Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hi, can someone please help me fill in these blanks? I do not know what goes there. Also, the top part is the example my

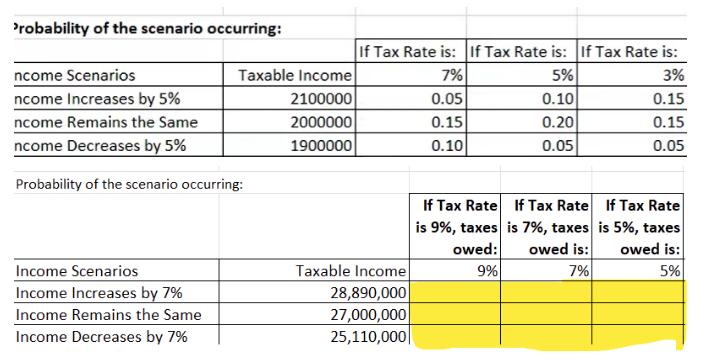

Hi, can someone please help me fill in these blanks? I do not know what goes there. Also, the top part is the example my teacher gave but i'm not sure how she got those.

thanks

Image transcription text

Image transcription textProbability of the scenario occurring: If Tax Rate is: If Tax Rate is: If Tax Rate is: ncome Scenarios Taxable Income 7% 5% 3% ncome Increases by 5% 2100000 0.05 0.10 0.15 ncome Remains the Same 2000000 0.15 0.20 0.15 ncome Decreases by 5% 1900000 0.10 0.05 0.05 Probability of the scenario occurring: Income Scenarios Income Increases by 7% Income Remains the Same Income Decreases by 7% Taxable Income 28,890,000 27,000,000 25,110,000 If Tax Rate If Tax Rate If Tax Rate is 9%, taxes is 7%, taxes is 5%, taxes owed: 9% owed is: 7% owed is: 5%

Step by Step Solution

★★★★★

3.33 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER Probability of the scenario occurring If Tax Rate is 7 005 5 010 3 015 Inco...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started