Hi, could you help me with two questins.

1.

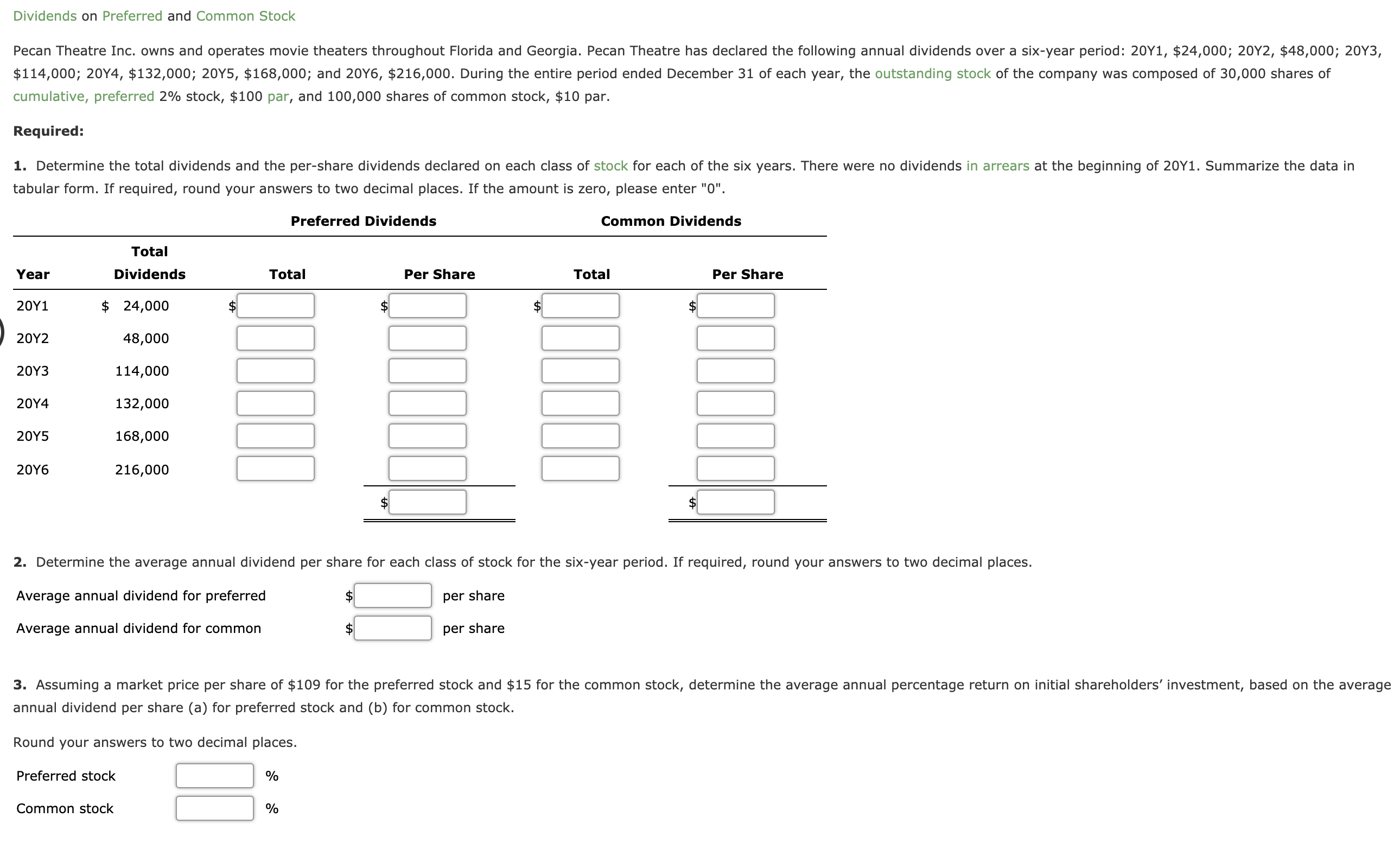

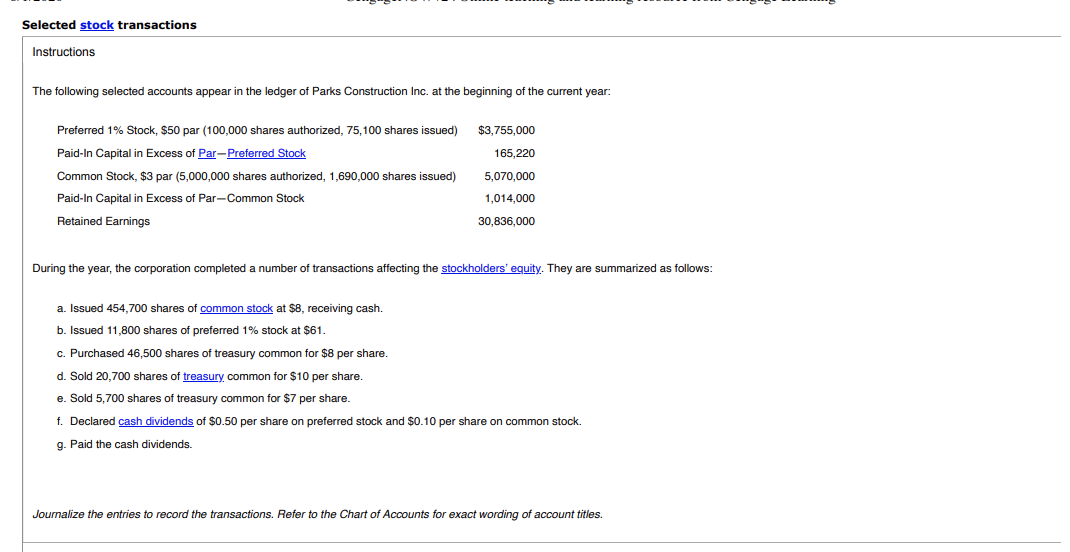

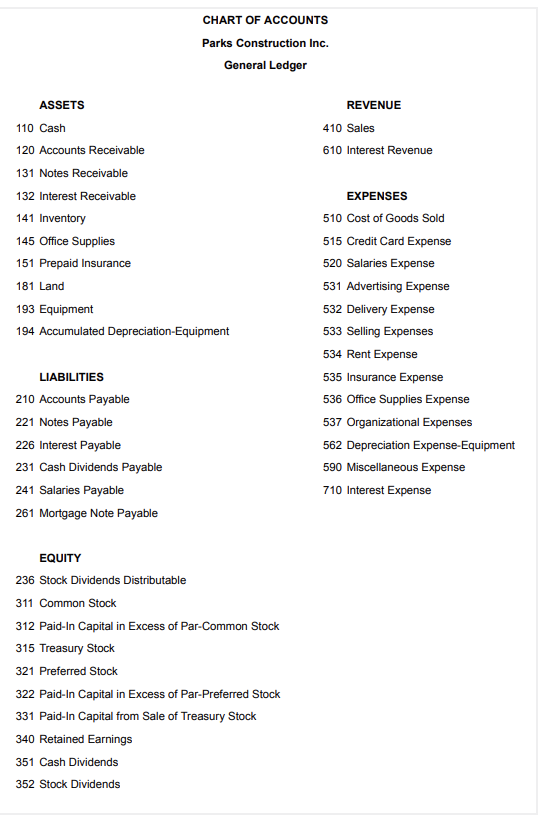

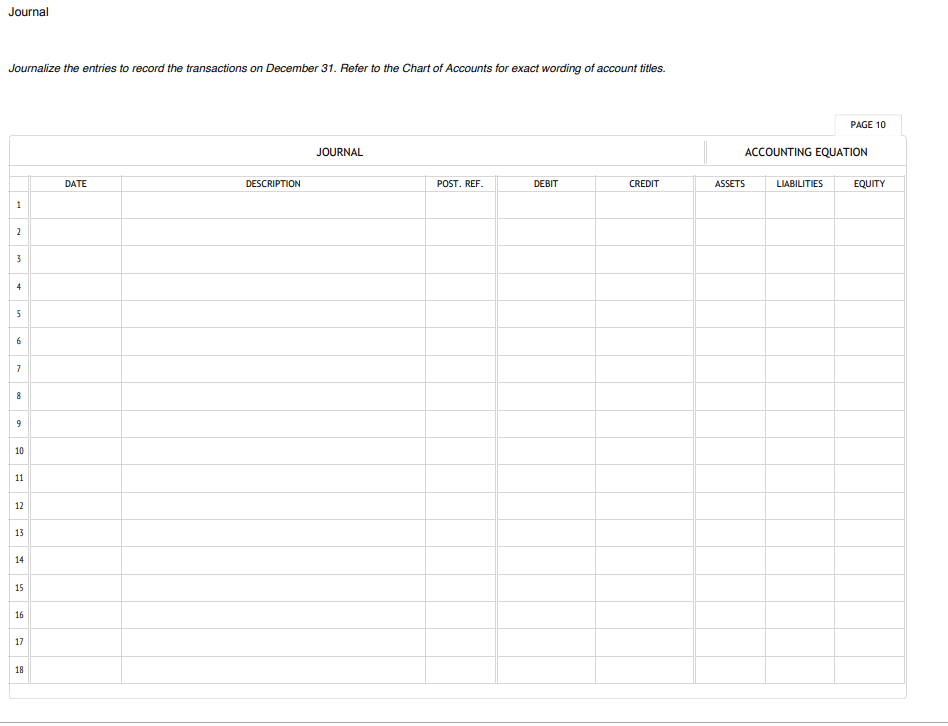

Dividends on Preferred and Common Stock Pecan Theatre Inc. owns and operates movie theaters throughout Florida and Georgia. Pecan Theatre has declared the following annual dividends over a six-year period: 20Y1, $24,000; 20Y2, $48,000; 20Y3, $114,000; 20Y4, $132,000; 20Y5, $168,000; and 20Y6, $216,000. During the entire period ended December 31 of each year, the outstanding stock of the company was composed of 30,000 shares of cumulative, preferred 2% stock, $100 par, and 100,000 shares of common stock, $10 par. Required: 1. Determine the total dividends and the per-share dividends declared on each class of stock for each of the six years. There were no dividends in arrears at the beginning of 20Y1. Summarize the data in tabular form. If required, round your answers to two decimal places. If the amount is zero, please enter "0". Preferred Dividends Common Dividends Total Year Dividends Total Per share Total Per Share 20v1 $ 24,000 $ $ $ $ zovz 48,000 : [: 20Y3 114,000 : :] 20Y4 132,000 [] 20Y5 168,000 | | | 20Y6 216,000 I | I $ $ 2. Determine the average annual dividend per share for each class of stock for the six-year period. If required, round your answers to two decimal places. Average annual dividend for preferred 9; per share UH Average annual dividend for common 3; per share 3. Assuming a market price per share of $109 for the preferred stock and $15 for the common stock, determine the average annual percentage return on initial shareholders' investment, based on the average annual dividend per share (a) for preferred stock and (b) for common stock. Round your answers to two decimal places. Preferred stock [2 % :1 Common stock % Selected stock transactions Instructions The following selected accounts appear in the ledger of Parks Construction Inc. at the beginning of the current year: Preferred 1% Stock, $50 par (100,000 shares authorized, 75,100 shares issued) $3,755,000 Paid-In Capital in Excess of Par-Preferred Stock 165,220 Common Stock, $3 par (5,000,000 shares authorized, 1,690,000 shares issued) 5,070,000 Paid-In Capital in Excess of Par-Common Stock 1,014,000 Retained Earnings 30,836,000 During the year, the corporation completed a number of transactions affecting the stockholders' equity. They are summarized as follows: a. Issued 454,700 shares of common stock at $8, receiving cash. b. Issued 11,800 shares of preferred 1% stock at $61. c. Purchased 46,500 shares of treasury common for $8 per share. d. Sold 20,700 shares of treasury, common for $10 per share. e. Sold 5,700 shares of treasury common for $7 per share. f. Declared cash dividends of $0.50 per share on preferred stock and $0.10 per share on common stock. 9- Paid the cash dividends. Journalize the entries to record the transactions. Refer to the Chart of Accounts for exact wording of account titles.CHART OF ACCOUNTS Parks Construction Inc. General Ledger ASSETS REVENUE 110 Cash 410 Sales 120 Accounts Receivable 610 Interest Revenue 131 Notes Receivable 132 Interest Receivable EXPENSES 141 Inventory 510 Cost of Goods Sold 145 Office Supplies 515 Credit Card Expense 151 Prepaid Insurance 520 Salaries Expense 181 Land 531 Advertising Expense 193 Equipment 532 Delivery Expense 194 Accumulated Depreciation-Equipment 533 Selling Expenses 534 Rent Expense LIABILITIES 535 Insurance Expense 210 Accounts Payable 536 Office Supplies Expense 221 Notes Payable 537 Organizational Expenses 226 Interest Payable 562 Depreciation Expense-Equipment 231 Cash Dividends Payable 590 Miscellaneous Expense 241 Salaries Payable 710 Interest Expense 261 Mortgage Note Payable EQUITY 236 Stock Dividends Distributable 311 Common Stock 312 Paid-In Capital in Excess of Par-Common Stock 315 Treasury Stock 321 Preferred Stock 322 Paid-In Capital in Excess of Par-Preferred Stock 331 Paid-In Capital from Sale of Treasury Stock 340 Retained Earnings 351 Cash Dividends 352 Stock DividendsJournal Journalize the entries to record the transactions on December 31. Refer to the Chart of Accounts for exact wording of account titles. PAGE 10 JOURNAL ACCOUNTING EQUATION DATE DESCRIPTION POST. REF. DEBIT CREDIT ASSETS LIABILITIES EQUITY 1 10 11 12 13 14 15 16 17 18