Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hi, Could someone please walk me through how the spot rates were calculated from the yields to maturity for the problem below? Thanks EXAMPLE 2

Hi,

Could someone please walk me through how the spot rates were calculated from the yields to maturity for the problem below?

Thanks

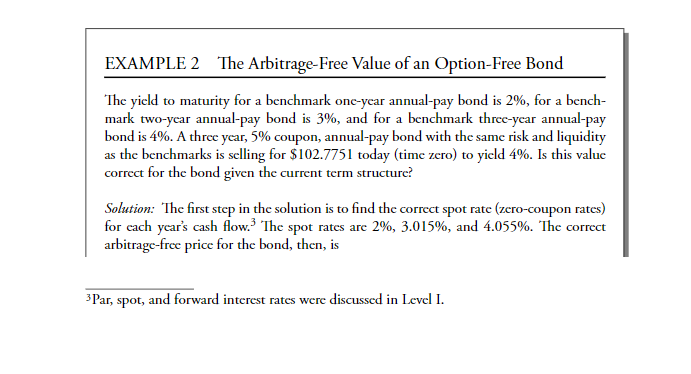

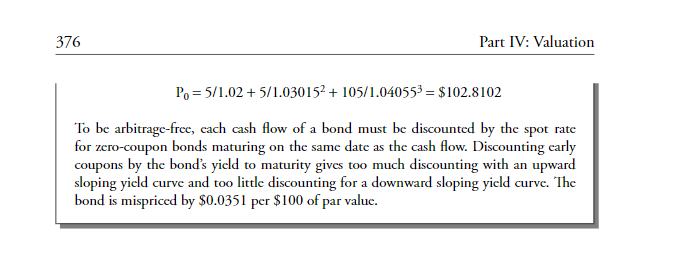

EXAMPLE 2 The Arbitrage-Free Value of an Option-Free Bond The yield to maturity for a benchmark one-year annual-pay bond is 2%, for a bench- mark two-year annual-pay bond is 3%, and for a benchmark three-year annual-pay bond is 4%. A three year, 5% coupon, annual-pay bond with the same risk and liquidity as the benchmarks is selling for $102.7751 today (time zero) to yield 4%. Is this value correct for the bond given the current term structure? Solution: The first step in the solution is to find the correct spot rate (zero-coupon rates) for each year's cash flow. The spot rates are 2%, 3.015%, and 4.055%. The correct arbitrage-free price for the bond, then, is 3 Par, spot, and forward interest rates were discussed in Level I. 376 Part IV: Valuation Po = 5/1.02 + 5/1.030152 + 105/1.040553 = $102.8102 To be arbitrage-free, cach cash flow of a bond must be discounted by the spot rate for zero-coupon bonds maturing on the same date as the cash flow. Discounting early coupons by the bond's yield to maturity gives too much discounting with an upward sloping yield curve and too little discounting for a downward sloping yield curve. The bond is mispriced by $0.0351 per $100 of par value

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started