Answered step by step

Verified Expert Solution

Question

1 Approved Answer

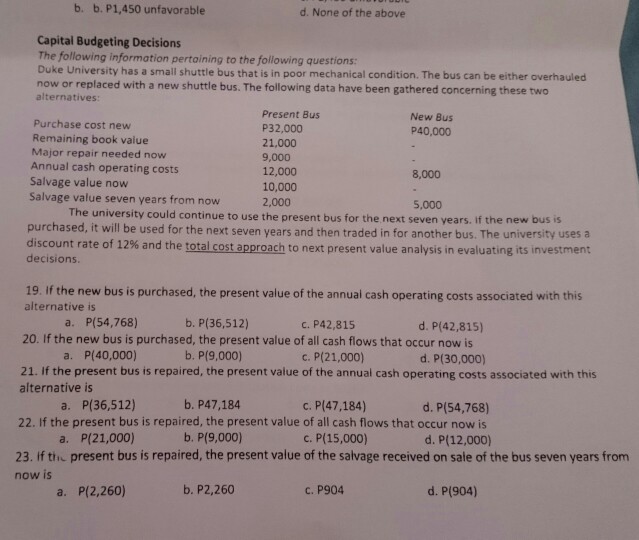

hi can you answer this question with solution please? thanks b. b. P1,450 unfavorable d. None of the above Capital Budgeting Decisions The following information

hi can you answer this question with solution please? thanks

b. b. P1,450 unfavorable d. None of the above Capital Budgeting Decisions The following information pertaining to the following questions Duke University has a small shuttle bus that is in poor mechanical condition. The bus can be either overhauled now or replaced with a new shuttle bus. The following data have been gathered concerning these two alternatives Present Bus P32,000 21,000 9,000 12,000 10,000 2,000 New Bus P40,000 Purchase cost new Remaining book value Major repair needed now Annual cash operating costs Salvage value now Salvage value seven years from now 8,000 5,000 Th e university could continue to use the present bus for the next seven years. if the new bus is purchased, it will be used for the next seven years and then traded in for another bus. The university uses a discount rate of 12% and the total cost approach to next p decisions resent value analysis in evaluating its investment 19. If the new bus is purchased, the present value of the annual cash operating costs associated with this alternative is 20. If the new bus is purchased, the present value of all cash flows that occur now is 21. If the present bus is repaired, the present value of the annual cash operating costs associated with this a. P(54,768) b. P(36,512) c. P42,815 d. P(42,815) a. P(40,000) b. P(9,000) c. P(21,000) d. P(30,000) alternative is 22. If the present bus is repaired, the present value of all cash flows that occur now is 23. if thi present bus is repaired, the present value of the salvage received on sale of the bus seven years from a. P(36,512) b. P47,184 C. P(47,184) d. P(54,768) a. P(21,000) b. P(9,000) c. P(15,000) d. P(12,000) now is a. P(2,260) b. P2,260 c. P904 d. P(904)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started