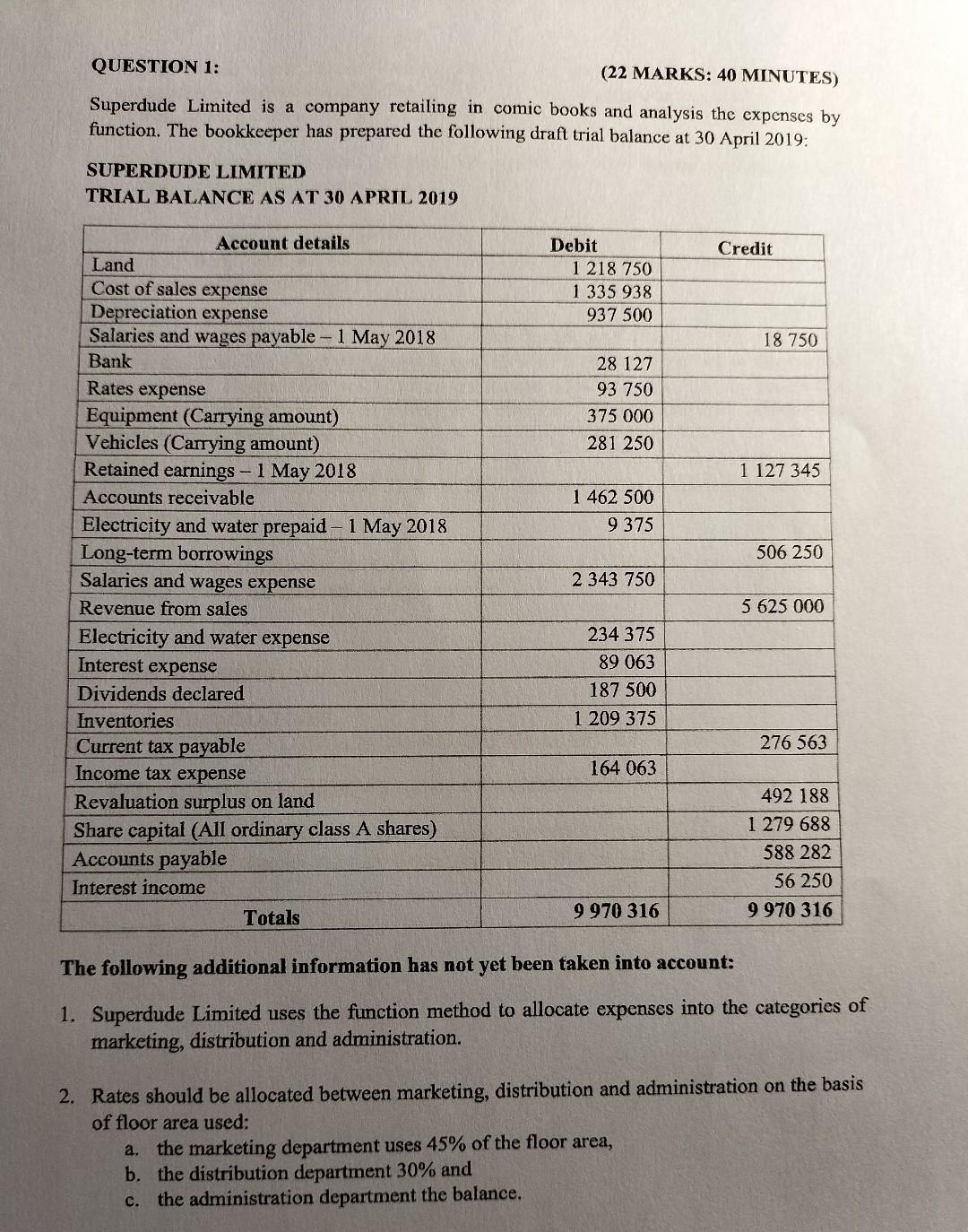

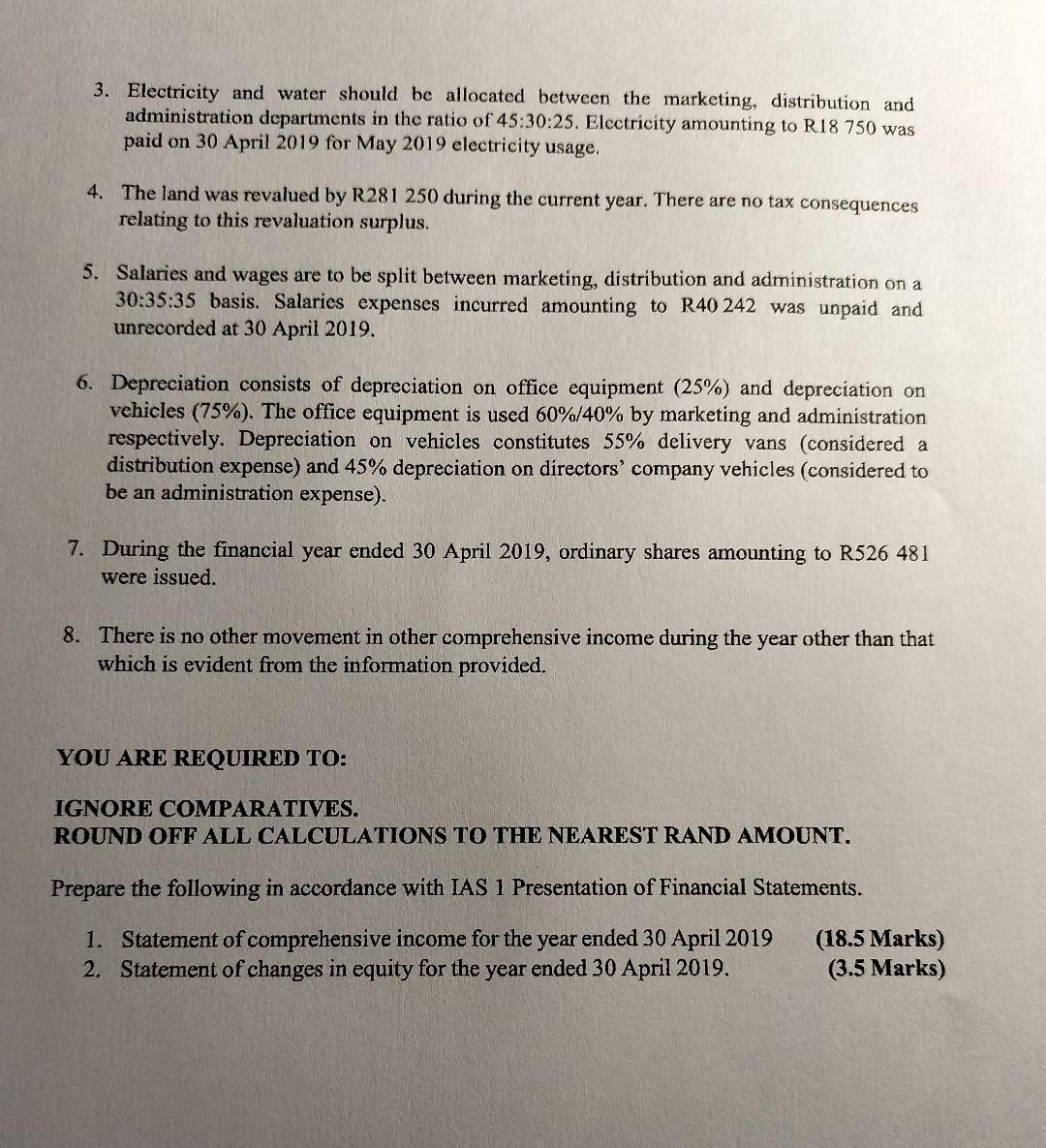

QUESTION 1: (22 MARKS: 40 MINUTES) Superdude Limited is a company retailing in comic books and analysis the expenses by function. The bookkeeper has prepared the following draft trial balance at 30 April 2019: SUPERDUDE LIMITED TRIAL BALANCE AS AT 30 APRIL 2019 The following additional information has not yet been taken into account: 1. Superdude Limited uses the function method to allocate expenses into the categories of marketing, distribution and administration. 2. Rates should be allocated between marketing, distribution and administration on the basis of floor area used: a. the marketing department uses 45% of the floor area, b. the distribution department 30% and c. the administration department the balance. 3. Electricity and water should be allocated between the marketing, distribution and administration departments in the ratio of 45:30:25. Electricity amounting to R 18750 was paid on 30 April 2019 for May 2019 electricity usage. 4. The land was revalued by R281 250 during the current year. There are no tax consequences relating to this revaluation surplus. 5. Salaries and wages are to be split between marketing, distribution and administration on a 30:35:35 basis. Salaries expenses incurred amounting to R40 242 was unpaid and unrecorded at 30 April 2019. 6. Depreciation consists of depreciation on office equipment (25%) and depreciation on vehicles (75%). The office equipment is used 60%/40% by marketing and administration respectively. Depreciation on vehicles constitutes 55% delivery vans (considered a distribution expense) and 45% depreciation on directors' company vehicles (considered to be an administration expense). 7. During the financial year ended 30 April 2019, ordinary shares amounting to R526 481 were issued. 8. There is no other movement in other comprehensive income during the year other than that which is evident from the information provided. YOU ARE REQUIRED TO: IGNORE COMPARATIVES. ROUND OFF ALL CALCULATIONS TO THE NEAREST RAND AMOUNT. Prepare the following in accordance with IAS 1 Presentation of Financial Statements. 1. Statement of comprehensive income for the year ended 30 April 2019 (18.5 Marks) 2. Statement of changes in equity for the year ended 30 April 2019. (3.5 Marks) QUESTION 1: (22 MARKS: 40 MINUTES) Superdude Limited is a company retailing in comic books and analysis the expenses by function. The bookkeeper has prepared the following draft trial balance at 30 April 2019: SUPERDUDE LIMITED TRIAL BALANCE AS AT 30 APRIL 2019 The following additional information has not yet been taken into account: 1. Superdude Limited uses the function method to allocate expenses into the categories of marketing, distribution and administration. 2. Rates should be allocated between marketing, distribution and administration on the basis of floor area used: a. the marketing department uses 45% of the floor area, b. the distribution department 30% and c. the administration department the balance. 3. Electricity and water should be allocated between the marketing, distribution and administration departments in the ratio of 45:30:25. Electricity amounting to R 18750 was paid on 30 April 2019 for May 2019 electricity usage. 4. The land was revalued by R281 250 during the current year. There are no tax consequences relating to this revaluation surplus. 5. Salaries and wages are to be split between marketing, distribution and administration on a 30:35:35 basis. Salaries expenses incurred amounting to R40 242 was unpaid and unrecorded at 30 April 2019. 6. Depreciation consists of depreciation on office equipment (25%) and depreciation on vehicles (75%). The office equipment is used 60%/40% by marketing and administration respectively. Depreciation on vehicles constitutes 55% delivery vans (considered a distribution expense) and 45% depreciation on directors' company vehicles (considered to be an administration expense). 7. During the financial year ended 30 April 2019, ordinary shares amounting to R526 481 were issued. 8. There is no other movement in other comprehensive income during the year other than that which is evident from the information provided. YOU ARE REQUIRED TO: IGNORE COMPARATIVES. ROUND OFF ALL CALCULATIONS TO THE NEAREST RAND AMOUNT. Prepare the following in accordance with IAS 1 Presentation of Financial Statements. 1. Statement of comprehensive income for the year ended 30 April 2019 (18.5 Marks) 2. Statement of changes in equity for the year ended 30 April 2019. (3.5 Marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started