Answered step by step

Verified Expert Solution

Question

1 Approved Answer

hi, help me answer question 1. I dont understand please help immediately study answer question. NextGen Machinery Ltd (NextGen) is a well-known public company that

hi, help me answer question 1. I dont understand please help immediately study answer question.

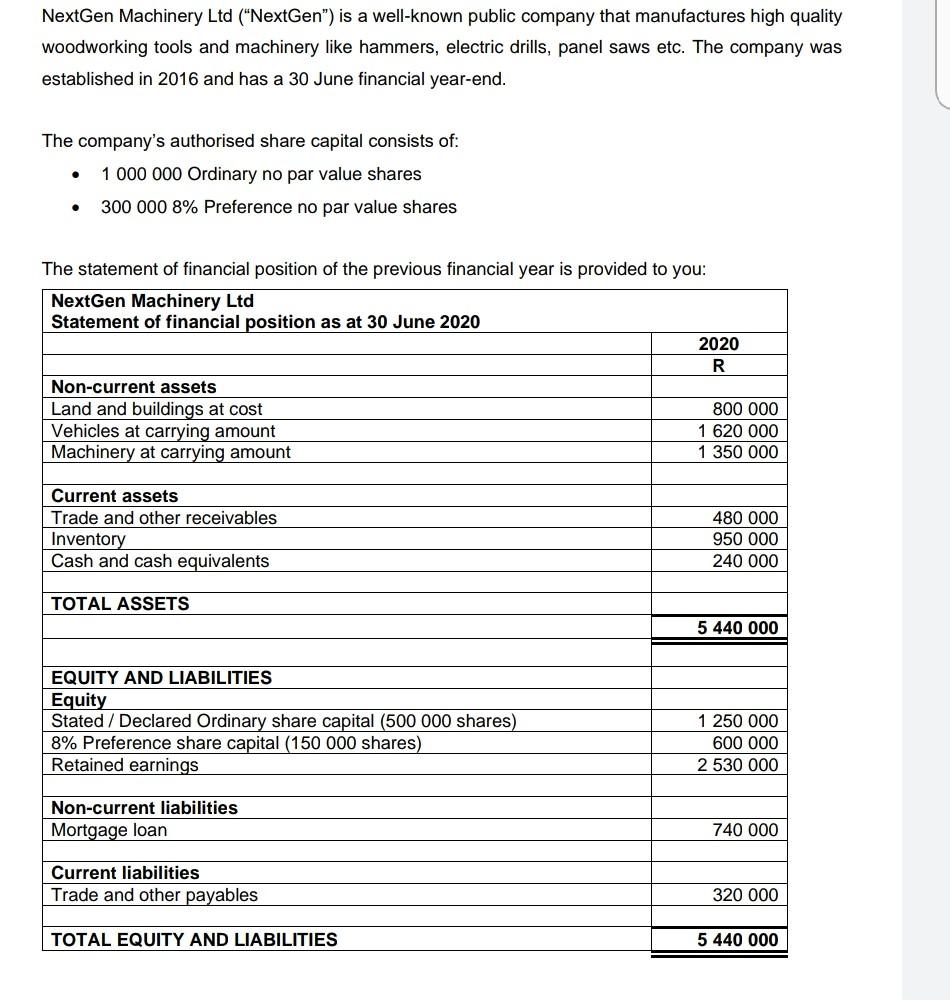

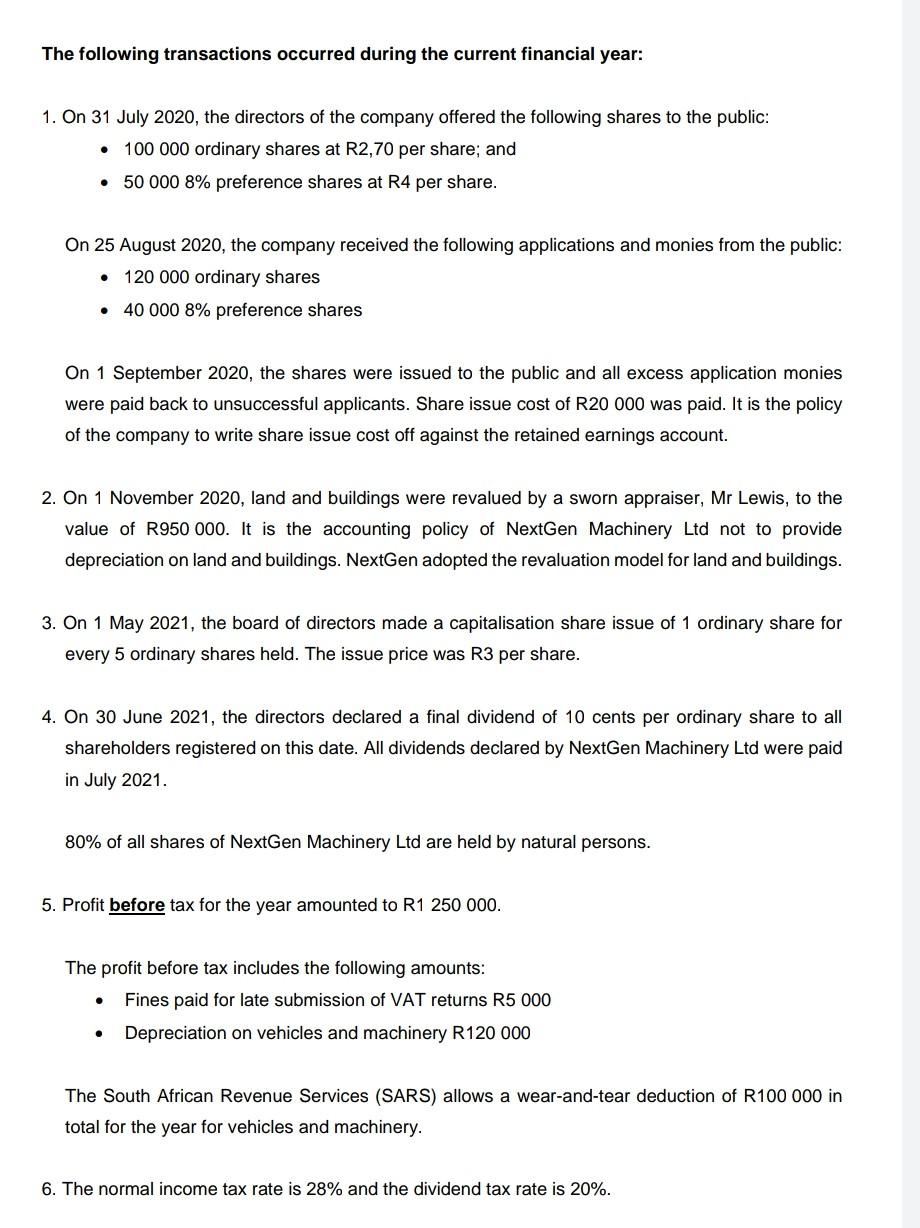

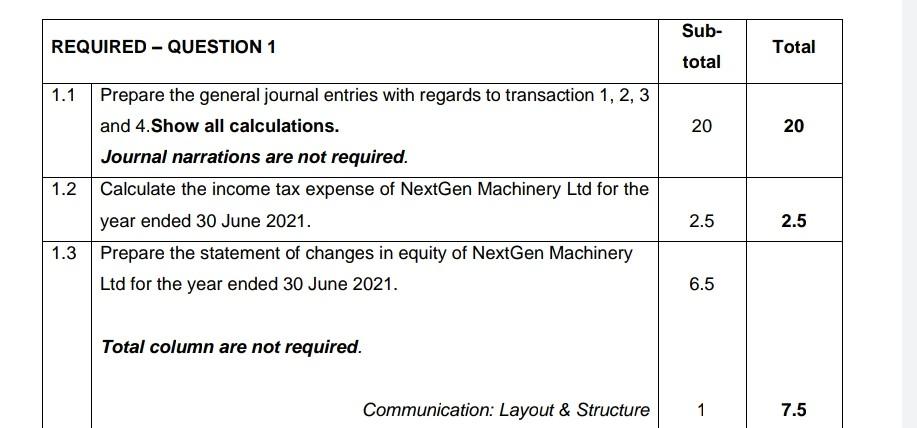

NextGen Machinery Ltd ("NextGen) is a well-known public company that manufactures high quality woodworking tools and machinery like hammers, electric drills, panel saws etc. The company was established in 2016 and has a 30 June financial year-end. The company's authorised share capital consists of: 1 000 000 Ordinary no par value shares 300 000 8% Preference no par value shares . The statement of financial position of the previous financial year is provided to you: NextGen Machinery Ltd Statement of financial position as at 30 June 2020 2020 R Non-current assets Land and buildings at cost 800 000 Vehicles at carrying amount 1 620 000 Machinery at carrying amount 1 350 000 Current assets Trade and other receivables Inventory Cash and cash equivalents 480 000 950 000 240 000 TOTAL ASSETS 5 440 000 EQUITY AND LIABILITIES Equity Stated / Declared Ordinary share capital (500 000 shares) 8% Preference share capital (150 000 shares) Retained earnings 1 250 000 600 000 2 530 000 Non-current liabilities Mortgage loan 740 000 Current liabilities Trade and other payables 320 000 TOTAL EQUITY AND LIABILITIES 5 440 000 The following transactions occurred during the current financial year: 1. On 31 July 2020, the directors of the company offered the following shares to the public: 100 000 ordinary shares at R2,70 per share; and 50 000 8% preference shares at R4 per share. . On 25 August 2020, the company received the following applications and monies from the public: 120 000 ordinary shares 40 000 8% preference shares On 1 September 2020, the shares were issued to the public and all excess application monies were paid back to unsuccessful applicants. Share issue cost of R20 000 was paid. It is the policy of the company to write share issue cost off against the retained earnings account. 2. On 1 November 2020, land and buildings were revalued by a sworn appraiser, Mr Lewis, to the value of R950 000. It is the accounting policy of NextGen Machinery Ltd not to provide depreciation on land and buildings. NextGen adopted the revaluation model for land and buildings. 3. On 1 May 2021, the board of directors made a capitalisation share issue of 1 ordinary share for every 5 ordinary shares held. The issue price was R3 per share. 4. On 30 June 2021, the directors declared a final dividend of 10 cents per ordinary share to all shareholders registered on this date. All dividends declared by NextGen Machinery Ltd were paid in July 2021. 80% of all shares of NextGen Machinery Ltd are held by natural persons. 5. Profit before tax for the year amounted to R1 250 000. The profit before tax includes the following amounts: Fines paid for late submission of VAT returns R5 000 Depreciation on vehicles and machinery R120 000 . . The South African Revenue Services (SARS) allows a wear-and-tear deduction of R100 000 in total for the year for vehicles and machinery. 6. The normal income tax rate is 28% and the dividend tax rate is 20%. Sub- REQUIRED - QUESTION 1 - Total total 20 20 Prepare the general journal entries with regards to transaction 1, 2, 3 and 4.Show all calculations. Journal narrations are not required. 1.2 Calculate the income tax expense of NextGen Machinery Ltd for the year ended 30 June 2021. 1.3 Prepare the statement of changes in equity of NextGen Machinery Ltd for the year ended 30 June 2021. 2.5 2.5 6.5 Total column are not required. Communication: Layout & Structure 1 7.5

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started