Question

Hi, Experts , Please help me with this I'm not sure if I had the right answers, thank you Part 1 Jans Floral Boutique is

Hi, Experts ,

Please help me with this I'm not sure if I had the right answers, thank you

Part 1

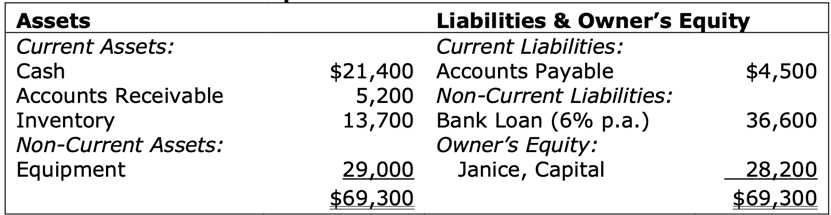

Jans Floral Boutique is a small flower shop that sells a variety of fresh flowers, potted plants and related gift items. The balance sheet at the end of March 2023 is shown below. Transactions for the month of April 2023 are also given (ignore taxes).

Jans Floral Boutique Balance Sheet as at 31 March 2023

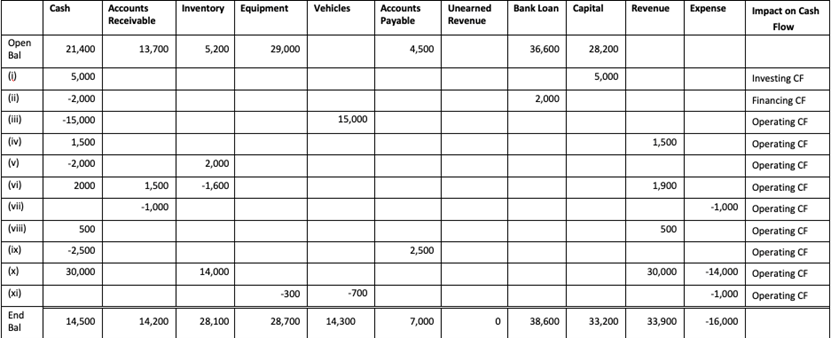

(i) 1 April, Jan invests an additional $5,000

(ii) 2 April, the business makes a $2,000 payment towards the bank loan principal.

(iii) 5 April, Jans Floral Boutique purchases a delivery van for $15,000 cash.

(iv) 7 April, the business pays $1,500 in rent for the month of April.

(v) 10 April, Jans Floral Boutique purchases $2,000 worth of inventory from a wholesaler on credit, with payment due in 30 days.

(vi) 10 April, the business sells $3,500 worth of flowers and gift items, with $1,500 being sold on credit and $2,000 in cash sales. The cost of goods sold for these items is $1,600.

(vii) 14 April, the business hires a part-time employee and pays a salary of $1,000 for the first two weeks of work.

(viii) 19 April, Jans Floral Boutique receives a $500 deposit for a large custom flower arrangement to be delivered in May.

(ix) 20 April, the business pays $2,500 towards the outstanding accounts payable.

(x) 30 April, sales for the rest of the month was $30,000 cash ($14,000 cost).

(xi) 30 April, estimated April depreciation expense of $700 for equipment and $300 for vehicles.

Required:

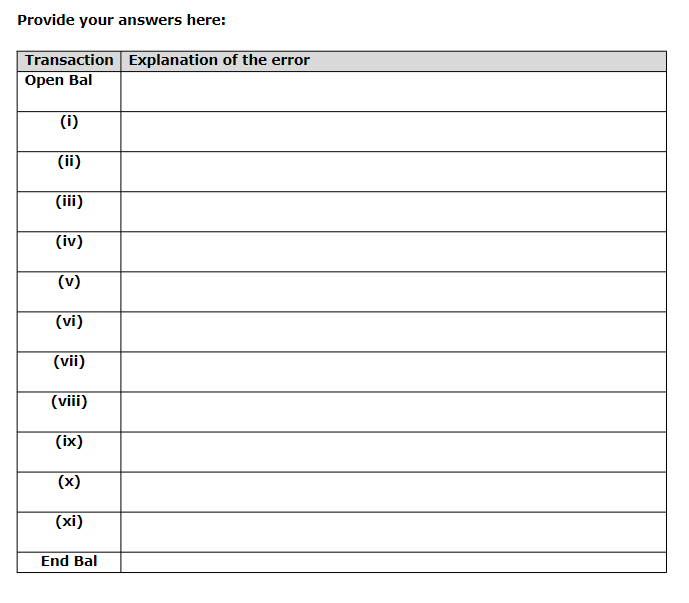

The worksheet has been prepared by a recent accounting graduate (see the answer booklet) Unfortunately, errors have been made in some of the transactions. In the space provided below the pre-prepared worksheet in the answer booklet, explain which transactions are incorrect and why. Note in the Impact on Cash Flow column, the impact on the Cash Flow Statement has been shown.

by writing operating CF, investing CF, financing CF, or no impact.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started