Hi can you please help me fill out the yellow parts? The yellow parts with numbers already in them are correct.

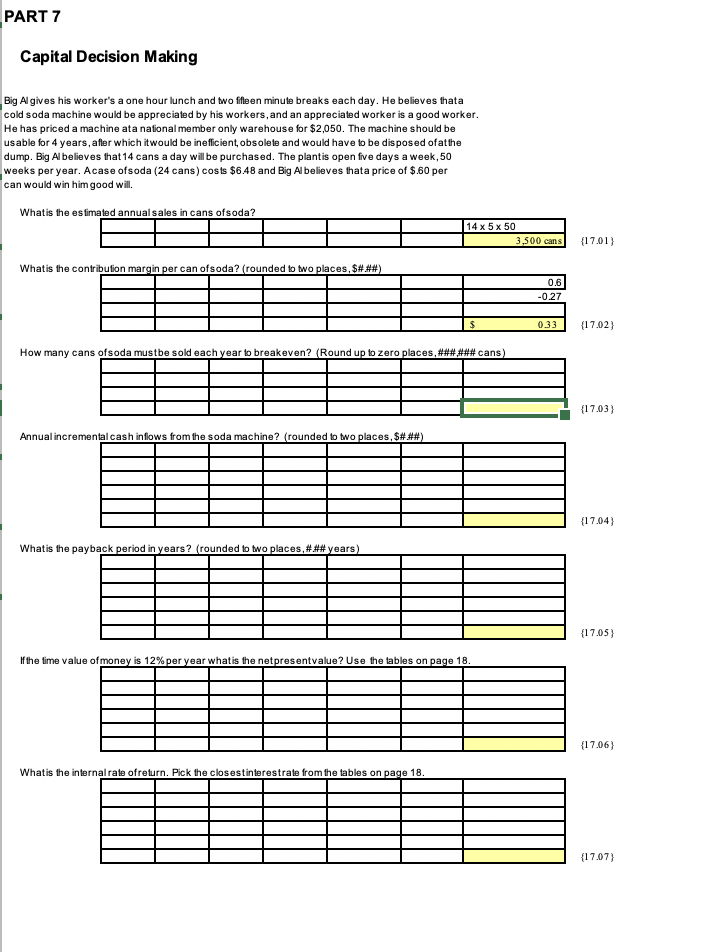

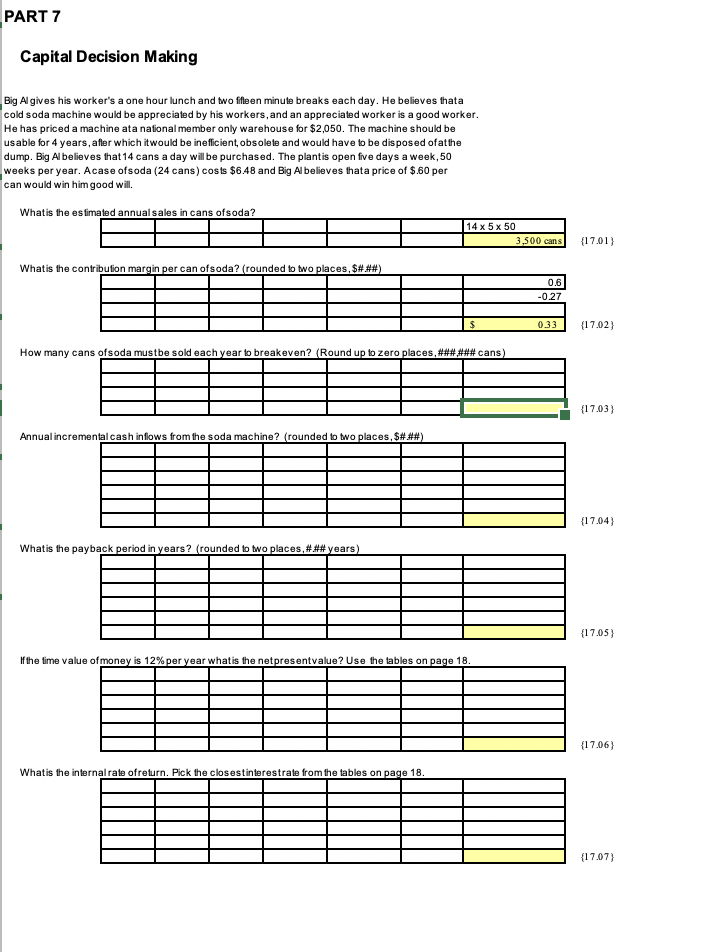

PART 7 Capital Decision Making Big Al gives his worker's a one hour lunch and two fifteen minute breaks each day. He believes thata cold soda machine would be appreciated by his workers, and an appreciated worker is a good worker. He has priced a machine ata national member only warehouse for $2,050. The machine should be usable for 4 years, after which it would be inefficient, obsolete and would have to be disposed of at the dump. Big Al believes that 14 cans a day will be purchased. The plantis open five days a week, 50 weeks per year. Acase ofsoda (24 cans) costs $6.48 and Big Al believes thata price of $.60 per can would win him good will. What is the estimated annual sales in cans ofsoda? 14 x 5 x 50 What is the contribution margin per can ofsoda? (rounded to two places, $###) $ How many cans ofsoda must be sold each year to breakeven? (Round up to zero places, ### ### cans) Annual incremental cash inflows from the soda machine? (rounded to two places, $###) What is the payback period in years? (rounded to two places, ### years) If the time value of money is 12% per year what is the netpresentvalue? Use the tables on page 18. What is the internal rate ofreturn. Pick the closest interestrate from the tables on page 18. 3,500 cans 0.6 -0.27 0.33 (17.01) (17.02) (17.03} (17.04} {17.05} (17.06) (17.07) PART 7 Capital Decision Making Big Al gives his worker's a one hour lunch and two fifteen minute breaks each day. He believes thata cold soda machine would be appreciated by his workers, and an appreciated worker is a good worker. He has priced a machine ata national member only warehouse for $2,050. The machine should be usable for 4 years, after which it would be inefficient, obsolete and would have to be disposed of at the dump. Big Al believes that 14 cans a day will be purchased. The plantis open five days a week, 50 weeks per year. Acase ofsoda (24 cans) costs $6.48 and Big Al believes thata price of $.60 per can would win him good will. What is the estimated annual sales in cans ofsoda? 14 x 5 x 50 What is the contribution margin per can ofsoda? (rounded to two places, $###) $ How many cans ofsoda must be sold each year to breakeven? (Round up to zero places, ### ### cans) Annual incremental cash inflows from the soda machine? (rounded to two places, $###) What is the payback period in years? (rounded to two places, ### years) If the time value of money is 12% per year what is the netpresentvalue? Use the tables on page 18. What is the internal rate ofreturn. Pick the closest interestrate from the tables on page 18. 3,500 cans 0.6 -0.27 0.33 (17.01) (17.02) (17.03} (17.04} {17.05} (17.06) (17.07)