Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hi . Help me solve the questions below, urgent. Thanks. 24. Suppose you expect to receive RM5,500.00 a year from now. What is the present

Hi . Help me solve the questions below, urgent. Thanks.

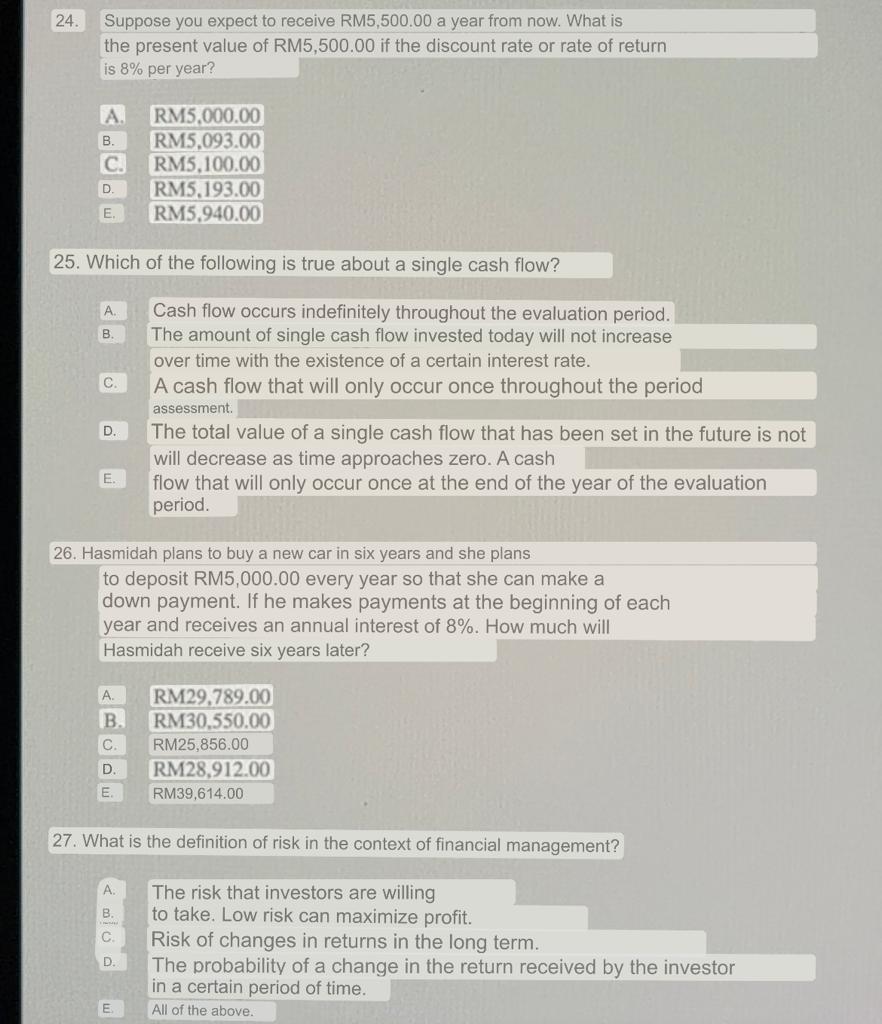

24. Suppose you expect to receive RM5,500.00 a year from now. What is the present value of RM5,500.00 if the discount rate or rate of return is 8% per year? A. RM5.000.00 RM5.093.00 RM5.100.00 RM5.193.00 RM5.940.00 25. Which of the following is true about a single cash flow? Cash flow occurs indefinitely throughout the evaluation period. The amount of single cash flow invested today will not increase over time with the existence of a certain interest rate. A cash flow that will only occur once throughout the period assessment. The total value of a single cash flow that has been set in the future is not will decrease as time approaches zero. A cash flow that will only occur once at the end of the year of the evaluation period. 26. Hasmidah plans to buy a new car in six years and she plans to deposit RM5,000.00 every year so that she can make a down payment. If he makes payments at the beginning of each year and receives an annual interest of 8%. How much will Hasmidah receive six years later? \begin{tabular}{ll} A. & RM29.789.00 \\ B. & RM30.550.00 \\ C. & RM25,856.00 \\ D. & RM28,912.00 \\ \hline & RM39,614.00 \end{tabular} 27. What is the definition of risk in the context of financial management? A. The risk that investors are willing B. to take. Low risk can maximize profit. Risk of changes in returns in the long term. D. The probability of a change in the return received by the investor in a certain period of time

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started