Answered step by step

Verified Expert Solution

Question

1 Approved Answer

hi guys can someone help with problem 1.3 only please, thx Bubbly's tangible assets and liabilities are reported at amounts approximating fair value, and the

hi guys can someone help with problem 1.3 only please, thx

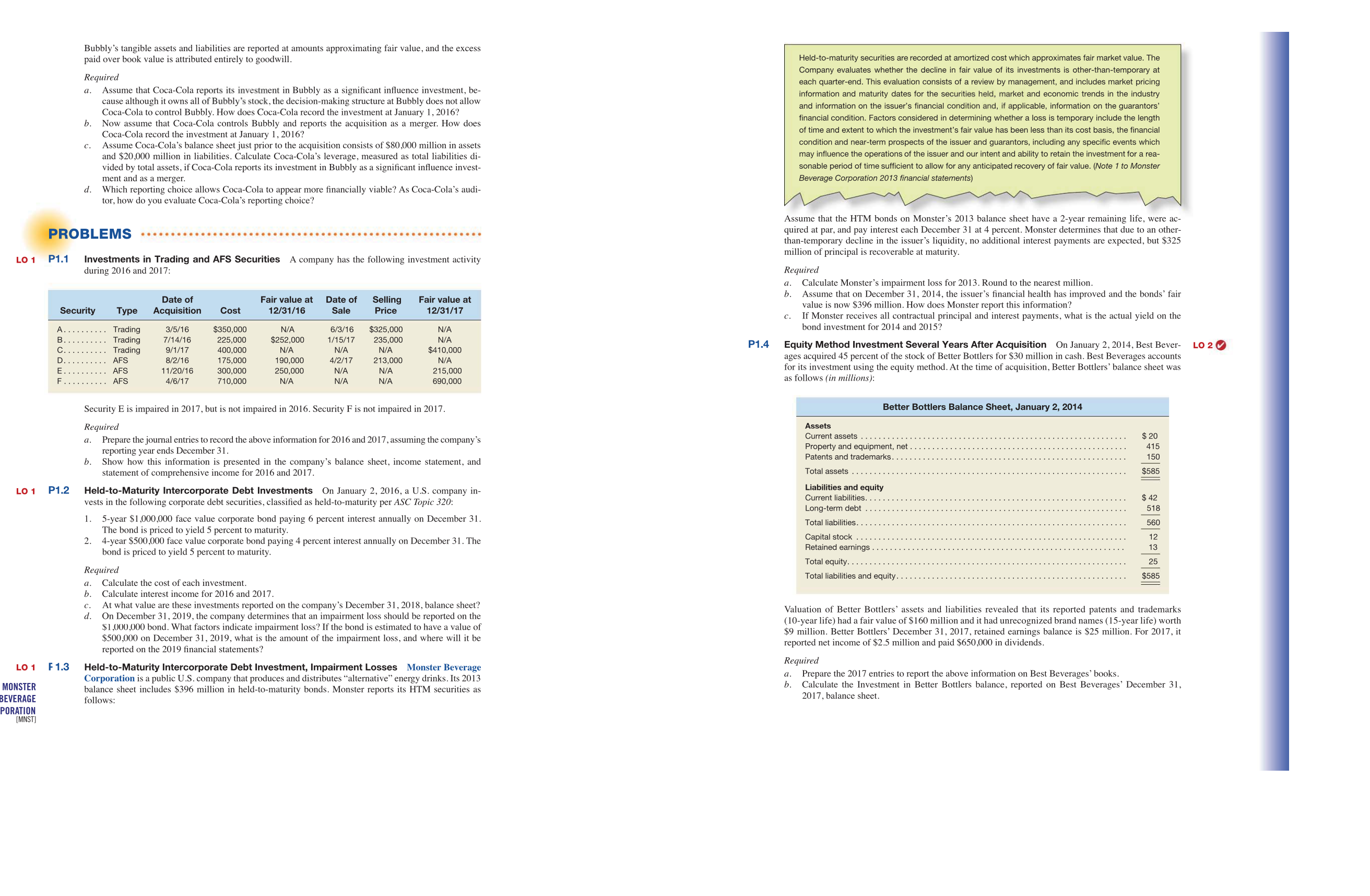

Bubbly's tangible assets and liabilities are reported at amounts approximating fair value, and the excess paid over book value is attributed entirely to goodwill. Required a. Assume that Coca-Cola reports its investment in Bubbly as a significant influence investment, because although it owns all of Bubbly's stock, the decision-making structure at Bubbly does not allow Coca-Cola to control Bubbly. How does Coca-Cola record the investment at January 1, 2016? b. Now assume that Coca-Cola controls Bubbly and reports the acquisition as a merger. How does Coca-Cola record the investment at January 1,2016? c. Assume Coca-Cola's balance sheet just prior to the acquisition consists of $80,000 million in assets and $20,000 million in liabilities. Calculate Coca-Cola's leverage, measured as total liabilities divided by total assets, if Coca-Cola reports its investment in Bubbly as a significant influence investment and as a merger. d. Which reporting choice allows Coca-Cola to appear more financially viable? As Coca-Cola's auditor, how do you evaluate Coca-Cola's reporting choice? PROBLEMS Lo 1 P1.1 Investments in Trading and AFS Securities A company has the following investment activity during 2016 and 2017: Security E is impaired in 2017, but is not impaired in 2016. Security F is not impaired in 2017. Required a. Prepare the journal entries to record the above information for 2016 and 2017, assuming the company's reporting year ends December 31. b. Show how this information is presented in the company's balance sheet, income statement, and statement of comprehensive income for 2016 and 2017. Lo 1 P1.2 Held-to-Maturity Intercorporate Debt Investments On January 2, 2016, a U.S. company invests in the following corporate debt securities, classified as held-to-maturity per ASC Topic 320: 1. 5-year $1,000,000 face value corporate bond paying 6 percent interest annually on December 31 . The bond is priced to yield 5 percent to maturity. 2. 4-year $500,000 face value corporate bond paying 4 percent interest annually on December 31 . The bond is priced to yield 5 percent to maturity. Required a. Calculate the cost of each investment. b. Calculate interest income for 2016 and 2017. c. At what value are these investments reported on the company's December 31, 2018, balance sheet? d. On December 31, 2019, the company determines that an impairment loss should be reported on the $1,000,000 bond. What factors indicate impairment loss? If the bond is estimated to have a value of $500,000 on December 31,2019 , what is the amount of the impairment loss, and where will it be reported on the 2019 financial statements? LO 1 F 1.3 Held-to-Maturity Intercorporate Debt Investment, Impairment Losses Monster Beverage Corporation is a public U.S. company that produces and distributes "alternative" energy drinks. Its 2013 balance sheet includes $396 million in held-to-maturity bonds. Monster reports its HTM securities as follows: Held-to-maturity securities are recorded at amortized cost which approximates fair market value. The Company evaluates whether the decline in fair value of its investments is other-than-temporary at each quarter-end. This evaluation consists of a review by management, and includes market pricing information and maturity dates for the securities held, market and economic trends in the industry and information on the issuer's financial condition and, if applicable, information on the guarantors' financial condition. Factors considered in determining whether a loss is temporary include the length of time and extent to which the investment's fair value has been less than its cost basis, the financial condition and near-term prospects of the issuer and guarantors, including any specific events which may influence the operations of the issuer and our intent and ability to retain the investment for a reasonable period of time sufficient to allow for any anticipated recovery of fair value. (Note 1 to Monster Beverage Corporation 2013 financial statements) Assume that the HTM bonds on Monster's 2013 balance sheet have a 2-year remaining life, were acquired at par, and pay interest each December 31 at 4 percent. Monster determines that due to an otherthan-temporary decline in the issuer's liquidity, no additional interest payments are expected, but $325 million of principal is recoverable at maturity. Required a. Calculate Monster's impairment loss for 2013. Round to the nearest million. b. Assume that on December 31,2014, the issuer's financial health has improved and the bonds' fair value is now $396 million. How does Monster report this information? c. If Monster receives all contractual principal and interest payments, what is the actual yield on the bond investment for 2014 and 2015 ? P1.4 Equity Method Investment Several Years After Acquisition On January 2, 2014, Best Beverages acquired 45 percent of the stock of Better Bottlers for $30 million in cash. Best Beverages accounts for its investment using the equity method. At the time of acquisition, Better Bottlers' balance sheet was as follows (in millions): Valuation of Better Bottlers' assets and liabilities revealed that its reported patents and trademarks (10-year life) had a fair value of \$160 million and it had unrecognized brand names (15-year life) worth $9 million. Better Bottlers' December 31, 2017, retained earnings balance is \$25 million. For 2017, it reported net income of $2.5 million and paid $650,000 in dividends. Required a. Prepare the 2017 entries to report the above information on Best Beverages' books. b. Calculate the Investment in Better Bottlers balance, reported on Best Beverages' December 31, 2017, balance sheet

Bubbly's tangible assets and liabilities are reported at amounts approximating fair value, and the excess paid over book value is attributed entirely to goodwill. Required a. Assume that Coca-Cola reports its investment in Bubbly as a significant influence investment, because although it owns all of Bubbly's stock, the decision-making structure at Bubbly does not allow Coca-Cola to control Bubbly. How does Coca-Cola record the investment at January 1, 2016? b. Now assume that Coca-Cola controls Bubbly and reports the acquisition as a merger. How does Coca-Cola record the investment at January 1,2016? c. Assume Coca-Cola's balance sheet just prior to the acquisition consists of $80,000 million in assets and $20,000 million in liabilities. Calculate Coca-Cola's leverage, measured as total liabilities divided by total assets, if Coca-Cola reports its investment in Bubbly as a significant influence investment and as a merger. d. Which reporting choice allows Coca-Cola to appear more financially viable? As Coca-Cola's auditor, how do you evaluate Coca-Cola's reporting choice? PROBLEMS Lo 1 P1.1 Investments in Trading and AFS Securities A company has the following investment activity during 2016 and 2017: Security E is impaired in 2017, but is not impaired in 2016. Security F is not impaired in 2017. Required a. Prepare the journal entries to record the above information for 2016 and 2017, assuming the company's reporting year ends December 31. b. Show how this information is presented in the company's balance sheet, income statement, and statement of comprehensive income for 2016 and 2017. Lo 1 P1.2 Held-to-Maturity Intercorporate Debt Investments On January 2, 2016, a U.S. company invests in the following corporate debt securities, classified as held-to-maturity per ASC Topic 320: 1. 5-year $1,000,000 face value corporate bond paying 6 percent interest annually on December 31 . The bond is priced to yield 5 percent to maturity. 2. 4-year $500,000 face value corporate bond paying 4 percent interest annually on December 31 . The bond is priced to yield 5 percent to maturity. Required a. Calculate the cost of each investment. b. Calculate interest income for 2016 and 2017. c. At what value are these investments reported on the company's December 31, 2018, balance sheet? d. On December 31, 2019, the company determines that an impairment loss should be reported on the $1,000,000 bond. What factors indicate impairment loss? If the bond is estimated to have a value of $500,000 on December 31,2019 , what is the amount of the impairment loss, and where will it be reported on the 2019 financial statements? LO 1 F 1.3 Held-to-Maturity Intercorporate Debt Investment, Impairment Losses Monster Beverage Corporation is a public U.S. company that produces and distributes "alternative" energy drinks. Its 2013 balance sheet includes $396 million in held-to-maturity bonds. Monster reports its HTM securities as follows: Held-to-maturity securities are recorded at amortized cost which approximates fair market value. The Company evaluates whether the decline in fair value of its investments is other-than-temporary at each quarter-end. This evaluation consists of a review by management, and includes market pricing information and maturity dates for the securities held, market and economic trends in the industry and information on the issuer's financial condition and, if applicable, information on the guarantors' financial condition. Factors considered in determining whether a loss is temporary include the length of time and extent to which the investment's fair value has been less than its cost basis, the financial condition and near-term prospects of the issuer and guarantors, including any specific events which may influence the operations of the issuer and our intent and ability to retain the investment for a reasonable period of time sufficient to allow for any anticipated recovery of fair value. (Note 1 to Monster Beverage Corporation 2013 financial statements) Assume that the HTM bonds on Monster's 2013 balance sheet have a 2-year remaining life, were acquired at par, and pay interest each December 31 at 4 percent. Monster determines that due to an otherthan-temporary decline in the issuer's liquidity, no additional interest payments are expected, but $325 million of principal is recoverable at maturity. Required a. Calculate Monster's impairment loss for 2013. Round to the nearest million. b. Assume that on December 31,2014, the issuer's financial health has improved and the bonds' fair value is now $396 million. How does Monster report this information? c. If Monster receives all contractual principal and interest payments, what is the actual yield on the bond investment for 2014 and 2015 ? P1.4 Equity Method Investment Several Years After Acquisition On January 2, 2014, Best Beverages acquired 45 percent of the stock of Better Bottlers for $30 million in cash. Best Beverages accounts for its investment using the equity method. At the time of acquisition, Better Bottlers' balance sheet was as follows (in millions): Valuation of Better Bottlers' assets and liabilities revealed that its reported patents and trademarks (10-year life) had a fair value of \$160 million and it had unrecognized brand names (15-year life) worth $9 million. Better Bottlers' December 31, 2017, retained earnings balance is \$25 million. For 2017, it reported net income of $2.5 million and paid $650,000 in dividends. Required a. Prepare the 2017 entries to report the above information on Best Beverages' books. b. Calculate the Investment in Better Bottlers balance, reported on Best Beverages' December 31, 2017, balance sheet Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started