Hi, could you help and guide me through the steps to solve these exercises It's about finding the BNE for the Akerlof model on the market of lemon car, Thanks for your help. I get stuck in the beginning. Thanks a lot

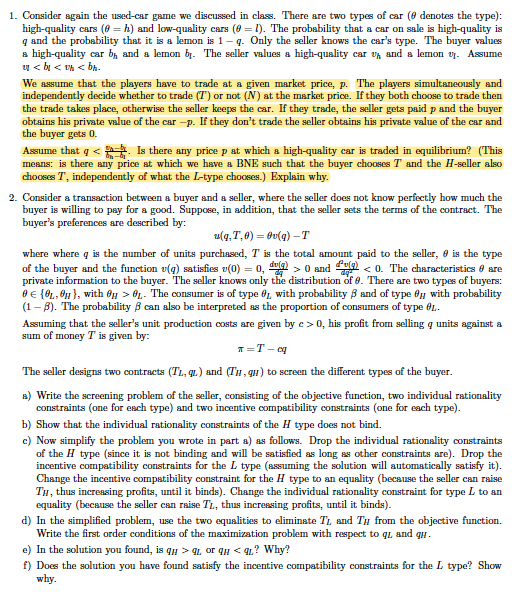

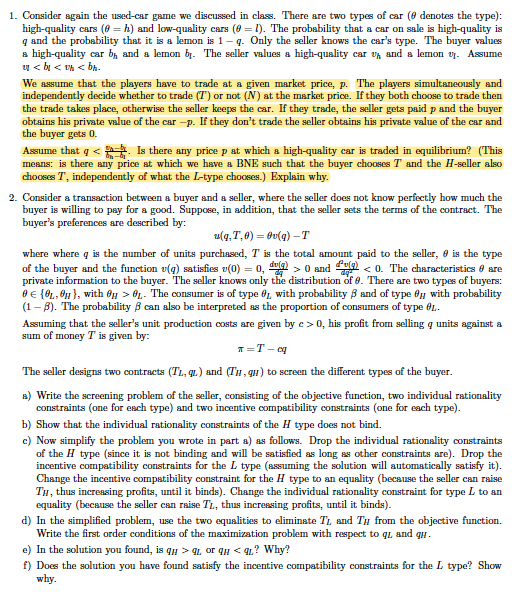

1. Consider again the used car game we discussed in class. There are two types of car ( denotes the type): high-quality cars (@=h) and low-quality cars (=1). The probability that a car on sale is high-quality is q and the probability that it is a lemon is 1-9. Only the seller knows the car's type. The buyer values a high-quality car by and a lemon br. The seller values a high-quality car un and a lemon 1. Assume u

and B.. The consumer is of type 0, with probability B and of type , with probability (1 - B). The probability B can also be interpreted as the proportion of consumers of type L. Assuming that the seller's unit production costs are given by c>0, his profit from selling q units against a sum of money T is given by: TET- The seller designs two contracts (TL, 9L) and (Th, gu) to screen the different types of the buyer. a) Write the screening problem of the seller, consisting of the objective function, two individual rationality constraints (one for each type) and two incentive compatibility constraints (one for each type). b) Show that the individual rationality constraints of the H type does not bind. c) Now simplify the problem you wrote in part a) as follows. Drop the individual rationality constraints of the H type (since it is not binding and will be satisfied as long as other constraints are). Drop the incentive compatibility constraints for the L type (assuming the solution will automatically satisfy it). Change the incentive compatibility constraint for the H type to an equality (because the seller can raise Th, thus increasing profits, until it binds). Change the individual rationality constraint for type L to an equality (because the seller can raise TL, thus increasing profits, until it binds). d) In the simplified problern, use the two equalities to eliminate T and T, from the objective function. Write the first order conditions of the maximization problem with respect to quand qu. e) In the solution you found, is qu> or qu and B.. The consumer is of type 0, with probability B and of type , with probability (1 - B). The probability B can also be interpreted as the proportion of consumers of type L. Assuming that the seller's unit production costs are given by c>0, his profit from selling q units against a sum of money T is given by: TET- The seller designs two contracts (TL, 9L) and (Th, gu) to screen the different types of the buyer. a) Write the screening problem of the seller, consisting of the objective function, two individual rationality constraints (one for each type) and two incentive compatibility constraints (one for each type). b) Show that the individual rationality constraints of the H type does not bind. c) Now simplify the problem you wrote in part a) as follows. Drop the individual rationality constraints of the H type (since it is not binding and will be satisfied as long as other constraints are). Drop the incentive compatibility constraints for the L type (assuming the solution will automatically satisfy it). Change the incentive compatibility constraint for the H type to an equality (because the seller can raise Th, thus increasing profits, until it binds). Change the individual rationality constraint for type L to an equality (because the seller can raise TL, thus increasing profits, until it binds). d) In the simplified problern, use the two equalities to eliminate T and T, from the objective function. Write the first order conditions of the maximization problem with respect to quand qu. e) In the solution you found, is qu> or qu