Answered step by step

Verified Expert Solution

Question

1 Approved Answer

hi can u give me proper answer the answer earlier is wrong 5 Problem 3 0 pts) GUMO, Inc., a leading manufacturer of Solar Panels

hi can u give me proper answer the answer earlier is wrong

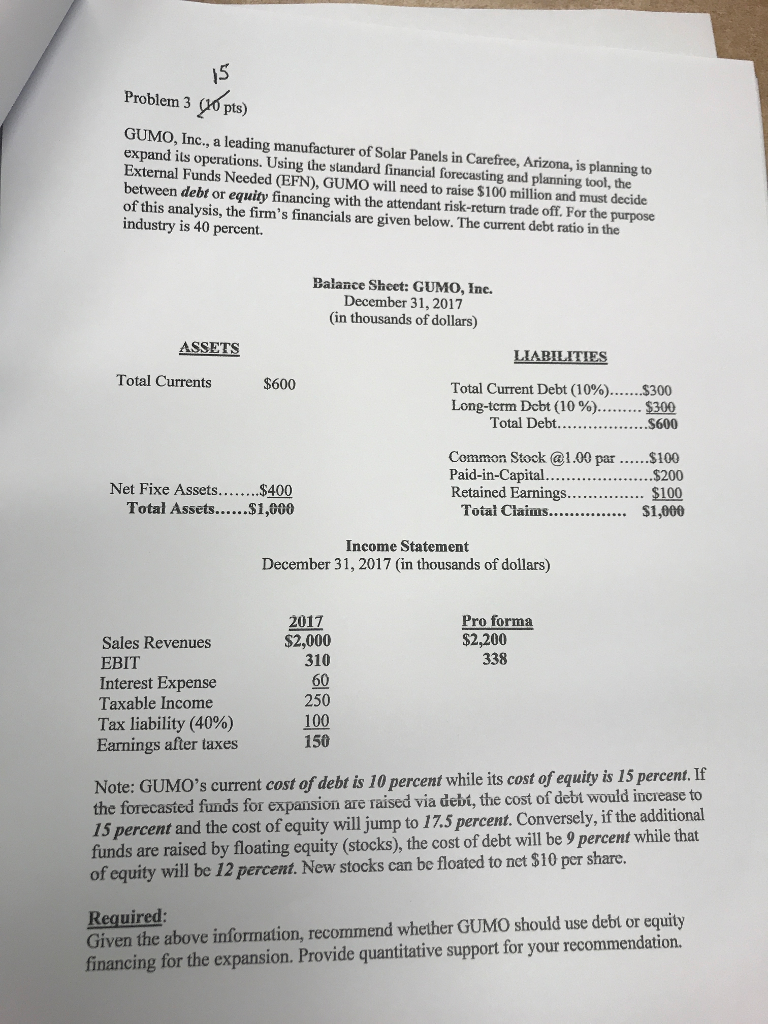

5 Problem 3 0 pts) GUMO, Inc., a leading manufacturer of Solar Panels in Carefree, Arizona, is planning to expand its operations. Using the standard financial forecasting and planning tool, the External Funds Needed (EFN), GUMO will need to raise $100 million and must decide between debt or equity financing with the attendant risk-return trade off. For the purpose of this analysis, the firm's financials are given below. The current debt ratio in the industry is 40 percent. Balance Sheet: GUMO, Inc. December 31,2017 (in thousands of dollars) ASSETS LIABILITIES Total Currents $600 Total Current Debt (10%) Long-term Debt (10 %) 5300 $300 Total Debs600 Common Stock1.00 par ....100 Paid-in-Capital Retained Earnings $100 $1,000 Income Statement December 31, 2017 (in thousands of dollars) Pro forma $2,200 2017 Sales Revenues EBIT Interest Expense Taxable Income Tax liability (40%) Earnings after taxes $2,000 310 60 250 100 150 338 Note: GUM0%current cost of debt is 10 percent while its cost of equity is 15 percent if the forecasted funds for expansion are raised via debt, the cost of debt would increase to 15 percent and the cost of equity will jump to 17.5 percent. Conversely, if the additional funds are raised by floating equity (stocks), the cost of debt will be 9 percent while that of equity will be 12 percent. New stocks can be floated to net $10 per sharc. Required Given the above information, recommend whether GUMO should use debl or equity financing for the expansion. Provide quantitative support for your recommendationStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started