Answered step by step

Verified Expert Solution

Question

1 Approved Answer

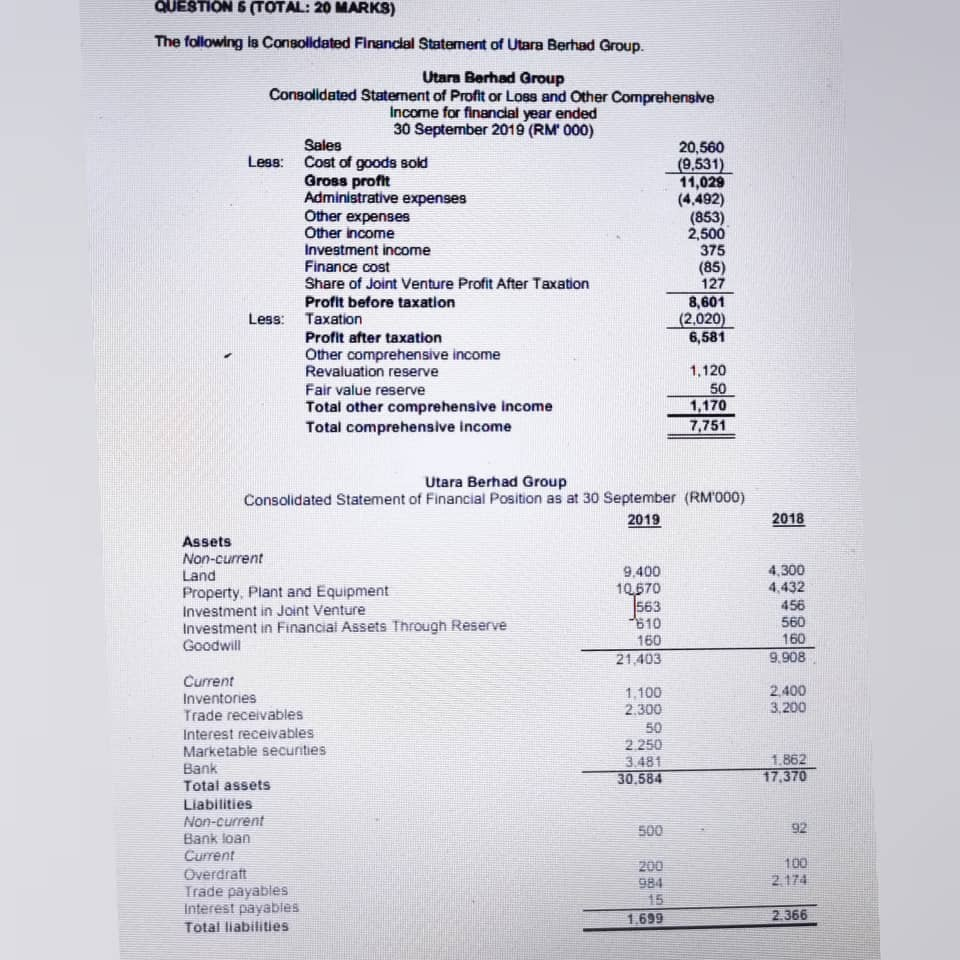

Hi do help me in this question QUESTIONS (TOTAL: 20 MARKS) The following la Consolidated Financial Statement of Utara Berhad Group. Utara Berhad Group Consolidated

Hi do help me in this question

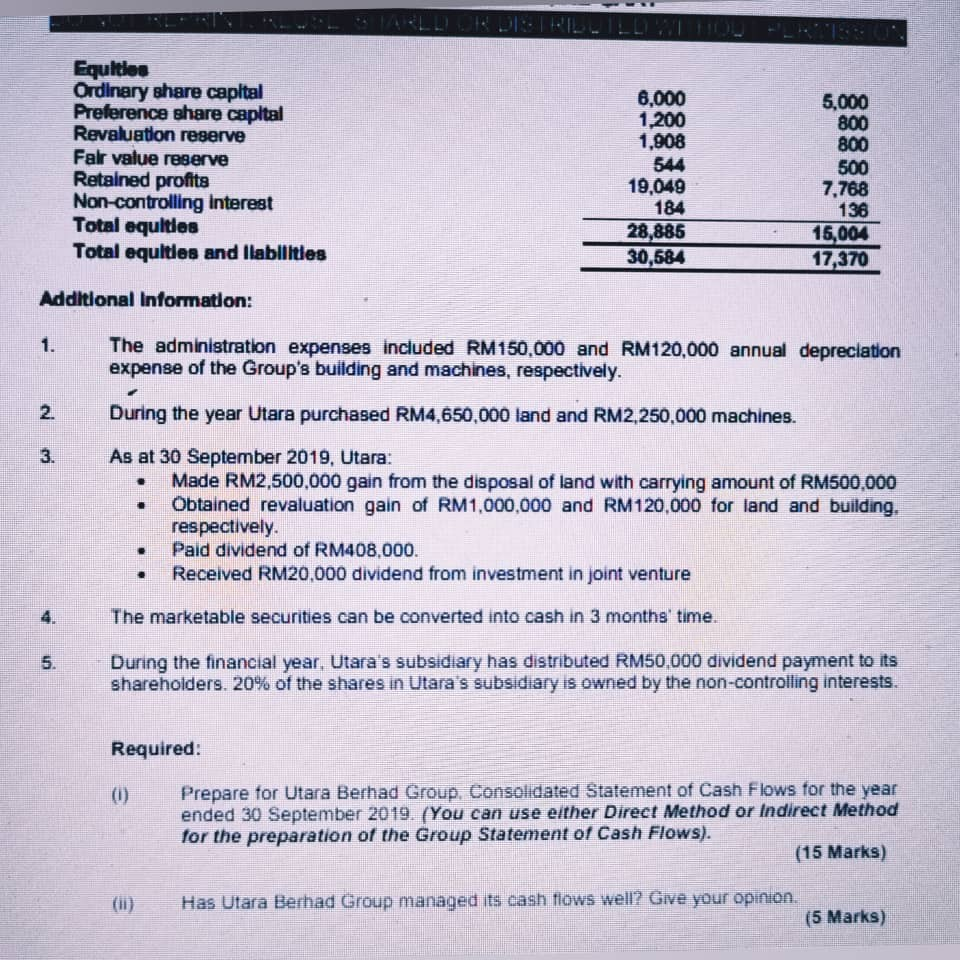

QUESTIONS (TOTAL: 20 MARKS) The following la Consolidated Financial Statement of Utara Berhad Group. Utara Berhad Group Consolidated Statement of Profit or Logs and Other Comprehensive Income for financial year ended 30 September 2019 (RM 000) Sales 20,560 Lees: Cost of goods sold (9,531) Gross profit 11,029 Administrative expenses (4.492) Other expenses (853) Other Income 2,500 Investment income 375 Finance cost (85) Share of Joint Venture Profit After Taxation 127 Profit before taxation 8,601 Less: Taxation (2.020) Profit after taxation 6,581 Other comprehensive income Revaluation reserve 1,120 Fair value reserve 50 Total other comprehensive Income 1,170 Total comprehensive Income 7,751 2018 4.300 4.432 456 560 160 9.908 Utara Berhad Group Consolidated Statement of Financial Position as at 30 September (RM'000) 2019 Assets Non-current Land 9.400 Property. Plant and Equipment 10670 Investment in Joint Venture 1563 Investment in Financial Assets Through Reserve -610 Goodwill 160 21.403 Current Inventories 1.100 Trade receivables 2.300 Interest receivables 50 Marketable secunties 2.250 Bank 3,481 Total assets 30.584 Liabilities Non-current Bank loan Current Overdratt 984 Trade payables Interest payables 15 Total liabilities 1.699 2.400 3,200 1.862 17,370 92 100 2.174 2.366 5,000 800 800 Equities Ordinary share capital Preference share capital Revaluation reserve Falr value reserve Retained profits Non-controlling interest Total equities Total equities and liabilities 6.000 1,200 1,908 544 19,049 184 28,886 30,584 500 7,768 136 15,004 17,370 Additional Information: 1. The administration expenses included RM150,000 and RM120,000 annual depreciation expense of the Group's building and machines, respectively. During the year Utara purchased RM4.650,000 land and RM2,250,000 machines. 3. . As at 30 September 2019, Utara: Made RM2,500,000 gain from the disposal of land with carrying amount of RM500,000 Obtained revaluation gain of RM1,000,000 and RM120,000 for land and building. respectively Paid dividend of RM408,000. Received RM20,000 dividend from investment in joint venture . . The marketable securities can be converted into cash in 3 months' time. 5. During the financial year, Utara's subsidiary has distributed RM50.000 dividend payment to its shareholders. 20% of the shares in Utara's subsidiary is owned by the non-controlling interests. Required: (1) Prepare for Utara Berhad Group. Consolidated Statement of Cash Flows for the year ended 30 September 2019. (You can use either Direct Method or Indirect Method for the preparation of the Group Statement of Cash Flows). (15 Marks) Has Utara Berhad Group managed its cash flows well? Give your opinion. (5 Marks) QUESTIONS (TOTAL: 20 MARKS) The following la Consolidated Financial Statement of Utara Berhad Group. Utara Berhad Group Consolidated Statement of Profit or Logs and Other Comprehensive Income for financial year ended 30 September 2019 (RM 000) Sales 20,560 Lees: Cost of goods sold (9,531) Gross profit 11,029 Administrative expenses (4.492) Other expenses (853) Other Income 2,500 Investment income 375 Finance cost (85) Share of Joint Venture Profit After Taxation 127 Profit before taxation 8,601 Less: Taxation (2.020) Profit after taxation 6,581 Other comprehensive income Revaluation reserve 1,120 Fair value reserve 50 Total other comprehensive Income 1,170 Total comprehensive Income 7,751 2018 4.300 4.432 456 560 160 9.908 Utara Berhad Group Consolidated Statement of Financial Position as at 30 September (RM'000) 2019 Assets Non-current Land 9.400 Property. Plant and Equipment 10670 Investment in Joint Venture 1563 Investment in Financial Assets Through Reserve -610 Goodwill 160 21.403 Current Inventories 1.100 Trade receivables 2.300 Interest receivables 50 Marketable secunties 2.250 Bank 3,481 Total assets 30.584 Liabilities Non-current Bank loan Current Overdratt 984 Trade payables Interest payables 15 Total liabilities 1.699 2.400 3,200 1.862 17,370 92 100 2.174 2.366 5,000 800 800 Equities Ordinary share capital Preference share capital Revaluation reserve Falr value reserve Retained profits Non-controlling interest Total equities Total equities and liabilities 6.000 1,200 1,908 544 19,049 184 28,886 30,584 500 7,768 136 15,004 17,370 Additional Information: 1. The administration expenses included RM150,000 and RM120,000 annual depreciation expense of the Group's building and machines, respectively. During the year Utara purchased RM4.650,000 land and RM2,250,000 machines. 3. . As at 30 September 2019, Utara: Made RM2,500,000 gain from the disposal of land with carrying amount of RM500,000 Obtained revaluation gain of RM1,000,000 and RM120,000 for land and building. respectively Paid dividend of RM408,000. Received RM20,000 dividend from investment in joint venture . . The marketable securities can be converted into cash in 3 months' time. 5. During the financial year, Utara's subsidiary has distributed RM50.000 dividend payment to its shareholders. 20% of the shares in Utara's subsidiary is owned by the non-controlling interests. Required: (1) Prepare for Utara Berhad Group. Consolidated Statement of Cash Flows for the year ended 30 September 2019. (You can use either Direct Method or Indirect Method for the preparation of the Group Statement of Cash Flows). (15 Marks) Has Utara Berhad Group managed its cash flows well? Give your opinionStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started