Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hi! Can you please help me with these questions as my teacher did not provide the answers. Thanks! A bank bill with a face value

Hi!

Can you please help me with these questions as my teacher did not provide the answers.

Thanks!

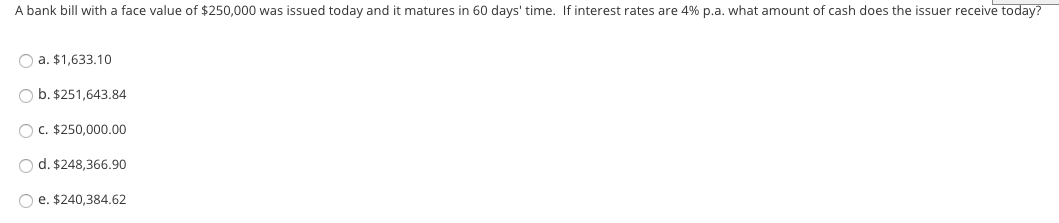

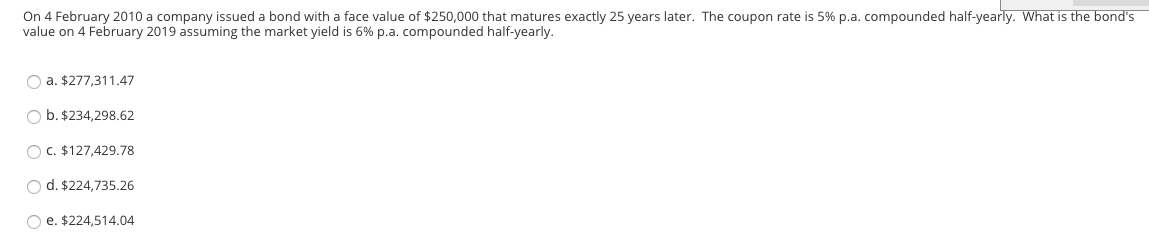

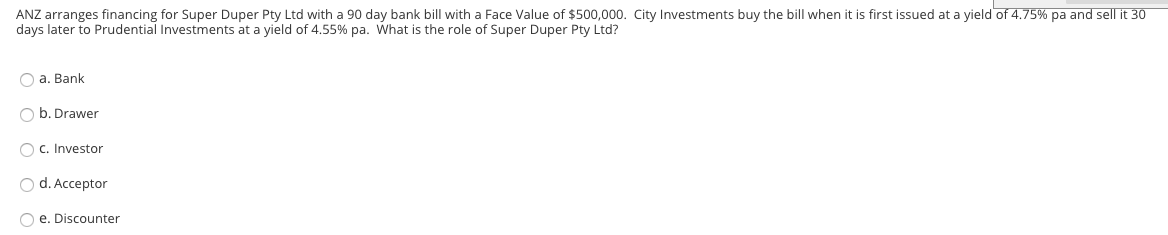

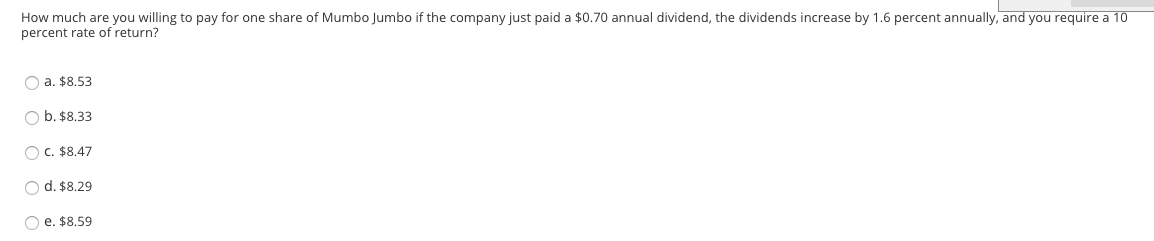

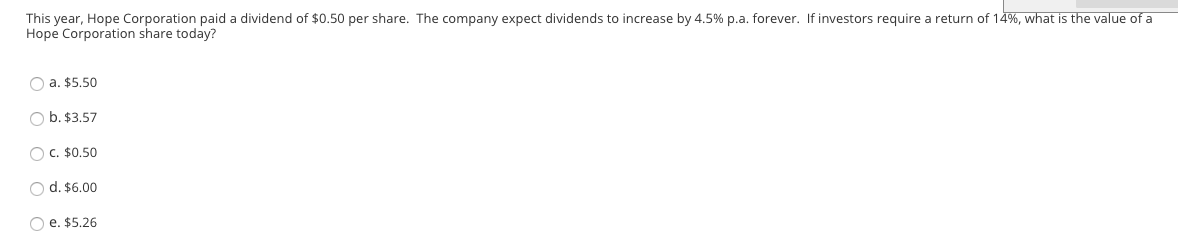

A bank bill with a face value of $250,000 was issued today and it matures in 60 days' time. If interest rates are 4% p.a. what amount of cash does the issuer receive today? O a. $1,633.10 b. $251,643.84 c. $250,000.00 d. $248,366.90 e. $240,384.62 On 4 February 2010 a company issued a bond with a face value of $250,000 that matures exactly 25 years later. The coupon rate is 5% p.a. compounded half-yearly. What is the bond's value on 4 February 2019 assuming the market yield is 6% p.a. compounded half-yearly. a. $277,311.47 b. $234,298.62 C. $127,429.78 od. $224,735.26 e. $224,514.04 ANZ arranges financing for Super Duper Pty Ltd with a 90 day bank bill with a Face Value of $500,000. City Investments buy the bill when it is first issued at a yield of 4.75% pa and sell it 30 days later to Prudential Investments at a yield of 4.55% pa. What is the role of Super Duper Pty Ltd? a. Bank b. Drawer OC. Investor O d. Acceptor e. Discounter How much are you willing to pay for one share of Mumbo Jumbo if the company just paid a $0.70 annual dividend, the dividends increase by 1.6 percent annually, and you require a 10 percent rate of return? a. $8.53 b. $8.33 OC. $8.47 d. $8.29 e. $8.59 This year, Hope Corporation paid a dividend of $0.50 per share. The company expect dividends to increase by 4.5% p.a. forever. If investors require a return of 14%, what is the value of a Hope Corporation share today? a. $5.50 b. $3.57 c. $0.50 d. $6.00 O e. $5.26Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started