Answered step by step

Verified Expert Solution

Question

1 Approved Answer

hi can you please help with this question thankyou Total: 18 marks Sx Question 5 Business combinations On 1 July 2016 Jenny Ltd and Susie

hi can you please help with this question thankyou

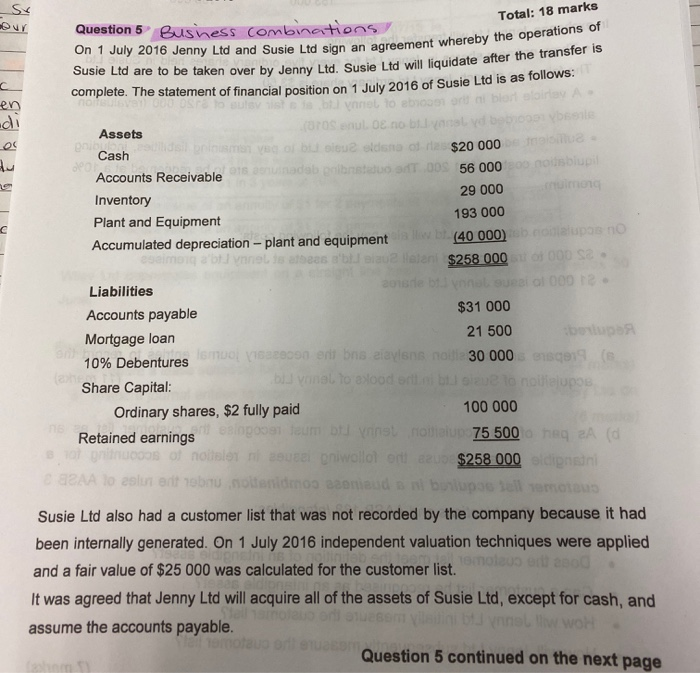

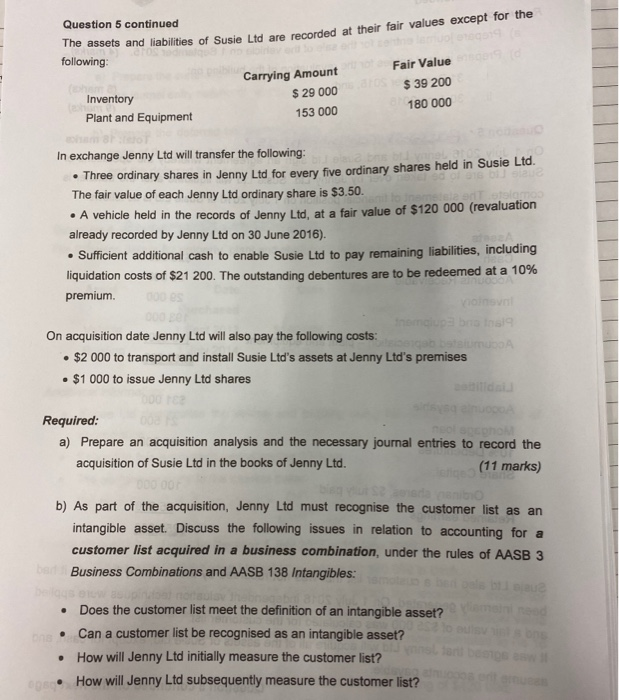

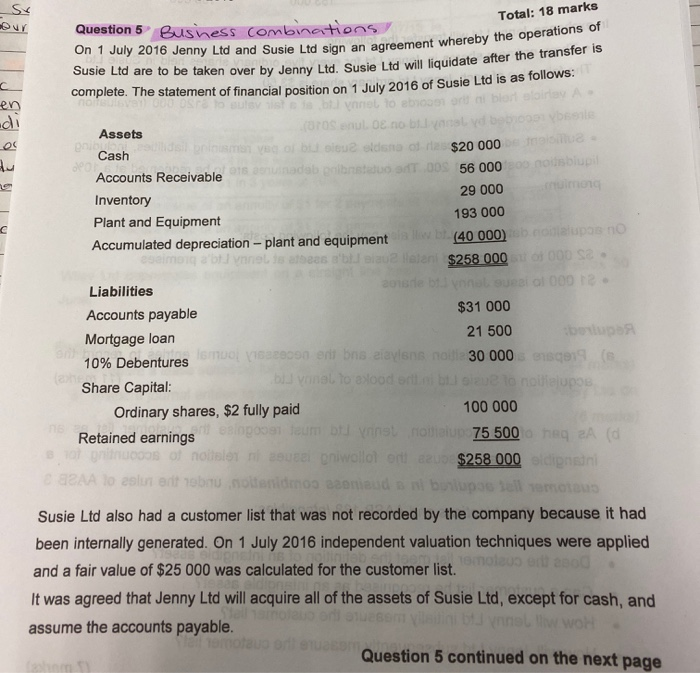

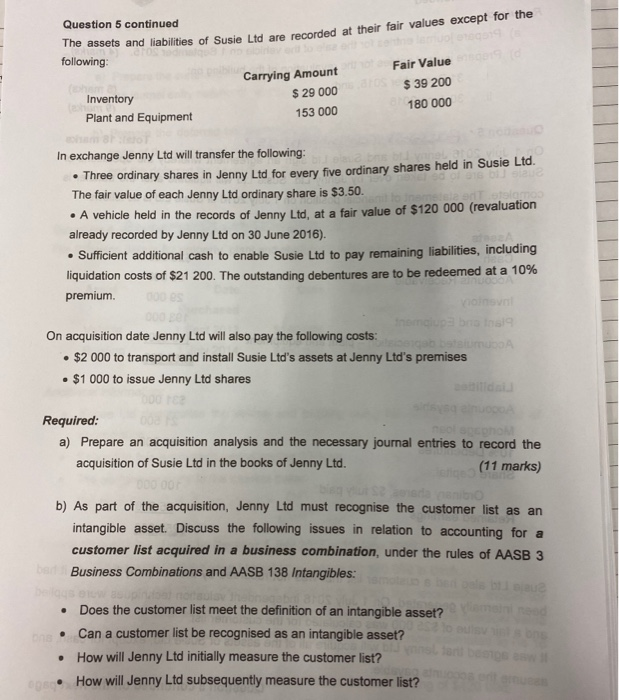

Total: 18 marks Sx Question 5 Business combinations On 1 July 2016 Jenny Ltd and Susie Ltd sign an agreement whereby the operations of Susie Ltd are to be taken over by Jenny Ltd. Susie Ltd will liquidate after the transfer is en complete. The statement of financial position on 1 July 2016 of Susie Ltd is as follows: di Assets OTOCUL Once Cash BRITISH VERSO bulatu eldonon $20 000 de budi Accounts Receivable dab absted DOS 56 000 29 000 huimang Inventory Plant and Equipment 193 000 Accumulated depreciation - plant and equipment (40 000) bollupes no en $258 000 000 sa Liabilities 2018 O 0002 Accounts payable $31 000 Mortgage loan 21 500 10% Debenturesolvisseecon dibris taylans no 30 000 Share Capital blonel to slood or to noitelupar Ordinary shares, $2 fully paid 100 000 Retained earnings soos Dvinst Mollu 75 500 ha 2A (d Ohooos of nollet ni oniwololo 2 $258 000 dinar A lo es un art bou no tenidos son ni buriuose tell motus Susie Ltd also had a customer list that was not recorded by the company because it had been internally generated On 1 July 2016 independent valuation techniques were applied and a fair value of $25 000 was calculated for the customer list. ole ola It was agreed that Jenny Ltd will acquire all of the assets of Susie Ltd, except for cash, and assume the accounts payable. now wOH Question 5 continued on the next page Question 5 continued The assets and liabilities of Susie Ltd are recorded at their fair values except for the following: Carrying Amount Fair Value Inventory $ 29 000 $ 39 200 Plant and Equipment 153 000 180 000 In exchange Jenny Ltd will transfer the following: Three ordinary shares in Jenny Ltd for every five ordinary shares held in Susie Ltd. The fair value of each Jenny Ltd ordinary share is $3.50. nelor A vehicle held in the records of Jenny Ltd, at a fair value of $120 000 (revaluation already recorded by Jenny Ltd on 30 June 2016). Sufficient additional cash to enable Susie Ltd to pay remaining liabilities, including liquidation costs of $21 200. The outstanding debentures are to be redeemed at a 10% premium Volnavn On acquisition date Jenny Ltd will also pay the following costs: asmuo $2 000 to transport and install Susie Ltd's assets at Jenny Ltd's premises $1 000 to issue Jenny Ltd shares Required: a) Prepare an acquisition analysis and the necessary journal entries to record the acquisition of Susie Ltd in the books of Jenny Ltd. (11 marks) b) As part of the acquisition, Jenny Ltd must recognise the customer list as an intangible asset. Discuss the following issues in relation to accounting for a customer list acquired in a business combination, under the rules of AASB 3 DE Business Combinations and AASB 138 Intangibles: . Does the customer list meet the definition of an intangible asset? Can a customer list be recognised as an intangible asset? How will Jenny Ltd initially measure the customer list? How will Jenny Ltd subsequently measure the customer list? Total: 18 marks Sx Question 5 Business combinations On 1 July 2016 Jenny Ltd and Susie Ltd sign an agreement whereby the operations of Susie Ltd are to be taken over by Jenny Ltd. Susie Ltd will liquidate after the transfer is en complete. The statement of financial position on 1 July 2016 of Susie Ltd is as follows: di Assets OTOCUL Once Cash BRITISH VERSO bulatu eldonon $20 000 de budi Accounts Receivable dab absted DOS 56 000 29 000 huimang Inventory Plant and Equipment 193 000 Accumulated depreciation - plant and equipment (40 000) bollupes no en $258 000 000 sa Liabilities 2018 O 0002 Accounts payable $31 000 Mortgage loan 21 500 10% Debenturesolvisseecon dibris taylans no 30 000 Share Capital blonel to slood or to noitelupar Ordinary shares, $2 fully paid 100 000 Retained earnings soos Dvinst Mollu 75 500 ha 2A (d Ohooos of nollet ni oniwololo 2 $258 000 dinar A lo es un art bou no tenidos son ni buriuose tell motus Susie Ltd also had a customer list that was not recorded by the company because it had been internally generated On 1 July 2016 independent valuation techniques were applied and a fair value of $25 000 was calculated for the customer list. ole ola It was agreed that Jenny Ltd will acquire all of the assets of Susie Ltd, except for cash, and assume the accounts payable. now wOH Question 5 continued on the next page Question 5 continued The assets and liabilities of Susie Ltd are recorded at their fair values except for the following: Carrying Amount Fair Value Inventory $ 29 000 $ 39 200 Plant and Equipment 153 000 180 000 In exchange Jenny Ltd will transfer the following: Three ordinary shares in Jenny Ltd for every five ordinary shares held in Susie Ltd. The fair value of each Jenny Ltd ordinary share is $3.50. nelor A vehicle held in the records of Jenny Ltd, at a fair value of $120 000 (revaluation already recorded by Jenny Ltd on 30 June 2016). Sufficient additional cash to enable Susie Ltd to pay remaining liabilities, including liquidation costs of $21 200. The outstanding debentures are to be redeemed at a 10% premium Volnavn On acquisition date Jenny Ltd will also pay the following costs: asmuo $2 000 to transport and install Susie Ltd's assets at Jenny Ltd's premises $1 000 to issue Jenny Ltd shares Required: a) Prepare an acquisition analysis and the necessary journal entries to record the acquisition of Susie Ltd in the books of Jenny Ltd. (11 marks) b) As part of the acquisition, Jenny Ltd must recognise the customer list as an intangible asset. Discuss the following issues in relation to accounting for a customer list acquired in a business combination, under the rules of AASB 3 DE Business Combinations and AASB 138 Intangibles: . Does the customer list meet the definition of an intangible asset? Can a customer list be recognised as an intangible asset? How will Jenny Ltd initially measure the customer list? How will Jenny Ltd subsequently measure the customer list

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started